Ace Info About Income Statement Period What Is The Use Of

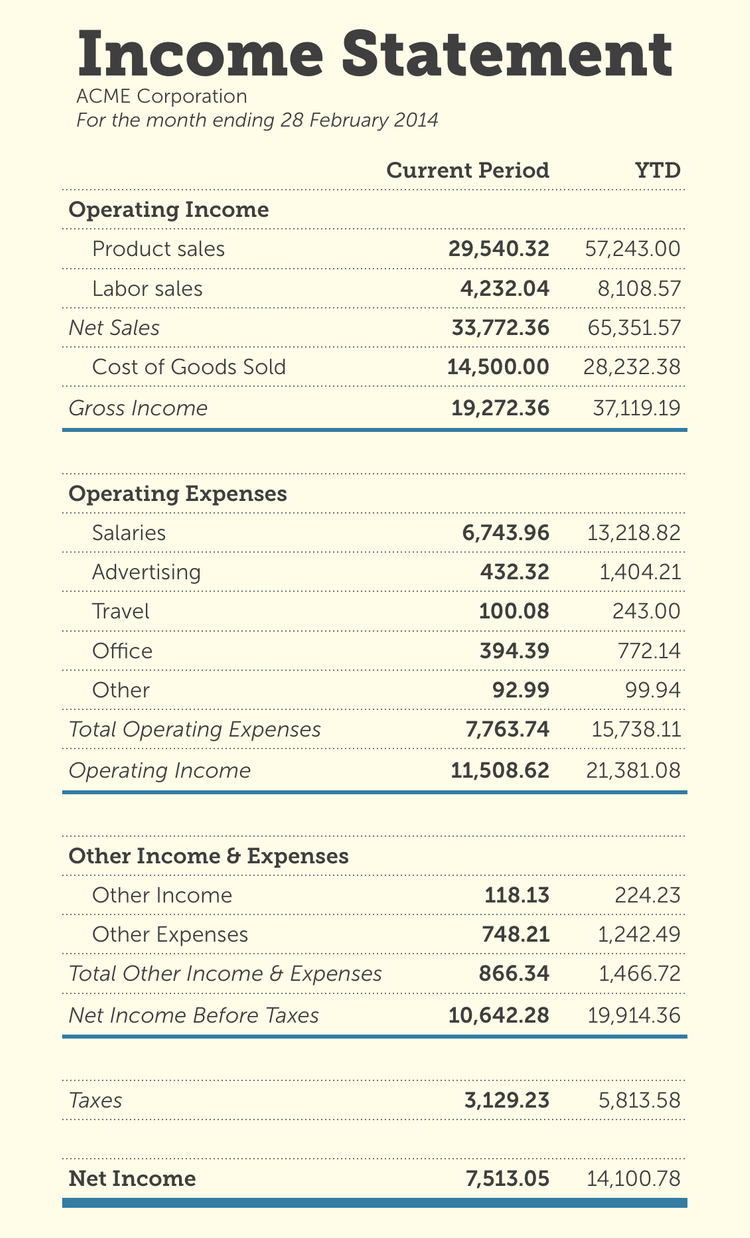

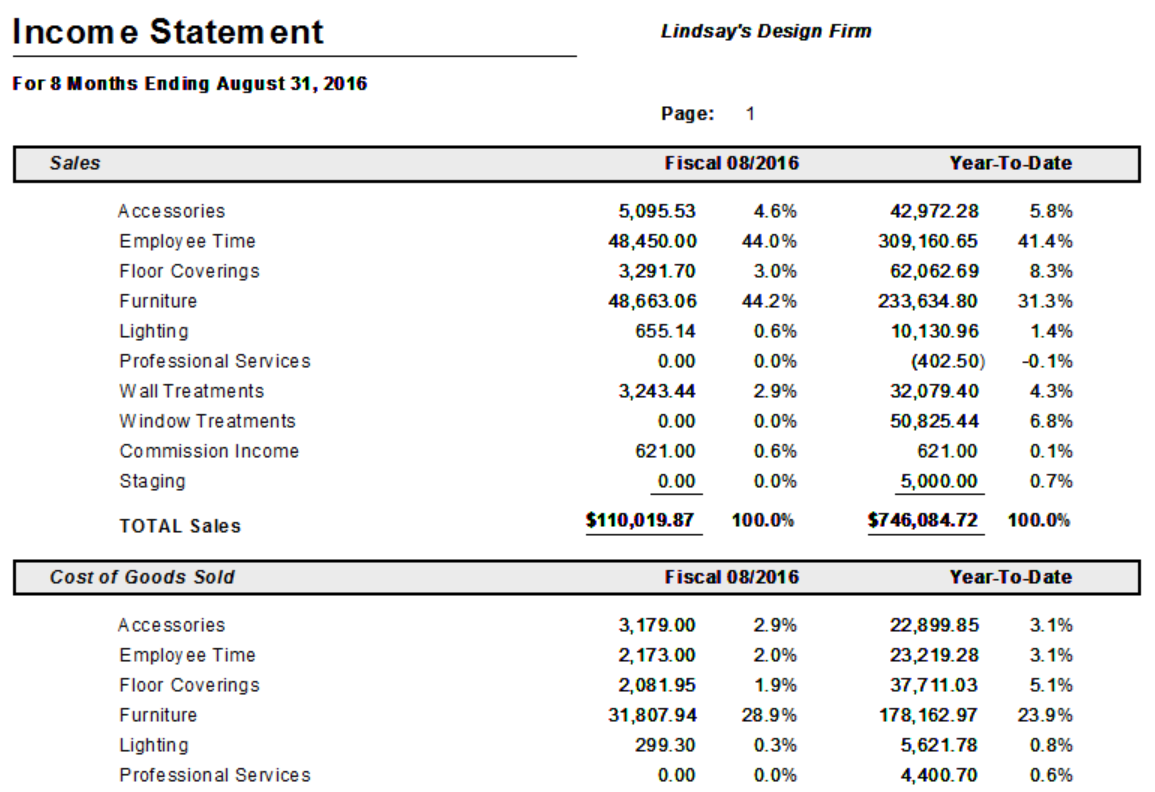

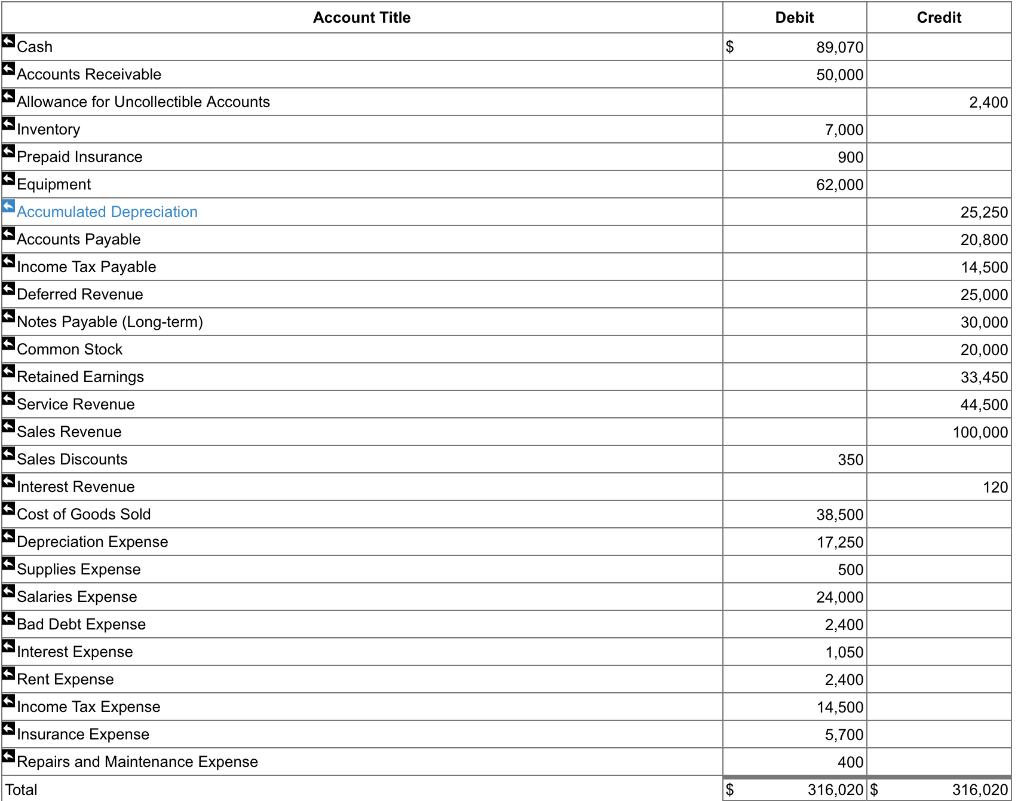

If the expenses are smaller than the sales, the net result is profitability, or net income, rather than a net loss.

