Impressive Info About Bank Indebtedness Cash Flow Statement Accounts Payable Decrease

Along with balance sheets and income statements, it’s one.

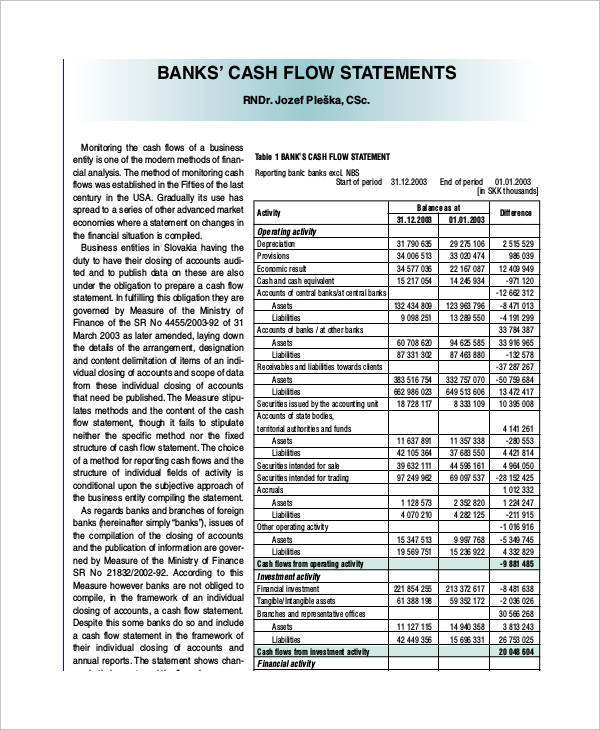

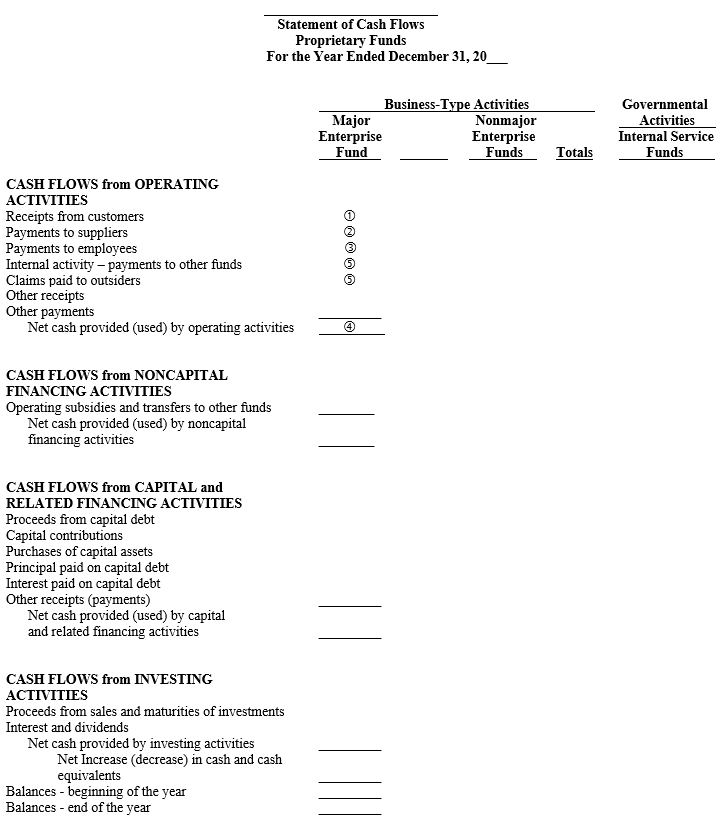

Bank indebtedness cash flow statement. Presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating. Statement of financial postion as at december 31, 2021; To help preparers of financial statements with canadian accounting standards for private enterprises (“aspe”) section 1540, cash flow statement, we’ve summarized the key.

1 r this communication contains a general overview of the topic and is current as of june 30, 2021. Bank of america earned $58.5 billion in interest income from loans and investments while paying out $12.9 billion for deposits.

