Top Notch Info About Cash Flow Statement For Service Company Expenses In Financial Statements

The term cash flow generally refers to a company’s ability to collect and maintain adequate amounts of cash to pay its upcoming bills.

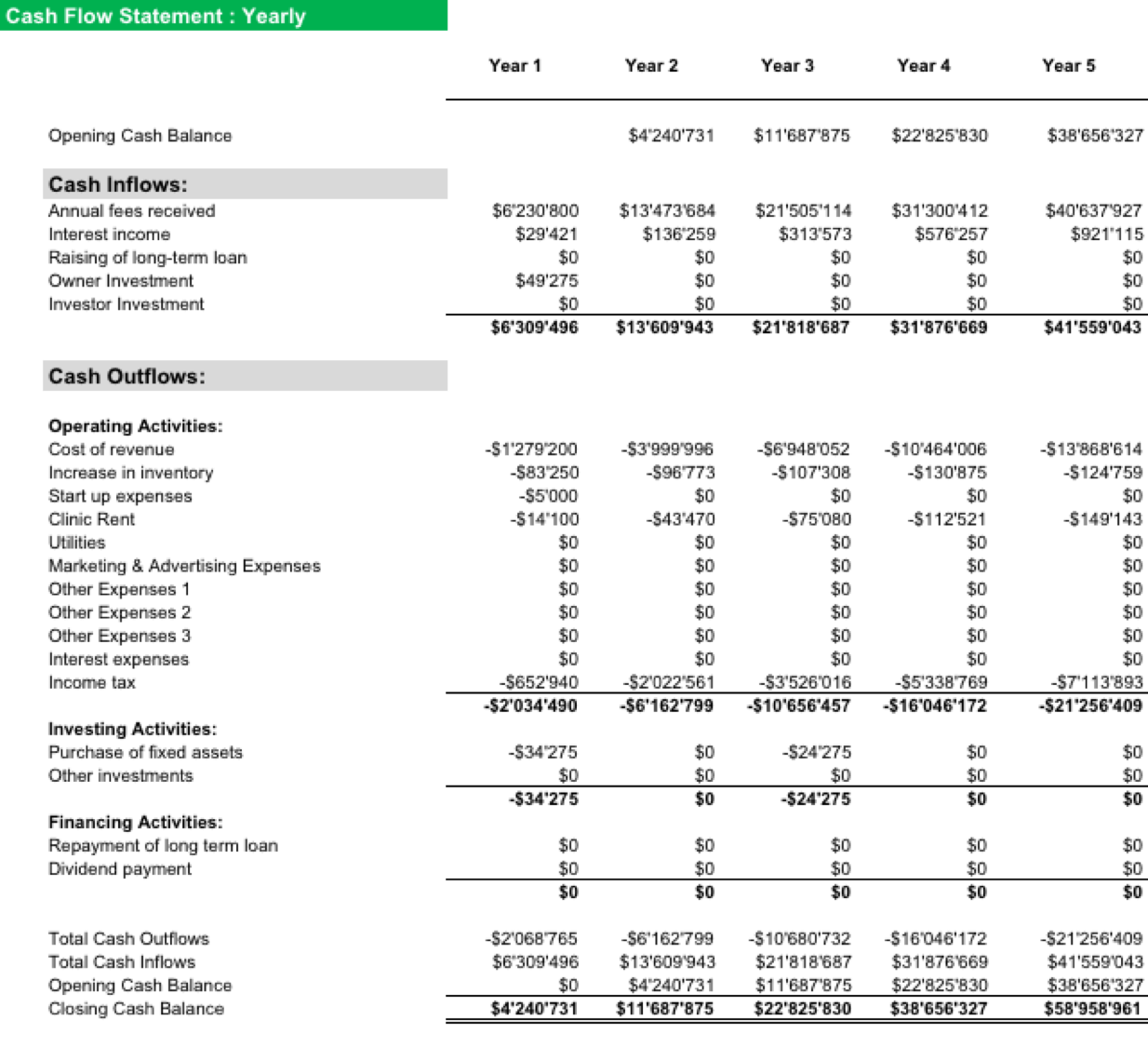

Cash flow statement for service company. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. For positive cash flows, and to provide a return to investors, a. A cash flow statement tracks all the money flowing in and out of your business.

