Cool Tips About Cost Of Good Sold Income Statement Trial Balance Quickbooks Desktop

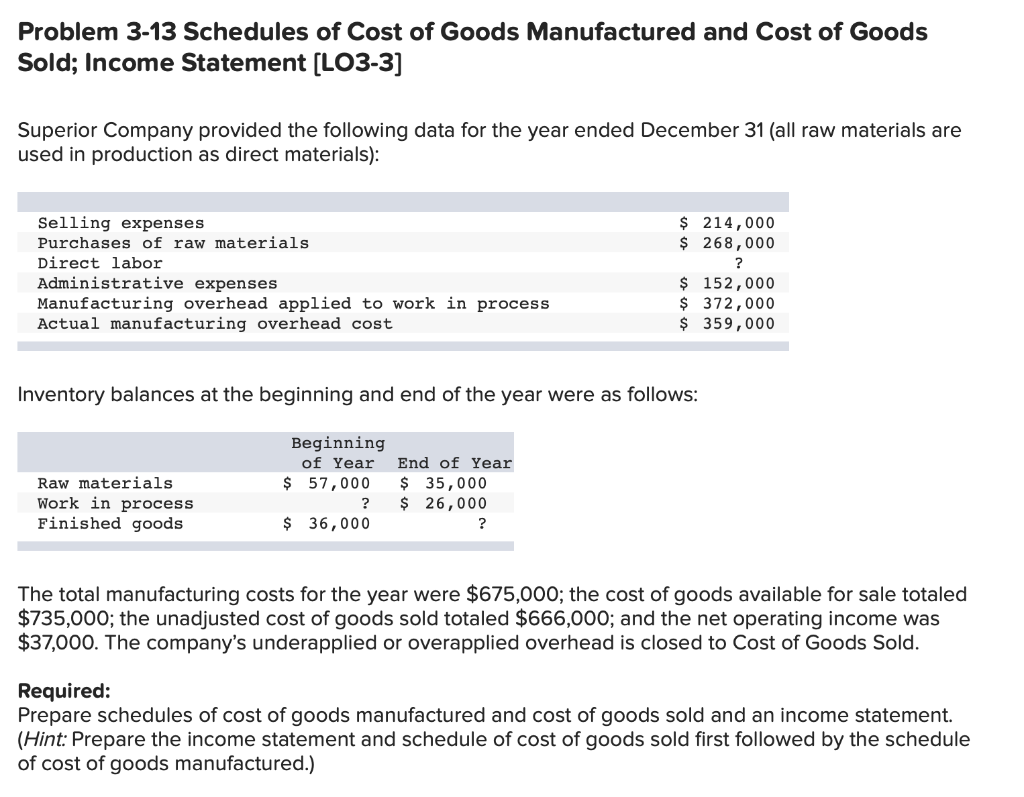