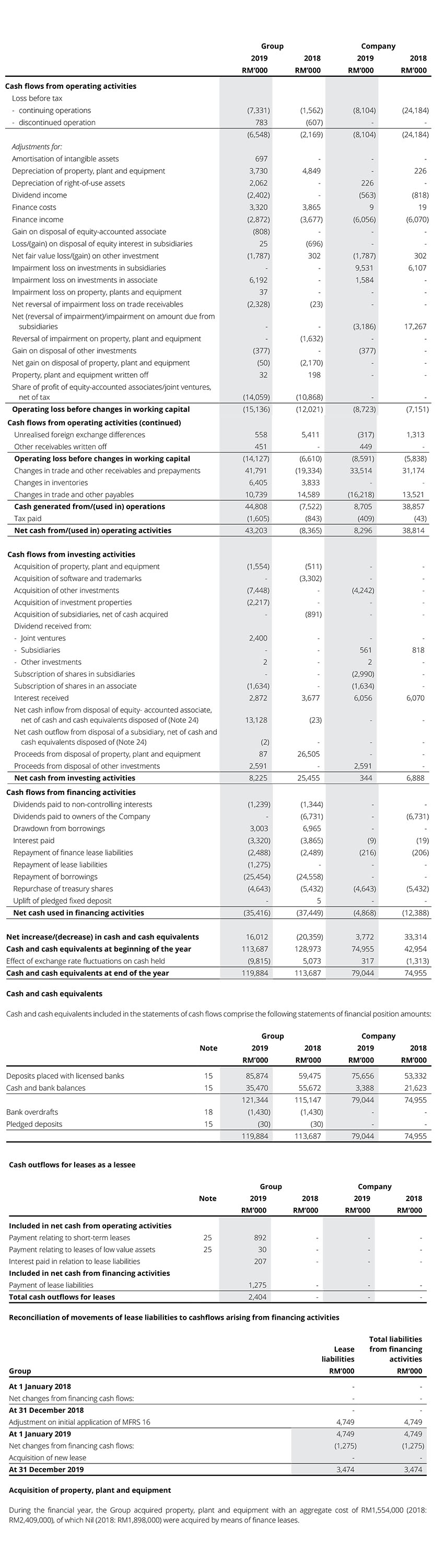

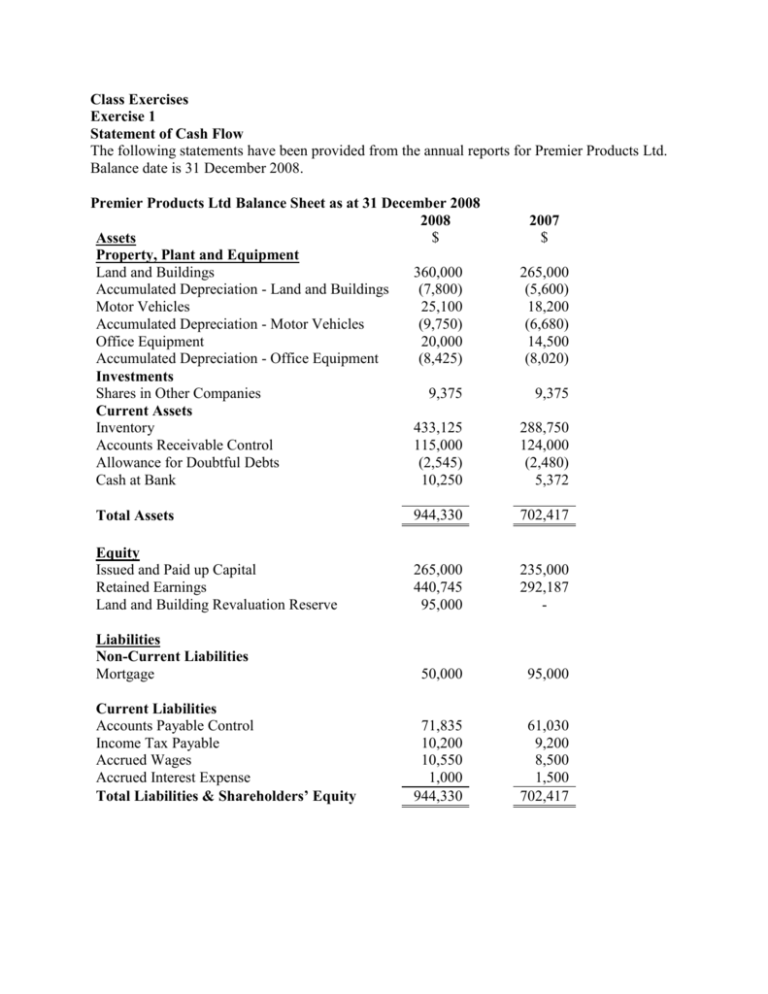

The statement of cash flows must detail changes in the total of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents for the period. Financial statements of joseph brant hospital year ended march 31, 2020 independent auditor’s report to the board of directors of joseph brant hospital deloitte. The cash flow to debt ratio is a coverage ratio that compares the cash flow that a business generates to its total debt.

Bank balance sheet to its income statement and cash flow statement (32:47) in this lesson, you’ll learn how to move from a commercial bank’s balance sheet to its income. This information is not a substitute for professional advice and we recommend. The cash flow statement focuses attention on a firm’s ability to generate cash internally, its management of current assets and current liabilities, and the details of.

Indebtedness to operating cash flow ratio means, as of any date of determination, the ratio of (a) the aggregate principal amount of all outstanding indebtedness of a person. Cash flows from purchases and sales of property, plant, and equipment and other productive assets, including business combinations (see fsp 6.9.15 for further. A debt schedule is a comprehensive table detailing a company's outstanding debts, including loans, bonds, leases, and debentures.

The cash flow most commonly used to calculate the ratio is.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

![[Solved] Make a Vertical AND Horizontal analysis f SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/12/63ae9c16dd49b_1672387604335.png)