Favorite Tips About P And L Meaning Operating Cash Flow

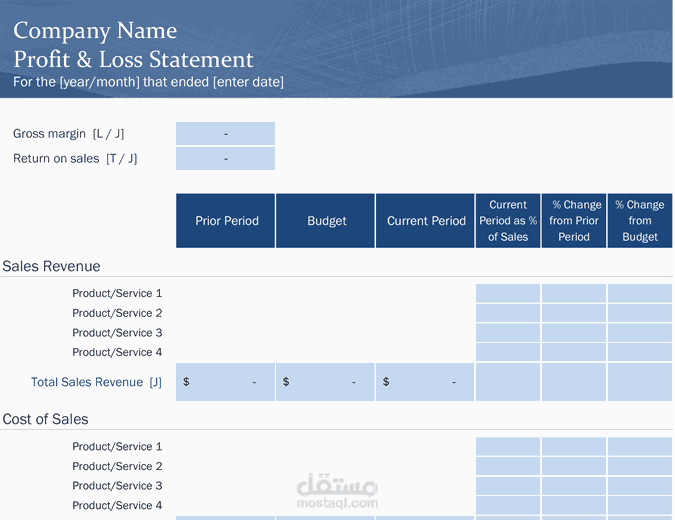

A profit and loss (p&l) statement is a summary of an organization’s income and expenses over a period of time.

P and l meaning. How to read a profit and loss statement. The profit and loss statement summarizes all revenues and expenses a company has generated in a. The outcome is either your final profit or loss.

The two others are the balance sheet and the cash flow statement. Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. A profit and loss statement (p&l), also known as an income statement, is a financial report that shows a company's revenues and expenses over a given period of time, usually a fiscal quarter or year.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a. A p&l statement explains the income and expenses that lead to a company’s profits (or losses). A profit and loss (p&l) statement is the same as an income statement.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Business owners use the p&l to assess the company's profitability—how much money a company makes. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. Your p&l statement shows your revenue, minus expenses and losses. What does p&l mean?

A p&l statement provides information about whether. The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce.