Brilliant Tips About Debt Equity Ratio Of Tcs Walt Disney Balance Sheet

As of 2022 they employed.

Debt equity ratio of tcs. With pledged shares data and 10 years income vs operating cashflow, debt equity ratio, current ratio etc. Paid up equity share capital (face value: The balance sheet page of tata consultancy services ltd.

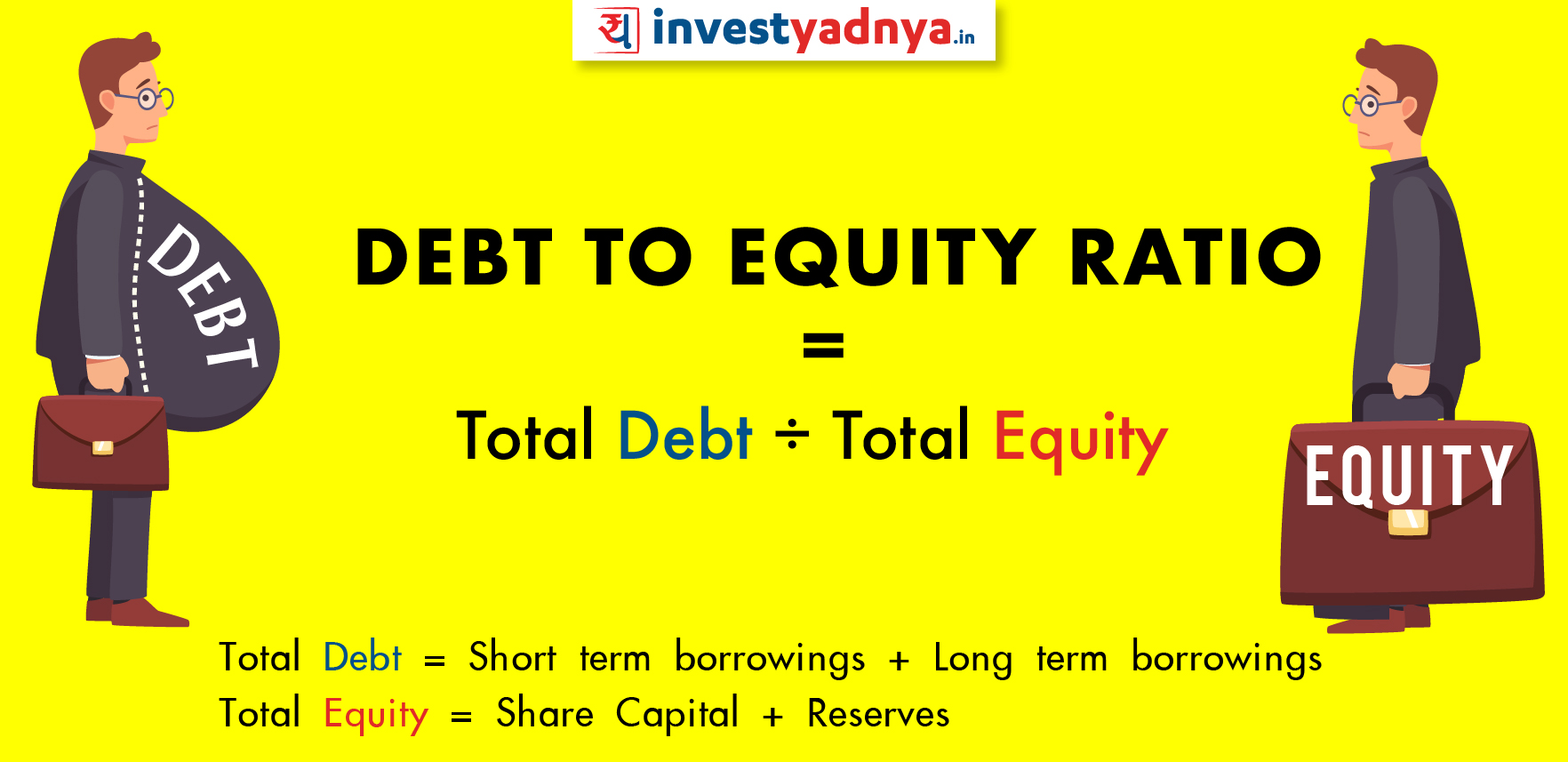

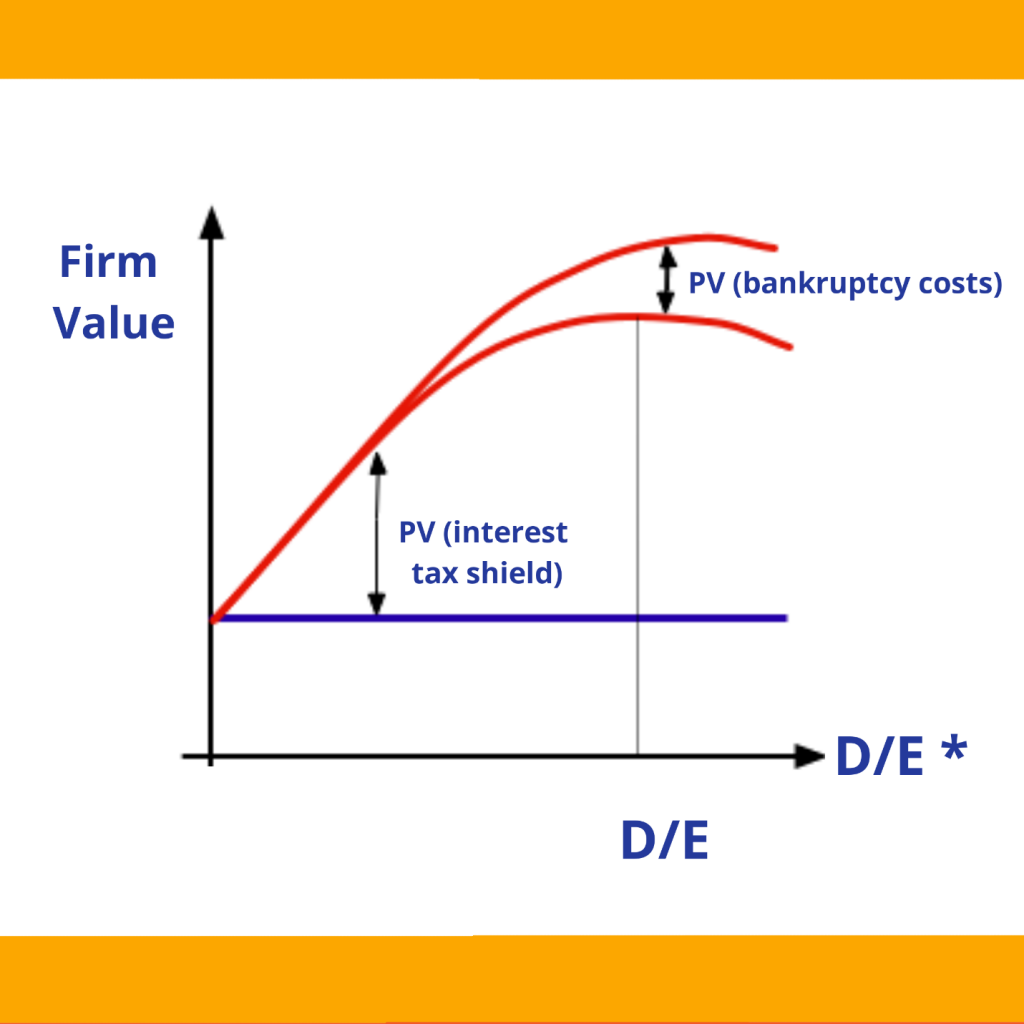

Tcs data sheet here are all the details of tcs’ financial performance, yearly earnings, quarterly results, management commentary, shareholding pattern, and capital structure. 30,284 feb 20, 2024 4:01 pm financial ratios consolidated * in (rs. While a high capitalization ratio can increase the return on equity because of the tax shield of debt, a higher proportion of debt increases the risk of bankruptcy for a company.

