Unique Tips About Accrued Commission In Balance Sheet Sample Personal

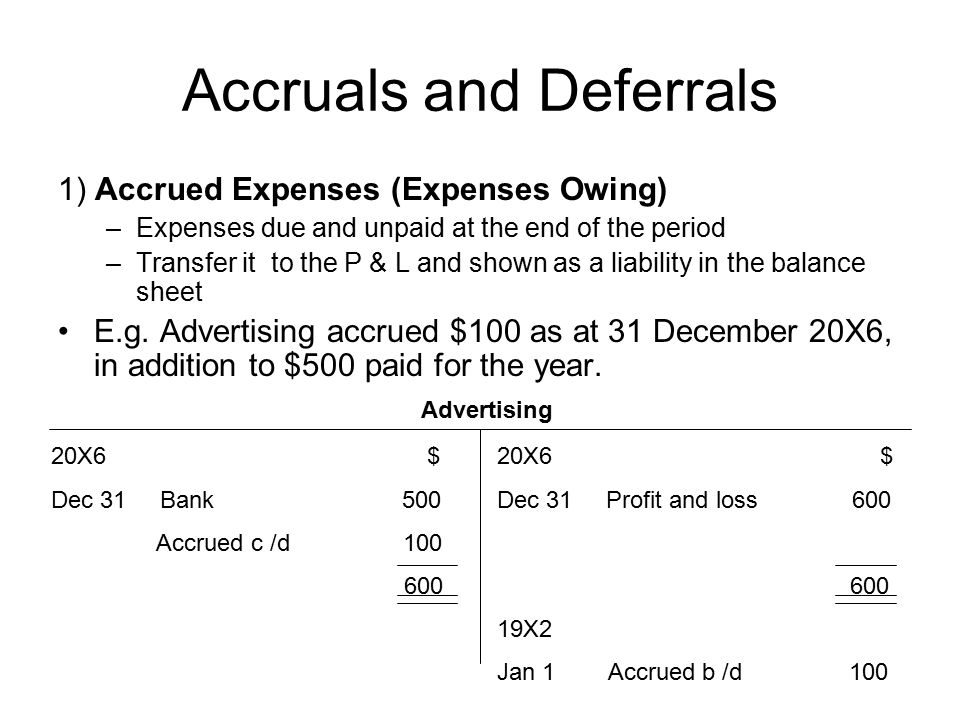

