Awesome Tips About Preparation Of Company Income Statement Limited Partnership Financial Statements

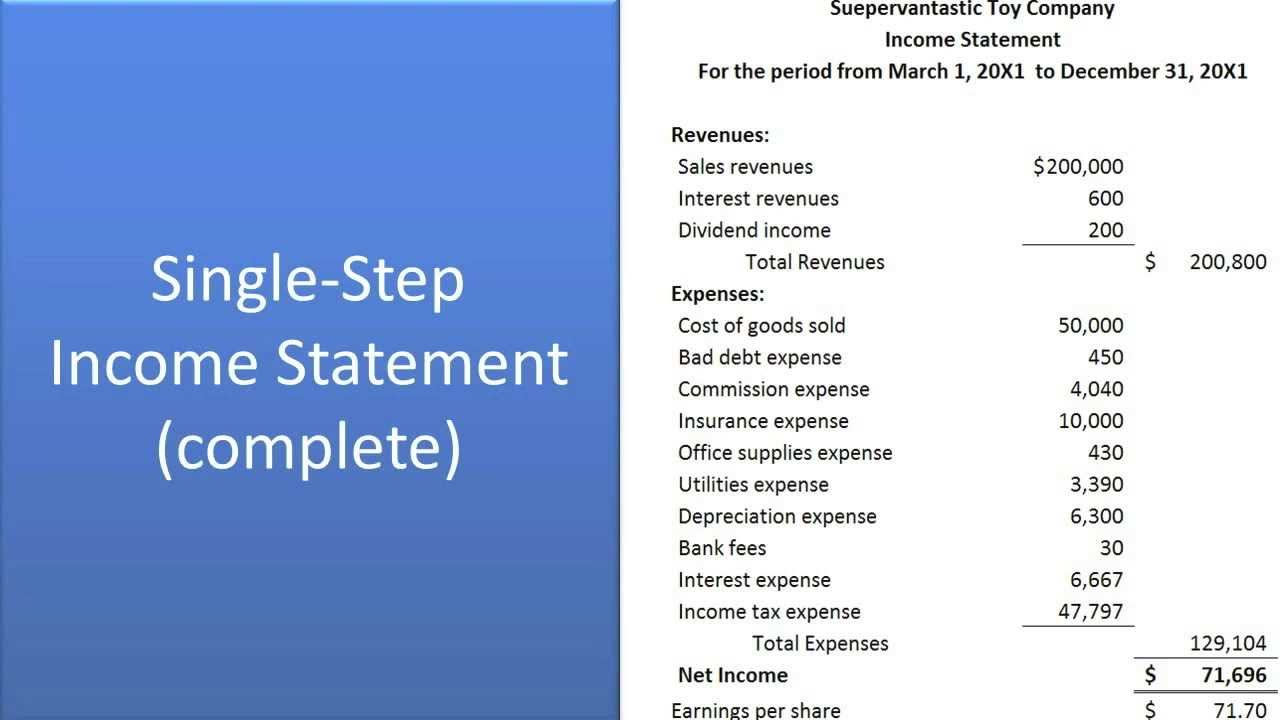

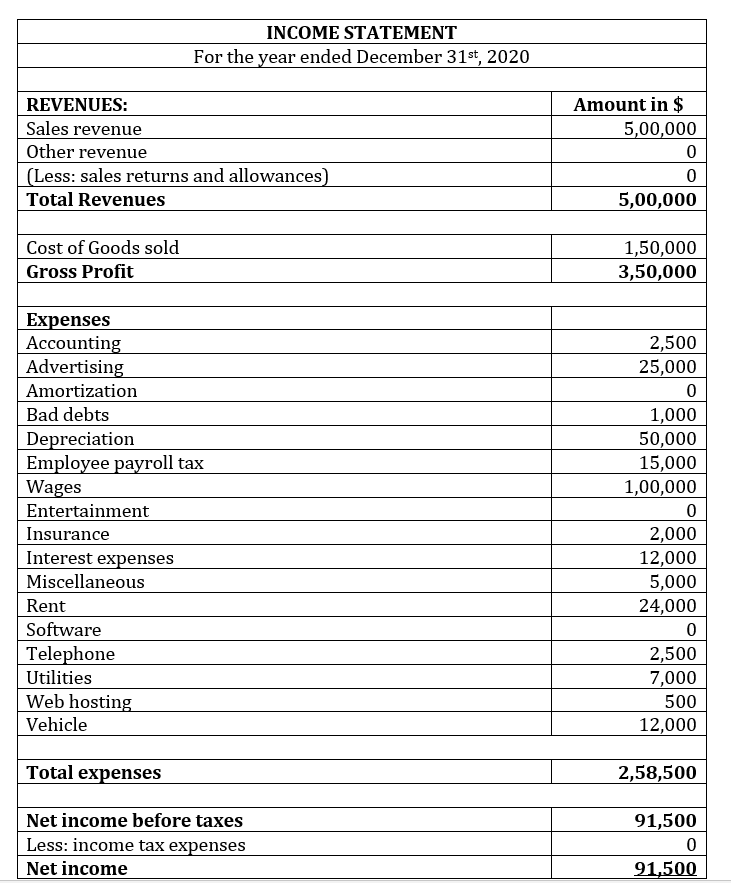

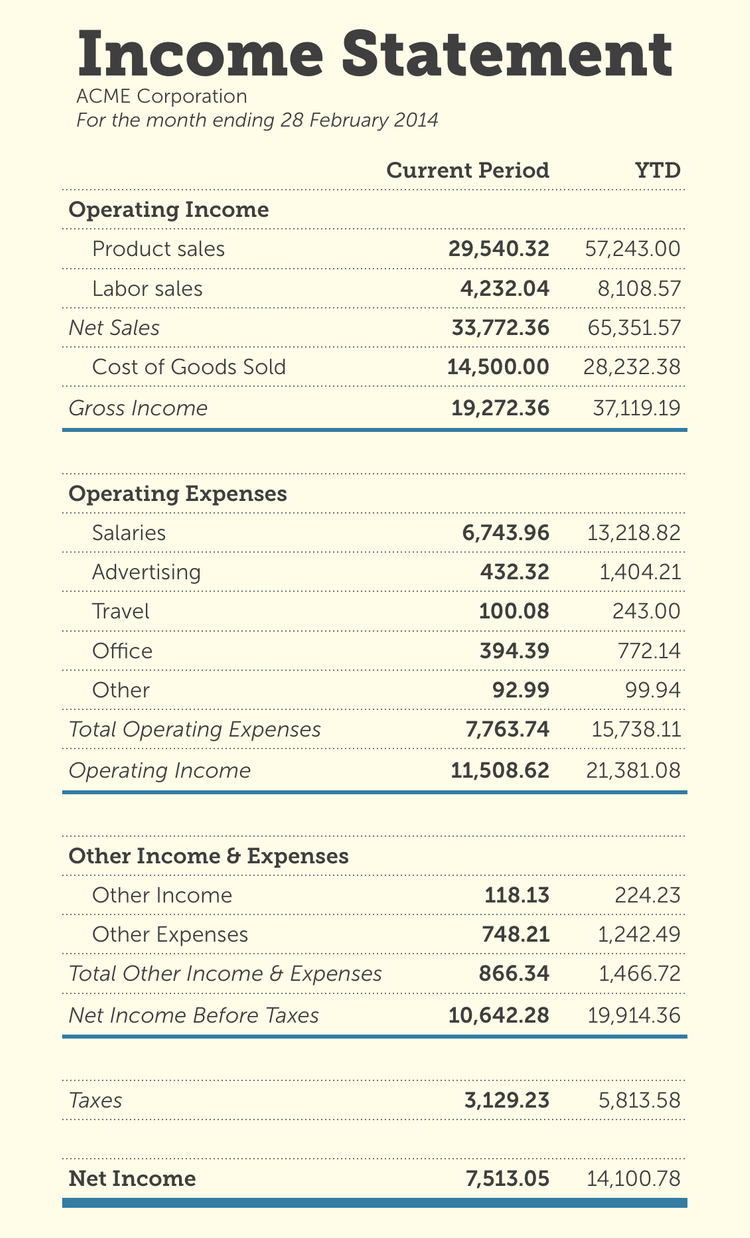

These are used to calculate the company’s gross profit and net income for the reporting period.

