Beautiful Work Tips About Outstanding Liabilities In Balance Sheet Income Tax Payable On

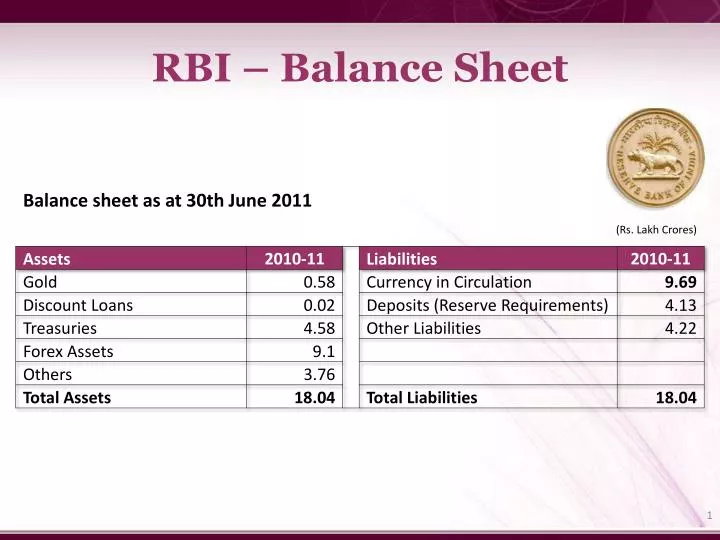

The balance sheet notes payable represent the face.

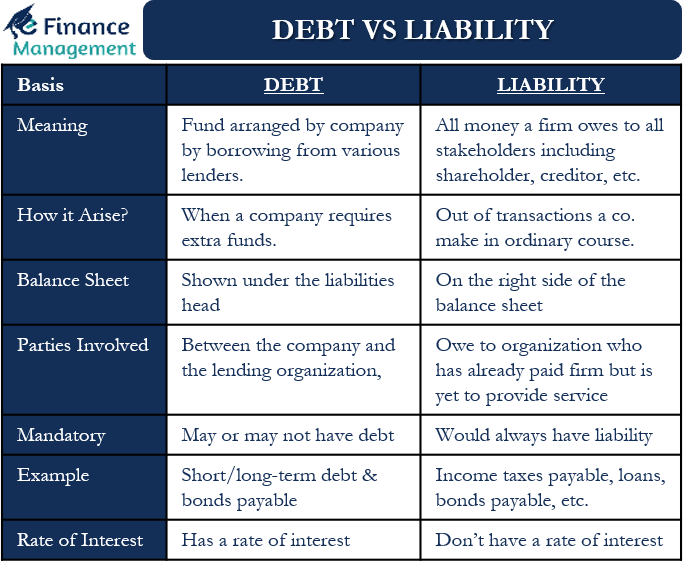

Outstanding liabilities in balance sheet. Based on 2 documents outstanding liabilities means the borrower present, future, actual or contingent liabilities to the bank under this agreement. Therefore, the reported cash balance on your balance sheet should be lower than the actual amount in your bank account. · be based in the united.