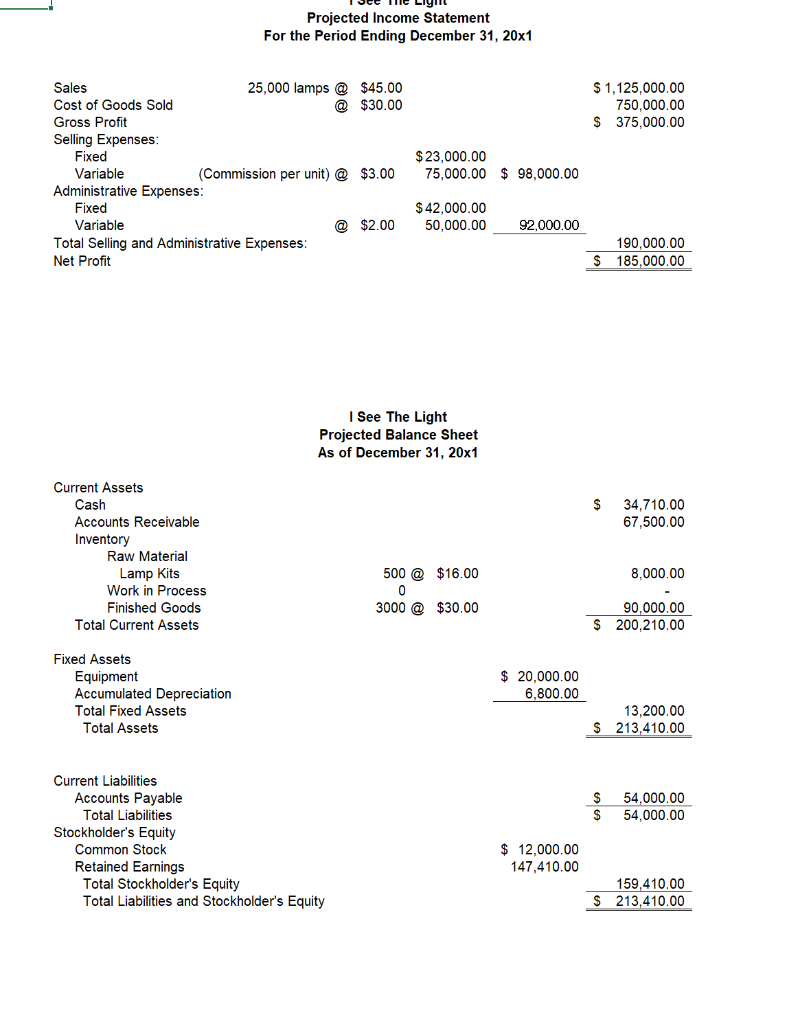

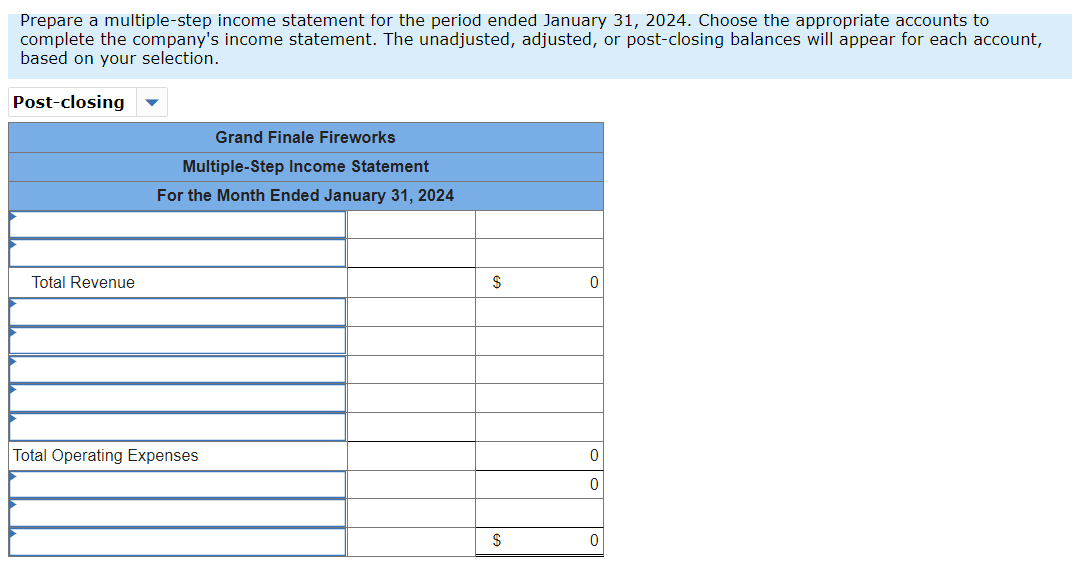

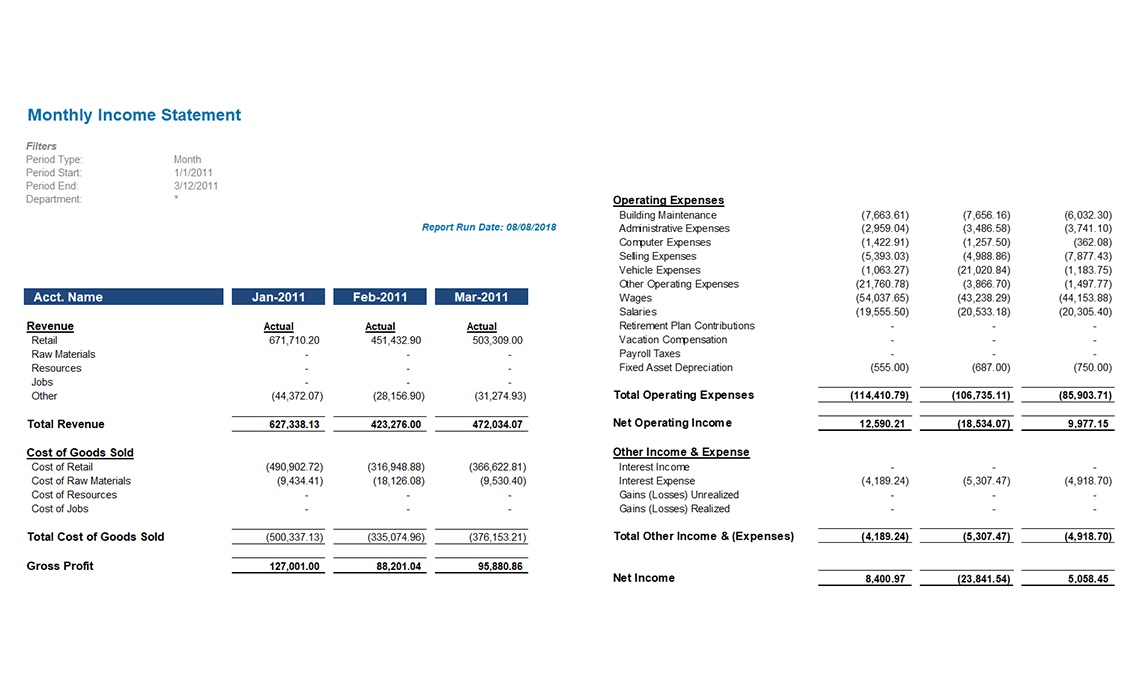

Income statement period. So, the income statement shows total revenue and. Typical periods or time intervals covered by an income statement include: The income statement presents the financial results of a business for a stated period of time.

