Formidable Tips About Business Income Statements And Payment Summaries Cashier Balance Sheet

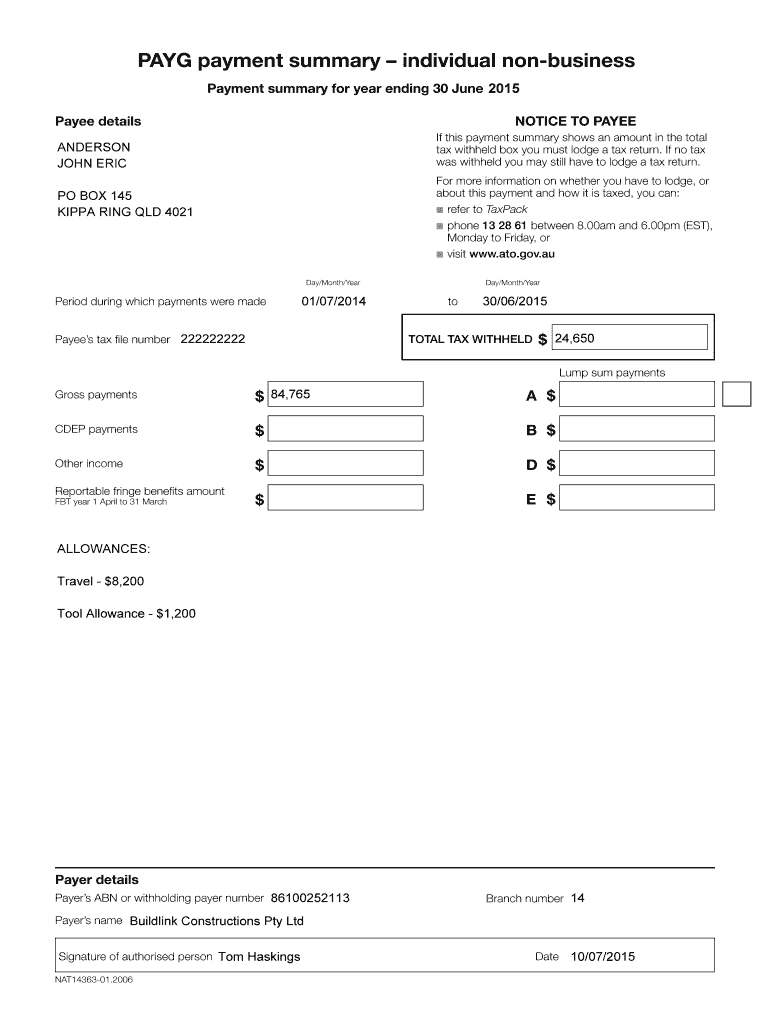

If you received any business income statements and payment summaries, click on and complete the details for each income statement you receive and save each one.

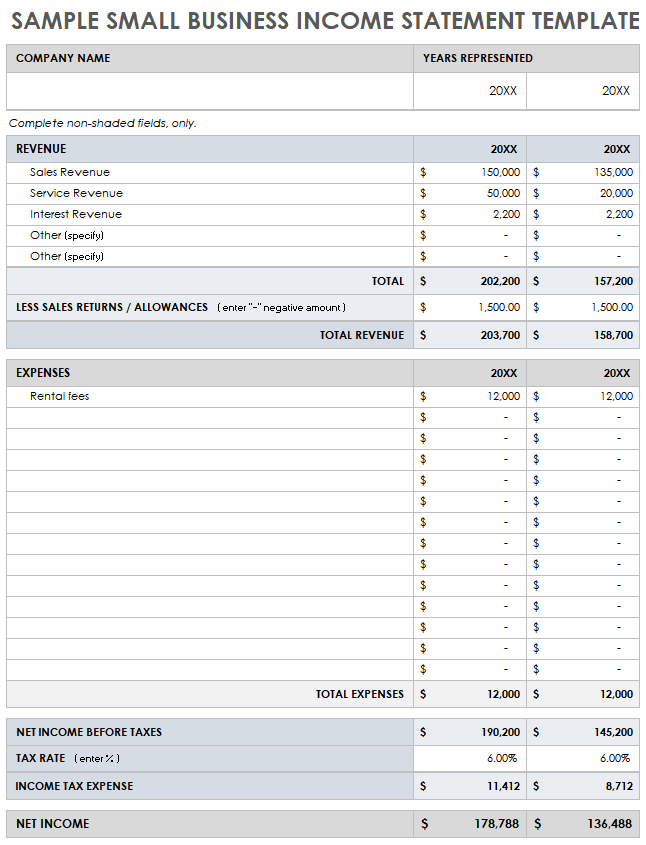

Business income statements and payment summaries. At the business income statements and payment summaries banner: If the income statement or payment summary has no tax. Personal services income (psi) business income statements and payment summaries (bip) item 15:

Your business income is considered business income, not psi, if psi rules don't apply. Income statements are available through ato online services. In 2020, business income statements and payment summaries (bip) will be a new worksheet.

