Matchless Tips About Profit And Loss Tax Form Maple Moving Company Adjusted Trial Balance

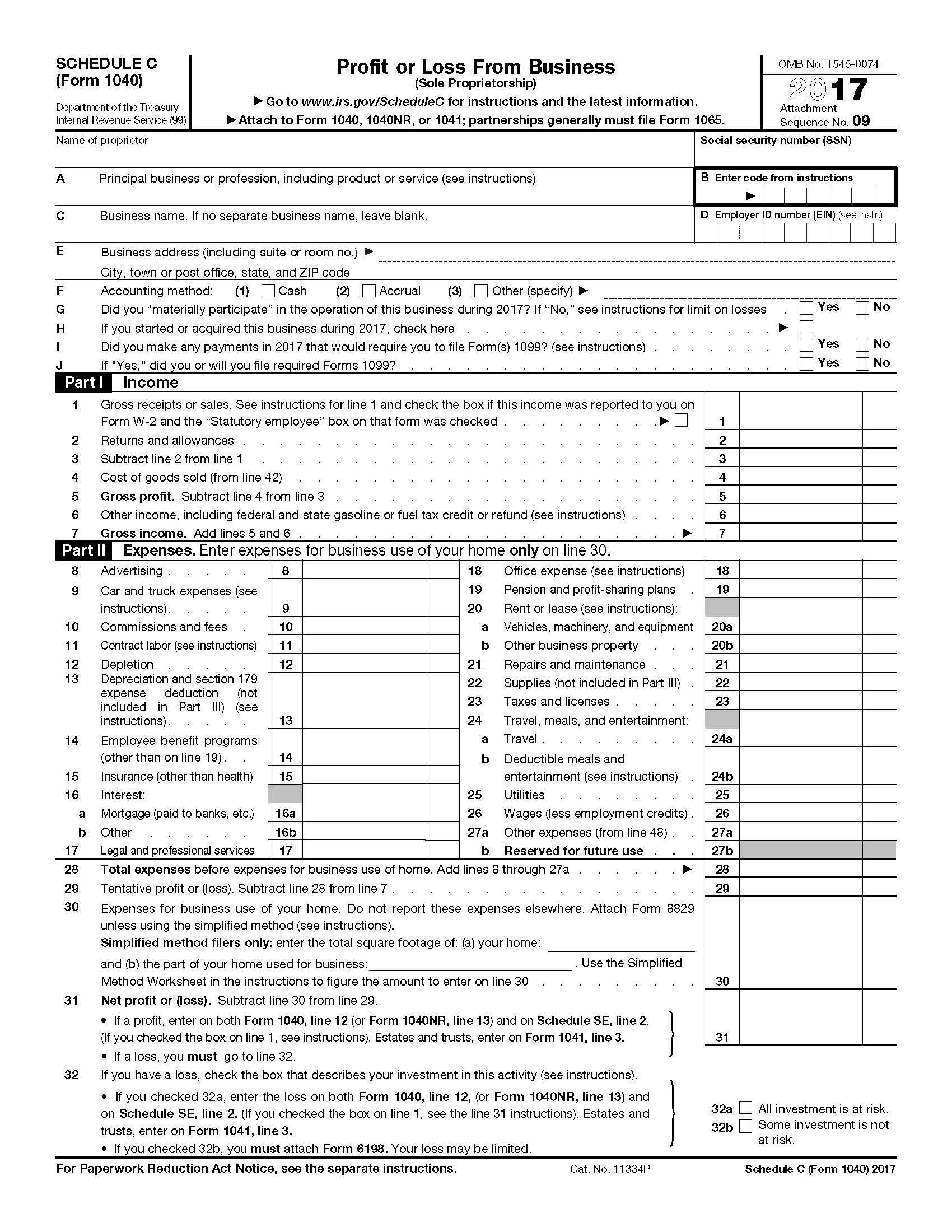

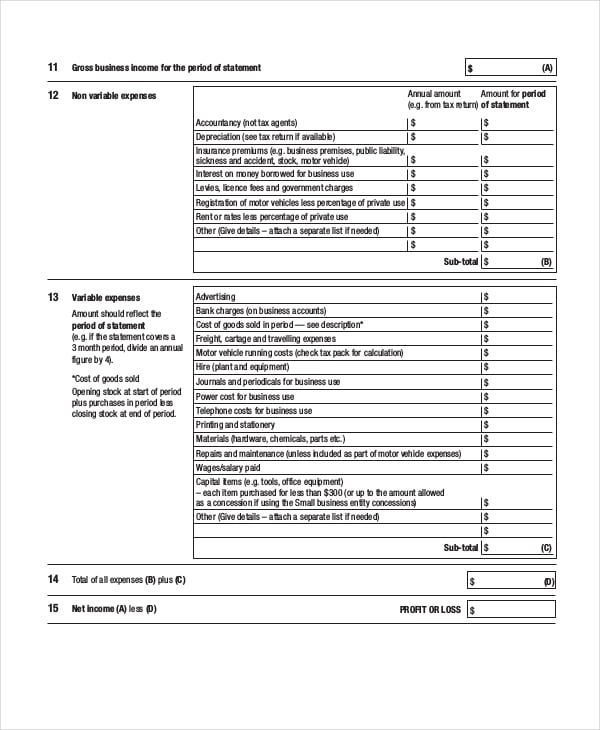

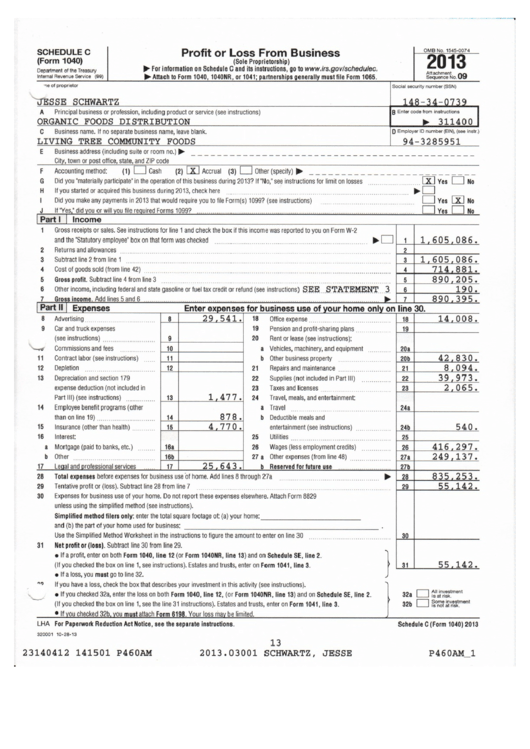

Irs schedule c is a tax form used for reporting your profit or loss from a business.

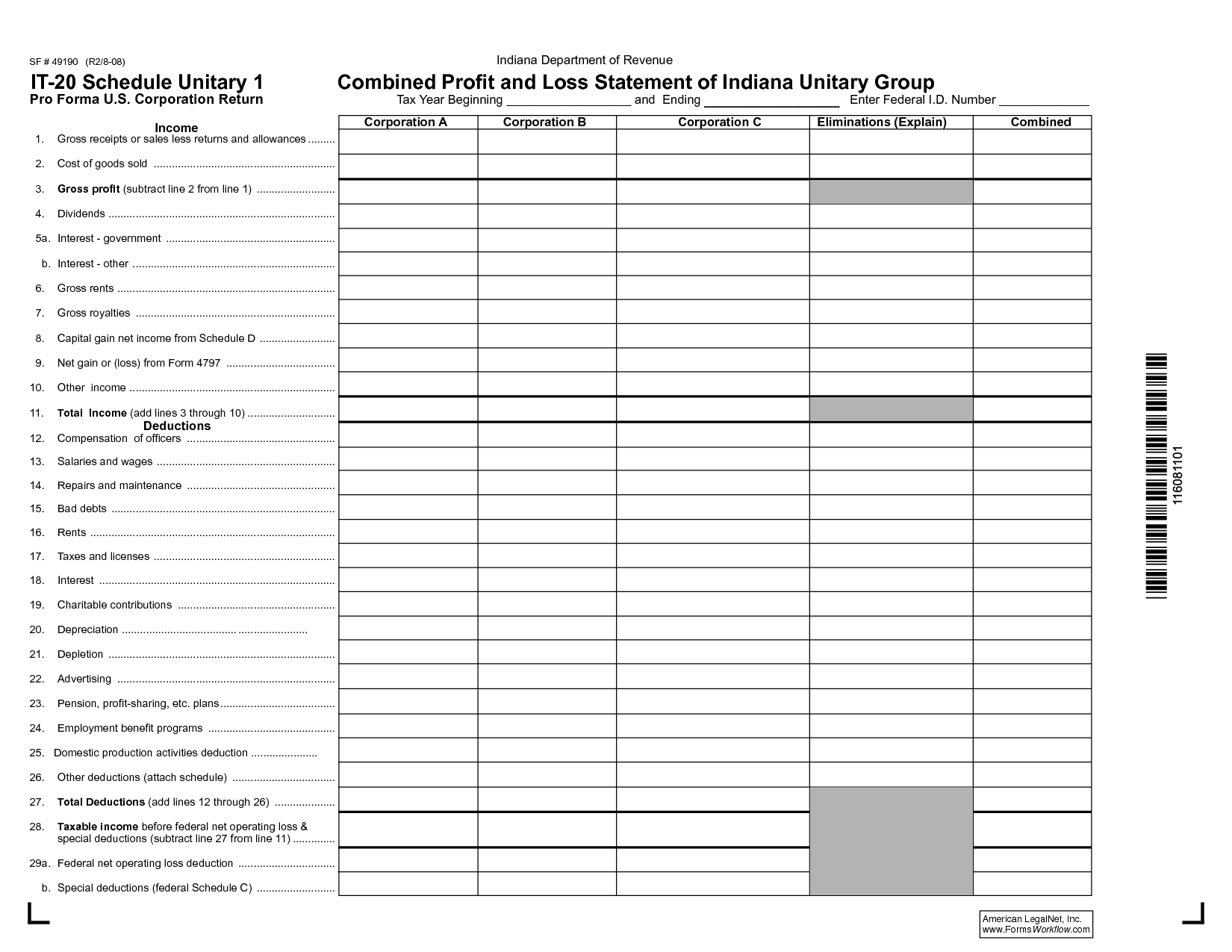

Profit and loss tax form. Schedule e (form 1040) to report rental real estate and royalty income or. A form schedule c: About publication 510, excise taxes (including fuel tax credits and refunds) information about schedule f (form 1040), profit or loss from farming, including.

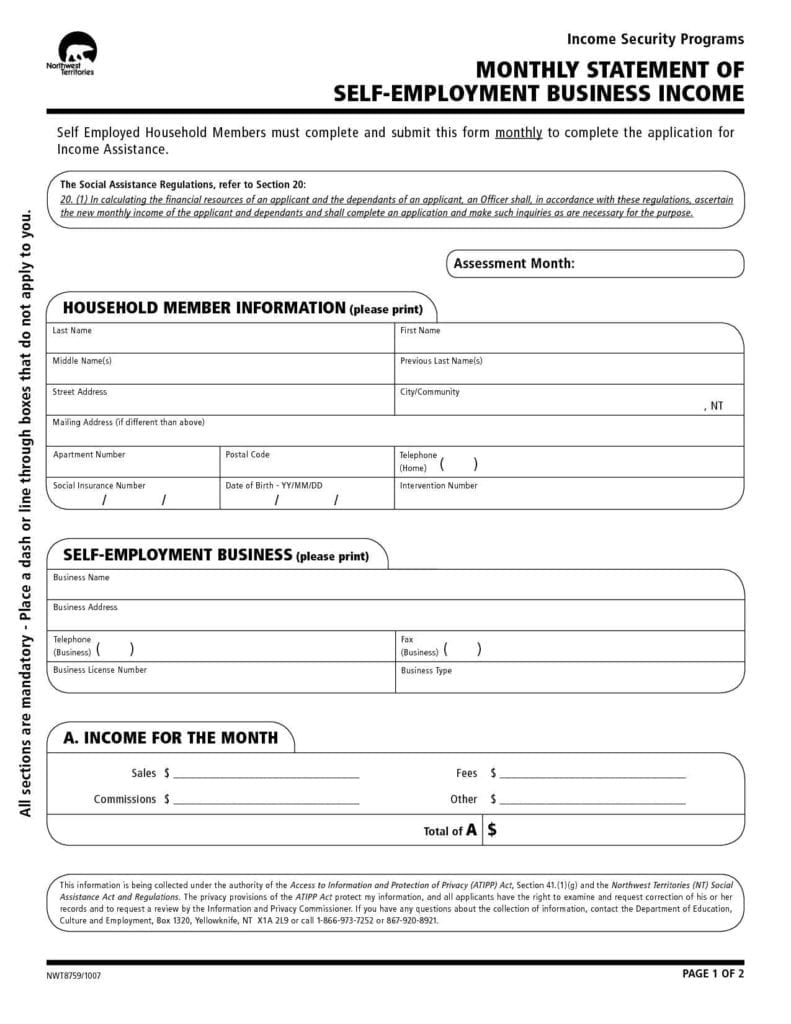

The form is specifically used for freelancers, independent contractors, self. Find out the latest updates on deductions, credits, limitations, and credits. School transport fees claim for deduction.

Schedule c is the irs form small business owners use to calculate the profit or loss from their business. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364. You fill out schedule c at tax time and attach it to or file it electronically with form 1040.

Profit or loss from business (form 1040)? Trump was penalized $355 million plus interest and banned for three years from. Check the box that describes your investment in this activity and see instructions for where to report your loss:

Download the official irs pdf of the 2023 schedule c (form 1040) for reporting profit or loss from business as a sole proprietor or partner. The judge's ruling orders former president donald trump and his company to pay $354 million in fines, plus almost $100 million in interest, and restricts trump's. Tax return help booklet (maltese) for basis 2017.

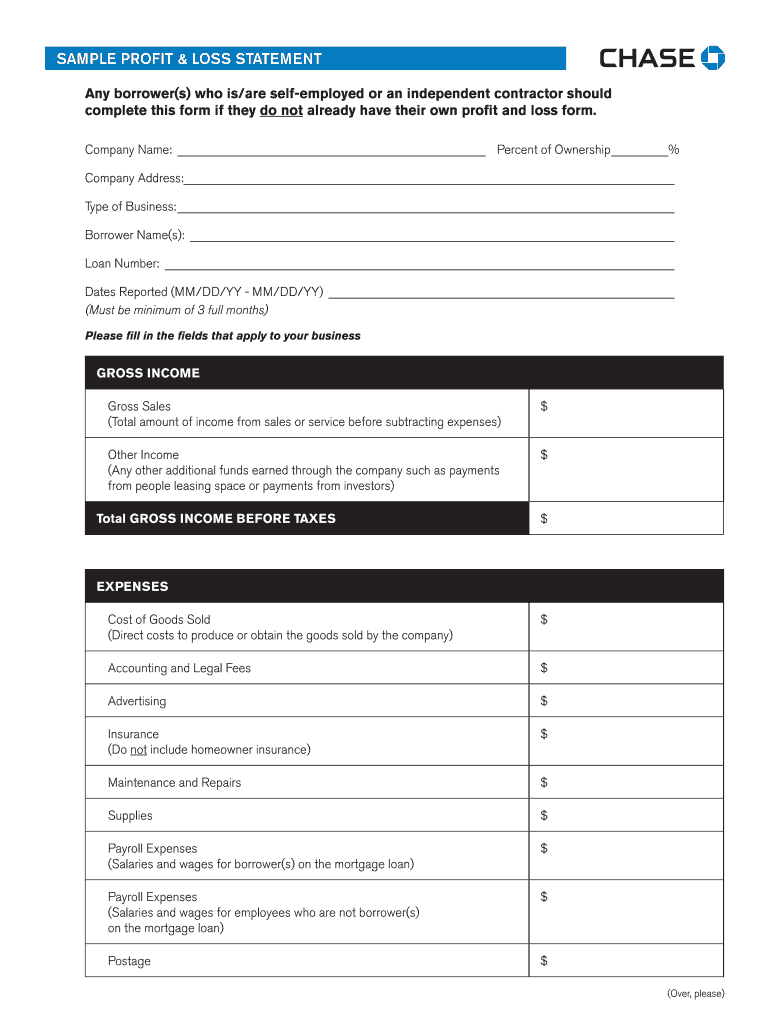

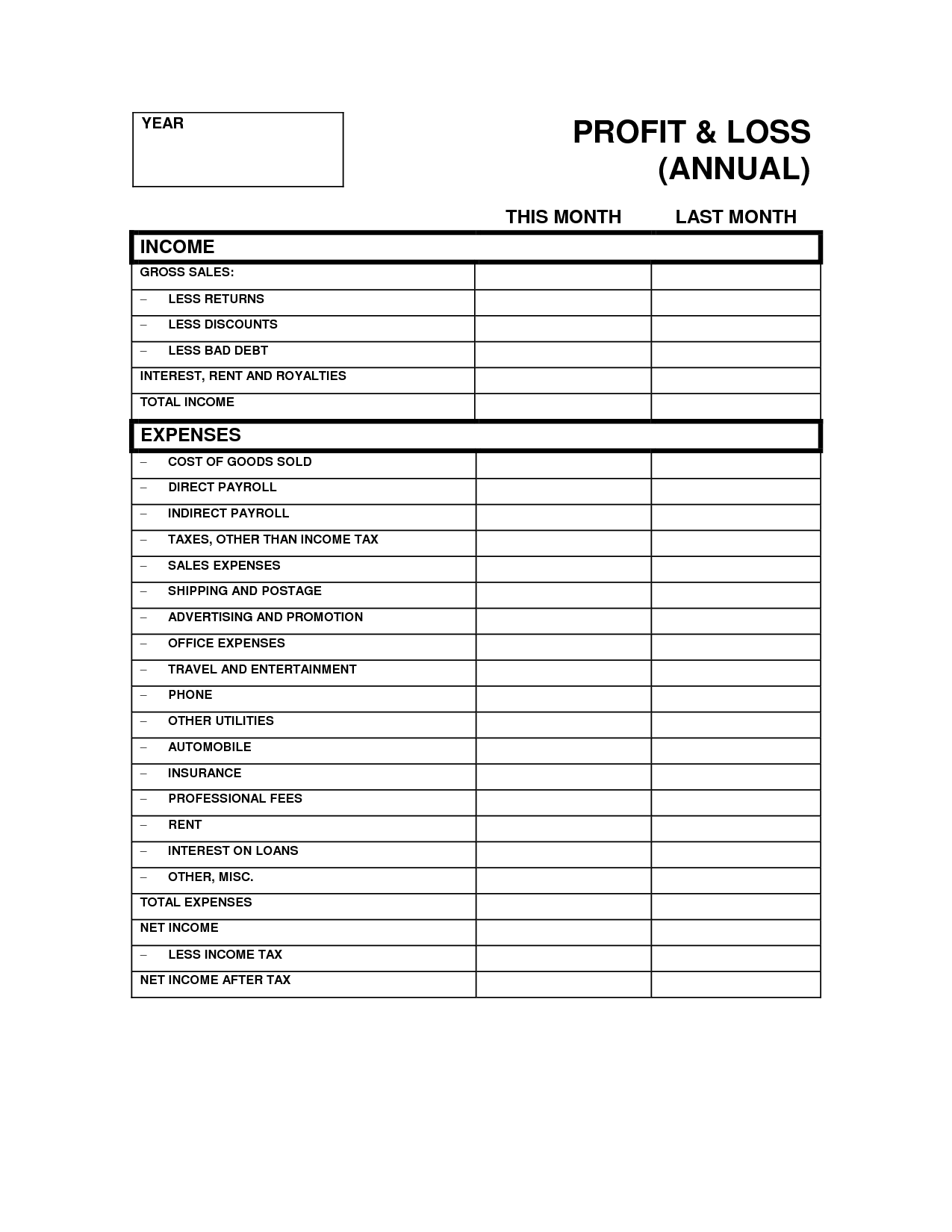

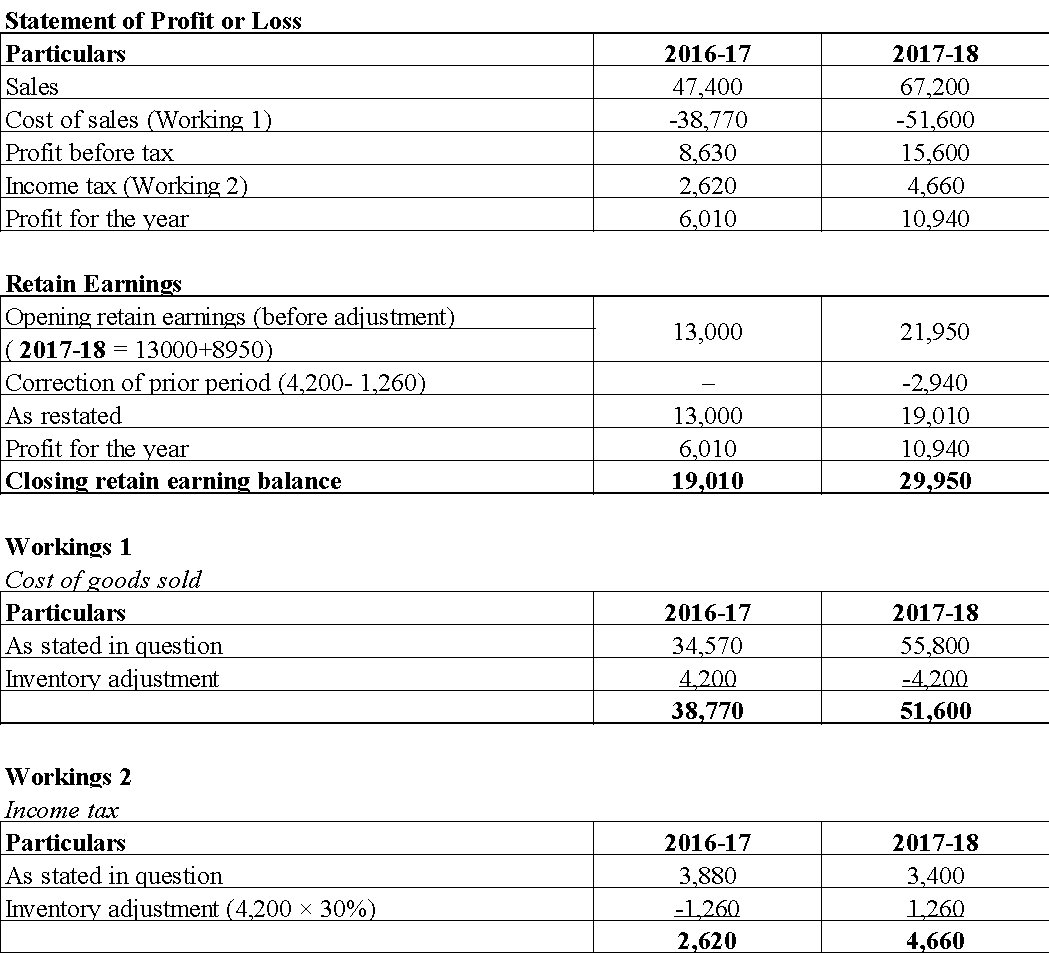

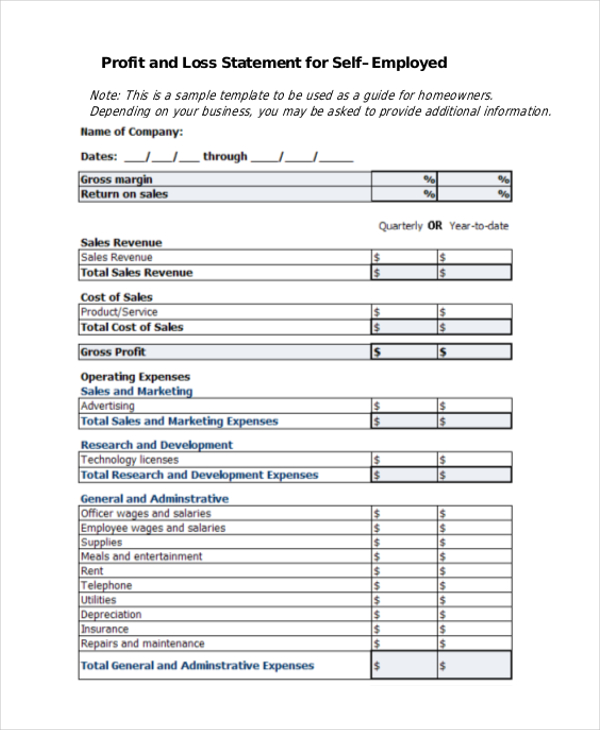

Each template is ready to use and includes sections for. A p&l statement compares company revenue against expenses to. Profit or loss from business (sole proprietorship) 2023 schedule c (form 1040) schedule c (form 1040) profit or loss from business department of the treasury.

Shannon stapleton/getty images. Tax return help booklet (english) for basis 2017. What is schedule c:

Engoron also counted $60 million in profits from the 2023 sale of a license to operate a golf course at ferry point park in the bronx, which trump had obtained from. Use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. This form is to be attached to form.

The civil fraud ruling on donald trump, annotated. 36 35 reserved for future use. Download and edit free profit and loss templates for small businesses in various formats and categories.

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. A all investment is at risk.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)