Beautiful Work Tips About Statement Of Cash Flows Partial Financial Performance Income

It helps identify the availability of liquid funds with the organization in a particular accounting period.

Statement of cash flows partial. The statement of cash flows analyses changes in cash and cash equivalents during a period. Jean carroll over defamatory statements he made while president in. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

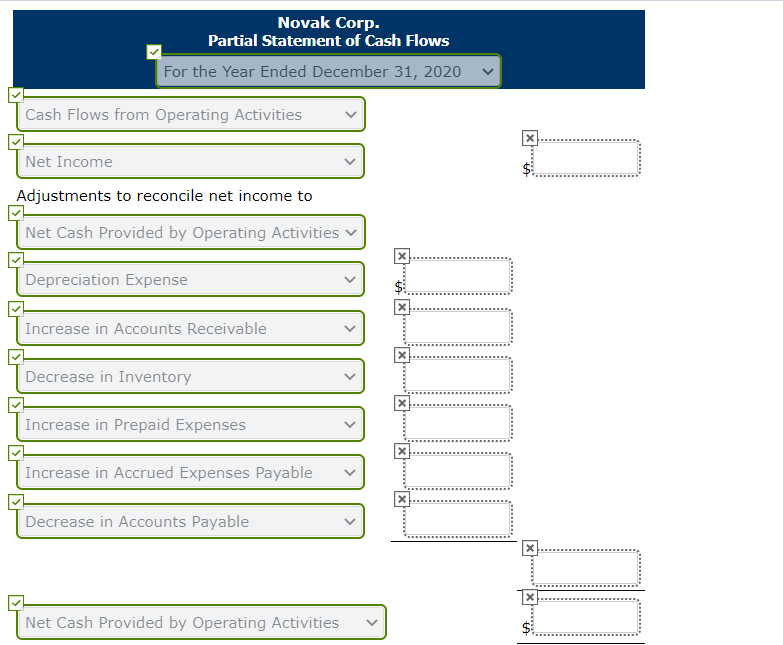

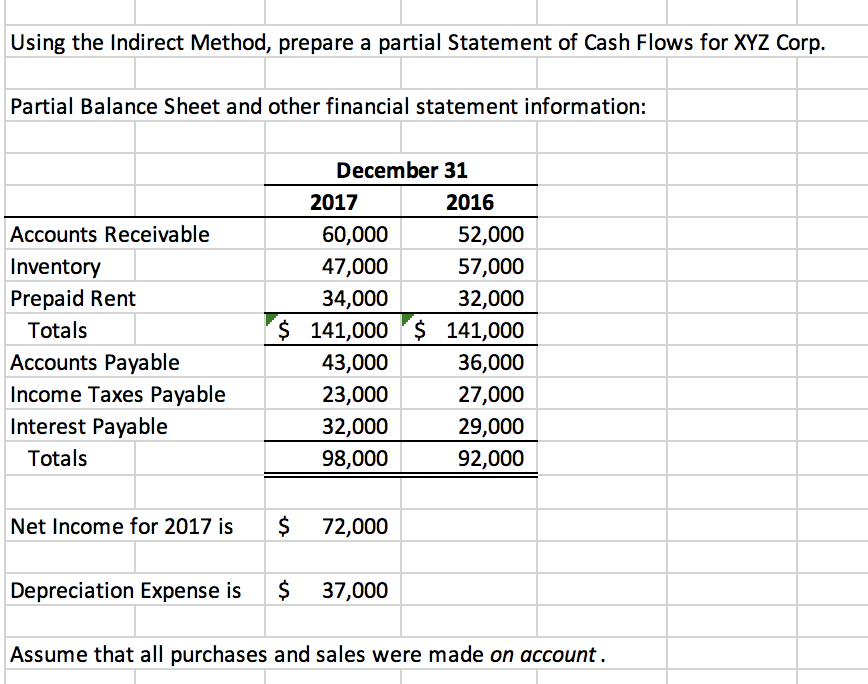

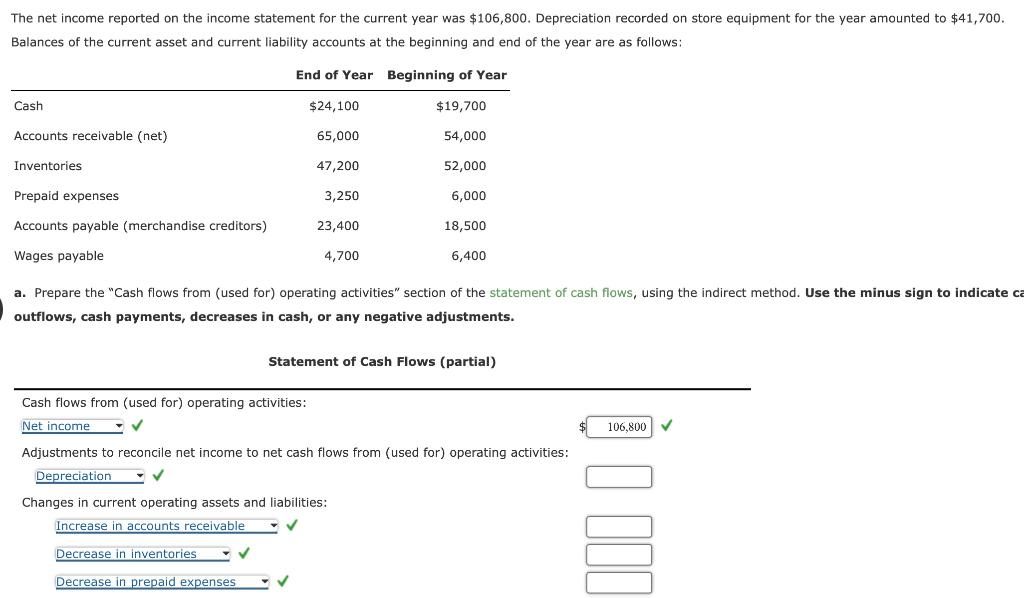

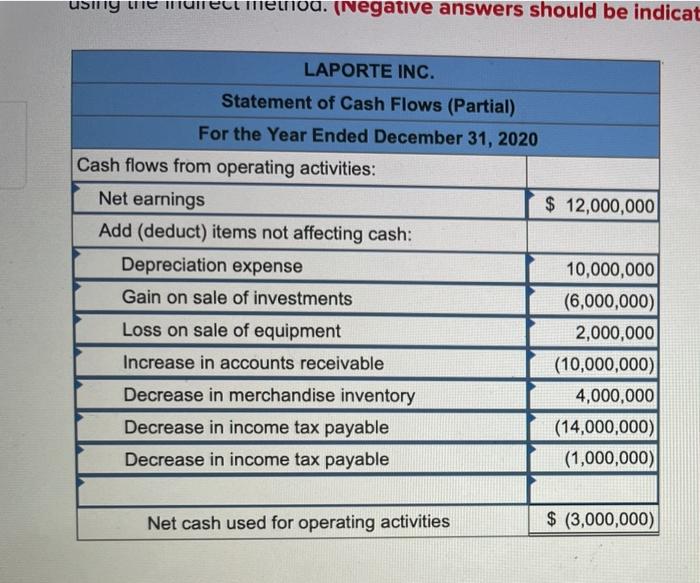

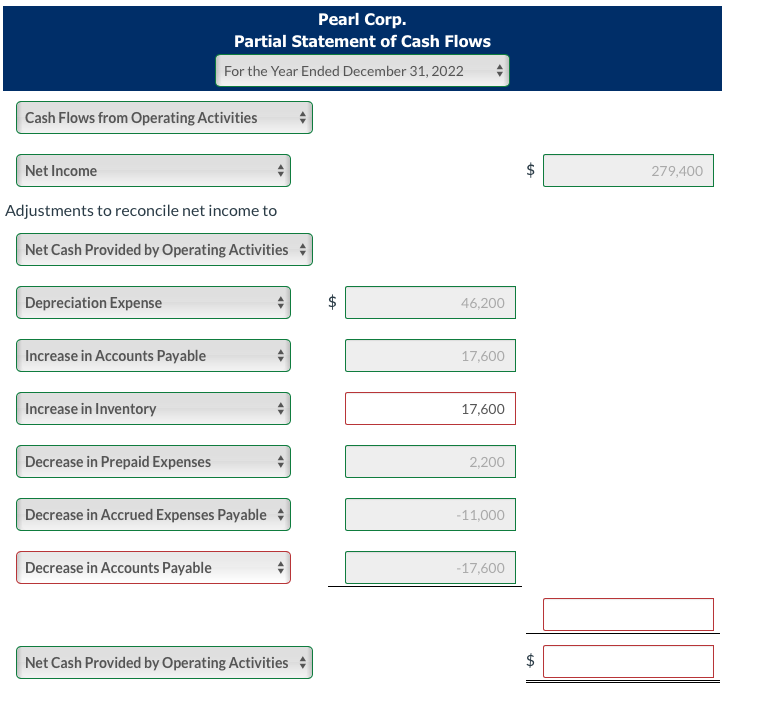

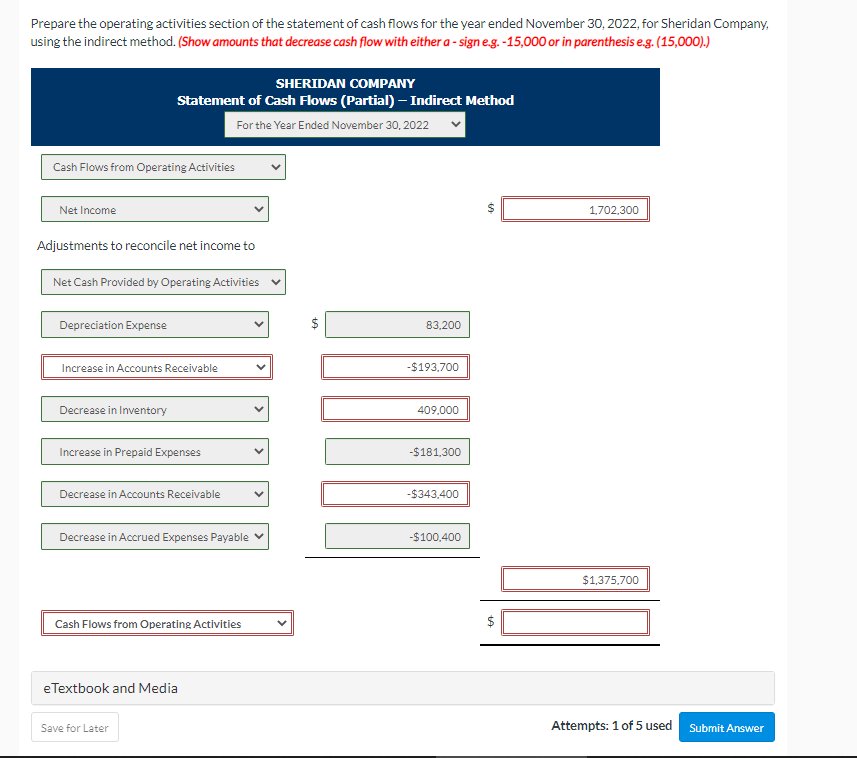

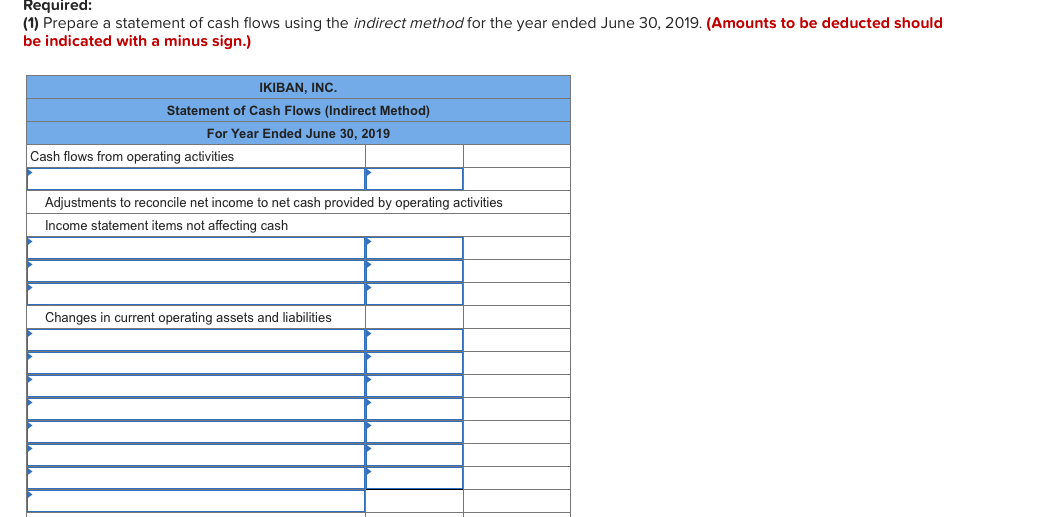

The cfs measures how well a. Prepare a working paper to convert net income from an accrual basis to a cash basis. The statement of cash flows can be used in a number of ways to assess firm performance by both internal and external financial statement users.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Add back noncash expenses, such as depreciation, amortization, and depletion. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It comes just weeks after a federal jury in a separate case ordered trump to pay $83.3 million in damages to the writer e.

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. An inflow occurs when cash is paid to a business. The purpose of this statement is to provide a means to assess the enterprise’s capacity to generate cash and to enable stakeholders to compare cash flows of different entities (cpa canada, 2016).

The statement of cash flows tracks the firm’s cash receipts and cash payments. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Internal users can assess sources of and uses of cash in order to aid in adapting, as.

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activi. An outflow is when a business makes a cash payment. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections:

The company established a niche counting loose change at the exits of supermarkets and other. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. International accounting standard 7 statement of cash flows objective scope benefits of cash flow information definitions cash and cash equivalents presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from.

Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. The time interval (period of time) covered in the scf is shown in its heading. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements.

![[Solved] Complete the partial Statement of Cash Flows. (Us](https://media.cheggcdn.com/study/c58/c58e099c-a218-4232-8e66-1d8fb5c913f3/image)