Brilliant Tips About Profit And Loss Statement Nonprofit Financial Assets Through

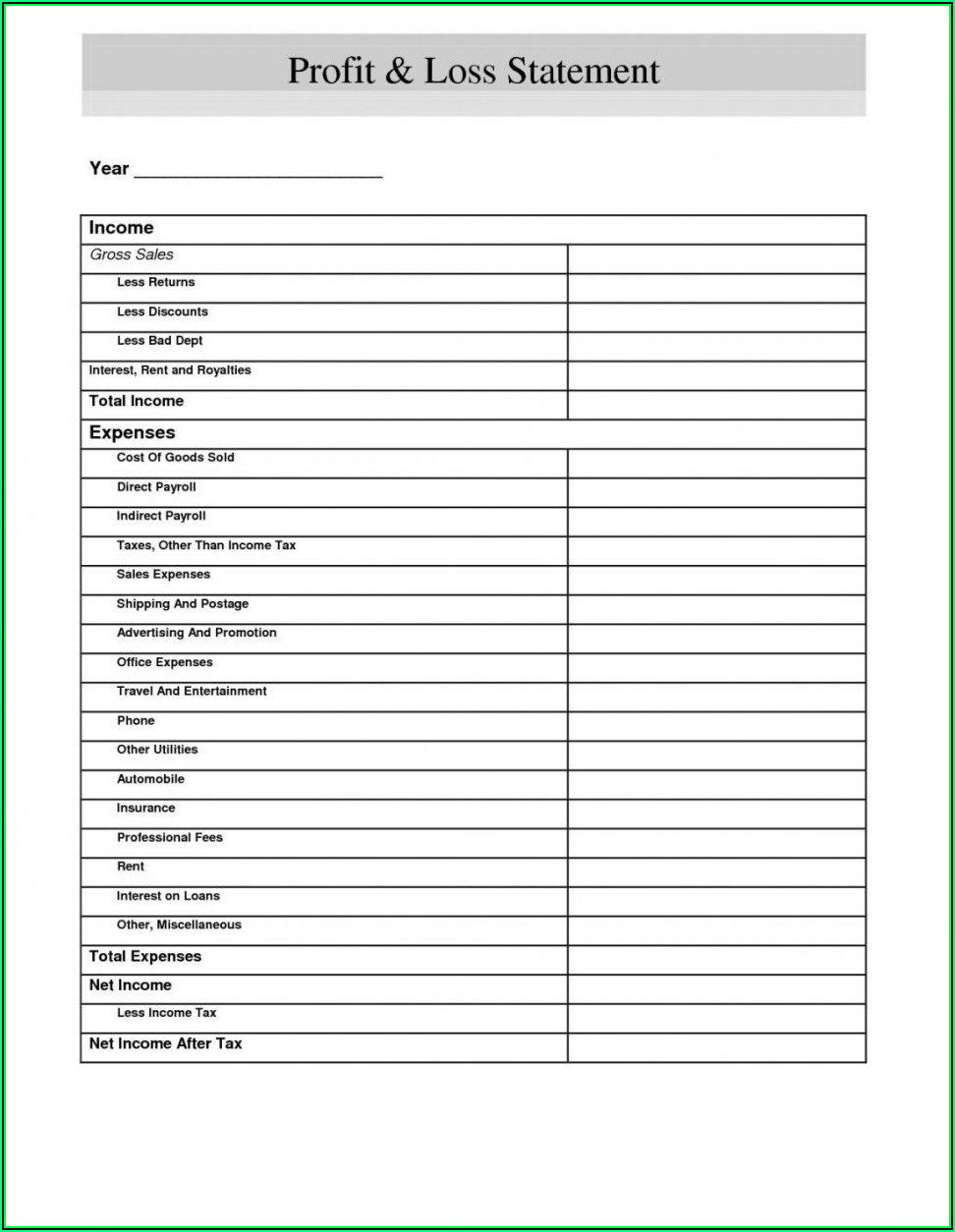

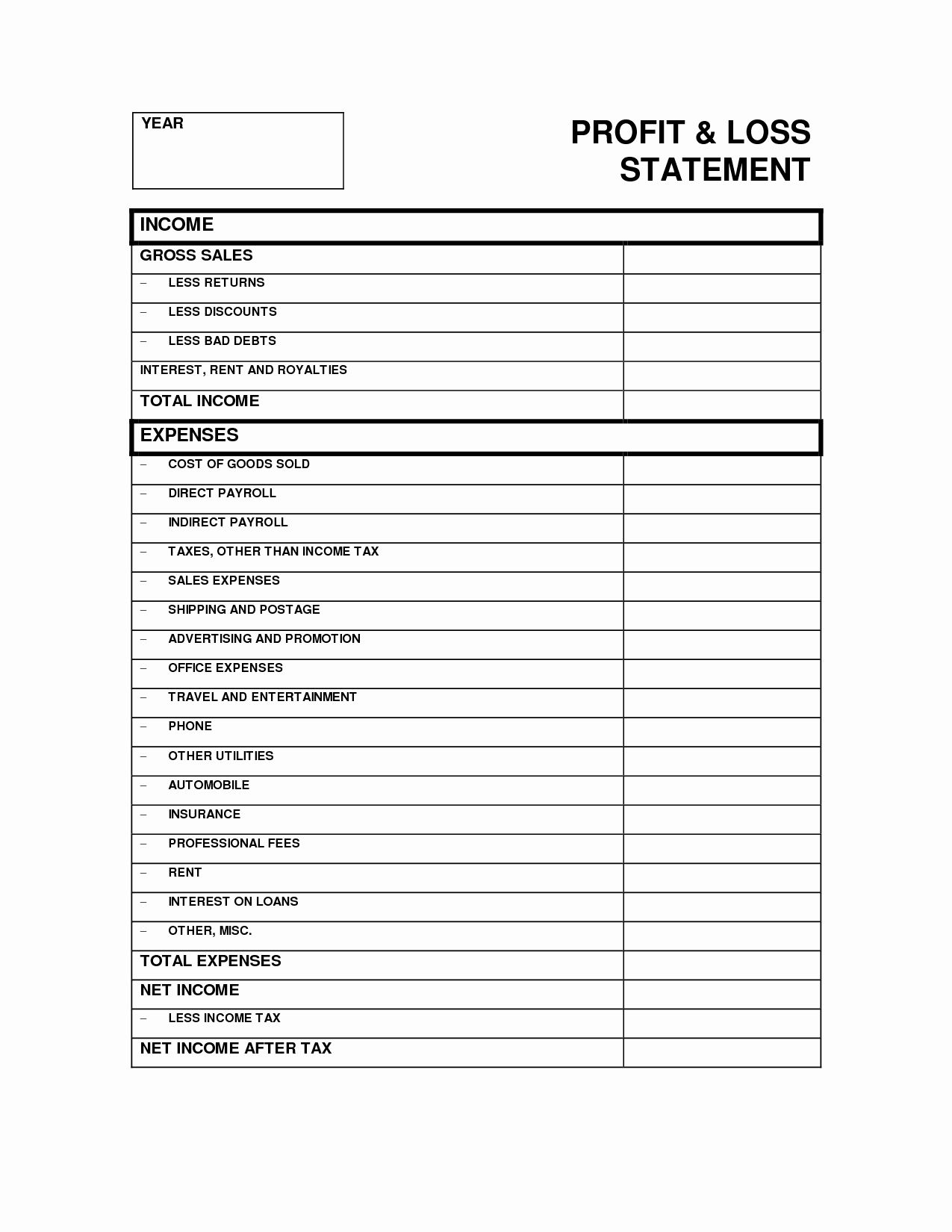

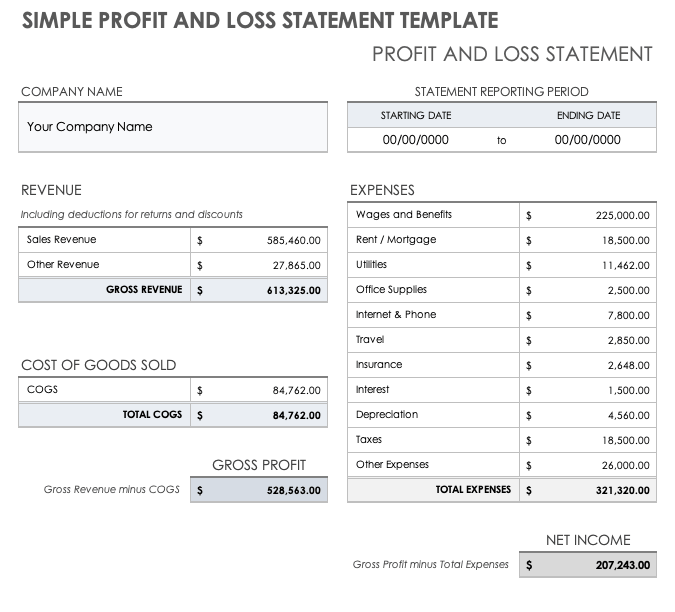

