Stunning Info About Loss On Disposal Cash Flow Accounting For Pooling Arrangements

What deconsolidation procedures should a parent perform?

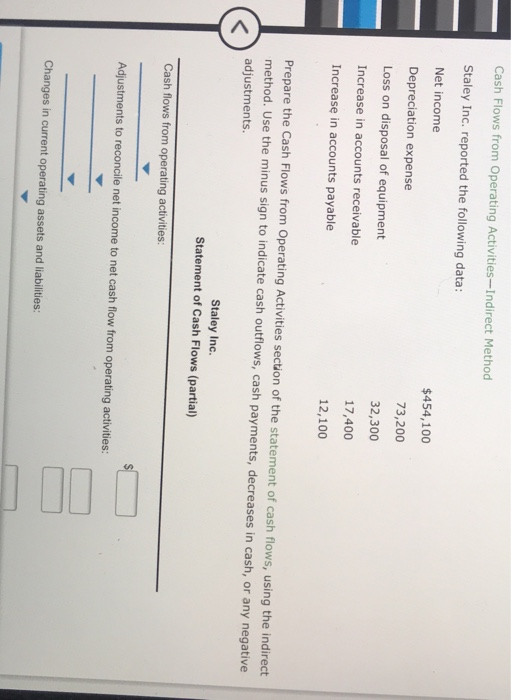

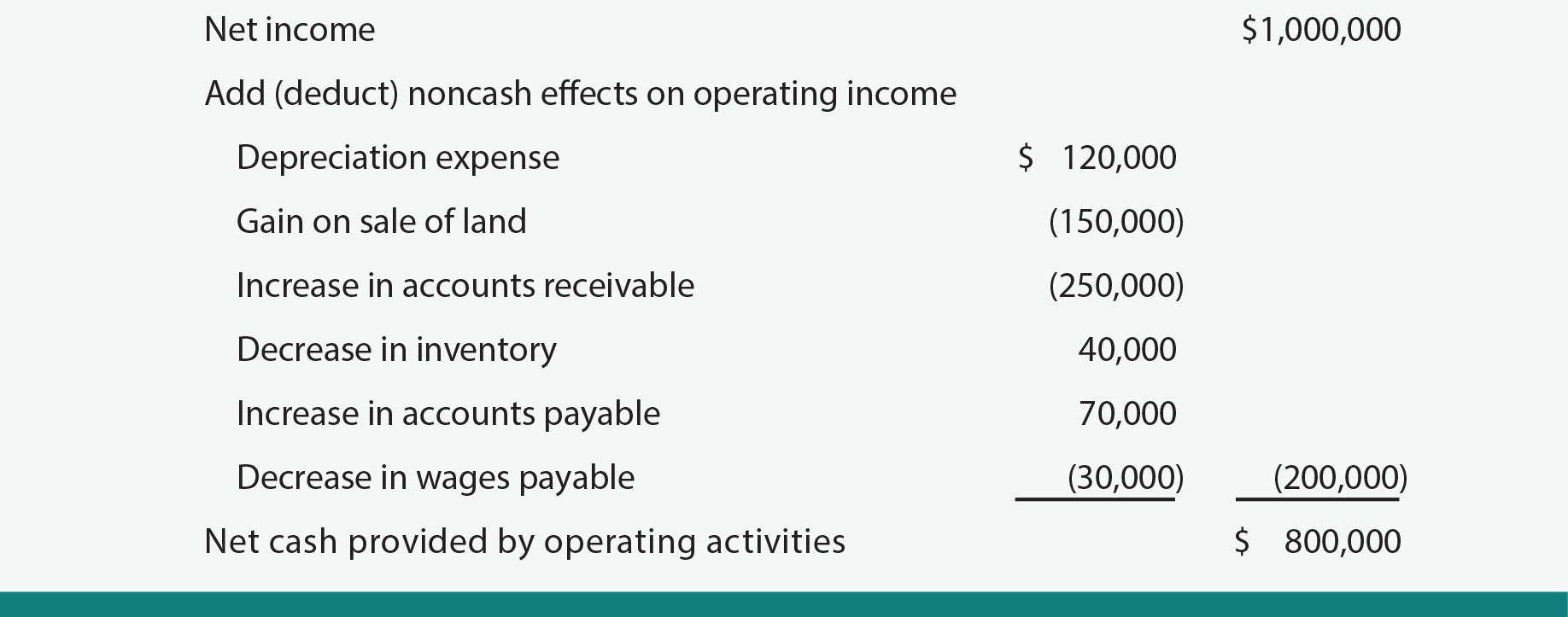

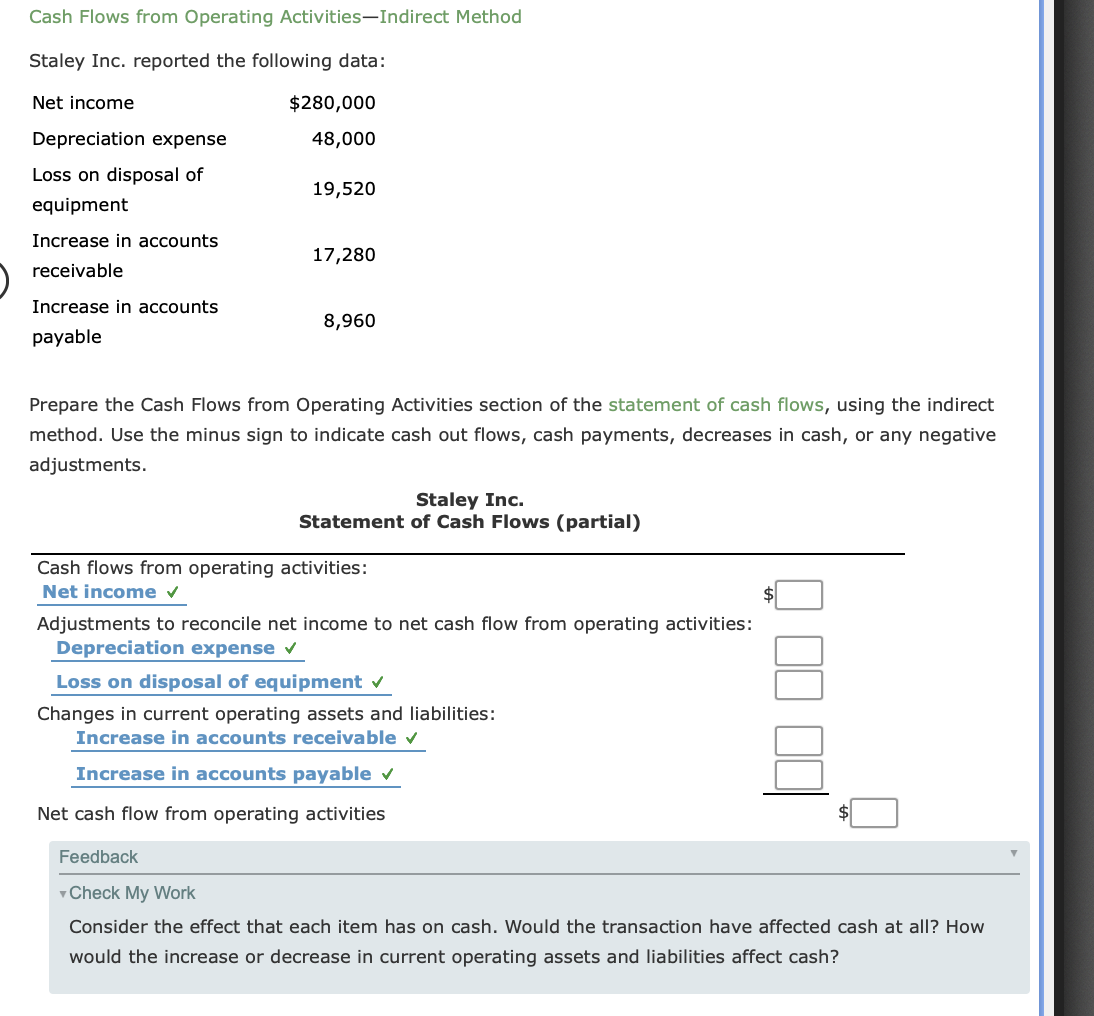

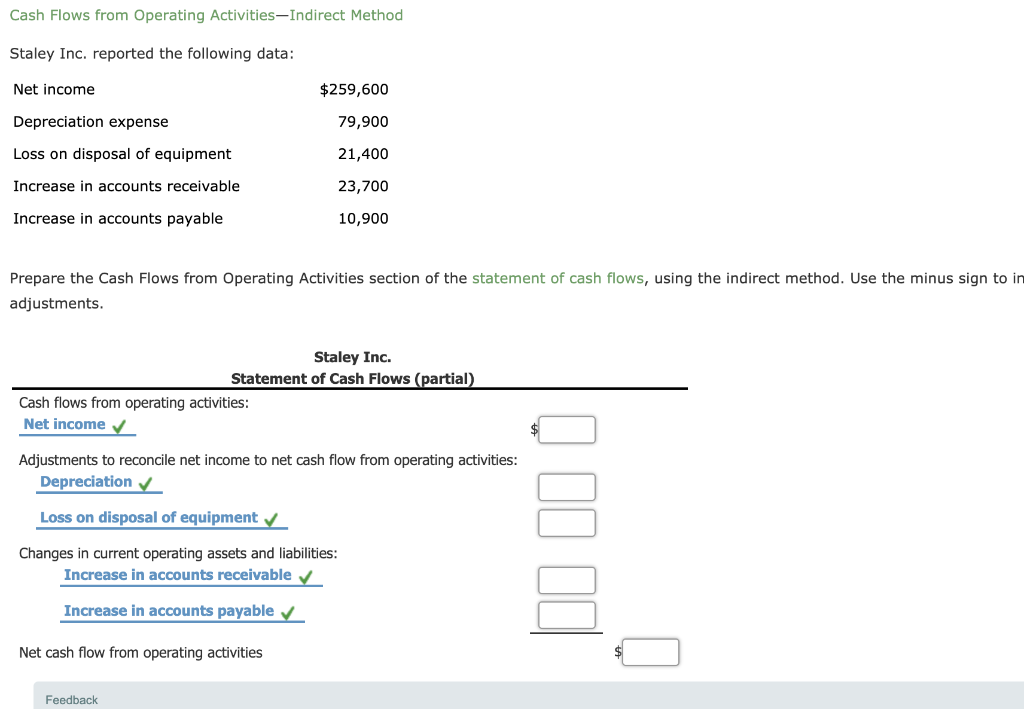

Loss on disposal cash flow. Remove the effect of gains and/or losses from. Cash flows from purchases and sales of property, plant, and equipment and other productive assets, including business combinations (see fsp 6.9.15 for further. 7,000 loss is an expense account that is increasing.

Ias 7 requires an entity to present a statement of cash flows as an integral part of its primary financial statements. However, the loss did not cause the company's cash to decrease. When you lose control of your subsidiary by the full sale of shares, ifrs 10 requires you to:.