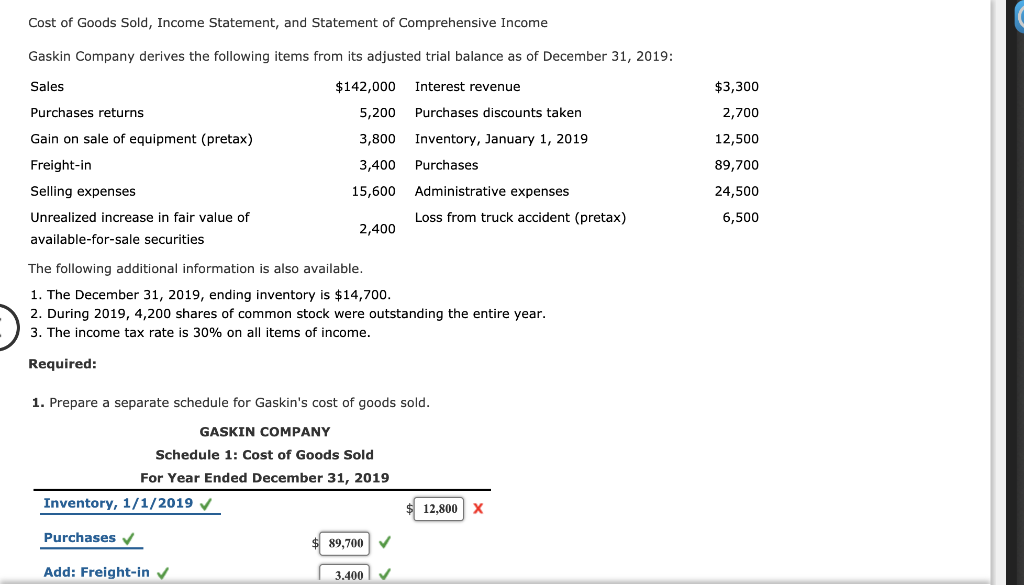

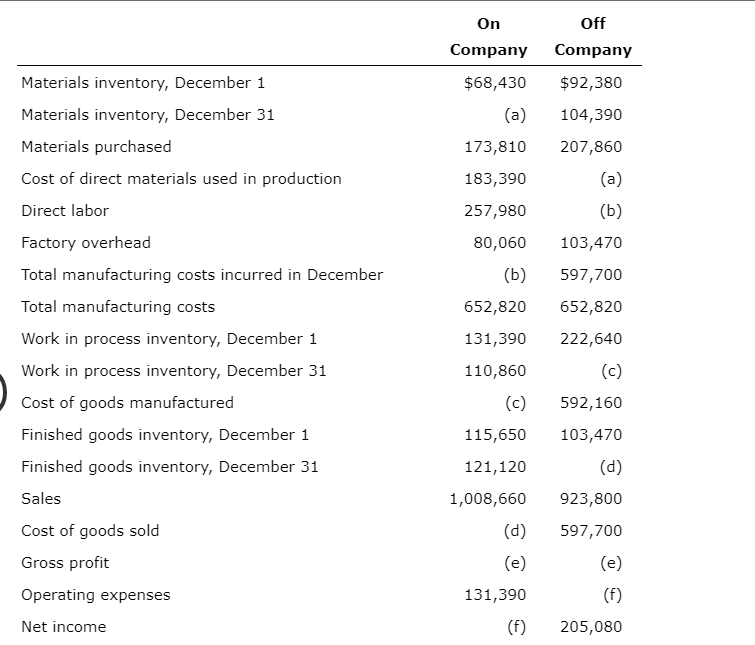