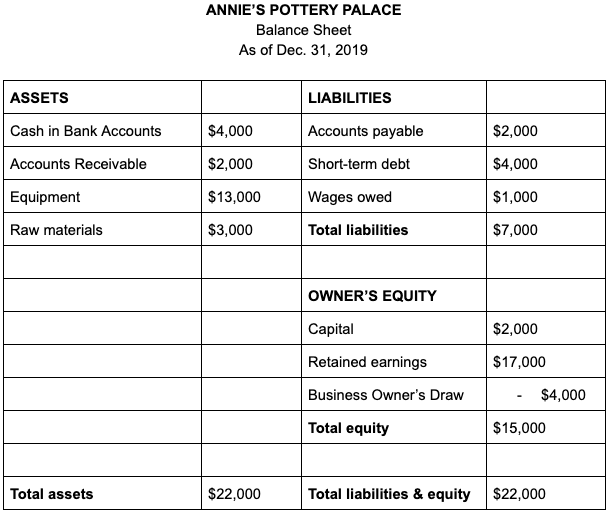

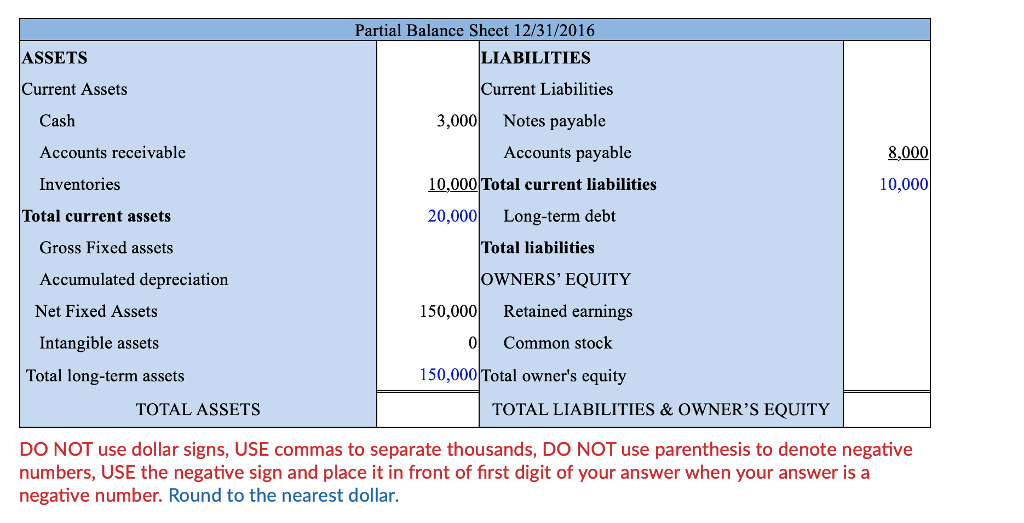

An outstanding expense is a type of expense that is due but has not been paid. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Current liabilities are a company's obligations that will come due within one year of the balance sheet's date and will require the use of a current asset or create another current liability.

The bonds due account on a balance sheet shows the face value of the company’s outstanding bonds. Outstanding liabilities shall include all amounts due and remaining unpaid by the borrower under this agreement or any other arrangement with the bank including the fees and bank charges. · have a market value of $5 billion or more.

