Here’s A Quick Way To Solve A Info About Receipts From Customers Cash Flow Under Armour Balance Sheet 2019

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

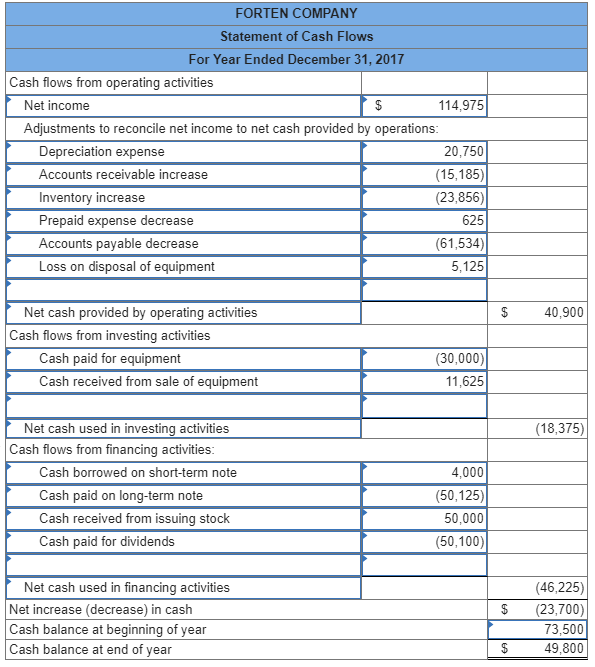

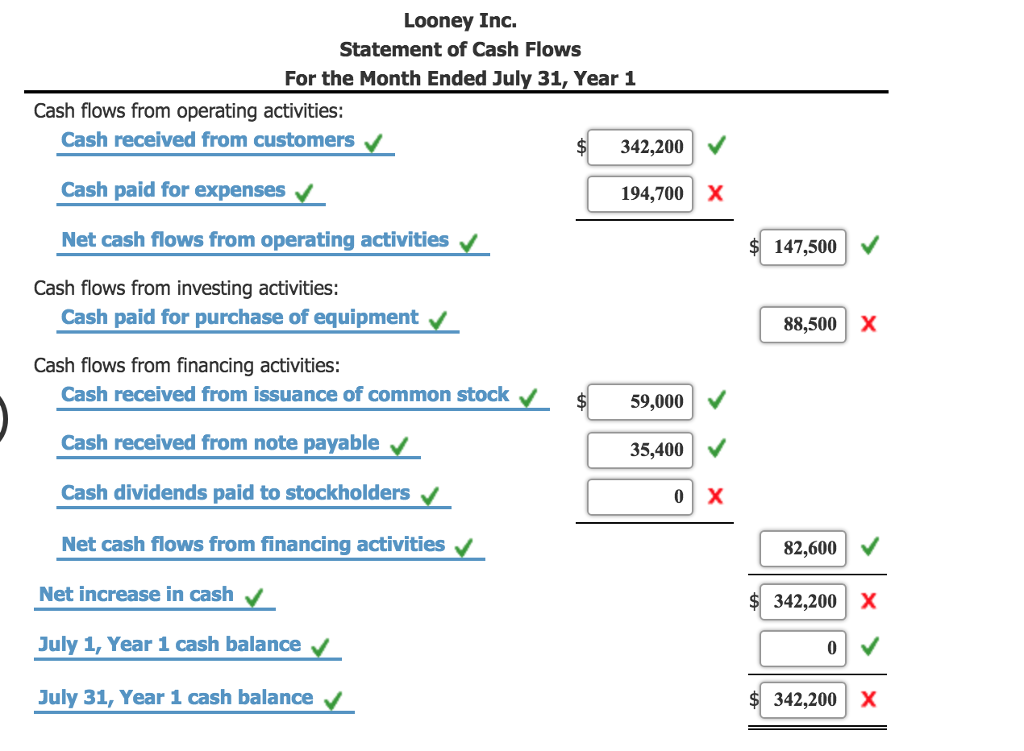

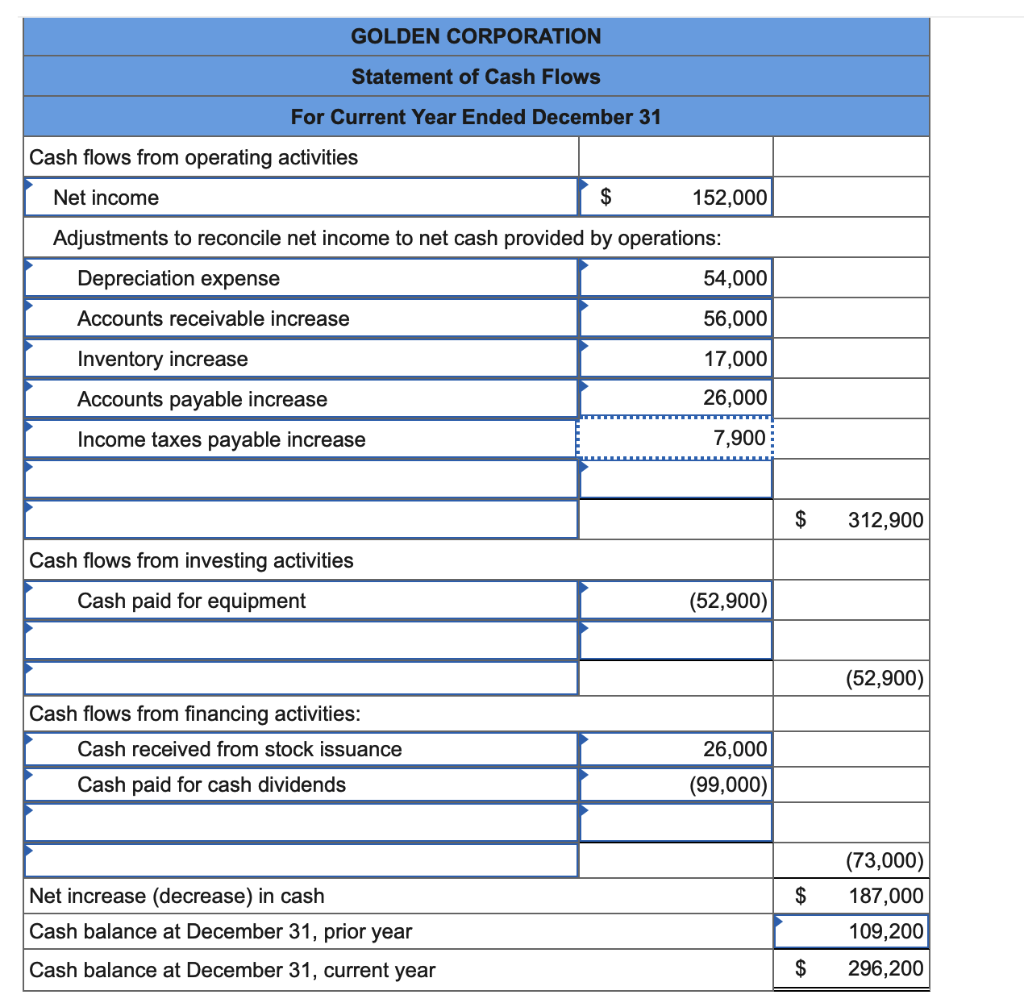

Cash flows from operating activities :

Receipts from customers cash flow. This video shows how to calculate the cash received from customers for the operating section of the statement of cash flows when a company uses the direct. A typical cash flow statement starts with a heading which consists of. Cash receipts typically increase (debits) the company’s cash.

The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period. There are two methods for cash. Interest paid ( 270) income.

Cash receipts from customers. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Investing activities generally include transactions involving the acquisition or disposal of noncurrent assets.

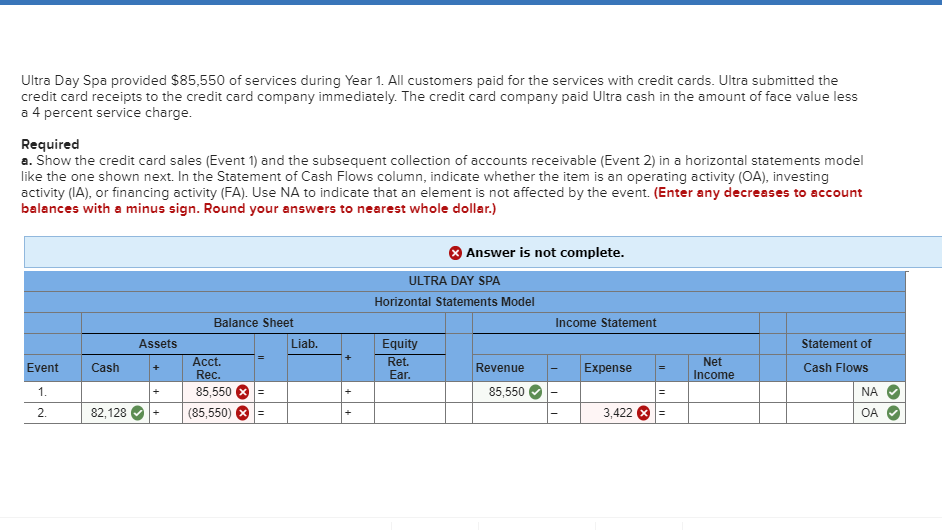

A cash receipt is an accounting entry that documents the collection of cash from a customer. Cash flows are either receipts (ie cash inflows) and so are represented as a positive number in a statement of cash flows, or payments (ie cash outflows) and so are. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the.

A cash flow statement consists of three sections: The direct method adds up all the various types of cash payments and receipts, including cash paid to suppliers, cash receipts from customers and cash. Here’s how to calculate cash flow.

Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. Thus, cash inflows from investing activities. You’ll need access to cash transaction data, including the cash receipts you pay suppliers and those you receive from customers.

Cash flow from operating activities. The cash receipts from customers equal to company net sales plus beginning accounts receivable and then minus ending receivables. Cash inflows from operating activities consist of receipts from customers for providing goods and services, and cash received from interest and dividend income (as well as the.

This is the cash receipts from customers. Uk government finances saw a record surplus in january due in part to a big rise in income tax receipts, with more britons forced into paying tax. Cash flow from operating activities:

Cash from operating activities, cash from investing activities and cash from financing activities. Cash paid to suppliers (29,800,000) cash paid to employees (11,200,000). Cash receipts and payments on behalf of customers (for example, receipt and repayment of demand deposits by banks, and receipts collected on behalf of and.

Cash paid for wages and salaries: