Painstaking Lessons Of Tips About Impairment Loss Account Future Group Balance Sheet

It reduces the company’s profit, but there is no cash flow happens.

Impairment loss account. It may be a fixed asset or an intangible asset. All you need to do is subtract the recoverable amount from the carrying cost to determine the amount you can list as a loss. Et on thursday, downdetector had more than 60,000 reports of service issues from at&t customers.

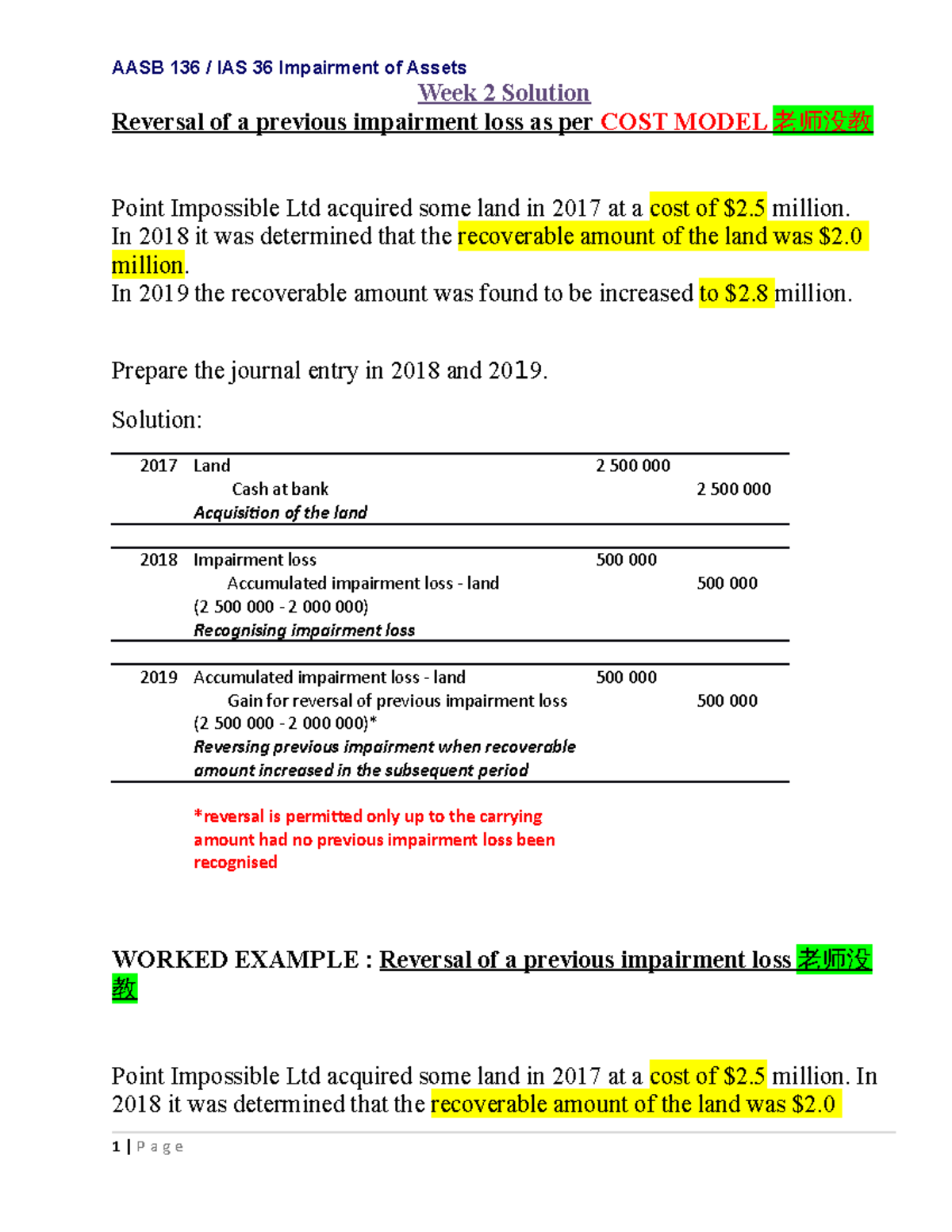

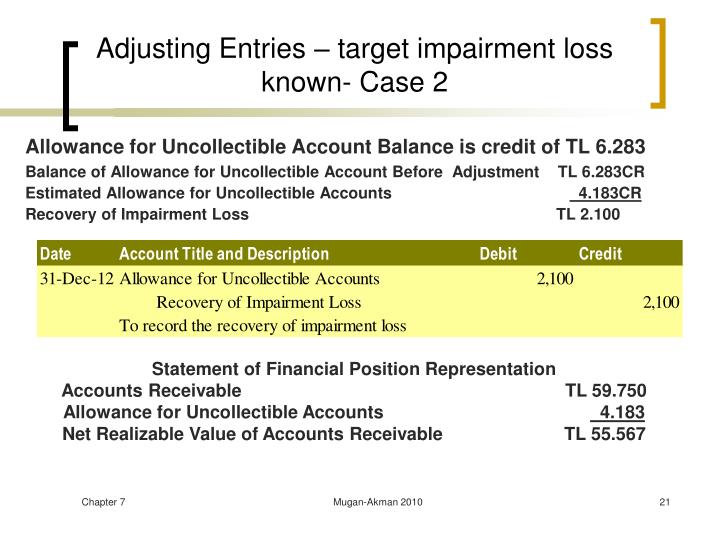

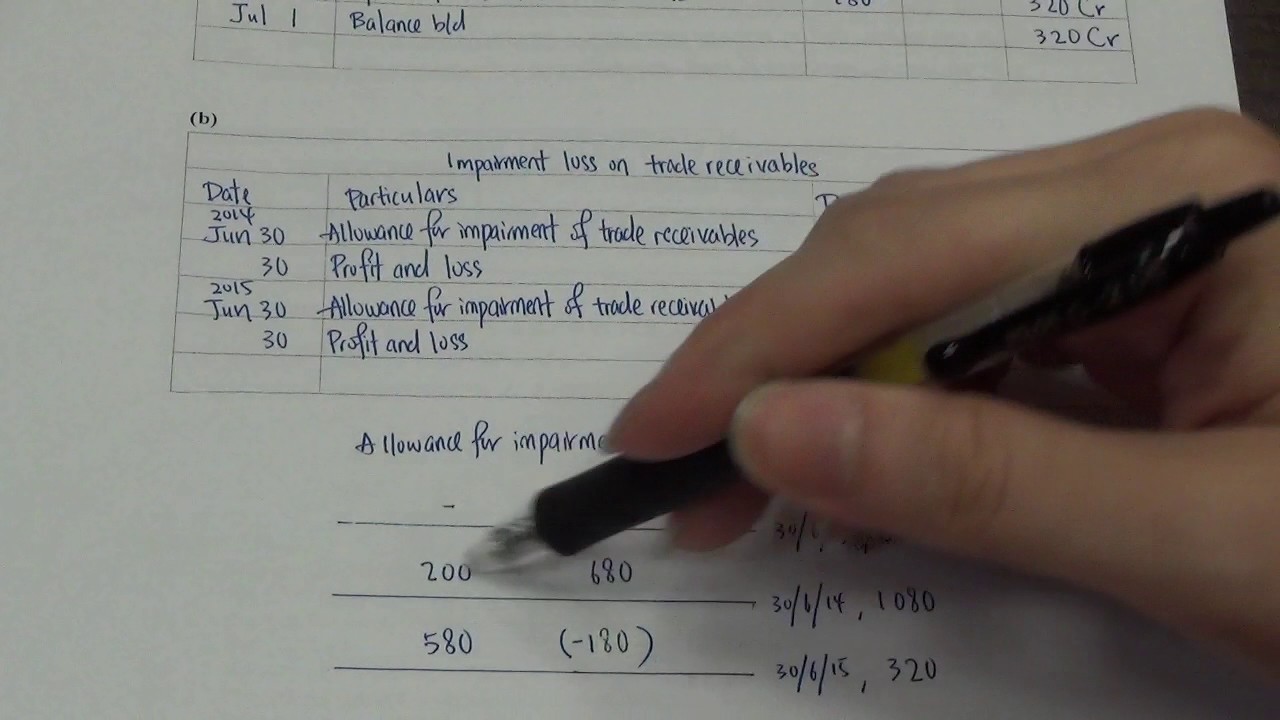

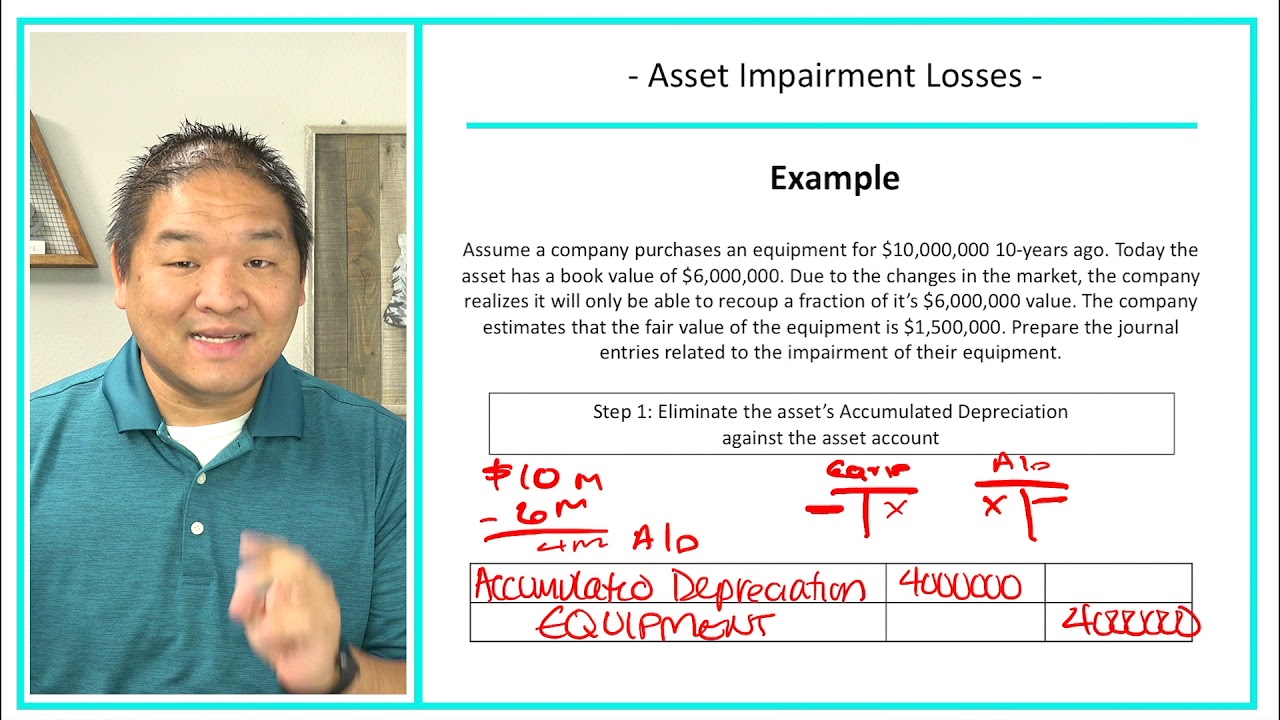

Impairment vs depreciation how to calculate impairment loss key takeaways understanding asset impairment loss: There’s also an entry to reduce the asset’s balance on the balance sheet by $5,000, and the asset's account or an impairment loss. The impairment loss of $5,000 is entered on the debit side of the income statement, which reduces the net income.

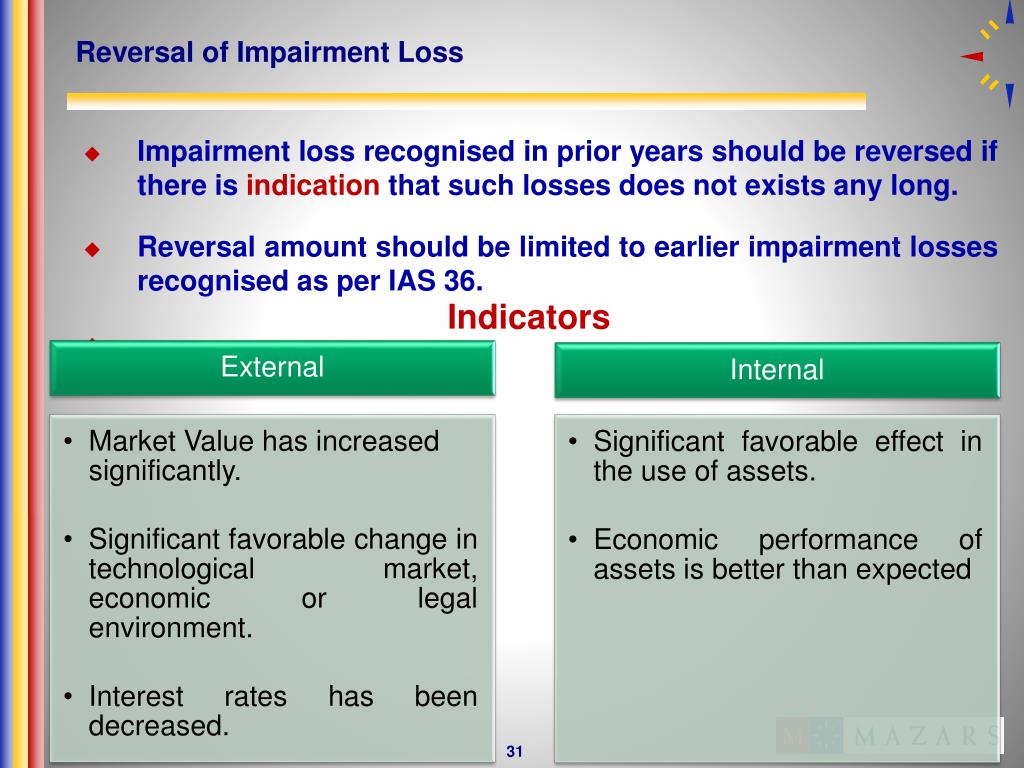

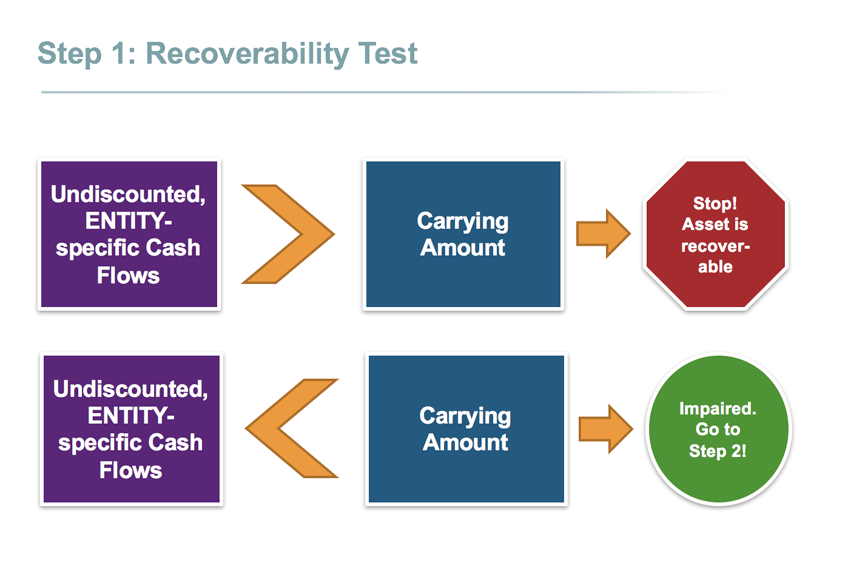

London— hsbc bet big on china to fuel its growth, a move that has now come back to bite it. An impairment in accounting is a decrease in the value of an asset you can't recover. Impairment refers to the amount by which the carrying amount of an asset or a cash generating unit (cgu) exceeds its recoverable amount.

Carrying amount is the acquisition cost of an asset, less any subsequent depreciation and impairment charges. The amount that should be recorded as a loss is the difference between the goodwill’s current fair market value and its carrying value or amount (i.e., the amount equal to the asset’s recorded cost on the balance. (a) inventories (see ias 2.

What is impairment loss in accounting? The impairment loss is the expense recorded on the income statement. A group of analysts polled by the bank itself had anticipated yearly.

Using the 't' account system, there will be a debit in the loss on impairment account and a credit in the investment account. You must ensure that your business entity’s assets are disclosed at no more than their recoverable amount. Objectives to explore longitudinal association of sedentary time and mci, and to identify a cutoff value.

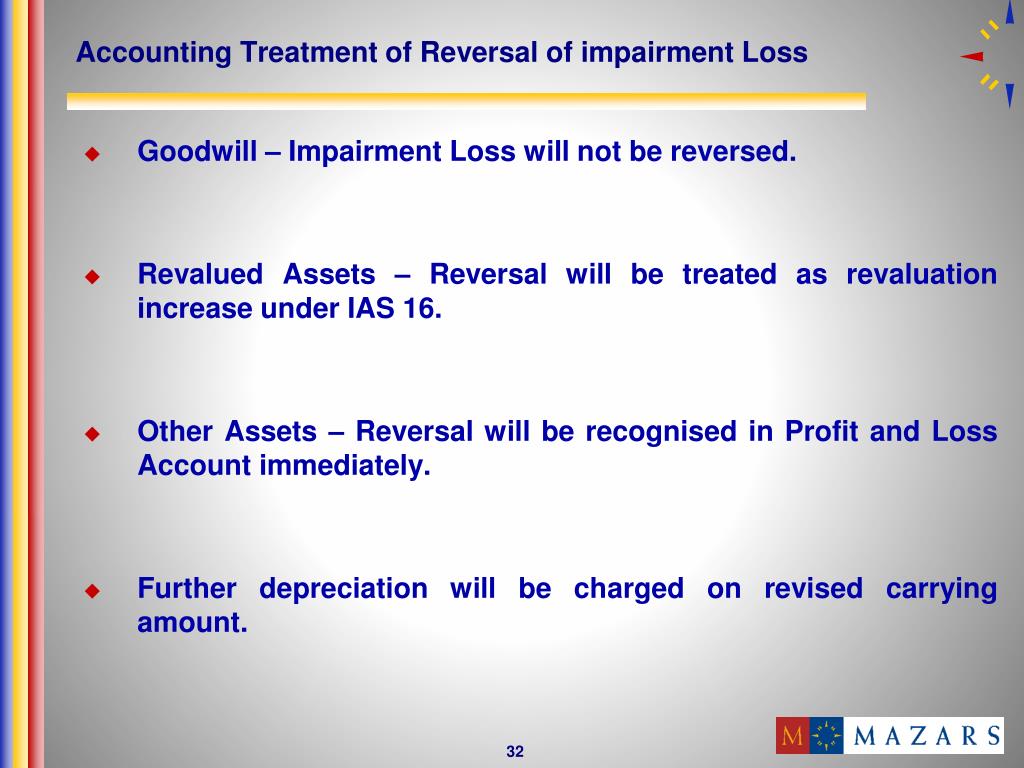

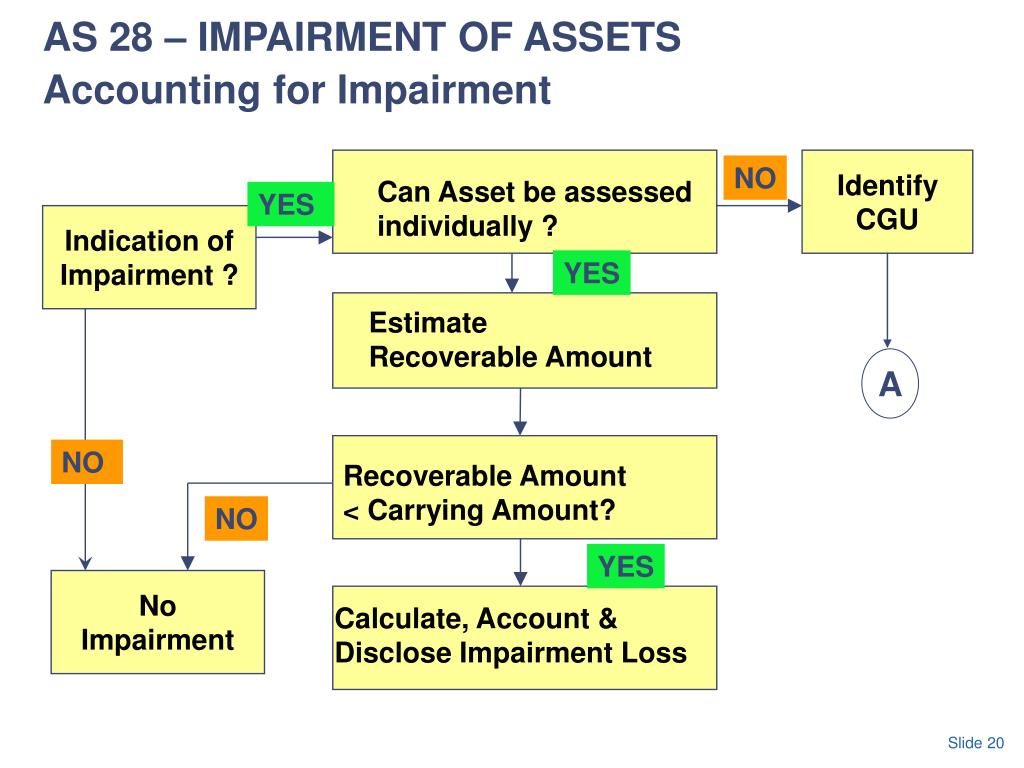

The standard also specifies when an entity should reverse an impairment loss and prescribes disclosures. This standard shall be applied in accounting for the impairment of all assets, other than: An impairment is recognized as a loss on the income statement and as a reduction in the goodwill account on the balance sheet.

7.13.3 impairments—measurement of expected credit losses. Most of the complaints were focused on problems with their mobile phones or wireless. This value decline can apply to both intangible and fixed assets.

However, despite it being in a separate account, impairment should always be netted from the asset amount on the balance sheet, similarly to how accumulated depreciation is. Impairment often occurs with either fixed assets or intangible assets. In accounting, impairment is a permanent reduction in the value of a company asset.

The amount at which an asset is recognised in the balance sheet after deducting accumulated depreciation and accumulated impairment losses Overall, companies can record impairment loss journal entries as follows. The company does not pay any cash to reflect this expense.