Matchless Tips About Trial Balance To Final Accounts The Fitness Studio Incs 2018 Income Statement

What is a trial balance?

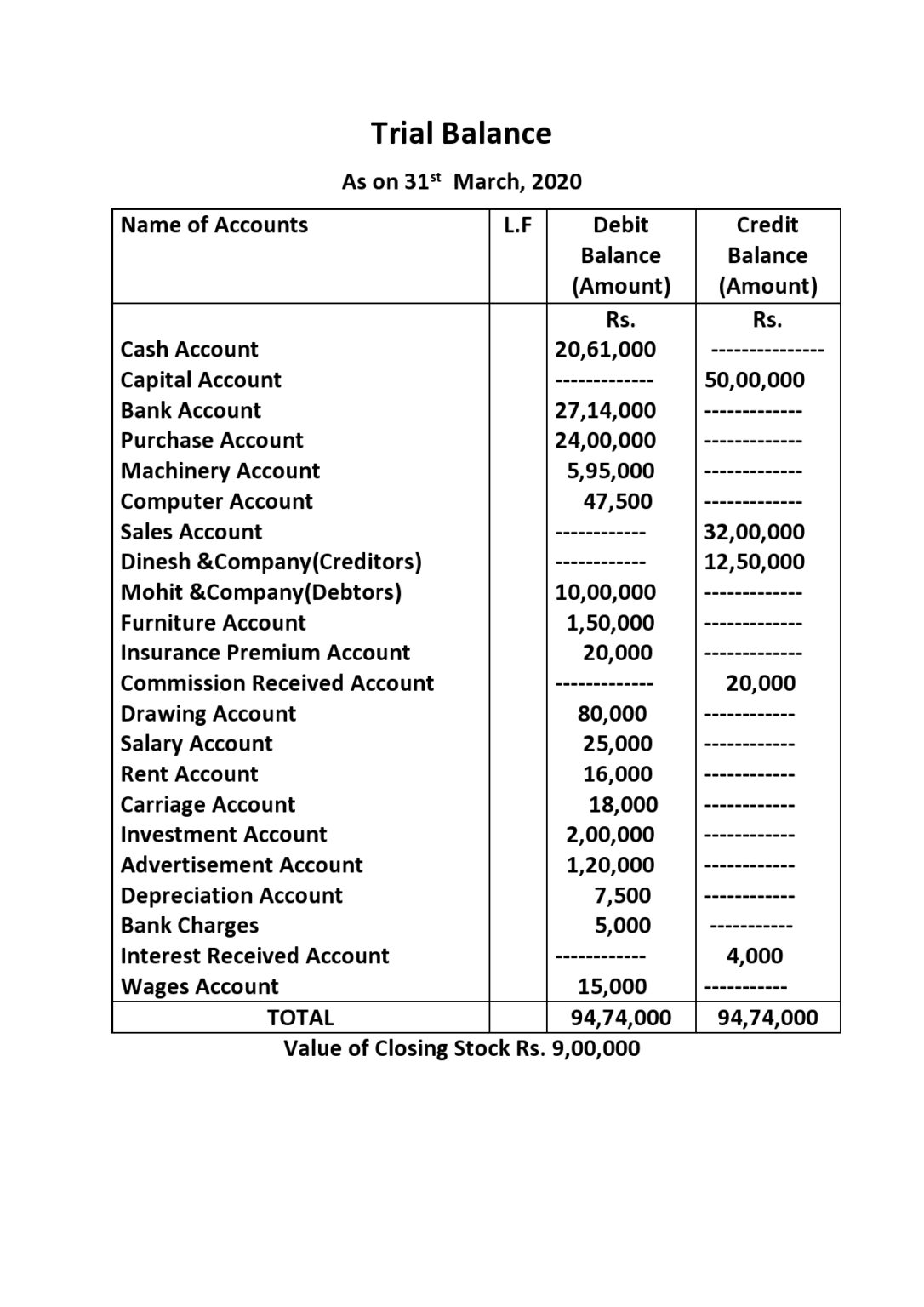

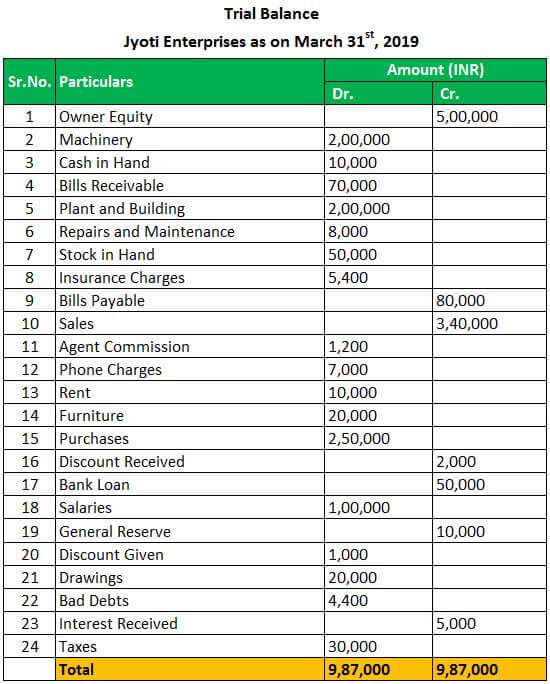

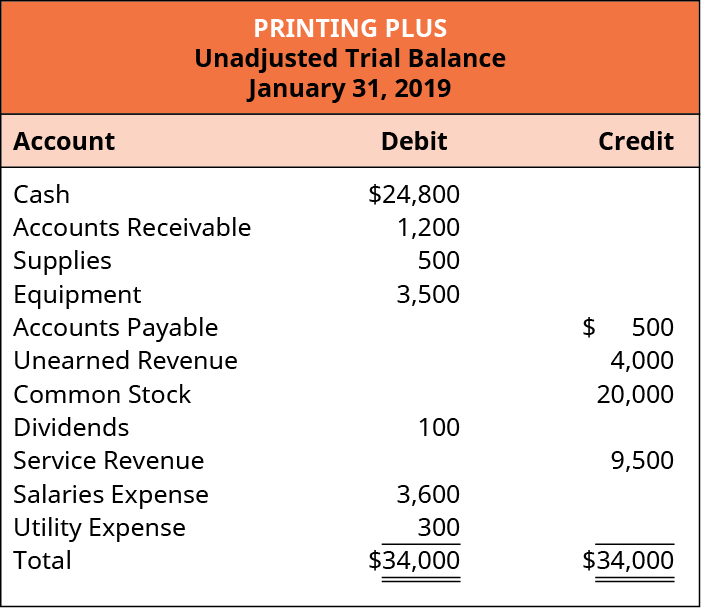

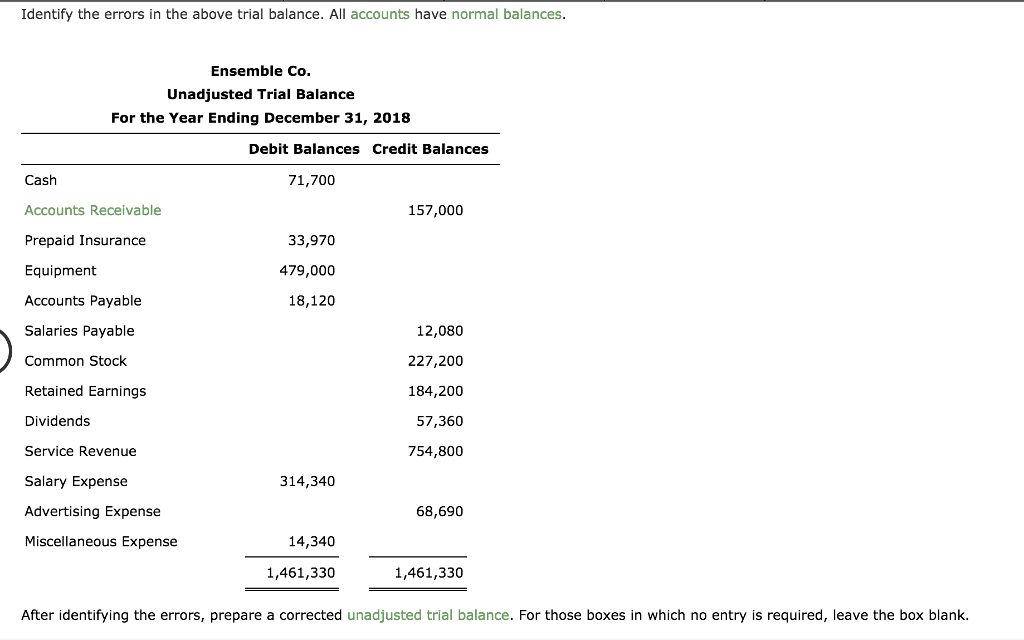

Trial balance to final accounts. A company prepares a trial balance. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses ,. Sample format of trial balance with pdf download.

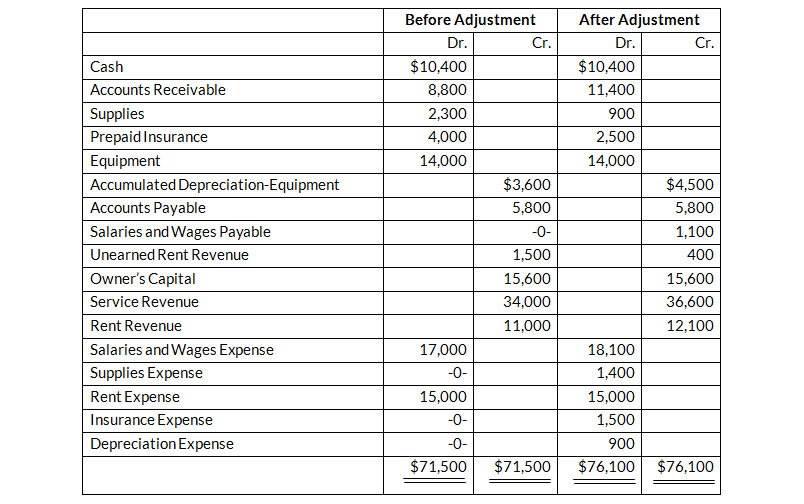

Asset, liability, equity, revenue, expense) with the ending account balance. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal. Final accounts is the ultimate stage of the accounting process where the different ledgers maintained in the trial balance (books of accounts) of the business organization are presented in the specified way to provide the profitability and financial position of the entity for a specified period to the stakeholders and other interested parties.

Trial balance is the end of the accounting process and the first step in preparing a final firm account. The trial balance forms the basis for the preparation of the final accounts. Stock at the end of year rs.

How do you match a trial balance? A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. It helps the accountant to assist in preparing final accounts.