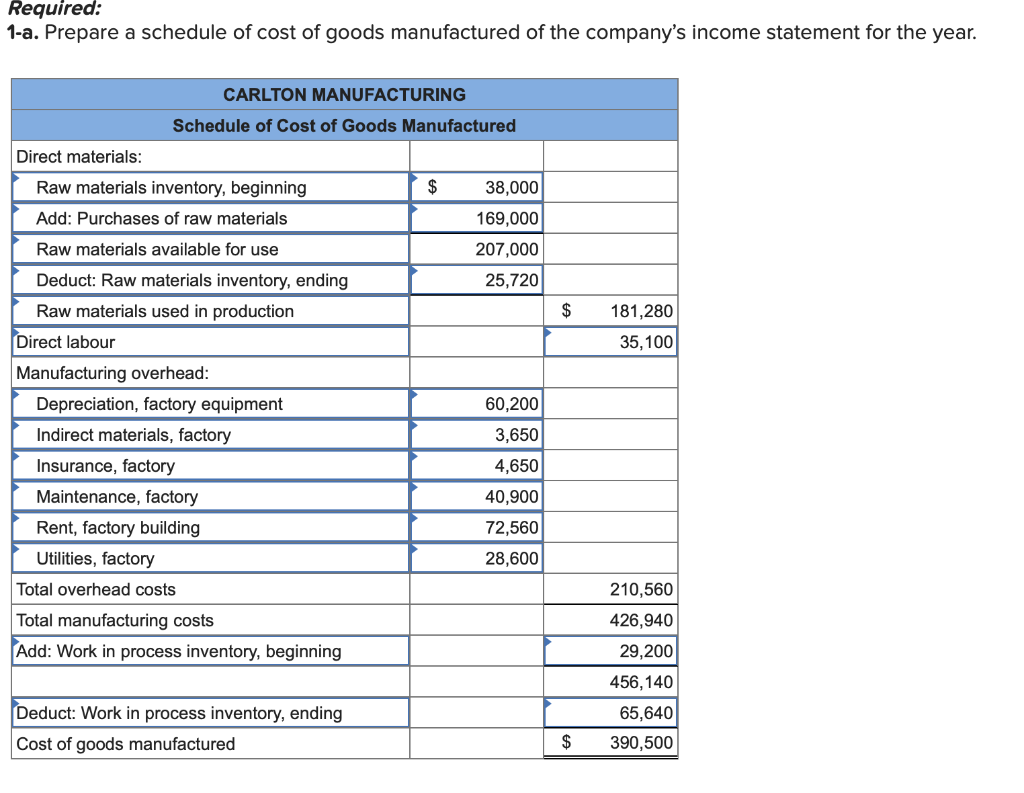

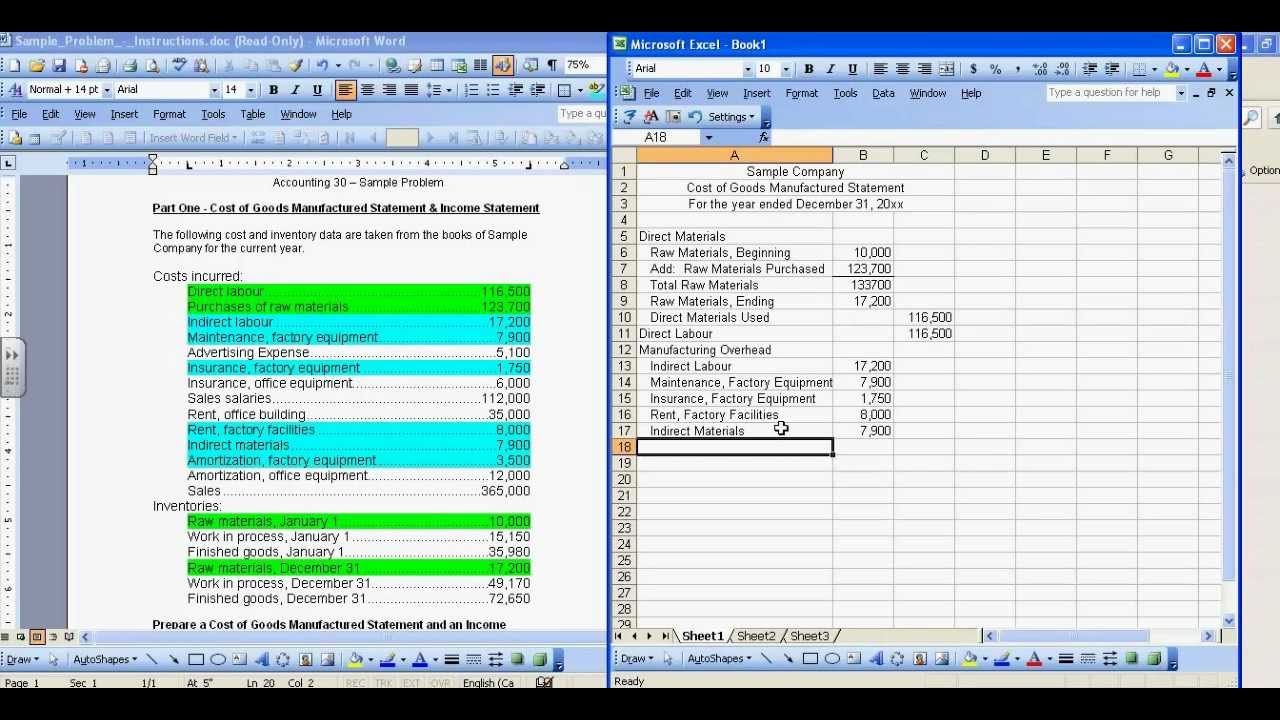

Cost of goods available for sale:

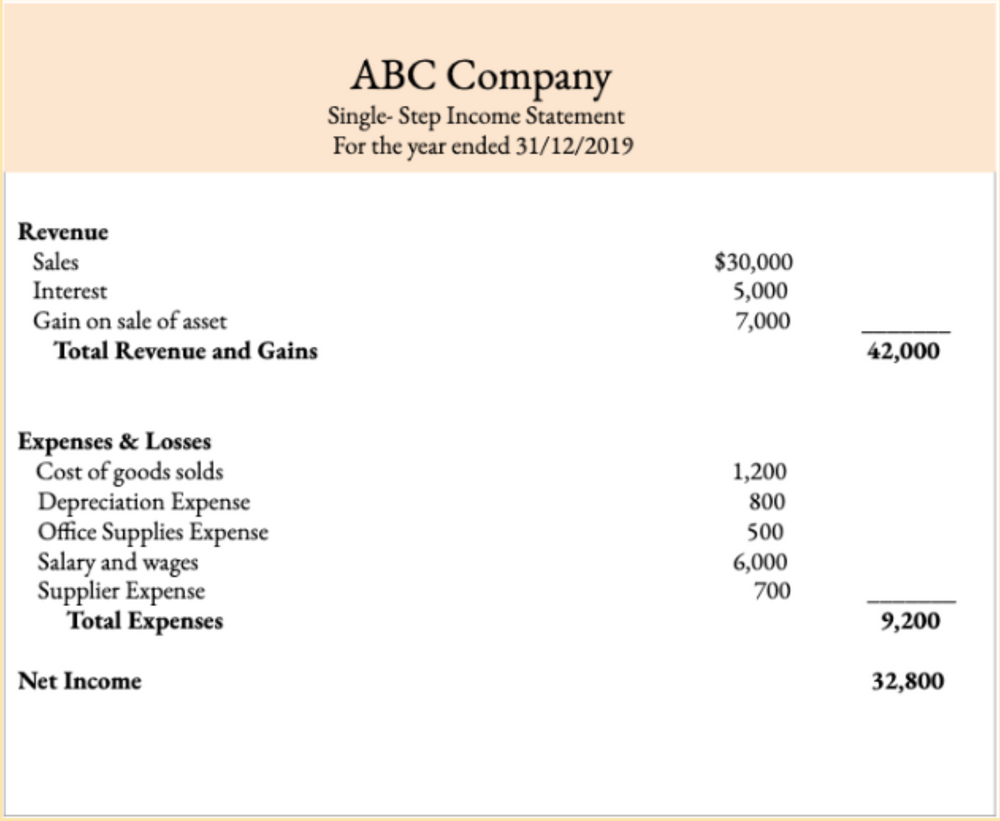

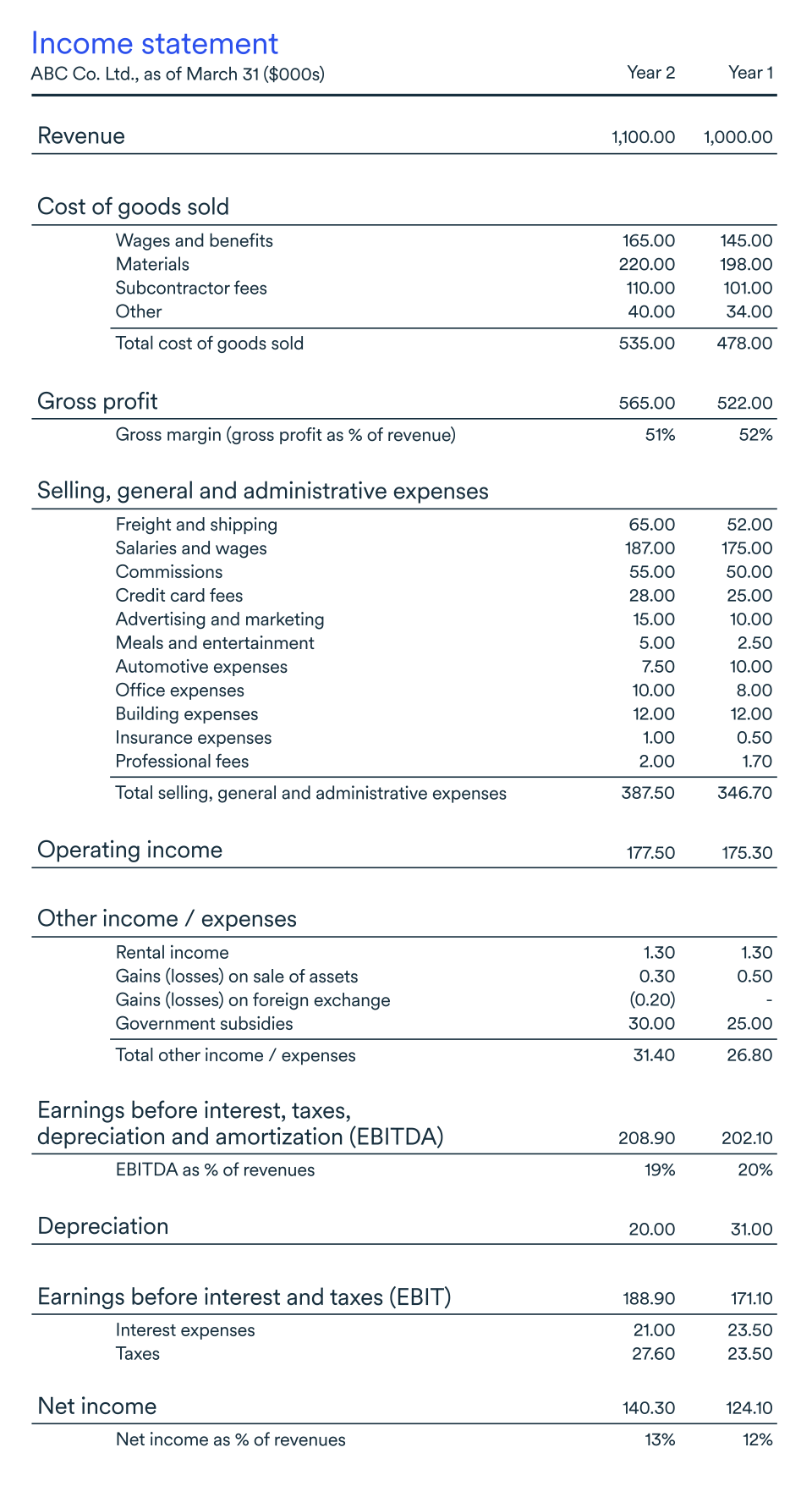

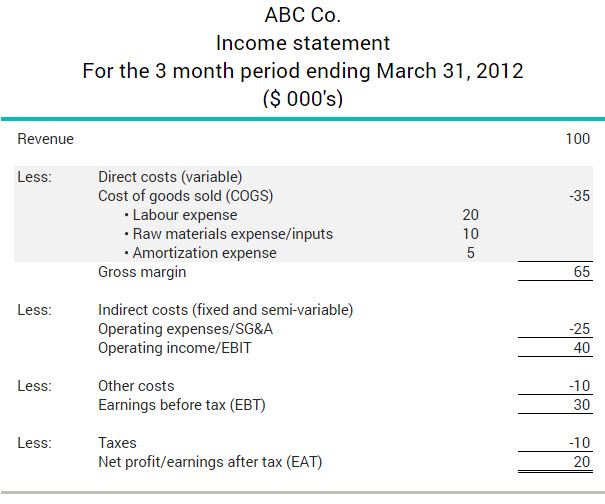

Cost of good sold income statement. To determine the cost per unit of goods produced or sold, divide the cogs by the total number of units: Cost of goods sold consists of all the costs associated with producing the goods or providing the services offered by the company. On the income statement, the cost of goods sold (cogs) line item is the first expense following revenue (i.e.

This number is vital for the company as it will help it make a better decision. Finished goods inventory, january 1: Cogs includes all direct costs needed to produce a product for sale.