Preparation of company income statement. Sales on credit) or cash vs. Calculate total revenue once you know the reporting period, calculate the total revenue your business generated. To prepare a full income statement, simply follow the below steps to piece together the 4 key line items that will take your from total revenue all the way down to net income!

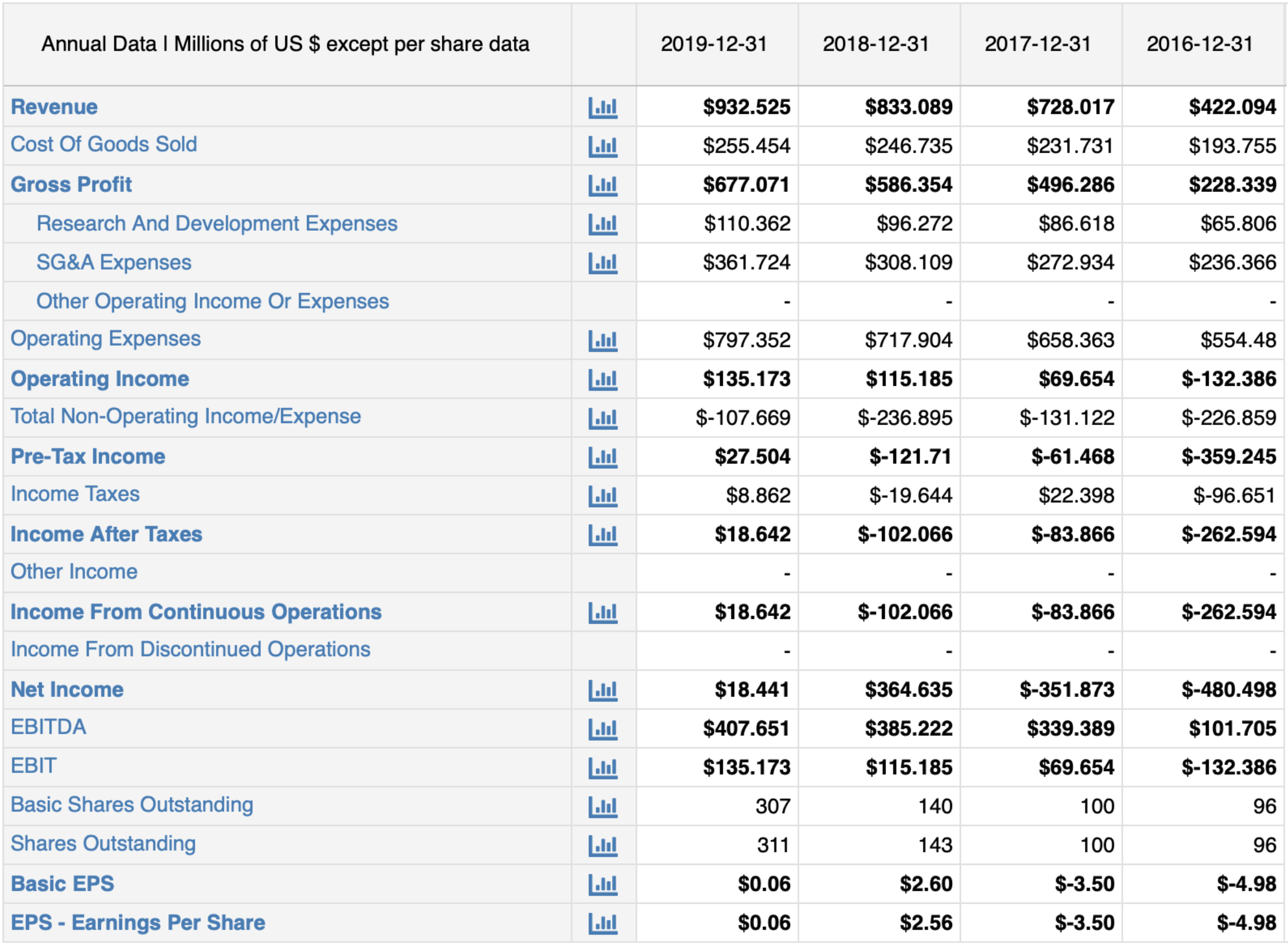

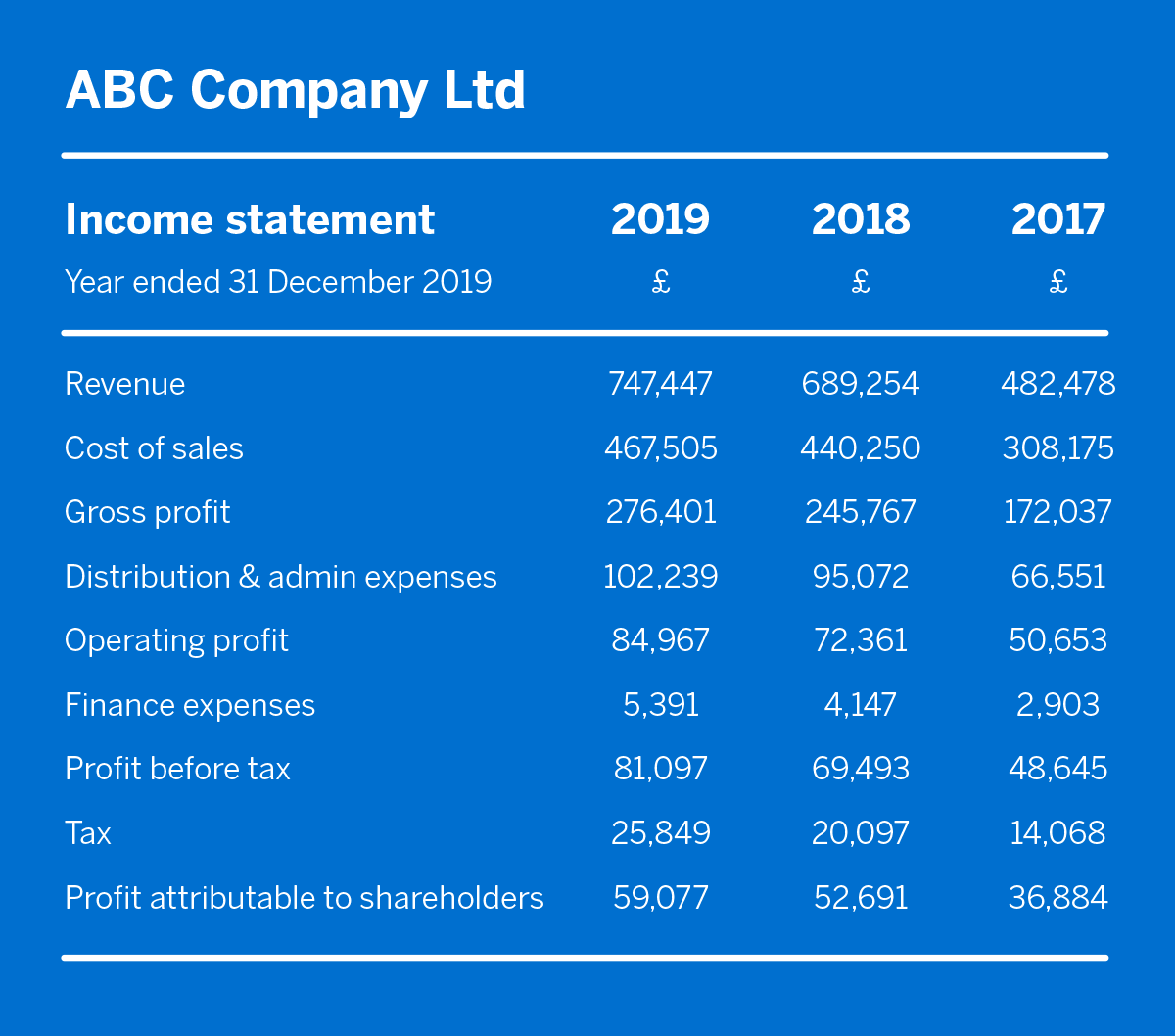

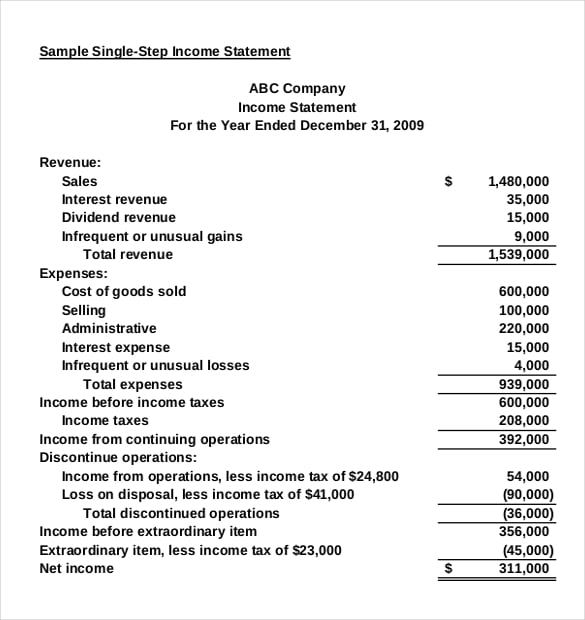

The income statement represents a company or business’s profit for a specific period. An income statement contains information about a company's revenues and expenses and the resulting net income. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Within an income statement, you’ll find all revenue and expense accounts for a set period. How to prepare a balance sheet. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies.