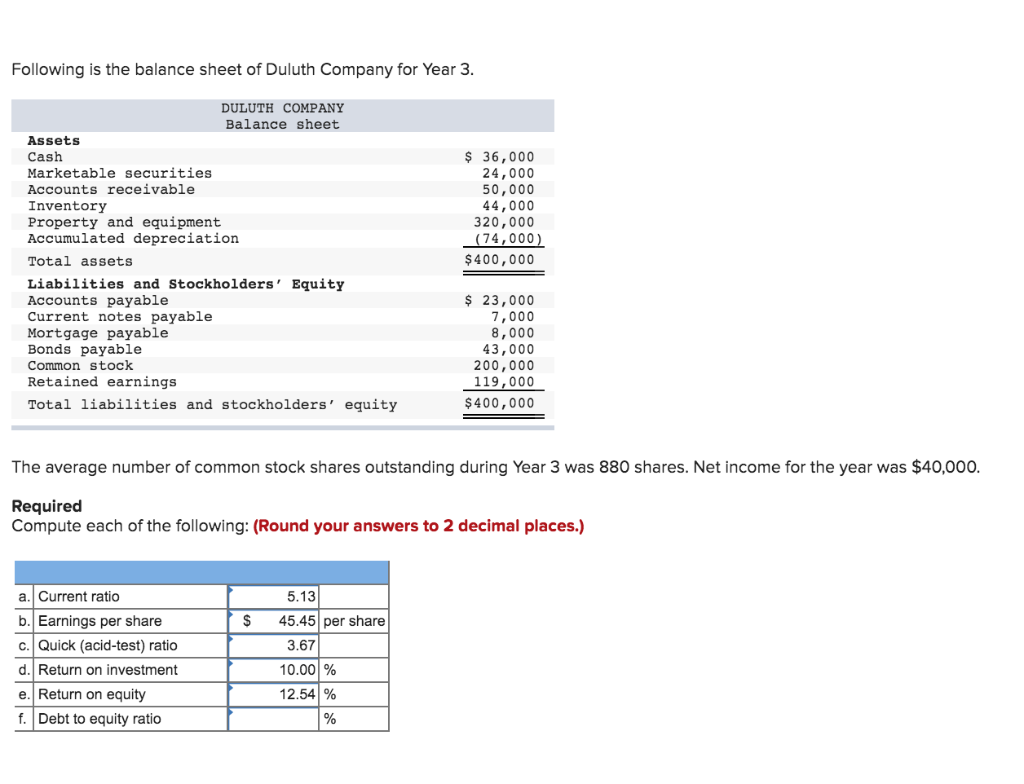

For accounting accuracy, these expenses need to. Calculating debt from a simple balance sheet is a cakewalk. To perform accounting with accuracy, these expenses are required need to be realized whether they are paid or not.

It is recorded on the liability side of the balance sheet of a business. Balance sheets are useful tools. For example, we usually pay the electricity bill of march, in april.

This is a list of what the company owes. With liabilities, this is obvious—you owe loans to a bank, or. Additionally, outstanding checks affect your current liabilities.

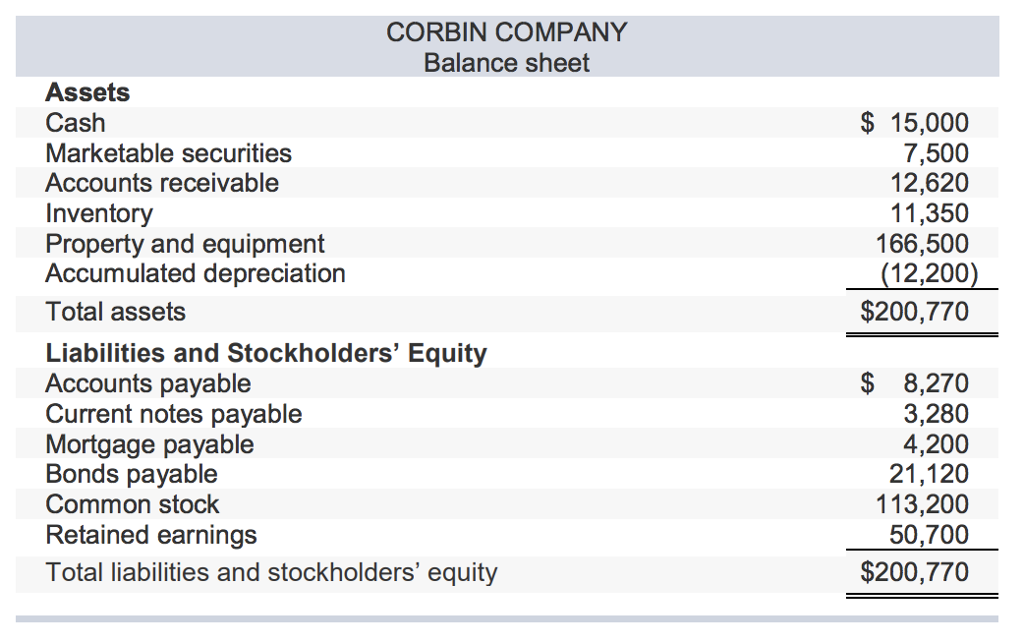

Everything the company owns is classified as an asset and all amounts the company. The number of outstanding bonds issued by a firm with a maturity of more than one year. Balance sheets provide the basis for.

A liability is anything a company or organization owes to a debtor. The outstanding expense is a personal account with a credit balance and is treated as a liability for the business. The balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities.

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Assets = liabilities + equity. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

In the below example, the assets equal $18,724.26. It can also be referred to as a statement of net worth or a statement of financial position. Total liabilities are the combined debts and obligations that an individual or company owes to outside parties.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)