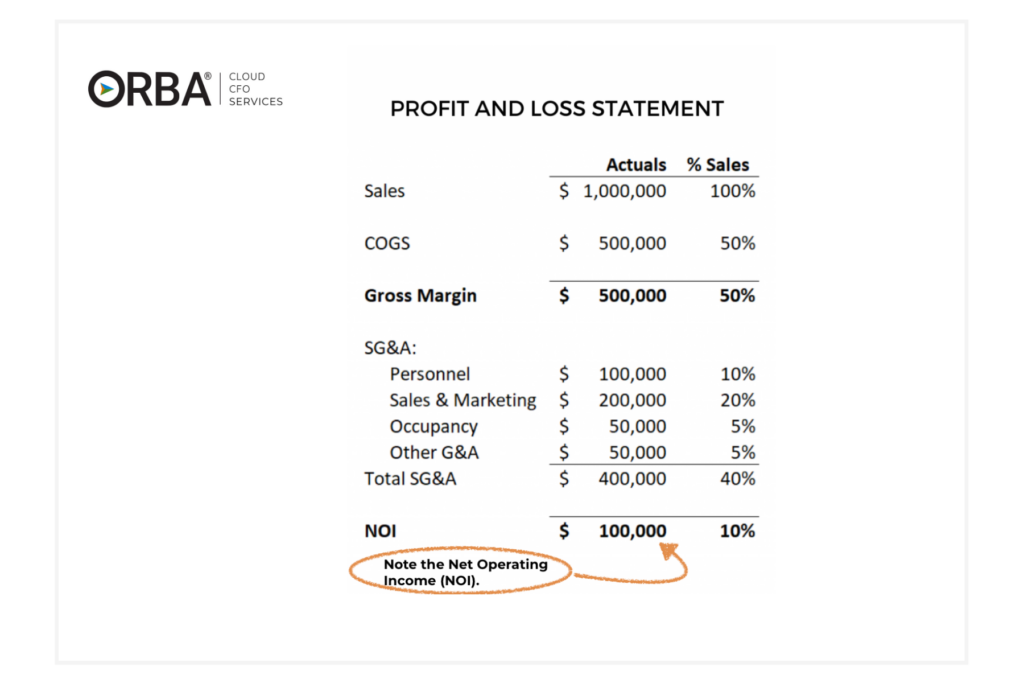

A p&l statement compares company revenue against expenses to determine the net income of the business.

Profit and loss statement nonprofit. Nonprofits use the statement of financial position to list their assets, liabilities, and net assets. The amounts are as of the date shown in the heading which is usually the end of a month, quarter, or year. What is a statement of activities?