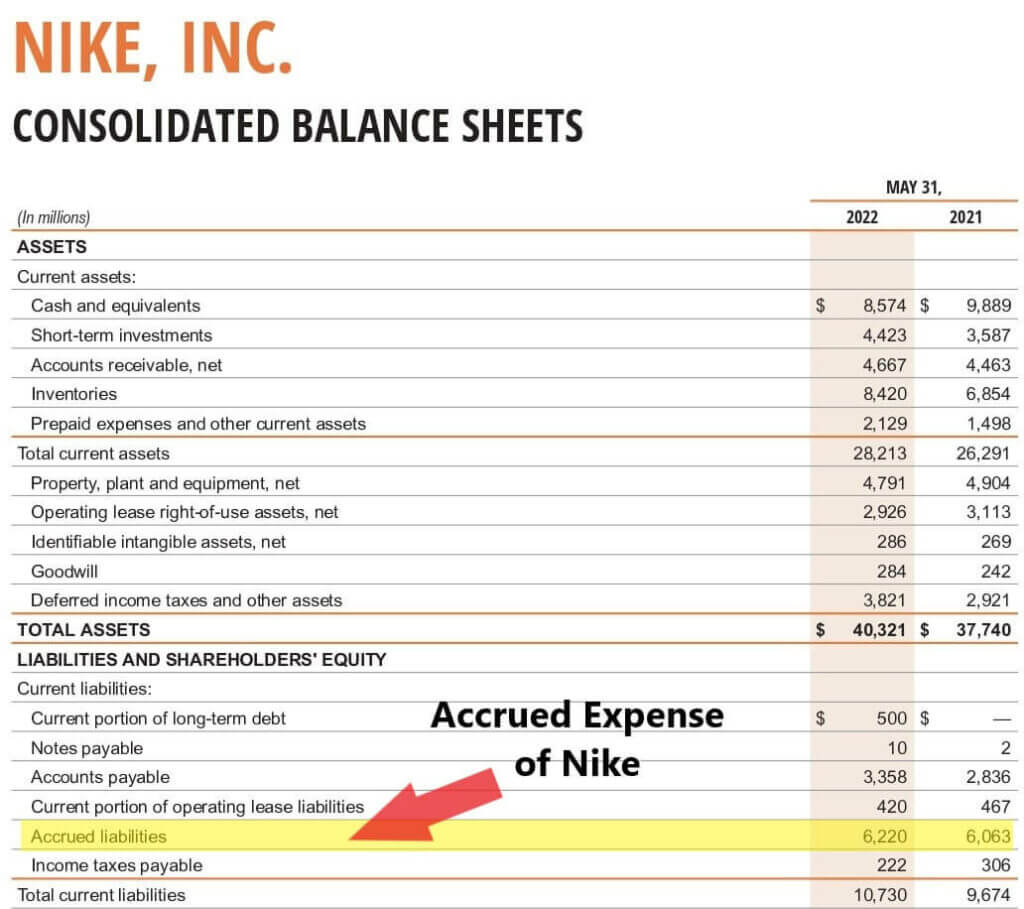

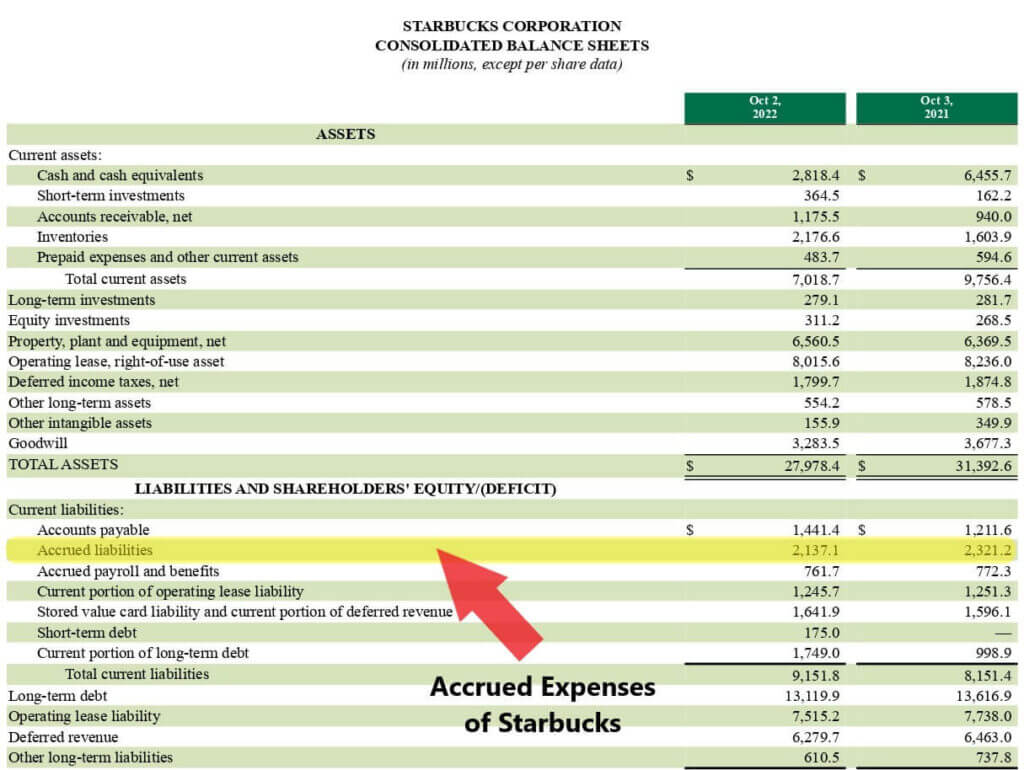

Accrued expenses are expenses incurred that have not yet been paid.