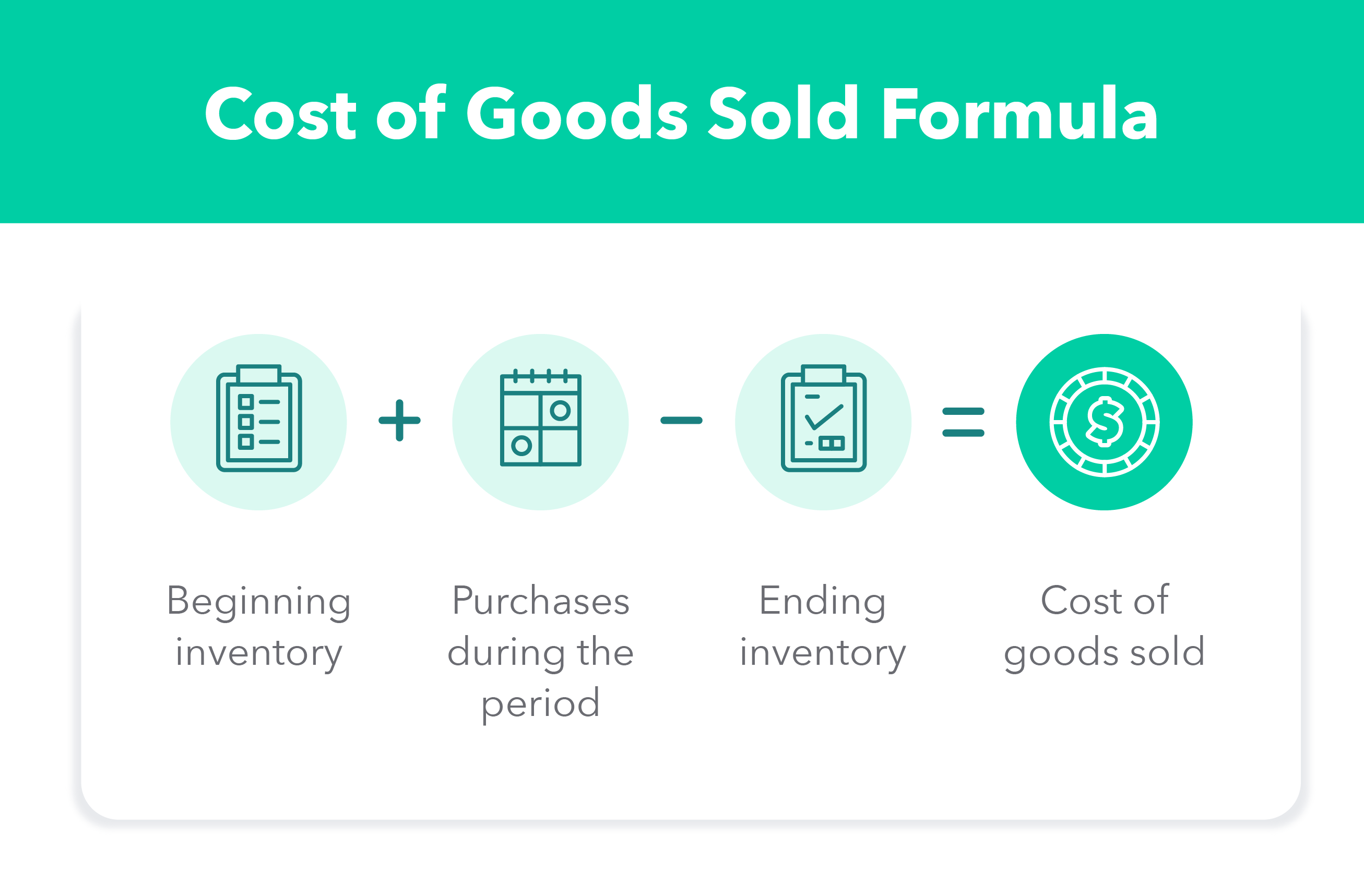

There are two formulas used to calculate the cost of goods sold: Cost of goods sold (cogs) is an essential accounting term used to calculate the cost associated with producing and selling a product. You can determine net income by subtracting expenses (including cogs) from revenues.

Key takeaways understanding and managing cogs helps leaders run their companies more efficiently and more profitably. Cost of goods sold: For the year ended december 31:

Opening inventories= 100,000$ purchase = $200,000; Table of contents cost of goods sold (cogs) meaning Finished goods inventory, december 31:

However, it excludes all the indirect expenses incurred by the company. For the year ending on december 31st, 2018, is $14,000. Cost of goods sold (cogs) on an income statement represents the expenses a company has paid to manufacture, source, and ship a product or service to the end customer.

This statement is not considered to be one of the main elements of the financial statements , and so is rarely found in practice. Noted that the cost of goods sold could be different if we use a. To do this, subtract the cost of goods sold from your revenue.

Example john manufacturing company, a manufacturer of soda bottles, had the following inventory balances at the beginning and end of 2018: How to calculate cost of goods sold. A cost of goods sold statement shows the cost of goods sold over a specific accounting period, typically offering more insights than are found on a normal income statement.

Both manufacturers and retailers list cost of good sold on the income statement as an expense directly after the total revenues for the period. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. The cost of goods sold (cogs) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs.

Cost of goods sold for the period: They’re used to report income for a specific accounting period, such as a year, quarter, or month. Cogs includes all the direct costs involved in creating a product or service, such as labor,.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)