Primary production income/loss and c: Business income statements and payment summaries (bip) is a new worksheet in 2020. The amounts at item 15:

Ps help levy australia 2020. The payment type you will select is depending on the payg payment summary you receive. You will need to choose one of the following options:

Net income or loss from business: Im in business income statements and payment summaries prt now, and i dont know what to input here, ie payers name will be my name? First you will need to complete the:

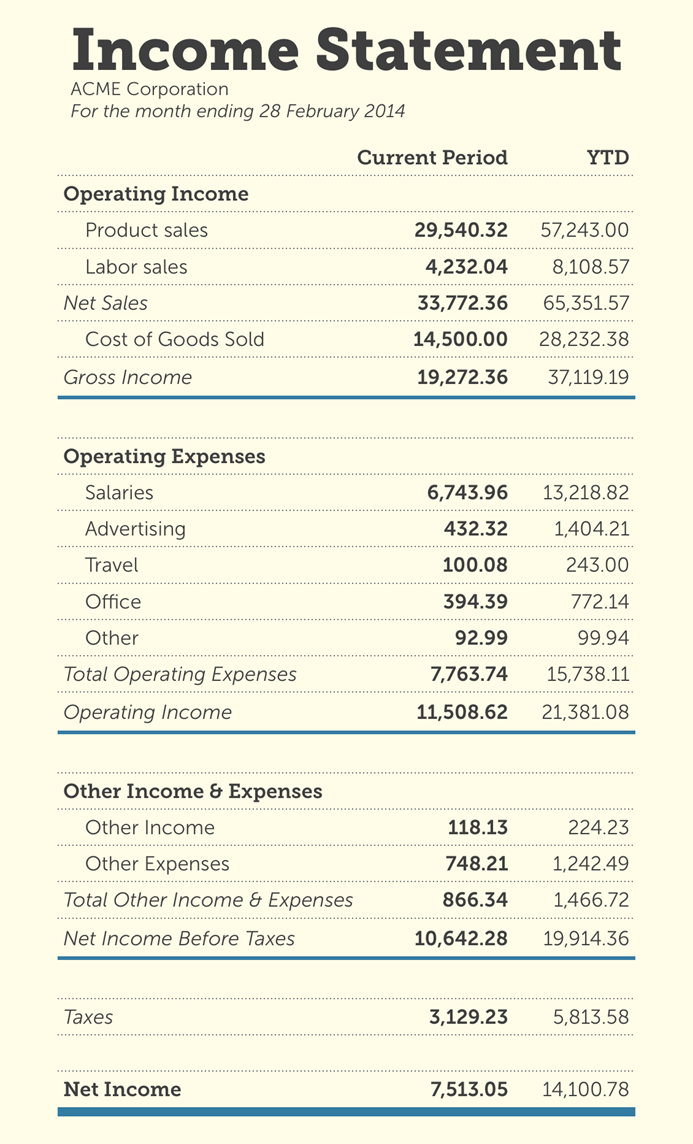

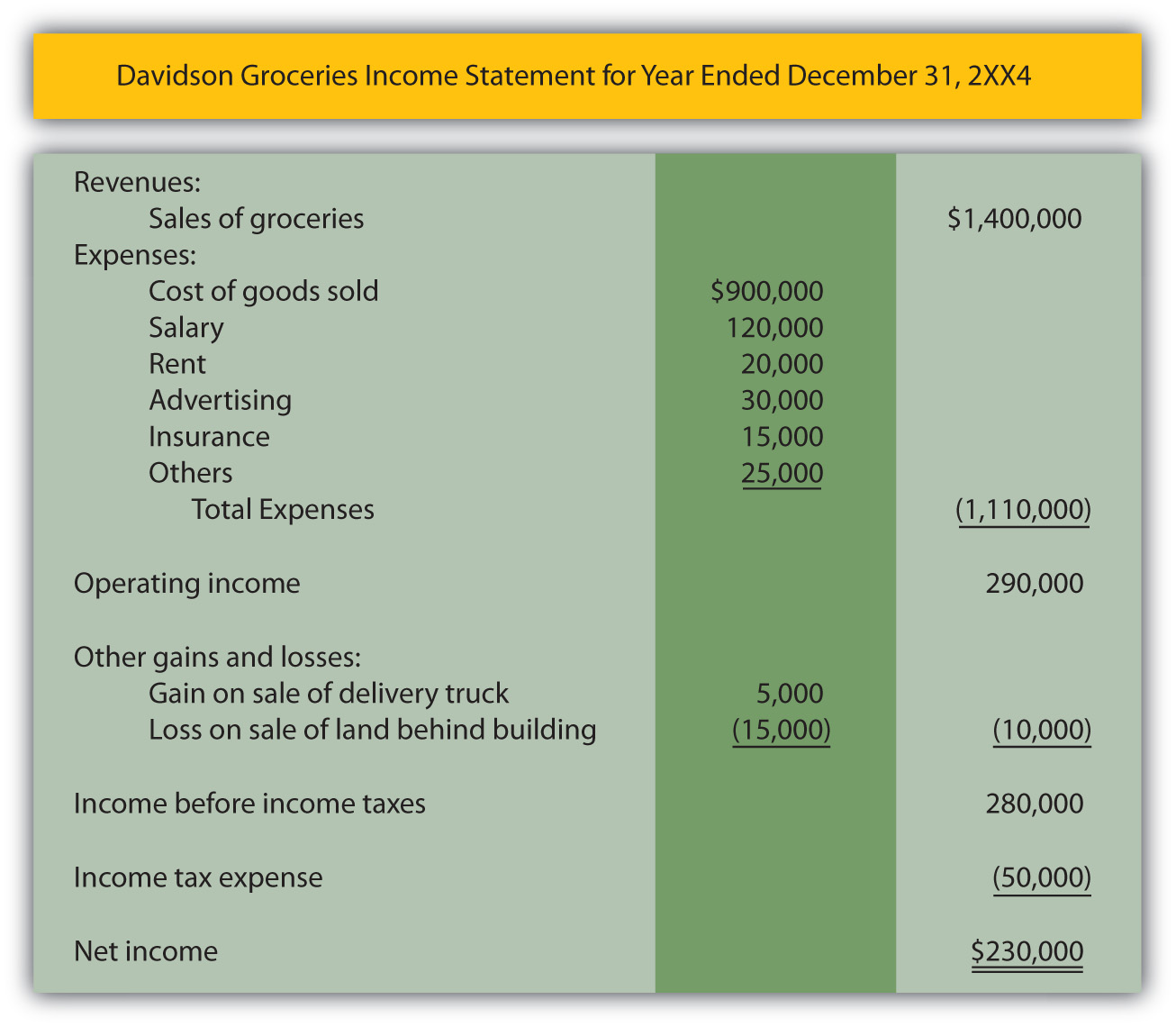

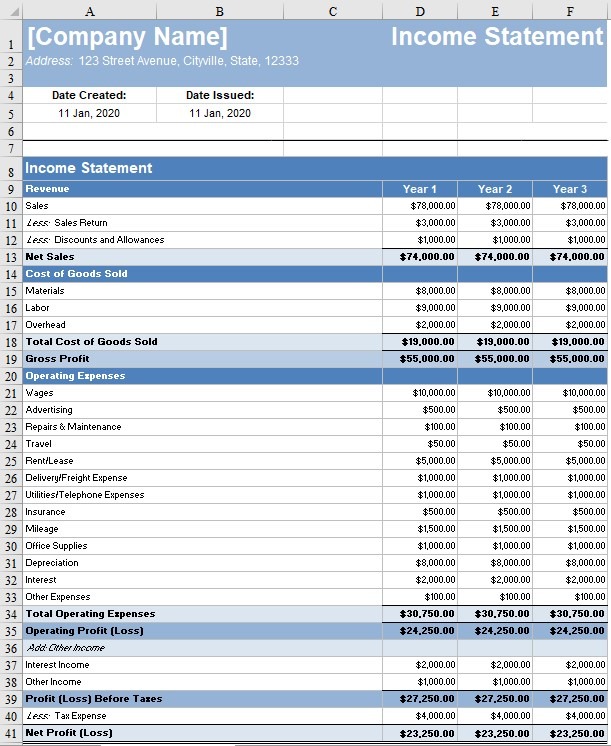

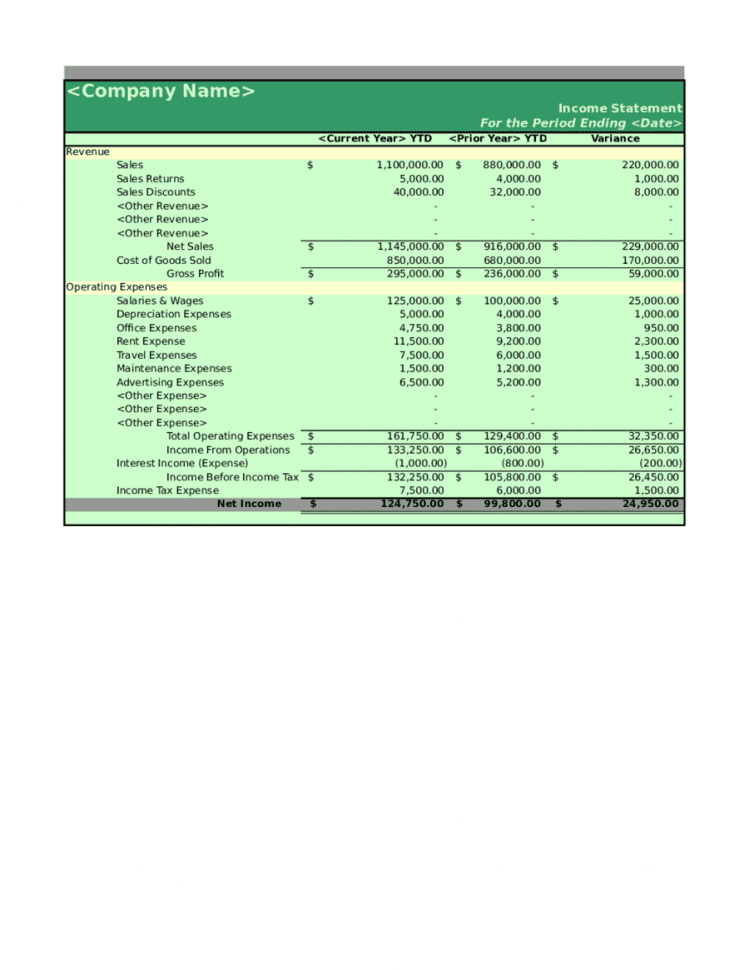

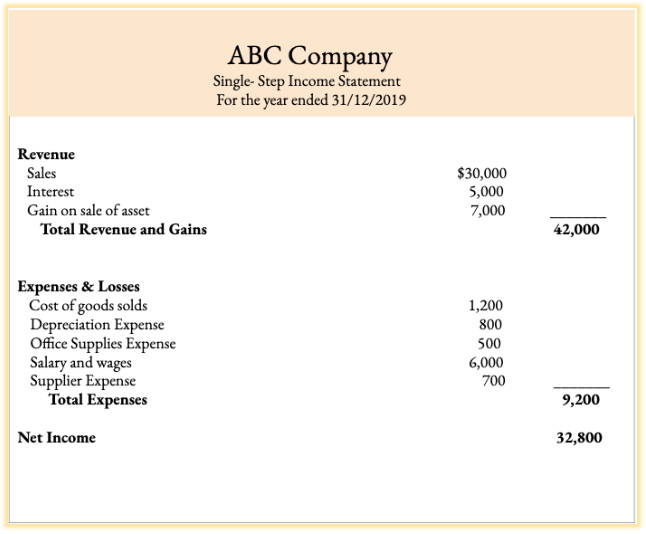

More information about accessing your income statement is available on the ato website. The purpose of an income statement is to summarize revenue, gains, expenses and losses on a monthly, quarterly or yearly basis. And what to put in.

Your income statement will show: Income statement analysis involves reading an income description so that you cannot understandable the finance performance to a businesses over adenine period. The ato has decommissioned the payment summary schedule (ps) for individual returns and introduced a new schedule business income statements and payment.

These psi income labels integrate from the business income statements and payment summaries (bip) schedule where the income type is p and the payment type i. Ps help tax australia 2020.