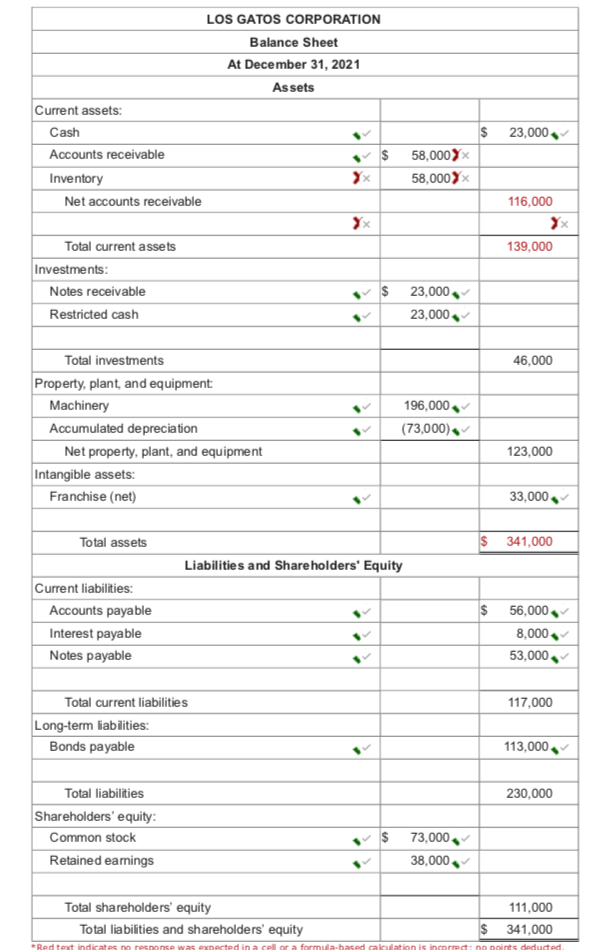

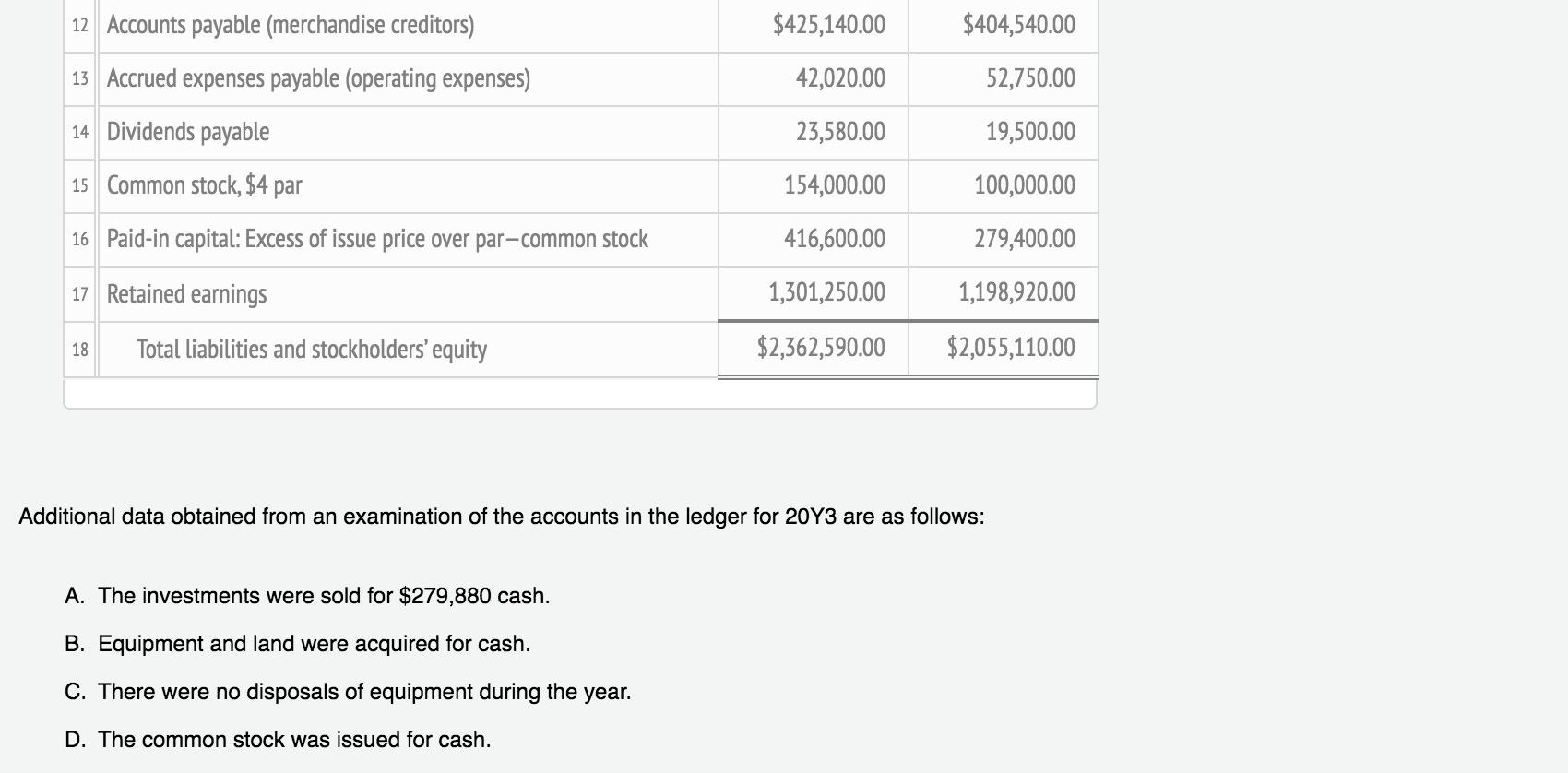

Accrued commission in balance sheet. While preparing the trading and profit and loss a/c we need to deduct the amount of prepaid. Accrued income is an amount earned but not actually received during the accounting period or till the date of preparation of final accounts for the period concerned. As mentioned earlier, accrued expenses are payments that need to be made by the organization to settle for goods and services they have already utilized.

When an accrual is created, it is typically with the intent of recording an. Accrued revenue is recognized as an asset on the balance sheet, because it represents revenue that has been earned but not yet received. Where does commission received go in balance sheet?

An accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. The commission received will be shown in income side of profit and loss account since it is a revenue. When payment is made.

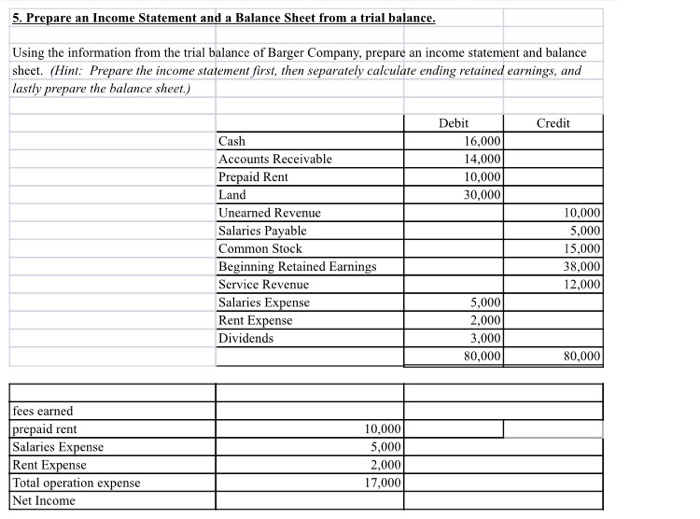

What is accrued commission revenue? The accrual of expenses and liabilities refers to expenses and/or liabilities that a company has incurred, but the company has not yet paid or recorded the transaction. Revenues and expenses are not listed on a balance sheet but.

A commission is a revenue or an expense, depending on whether it is incoming or outgoing. The prepaid expense a/c appears on the assets side of the balance sheet. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported.

Accrued income is listed in the asset section of the balance sheet because it represents a future benefit to the company in the form of a future cash payout. Accrued expenses are a specific type of liability that appears on the balance sheet, and understanding them is essential for a comprehensive analysis of a. If a company has earned the commissions but has not yet received the money, the company should make an accrual adjusting entry so that its income statement will report.

An accrued expense is always recorded as a liability on your balance sheet. The balance in the commission. Accrued revenue is revenue that has been earned by providing a good or service, but for which no cash has been.

Accrued income reported on the balance sheet. Accrued income refers to those incomes which have been earned by the firm in the current accounting period but have not been received yet.