Per share data tata consultancy services ltd. Company is almost debt free. Company has been maintaining a healthy dividend payout of 61.4%;.

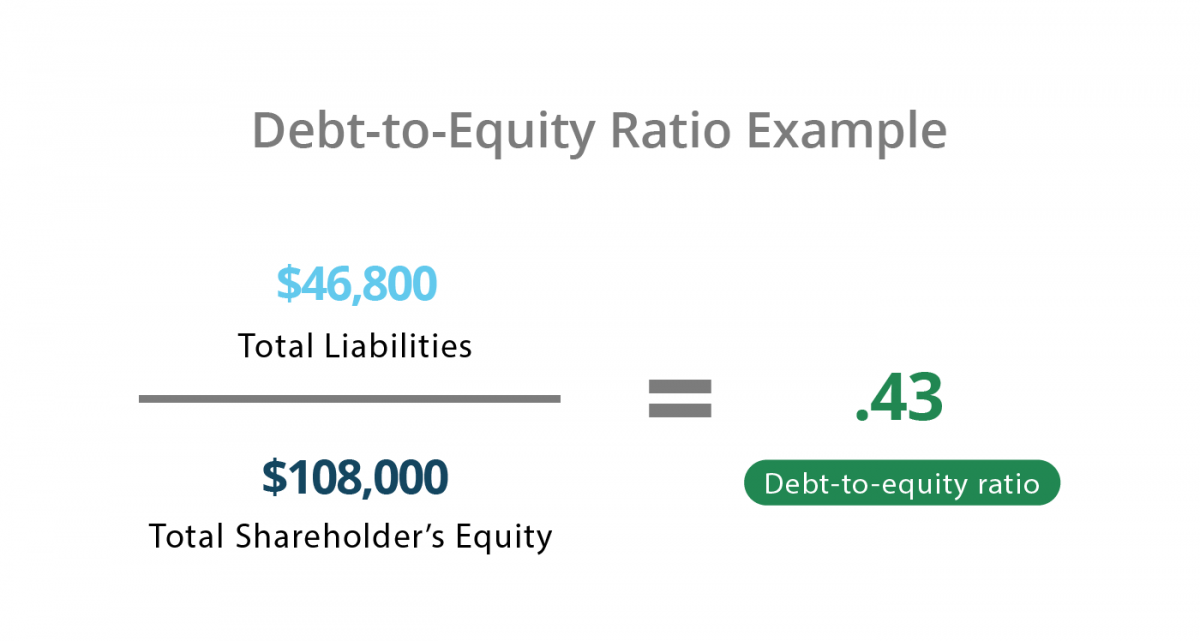

The debt equity ratio for the company remained relatively stable at around 0.11:1 for the years 2020 and 2021. All values updated annually at fiscal year end 16 feb 04:01 pm price summary.

Roe, roce, book value, and debt to equity ratio as of mar 2023 and 10 year history. Company has a good return on equity (roe) track record: Debt to equity ratio of tcs has grown.

Tata consultancy services ltd. Total debt/equity (x) 0.00: Overview earnings & estimates tata consultancy services ltd.

Presents the key ratios, its comparison with the sector peers and 5 years of balance sheet. Asset turnover ratio (%) 1.58: Tata consultancy services

The company has an enterprise value to ebitda ratio of 23.76. Total debt to equity mrq: Get tata consultancy services latest key financial ratios, financial statements and tata consultancy services detailed profit and loss accounts.

Analyse safety of investment in tata consultancy services ltd. And the median was 0.01. Total equity (primarily retained earnings) includes ₹1,645 crore and ₹1,358 crore as at december 31, 2022 and 2021, respectively, pertaining to trusts and tcs foundation.

Tata consultancy services ltd.

:max_bytes(150000):strip_icc()/debtequityratio_final-86f5e125b5a3459db4c19855481f4fc6.png)

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)