Here’s A Quick Way To Solve A Tips About Common Size Ratio Vivendi Financial Statements

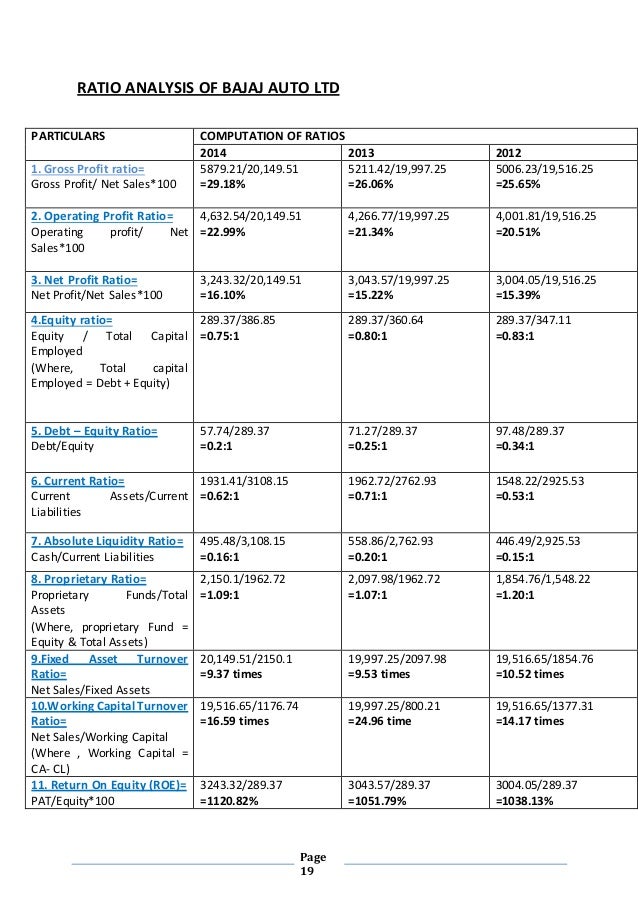

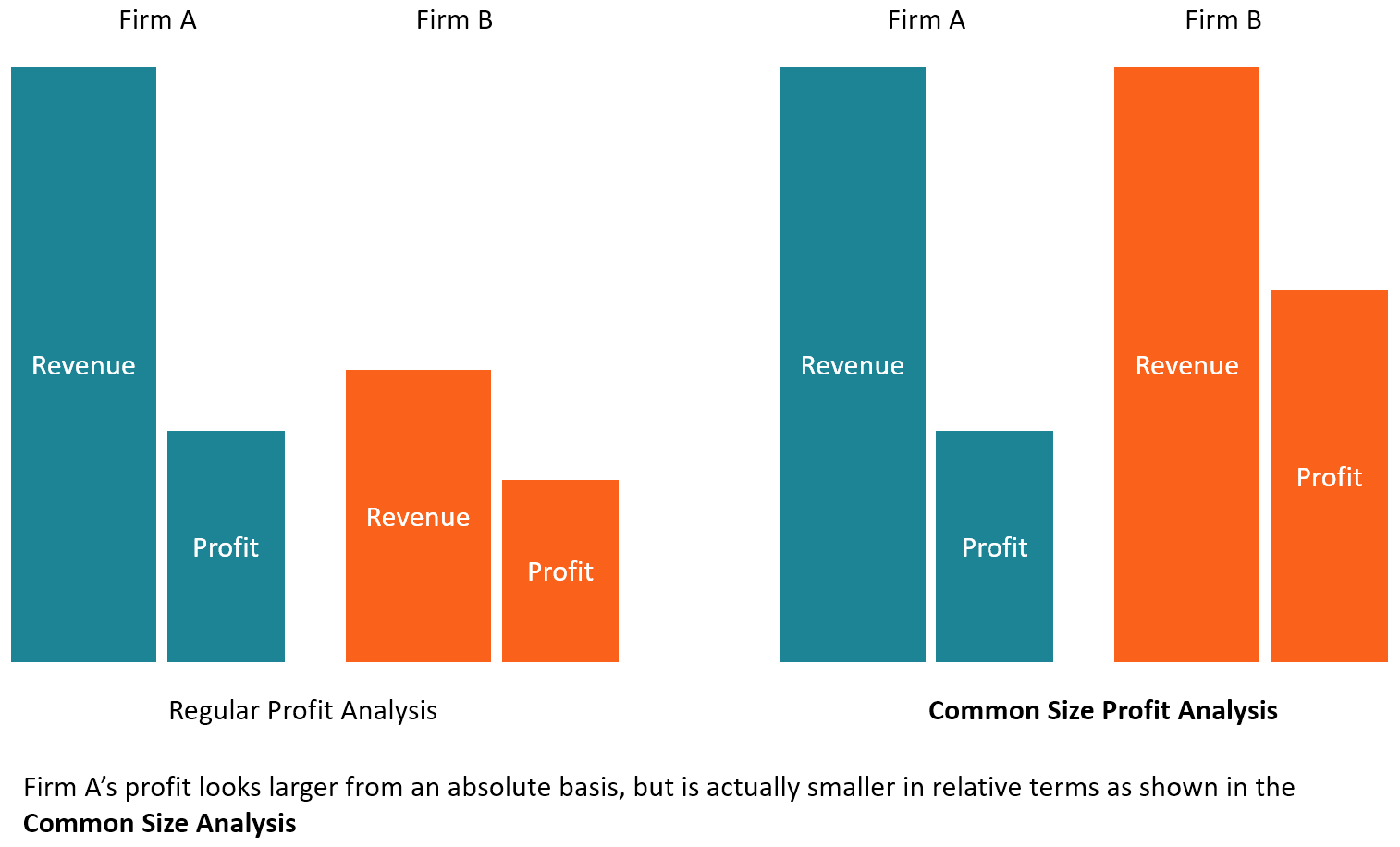

Common size ratios can be very useful when trying to get a better understanding of a business.

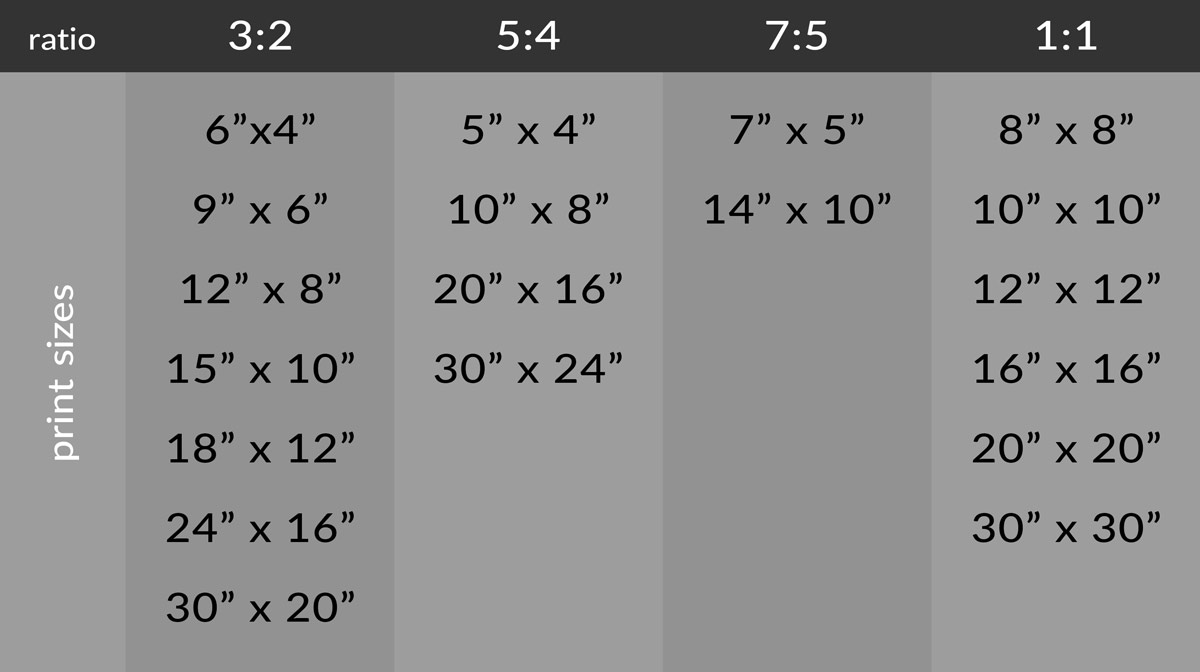

Common size ratio. To find the common size ratio of each sales line item, take the amount and divide it by $350,000. By expressing the items in proportion to.

However, they need to be examined within a certain context in order to derive meaningful conclusions. Because view transitions are built on top of css, we can alter these defaults. The common size ratio is a tool that compares the size of items in your business to the whole.