Subtract taxes and depreciation expenses (if applicable) from your operating income or ebitda to get the bottom line: Also known as a “ profit and loss statement ” or “statement of earnings,” it includes items such as: Here’s an explanation of how revenue is generated.

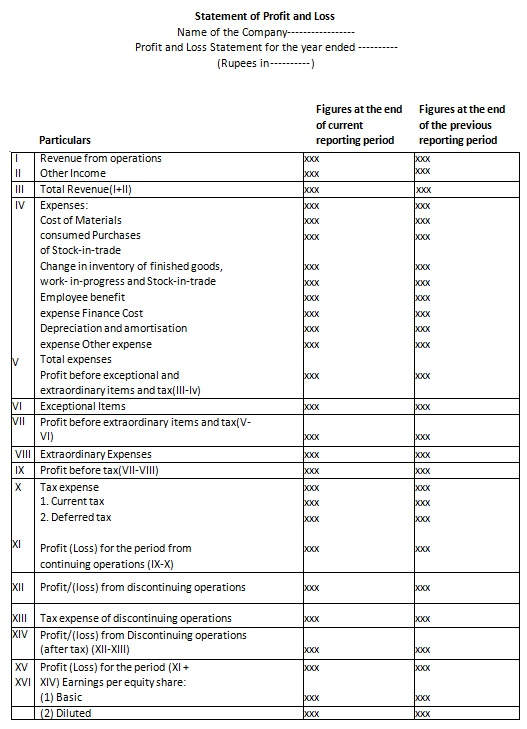

The income statement can either be prepared in report format or account format. Steps to prepare an income statement 1. To prepare an income statement or profit and loss report, you have to follow these steps:

These statements, which include the balance sheet, income statement, cash flows, and shareholders equity statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. Revenue, expenses, gains, and losses. Income statements are an essential part of a company's financial reporting.

The income statement focuses on four key items: When you prepare an income statement, there are four main categories to take into account: To create an income statement for your business, you’ll need to print out a standard.

A company’s three primary financial statements are the balance sheet, the income statement and the statement of cash flows. While an income statement is vital for the business, it should be noted that an income statement is just one of the three financial statements. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

Choose your reporting period your reporting period is the specific timeframe the income statement covers. An income statement is a part of financial statement of a company which emphasizes on showcasing the profit or loss of the company over a period of time. Lists the gross revenue for the reporting period, which is the total amount of money earned from sales.

Revenue cost of goods sold expenses taxes The other popular name to prepare income statement of a company is profit and loss account or better known as statement of profit and loss as per the revised schedule vi of the. Goods are transferred to the trading account at a value which the business would have paid had these goods been bought from other manufacturers.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)