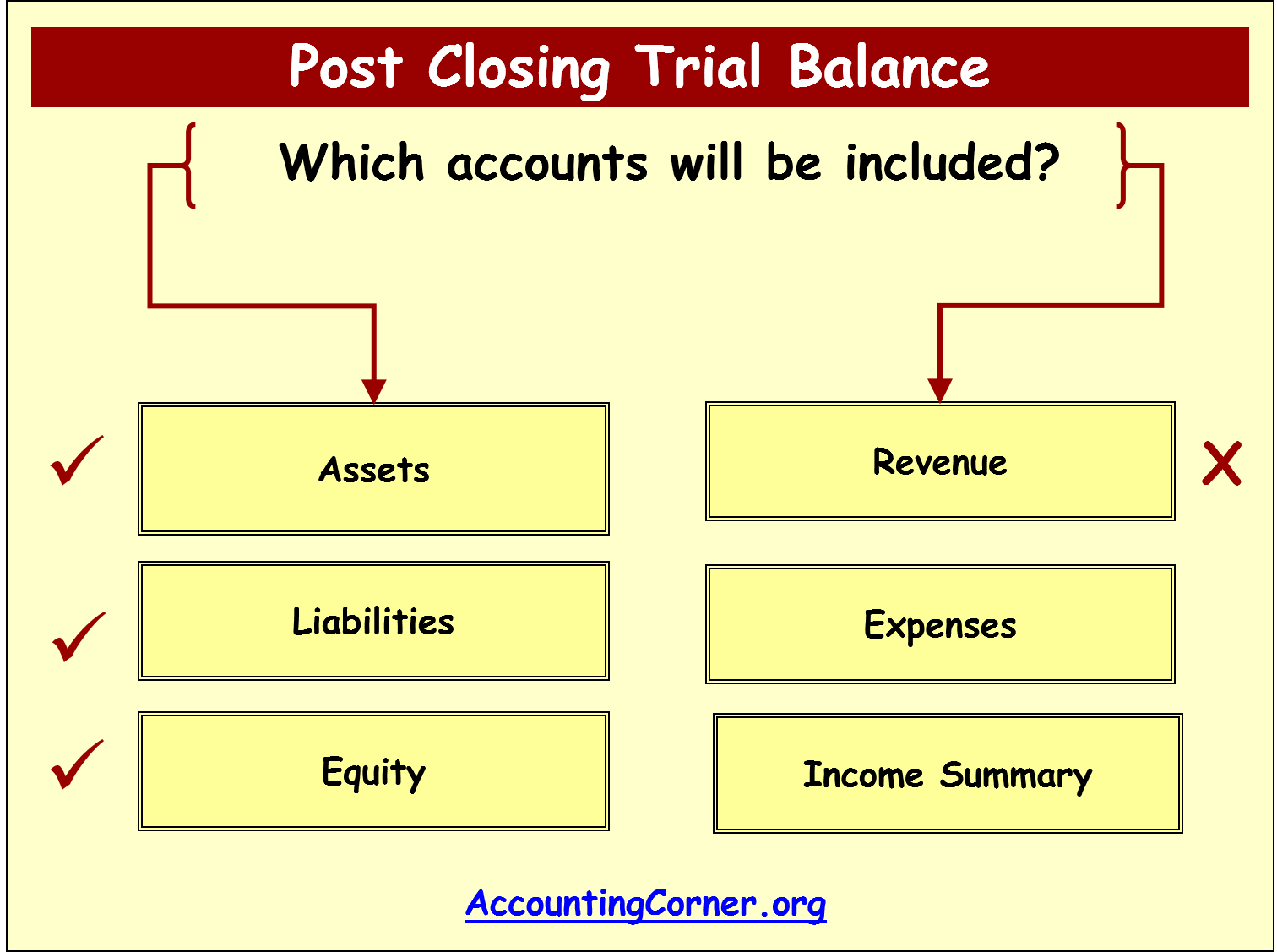

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. It may be noted here by way of a general rule that if an item appears in the trial balance, it will find its place only once in any final accounts, i, trading account or profitand loss account or the balance sheet. Trading and profit and loss account and balance sheet.