(a nonprofit corporation) as of june 30, 20x7 and 20x6, and the related statements of activities, functional expenses, and cash flows for the years then ended, in accordance with statements on standards for accounting and review services issued by the ameri. A statement of activities, also called a profit & loss statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. Nonprofits also have a primary task to their donations when filing or exchange these financial statements.

Businesses have income statements displaying revenues, expenses, and any profits or losses. The organization receives a $100 donation which increases cash, an asset on the balance sheet. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

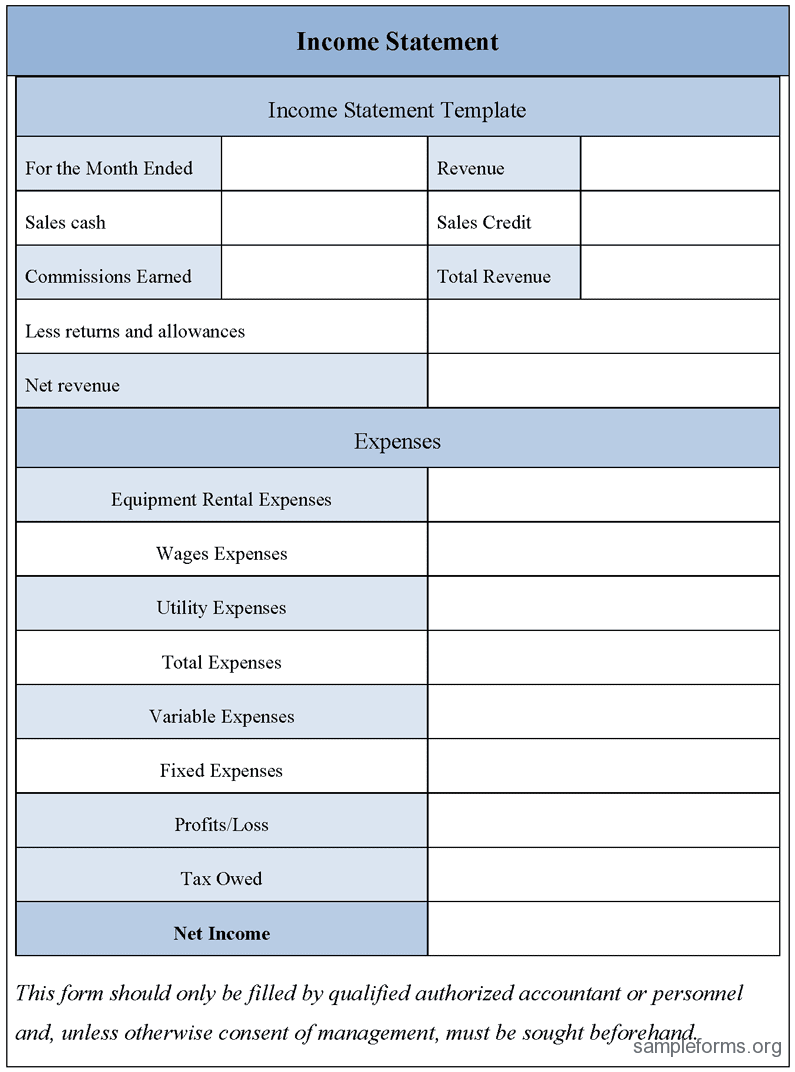

Revenue, expenses, and net income. The statement of activities is a nonprofit’s organization income statement. This statement reports the change in net assets with donor restrictions and without donor restrictions.

Let’s walk through a quick example: The statement of activities (soa) is the correct nonprofit term for the report we may commonly have called the income statement, budget report, profit & loss, income and expense report, etc. A nonprofit's statement of financial position (similar to a business's balance sheet) reports the organization's assets and liabilities in some order of when the assets will turn to cash and when the liabilities need to be paid.