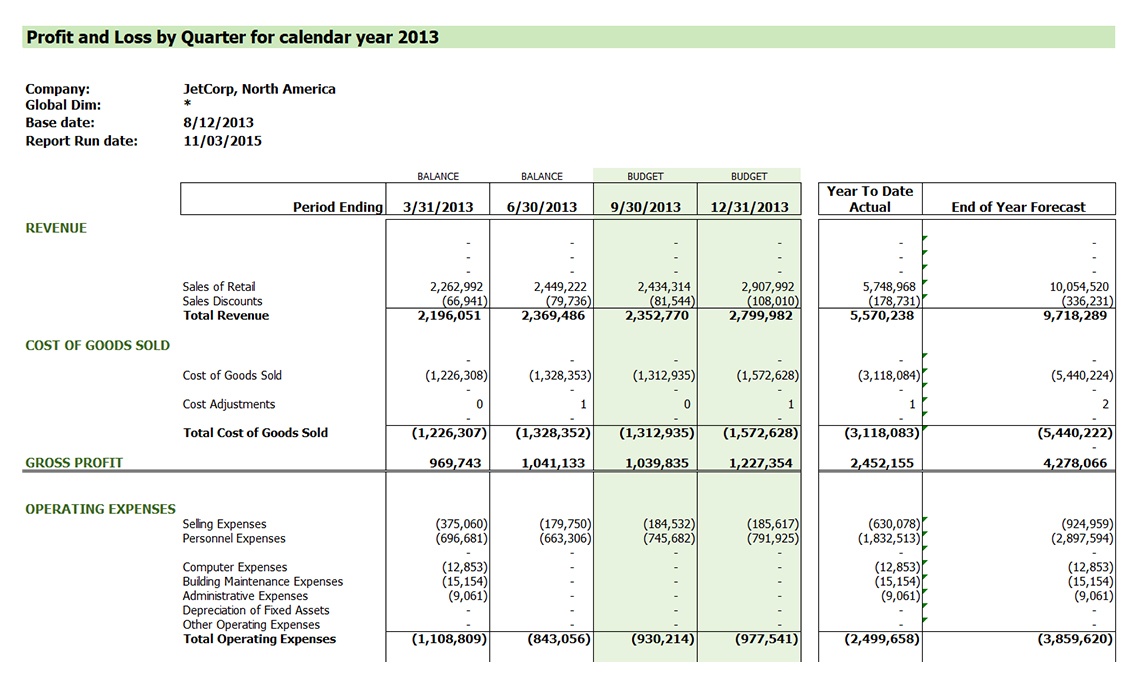

Full year operating income of $2.279 billion; It is also known as the profit and loss (p&l) statement, where profit or loss is determined by subtracting all expenses from the. In such a stressful economic environment, the last thing anyone.

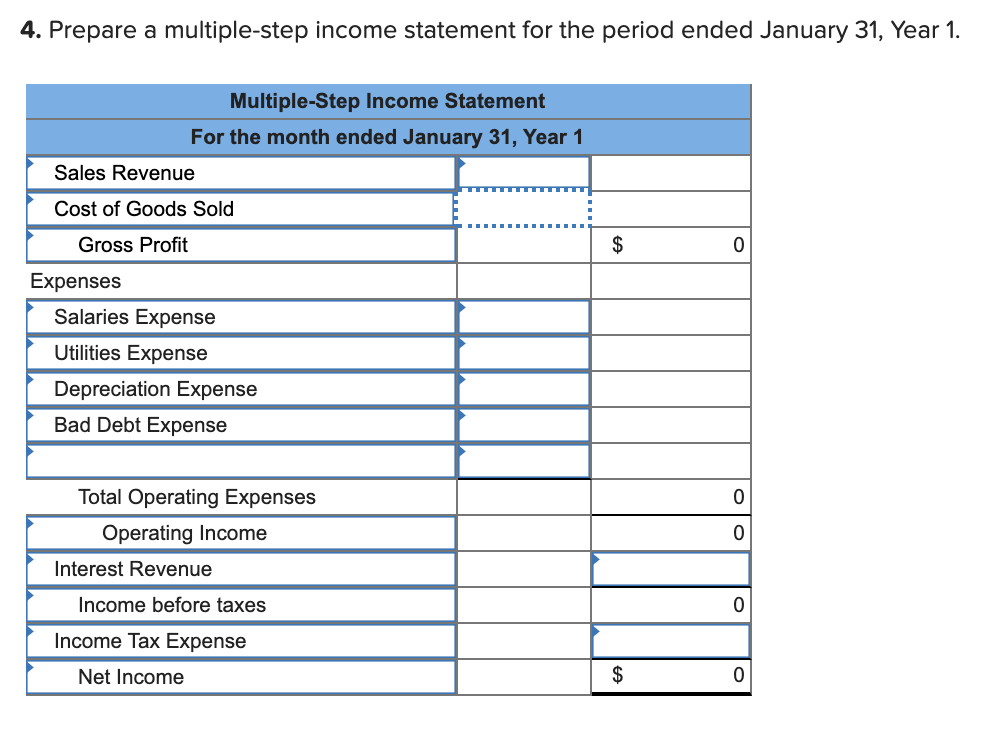

2023 cash from operating activities of $4.320 billion and free cash flow* of $2.756 billion ; Steps to prepare an income statement 1. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

Add up the income tax for the reporting period and the interest incurred for debt during that time. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss. While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year, and.

Put simply, an income statement follows this equation: An income statement reports a company’s revenue, expenses and profit or loss during a specific accounting period. In the budgeted income statement example above, we can see that the actual profit for the period is about $8,500 less than what was planned for.

The income statement, often called the profit and loss statement, shows the revenues, costs, and expenses over a period which is typically a fiscal quarter or a fiscal year. The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or. Record adjusted ebitda margin fourth.

It reports net income by detailing a business’s revenues, gains, expenses, and losses. The statement then deducts the cost of goods sold ( cogs) to find gross profit. The statement helps financial statement users understand the sales generated during the period and the expenses incurred to generate those sales.

Realty income (o 0.42%) q4 2023 earnings call feb 21. Leverage ratio * of 1.1 at december. Record full year operating revenues of $21.833 billion, reflecting strong demand for air travel;

An income statement tells you whether or not a company made a profit or loss during the reporting period. The income statement, also known as a profit and loss statement, shows a business’s financial performance during a specific accounting period. O earnings call for the period ending december 31, 2023.

It's sometimes referred to simply as the profit and loss statement, or just p & l. This year, the process of filing an income tax and benefit return may feel particularly daunting. The board of directors of safran (euronext paris:

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)