Fine Beautiful Info About Calculate Quick Ratio From Balance Sheet Jblu

This tutorial will teach you how to calculate the quick ratio (also known as the acid test) for an analysis of the balance sheet.this is a key test used in accountancy to test the financial health.

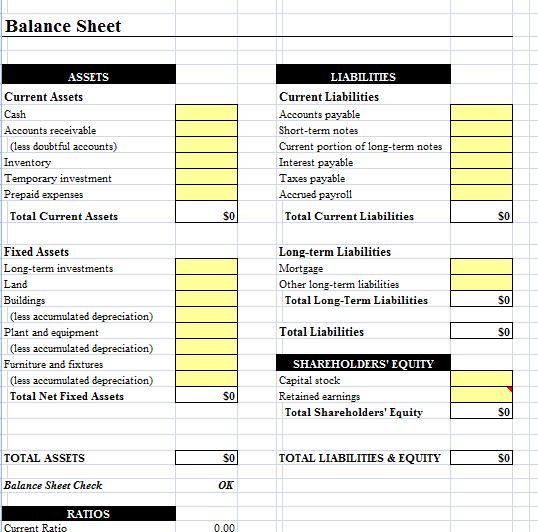

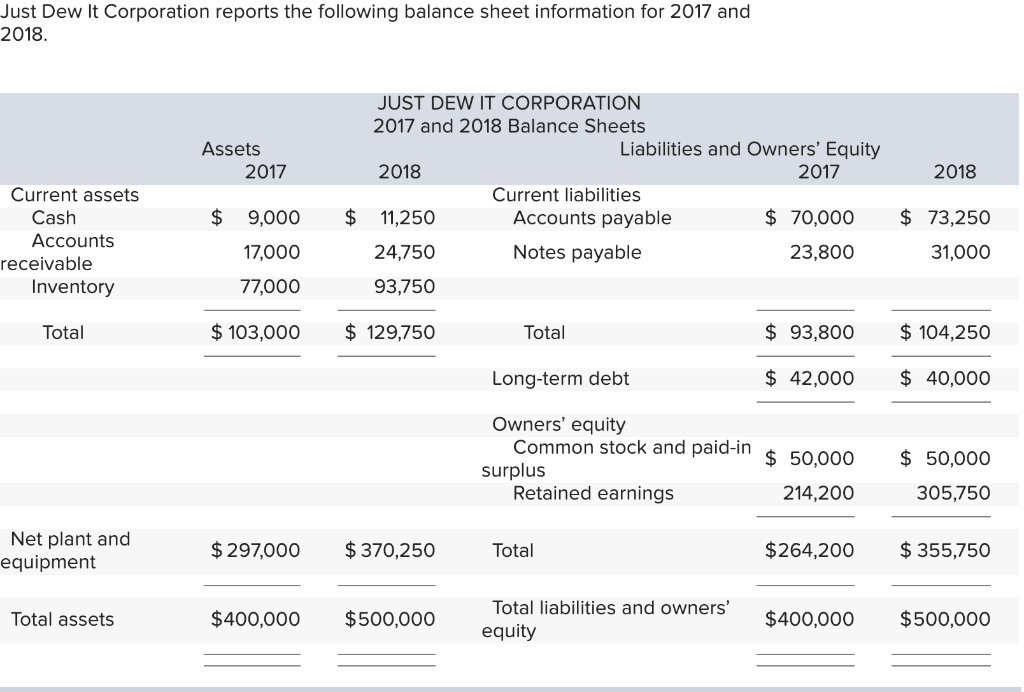

Calculate quick ratio from balance sheet. A positive quick ratio can indicate the company’s ability to survive emergencies or other events that create temporary cash flow problems. Values can be taken from the balance sheet in the company's most recent financial filing to calculate the quick ratio yourself. How to calculate quick ratio from a balance sheet.

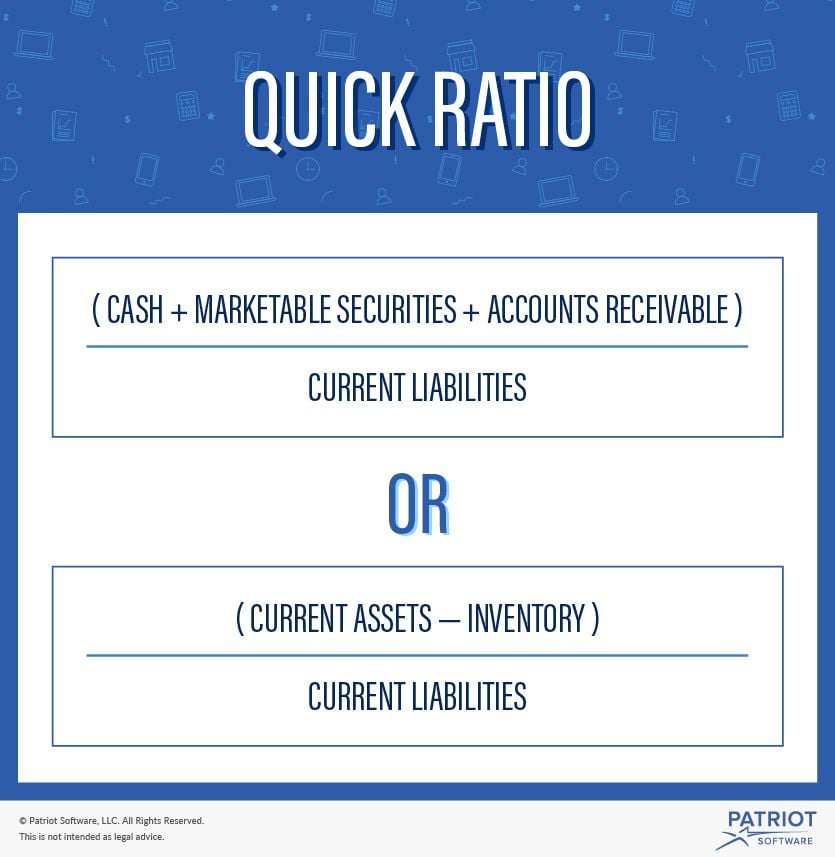

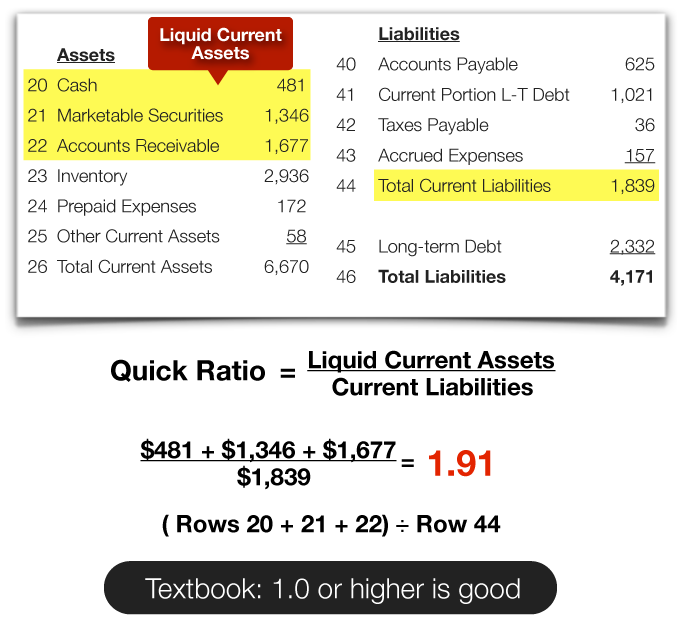

If you look at a few years’ worth of balance sheets, you can calculate and track certain ratios to get an even better picture of the company’s health. You will also need to factor in the marketable securities. Quick ratio = (cash and cash equivalents + accounts receivable) ÷ current liabilities for example, suppose a company has the following balance sheet data:

28, 2019) is shown here. Long term liabilities should be excluded. Quick ratio is one of many financial ratios used for evaluating firms.

If the value of quick assets is not directly available, you can always calculate it yourself from the data available on the balance sheet. To run the quick ratio, you can use your total current liabilities based on the balance sheet above, which is $9,440.53. You can calculate the quick ratio by getting the values from the balance sheet.