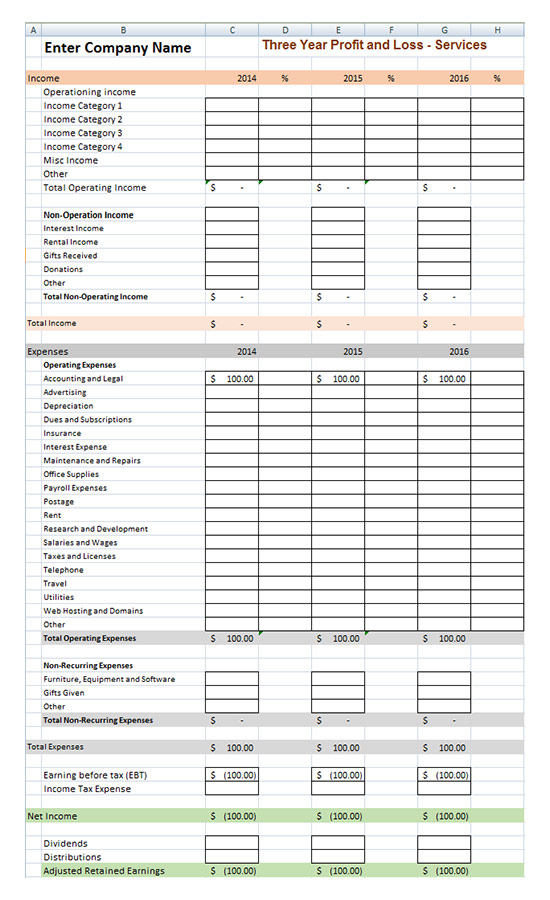

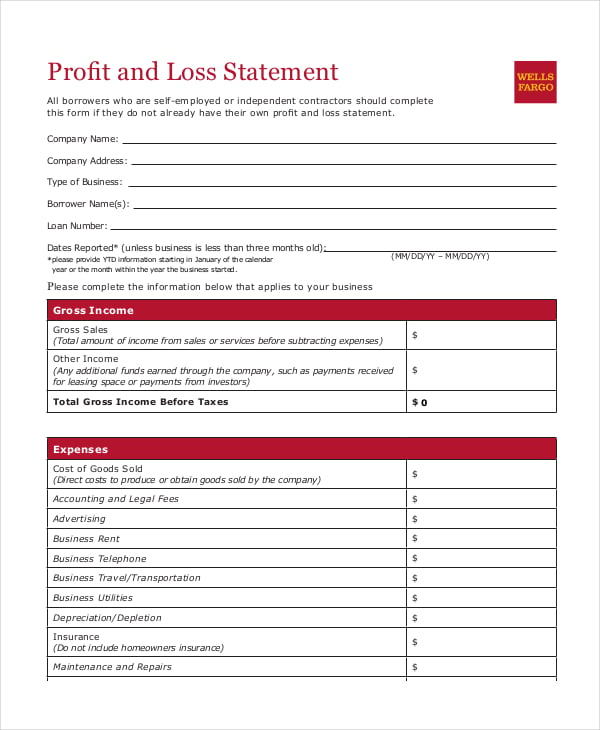

These reports collectively provide the financial insights your nonprofit needs to thrive. Subtract operating expenses from business income to see your net profit or loss. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

Government and profit governments treat our money in a distinctive way—they're not trying to make a profit. The statement of activities is the income statement of a nonprofit organization.

The $100 of income flows from the profit and loss report into the net assets bucket. You may also hear it referred to as a profit and loss statement or income and expense report. However, nonprofits are not in the business of making a profit (or a loss), thus this is an incorrect assumption.

Nonprofits do have profit and loss statements, but they take the form of a statement of activities. A profit and loss statement contains three basic elements: Assets = liabilities + net assets here’s an example from code for science & society’s statement of financial position from 2021.

Your financial statement should include: Your financial statement also demonstrates that your nonprofit has spent income from donors, grantors, and other sources as promised and in ways that align with your mission. The p&l statement is one of the most important documents for nonprofit organizations.