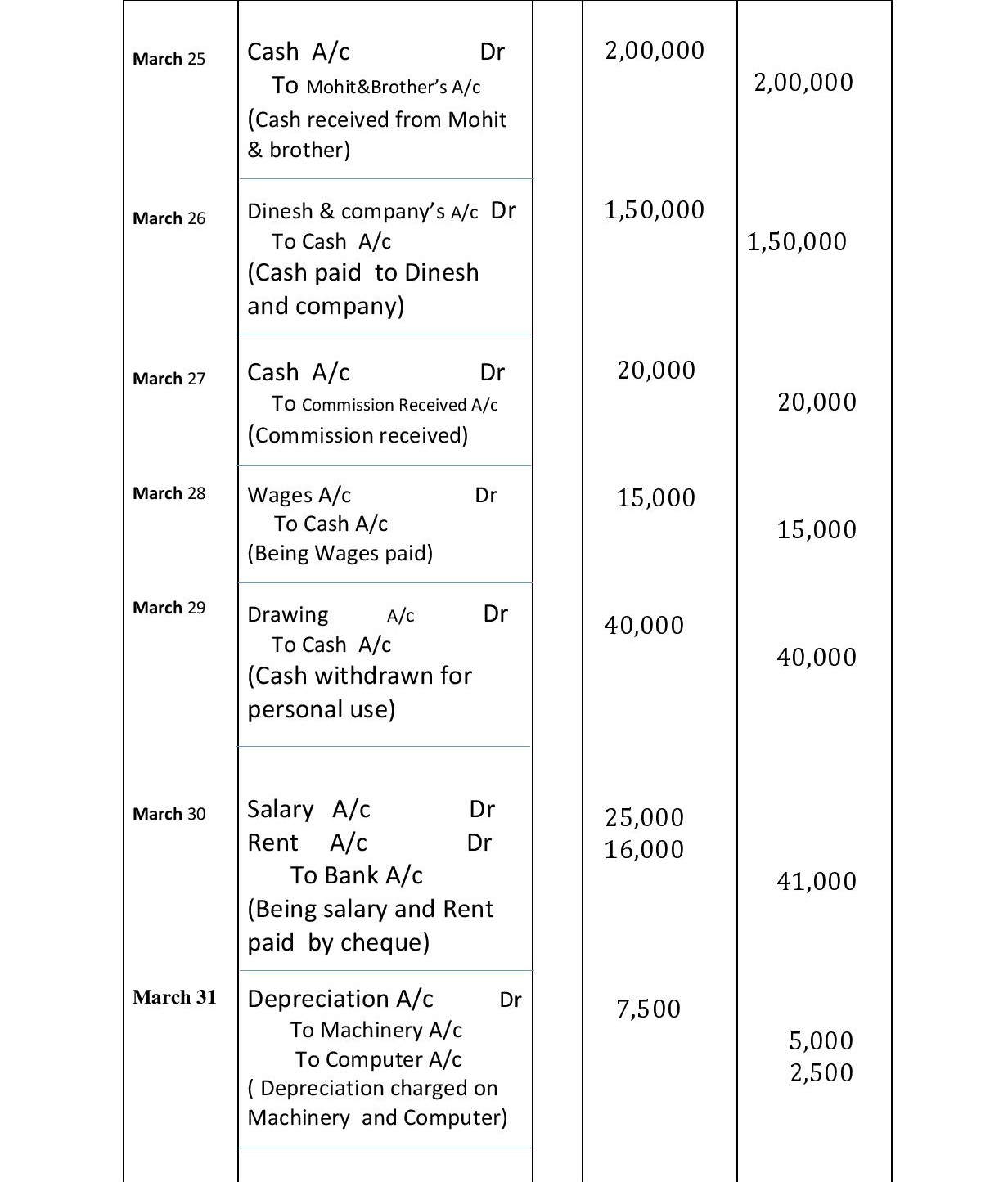

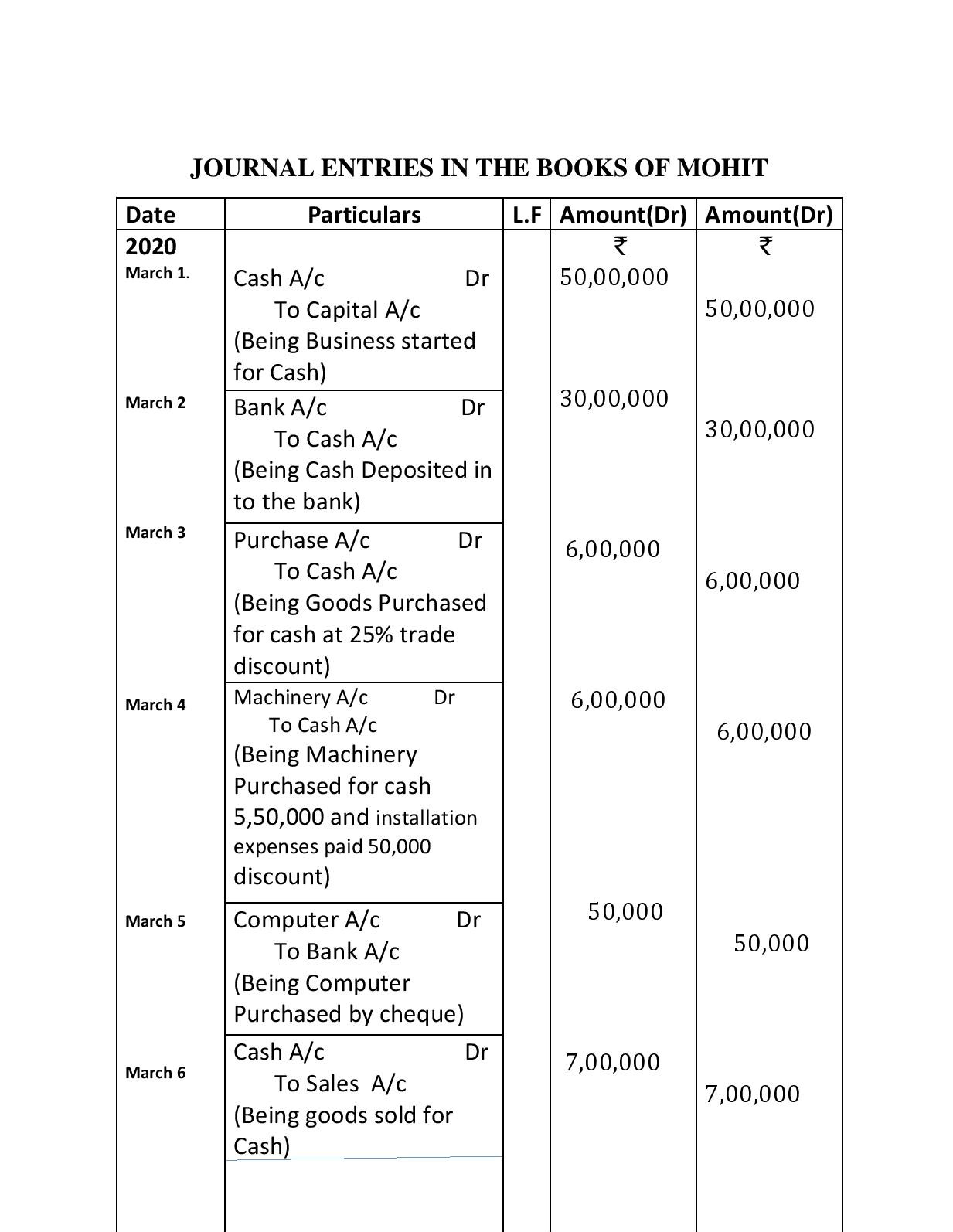

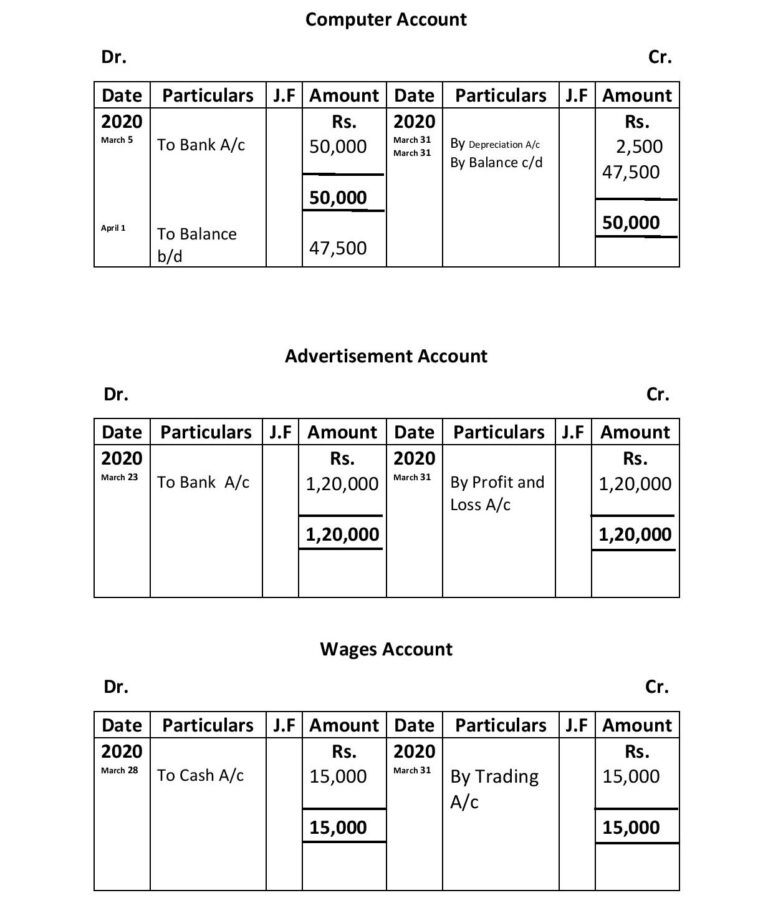

How are accounts listed in trial balance? Use of a trial balance. 20 transactions with their journal entries, ledger and trial balance.

The suffix “account” or “a/c” may or may not be written after the. On the appropriate side of trading a/c, profit and loss a/c or the balance sheet. A trial balance is a listing of all accounts (in this order:

Profit and loss appropriation account; How do you prepare a trial balance? What are the methods of preparing trial balance?

The final account balance depends on the final trial balance and the financial statements of each year. In this article, we have covered the following list: This summary of the ledger at the end of an accounting period, is a convenient starting point in the preparation of the final accounts i.e.

The trial balance includes all the balances of the ledger accounts, including the account balances of expenses, revenue, assets, liabilities, capital, and drawings. Final accounts is a somewhat archaic bookkeeping term that refers to the final trial balance at the end of an accounting period from which the financial statements are derived. The trial balance is simply a list of ledger accounts balances at the end of an accounting period.