Recommendation Tips About Treatment Of Goodwill In Balance Sheet Ford 2018

Goodwill is defined as the part of the sales price that is greater than the sum.

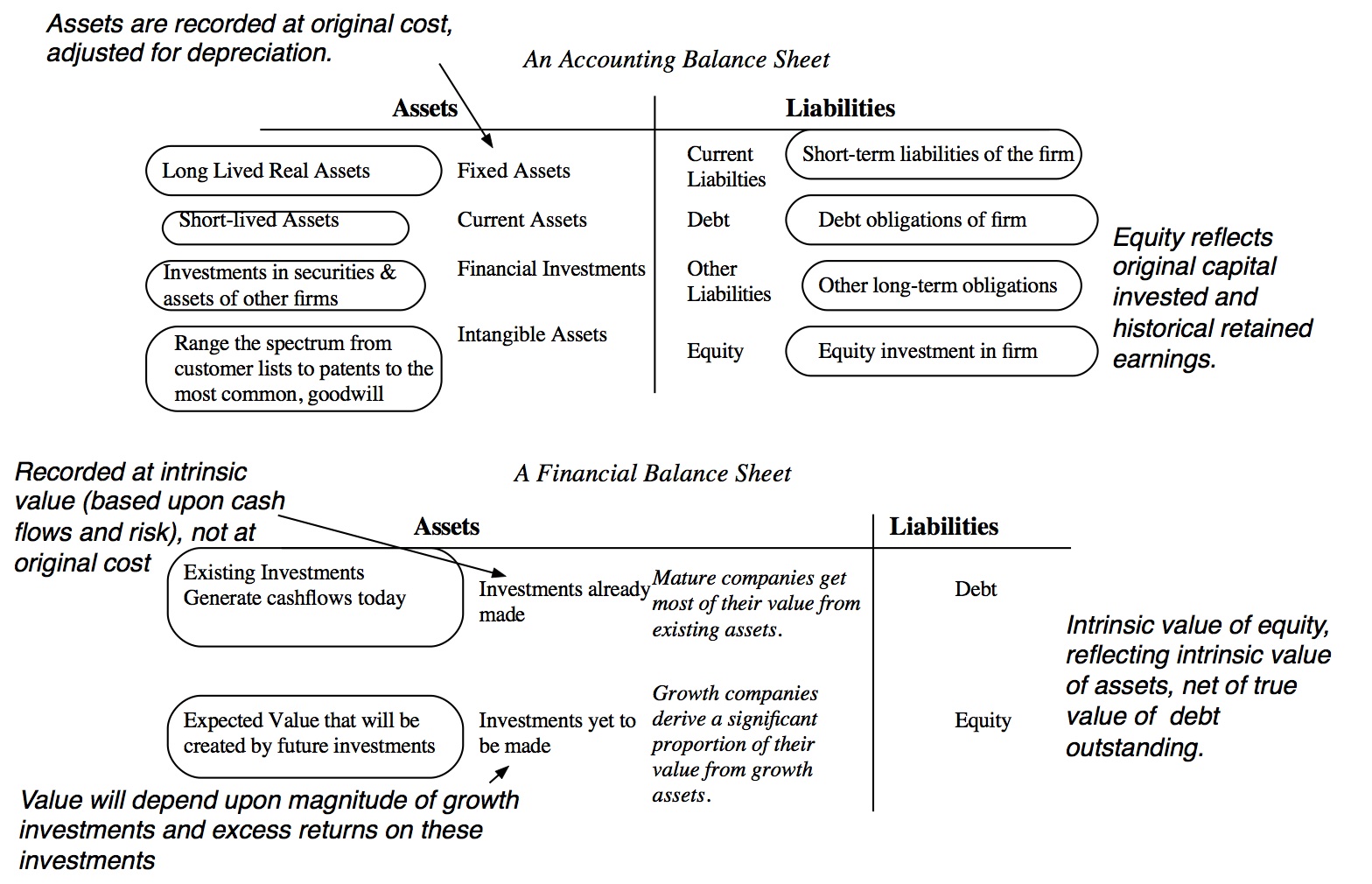

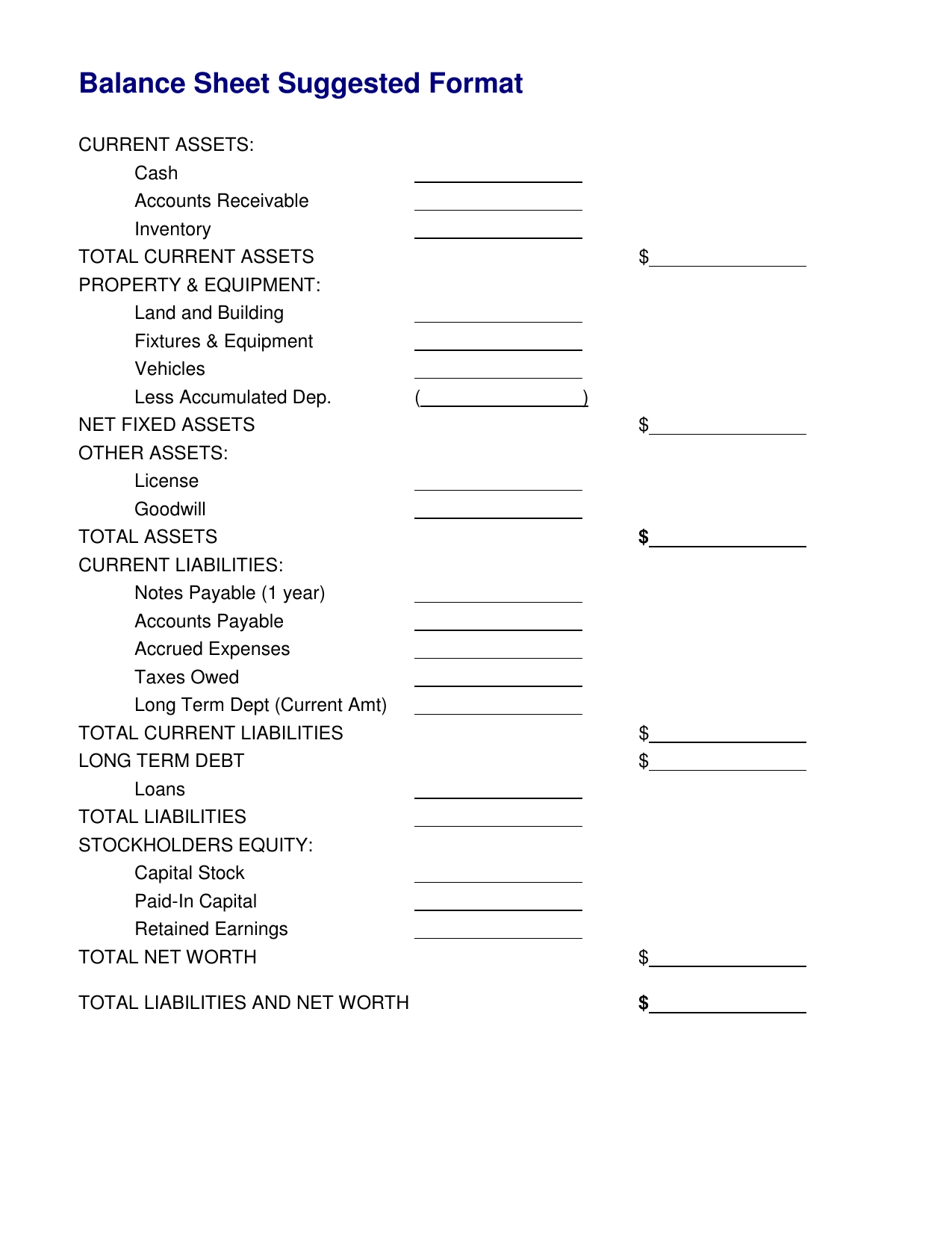

Treatment of goodwill in balance sheet. Goodwill is shown separately in the assets of the buying company’s balance sheet but the treatment of goodwill can vary by the accounting standard. Business assets should be properly measured at their fair market value before testing for impairment. If the acquiring company pays less than the target’s.

11 minute read in the complicated world of accounting, where numbers paint a precise picture of a company’s financial health, there exists a concept that transcends. In accounting, goodwill is an intangible asset. Key takeaways goodwill represents the intangible value of a business beyond its identifiable assets and liabilities.

What amount should be recorded as an impairment loss? [1] calculating goodwill in order to calculate goodwill, the fair market value of identifiable assets and liabilities of the company acquired is deducted from the purchase price. Goodwill reflects a company's reputation, customer.

If negative goodwill still arises, then this should be recognised and disclosed separately on the face of the balance sheet, directly underneath the goodwill heading. In this comprehensive guide, we’ll delve into the intricacies of goodwill on a balance sheet, exploring its definition, various types, calculation methods, implications,. The full value of goodwill will appear on the balance sheet of the reconstituted firm.

For example, if company a acquires company b for. In accounting, goodwill is an intangible asset that occurs when a buyer buys an existing business. If it is decided that.

This can be done in just one journal entry. To record goodwill on a balance sheet, the acquirer must list it as an intangible asset under the “assets” section. Written by cfi team what is negative goodwill?

Written by cfi team what is goodwill? Goodwill accounting is the act of ‘recognizing’ both economic and professional goodwill in the balance sheet. The amount that the acquiring company pays for the target company that is over and above the target’s net assets at fair value usually accounts for the value of the target’s goodwill.

2] raising the goodwill to its full value and writing it off immediately. The concept of goodwill comes into play when a company looking to acquire another. With an asterisk.when companies announce acquisitions, the executives throw around a number called goodwill, which is.

The negative goodwill (ngw) amount, also known as the “bargain purchase” amount, is the difference between the purchase. (for a detailed history, see hugh p.