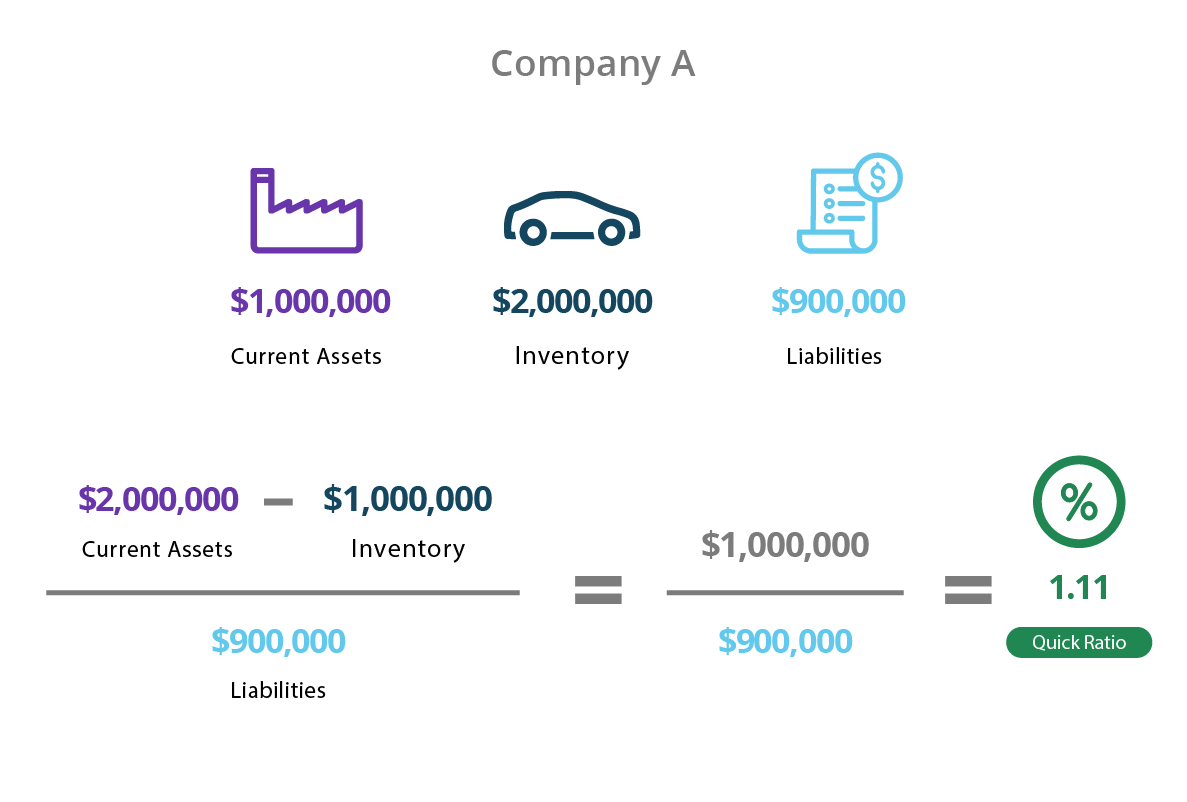

Cash = $20 million marketable securities = $10 million accounts receivable (a/r) = $20 million inventory =. Investors and lenders can calculate a company’s quick ratio from its balance sheet. The formula for calculating the quick ratio is as follows:

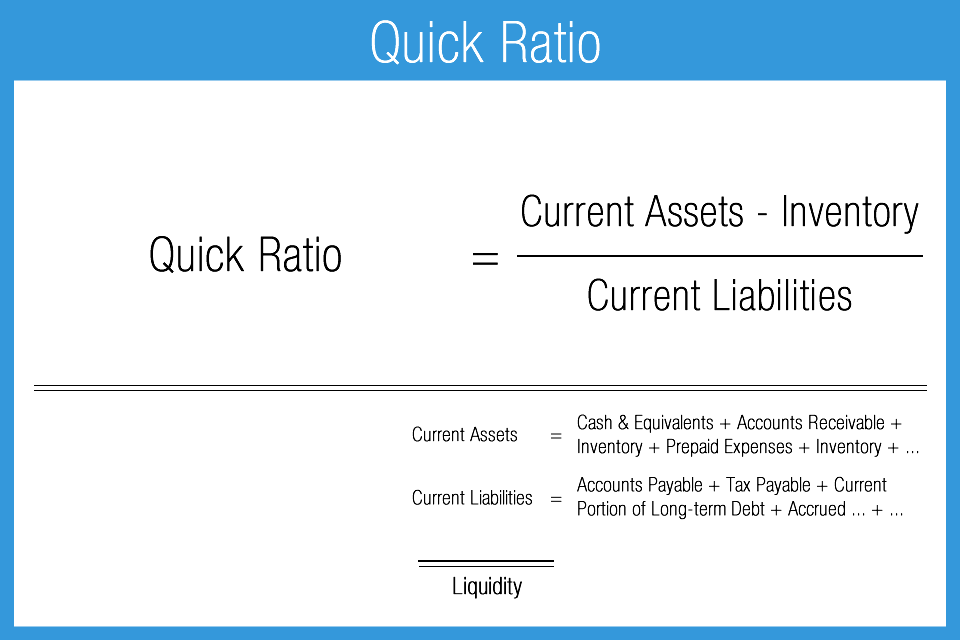

Inventories and prepayments are not included. This brings us to talk about the balance sheet ratios, which further our cause of estimating the company's financial structure. Typically expressed as a ratio, the quick ratio is calculated by dividing the total quick assets by the total current liabilities.

The quick ratio is calculated by dividing a company's most liquid assets like cash, cash equivalents, marketable securities, and accounts receivables by total current liabilities. Hence, the quick ratio can also be computed as: Calculate the quick ratio assuming a company with a current liabilities of $170,000 has the following balance sheet data:

For example, let’s assume a company has: You can do this by finding the values of cash and cash equivalents along with accounts receivable. How to calculate the quick ratio from a balance sheet.

You can obtain the exact values of this equation's particular factors on the basis of the company’s annual report (balance sheet). It does not include inventory in the calculation, so it’s more conservative than the current ratio. (all data is in millions.) the easiest formula to use would be the first one (i.e., add up cash and equivalents, marketable securities, and net receivables.)

We can calculate the quick ratio by dividing the most liquid assets of a company by total current liabilities. The current ratio and the quick ratio (see below) are examples of “liquidity ratios” used to gauge the likelihood that the company can, at any point. The ratio is also known as a quick ratio.

:max_bytes(150000):strip_icc()/Quick_ratio-5c720ee246e0fb00010762ee.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)