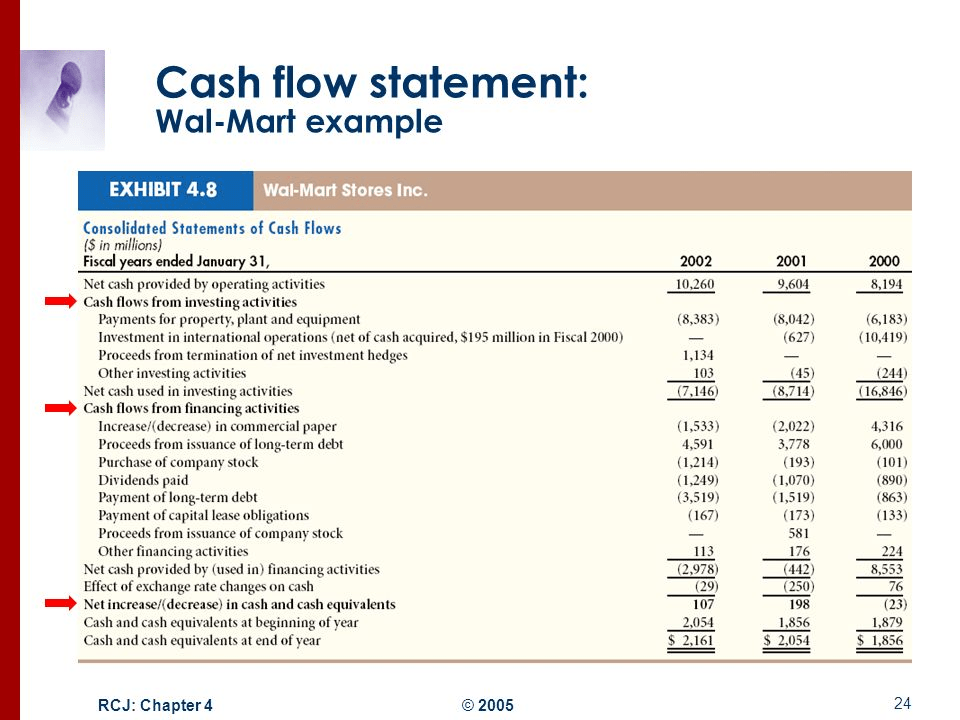

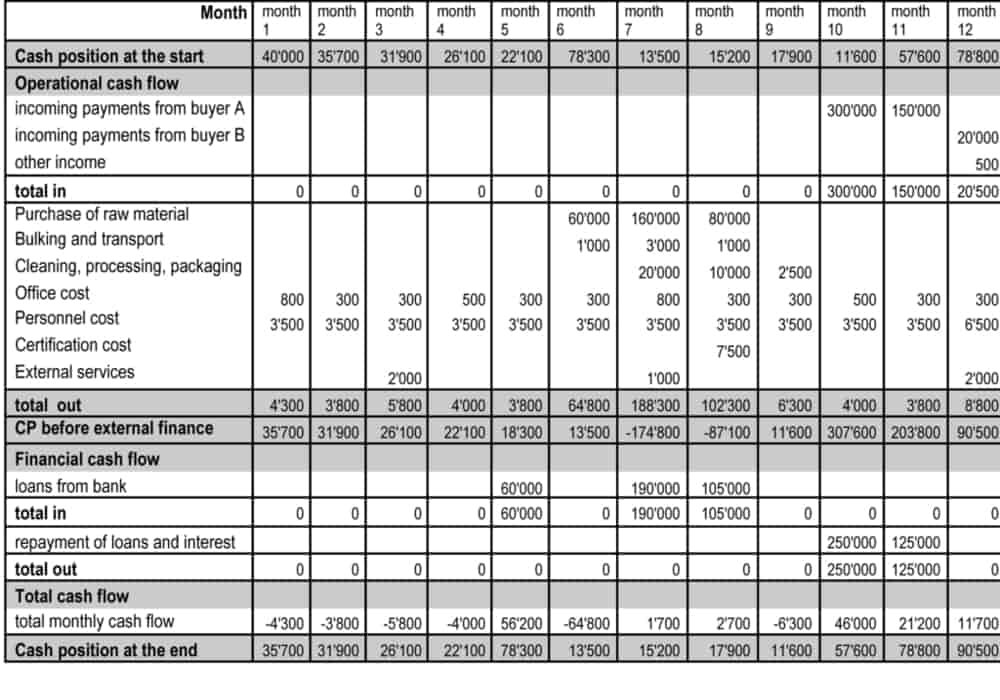

The cash flow statement is a standardized document that clarifies the state of a company's cash flow at a point in time. The cash flow statement is divided into three sections: Cash flow statements are one of the three fundamental financial statements financial leaders use.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. It is one of the three essential financial statements, along with the balance sheet and income statement. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Typically, you create a cash flow document every month, quarter, or year. Help predict shortages and surpluses; Simply enter the financial data for your business, and the template completes the calculations.

The cash flow statement is required for a complete set of financial statements. In other words, a company with good cash flow can collect enough cash to pay for its operations. As the name suggests, your cash flow from financing activities covers your net flow of cash used to fund the company.

You can use your cash flow statement to: On a broad scale, this includes debt, equity and dividends. The cash flow statement, also known as the statement of cash flows, is one of three main financial statements every company needs, along with the balance sheet and income statement.

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you have on hand for that time period. We will use these names interchangeably throughout our explanation, practice quiz, and other materials. The section gives you an idea of how well you’re managing your debt and how strong the company is financially.

Finances can be complicated, we make them simple. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. To ensure your business is cash positive, you need to draw up a cash flow statement.

The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. Operating activities—this section records the movement of cash from typical business activities, like sales and purchases of goods/services. Award winning service6 month trial period

It’s a snapshot of the amount of cash entering and leaving your business, enabling you to evaluate its financial health. A cash flow statement summarizes your company's cash inflows and outflows. For example, depreciation is recorded as a.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)