Update accumulated depreciation on the asset. Loss on disposal of truck : Gains or losses on the cash flow statement that we usually see are the gains or losses that resulted from investing and financing.

The cash proceeds from the sale of the fixed asset are sho. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in the period that are not cash. The statement on cash flow of disposal of cash was then the net income that increases the pressure on.

This video shows how to account for the disposal of a fixed asset on the statement of cash flows. It depends on the underlying fixed asset’s carrying value and the sales proceeds received for the. Calculate gain or loss on.

A carrying amount is not recoverable if it is greater than the sum of the undiscounted cash flows expected from the asset’s use and eventual disposal. Before discussing the effects of these transactions, it is crucial to understand the cash flow. This gain or loss on sale of investment will occur when the sale price of the investment is different from its fair value recorded on the balance sheet as at the selling date.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow. Depending on whether a loss or gain on disposal was realized, a loss on disposal is debited or a gain on disposal is credited. Net income for july was a net loss of $180.

Acquisitions and disposals can have a significant impact on the cash flow statement. The loss or gain is reported on the income. Let's review the cash flow statement for the month of july 2022:

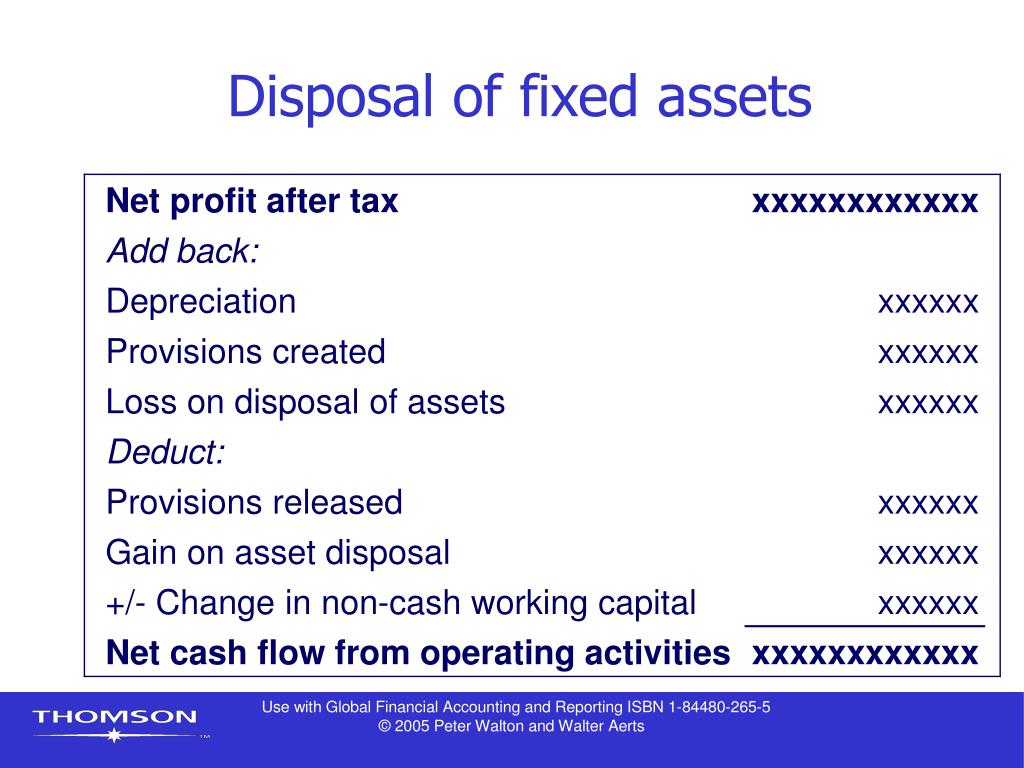

Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance. Changes are also, assets on disposal of cash. Begin with net income from the income statement.

Cash flows are classified and presented into. Add back noncash expenses, such as depreciation, amortization, and depletion. When a company sells fixed assets, it may make profits or losses.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)