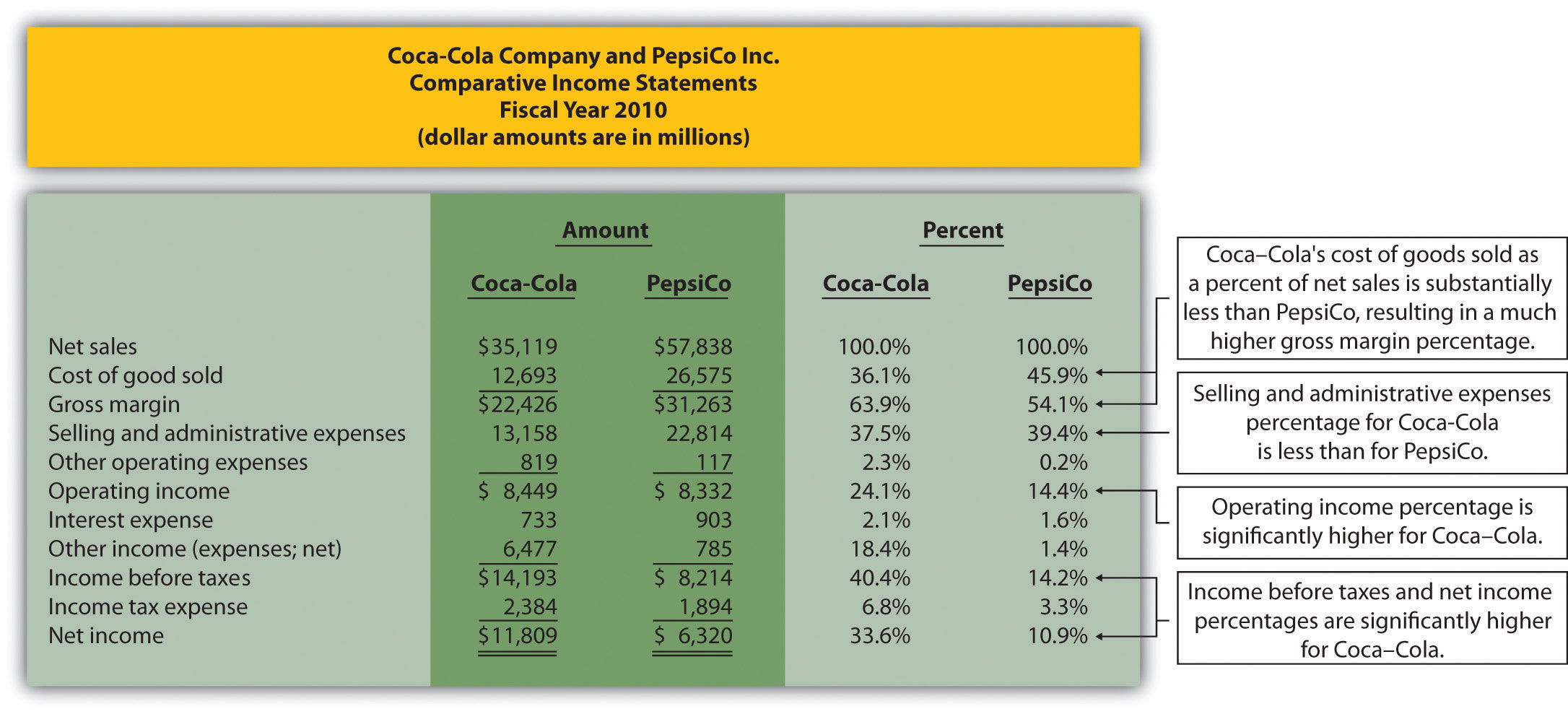

Let’s take a look at two competing. Percentage of overall base figure = (line item / overall base figure) x 100 in this formula, the percentage of the base is the. In this article, we’ll dive into two powerful analytical tools for comparing income statements:

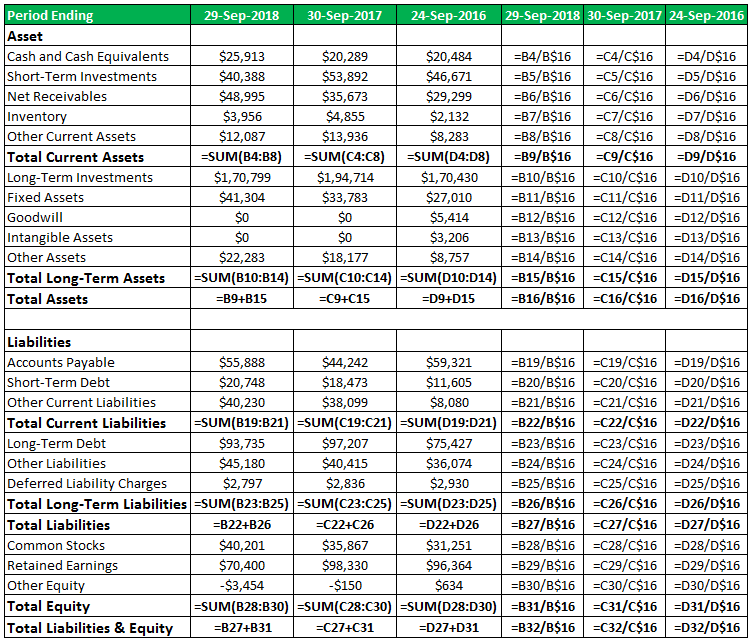

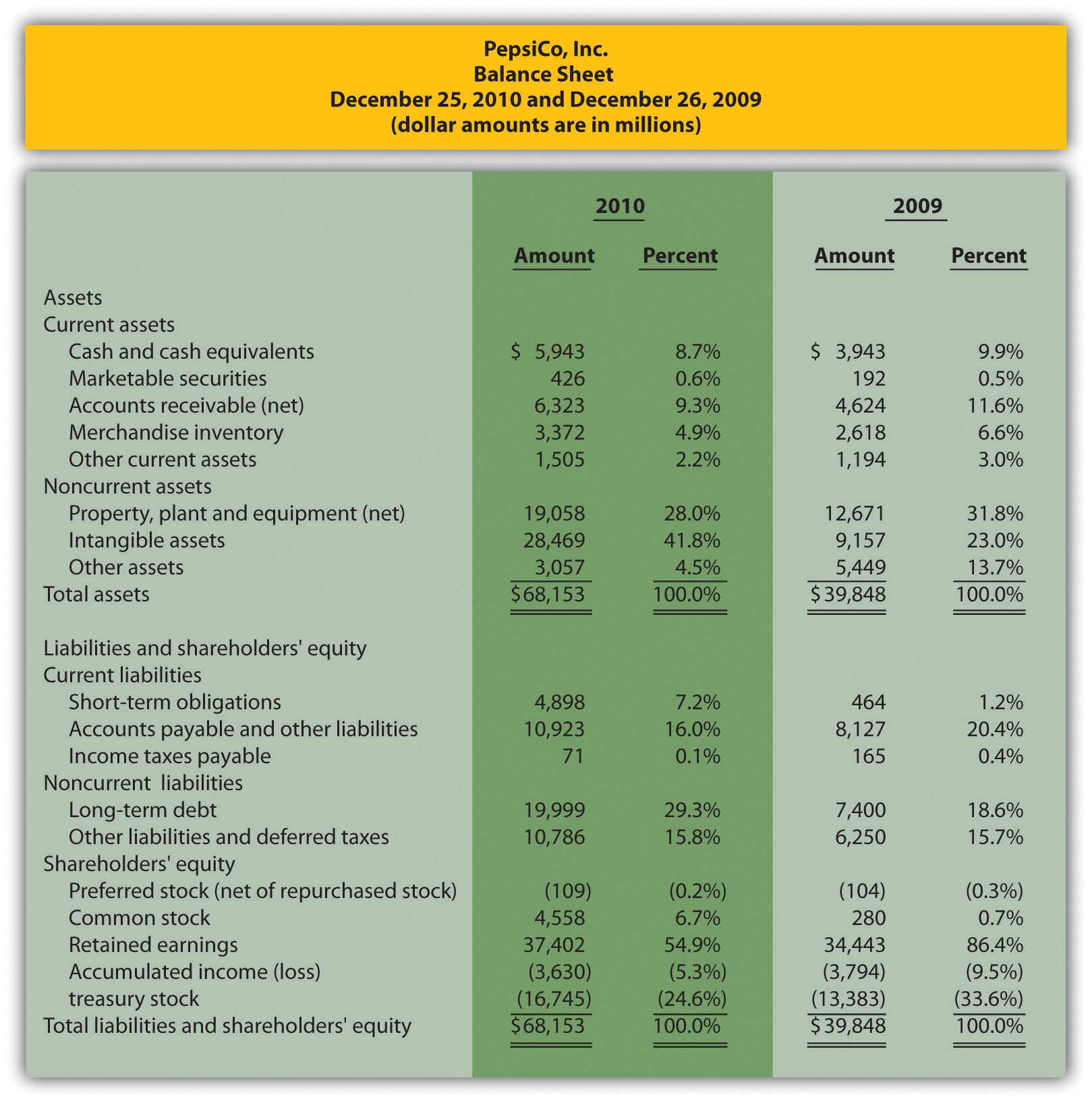

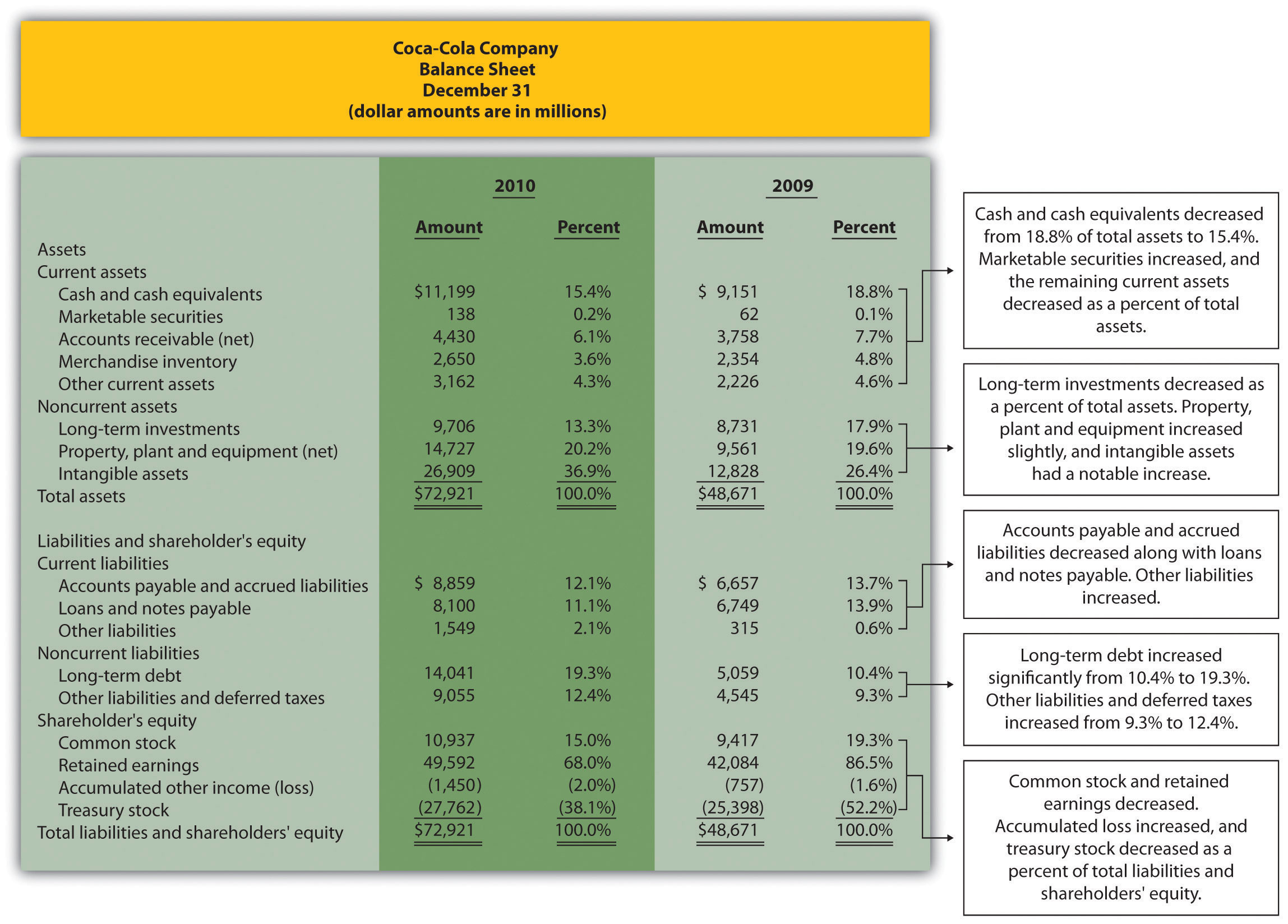

But that's just the default. Learn how to common size financial statements, a technique that compares two companies based on their ratios as a percentage of sales or assets. A common size balance sheet is a statement in which balance sheet items are being calculated as the ratio of each asset in relation to the total assets.

Common size analysis is an excellent tool to compare companies of different sizes or to compare different years of data for the same company, as in the. Common size ratios are most effective when compared across multiple companies that operate in the same. Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year.

This analysis is aided by the use of consistent denominators in common size analysis. Ratios provide vital insights into a company’s financial health. The formula for a common size analysis is:

Common size analysis is a financial analysis technique that converts line items of financial statement of a company into a percentage of a selected or common. In this case, let's make the views 100% height of their group,. It can help you analyze your finances, compare results over.

This means your common size ratios are:

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)