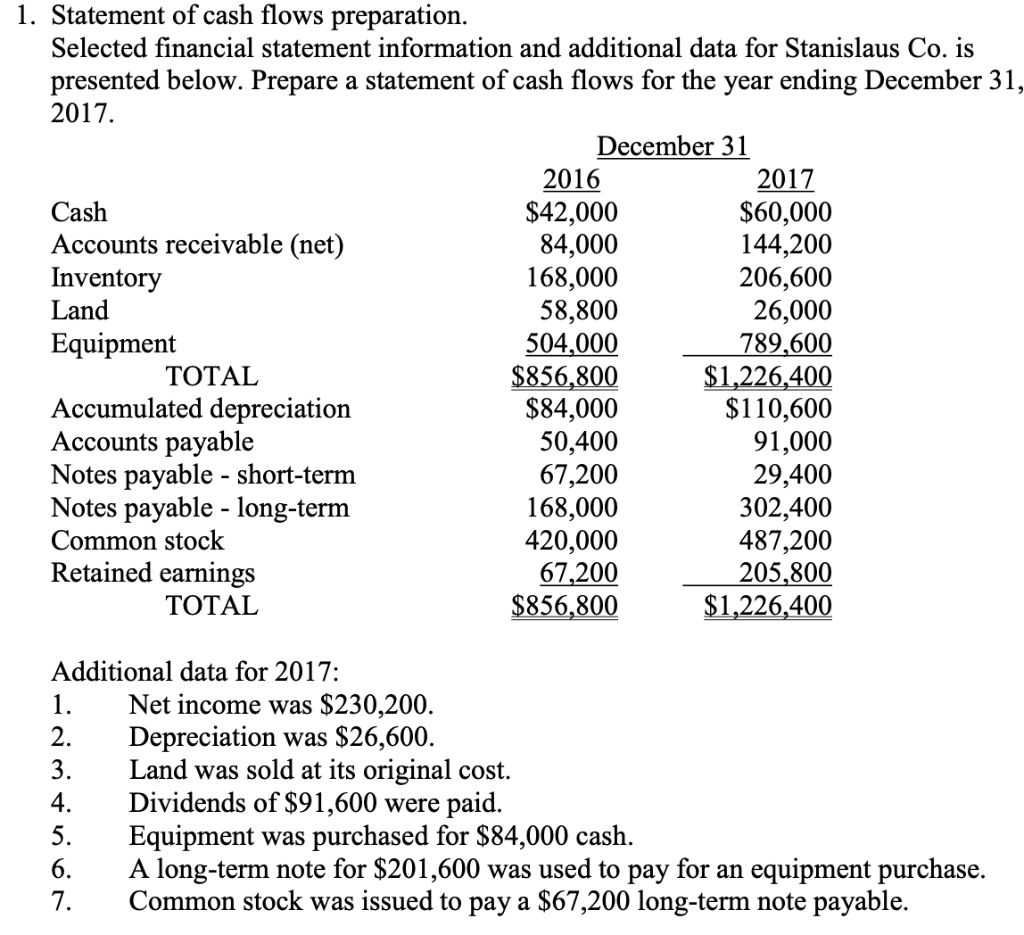

Build A Tips About Increase In Notes Payable Cash Flow Prepare Balance Sheet And Income Statement

A decrease in accounts payable is the opposite effect of an increase in accounts payable.

Increase in notes payable cash flow. How a decrease in accounts payable affect cash flow. Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the. As mentioned, an increase in accounts payable has a positive effect on cash flows as it represents a postponement of cash payments that helps to free up cash in the current period.

Financing activities leading to an increase in cash. Your accounts payable, or notes payable, are the amounts you owed to vendors that are payable within the next 30 to 90 days. Increasing the frequency of paying back vendors affects cash flow negatively, while decreasing it affects cash flow positively.

A note payable affects the cash flow statement by reducing the amount of cash that a company has available, as payments must be made to repay the loan. There is an impact on cash flow when a company repays the note. The sum should equal the increase (or decrease) in cash amount.

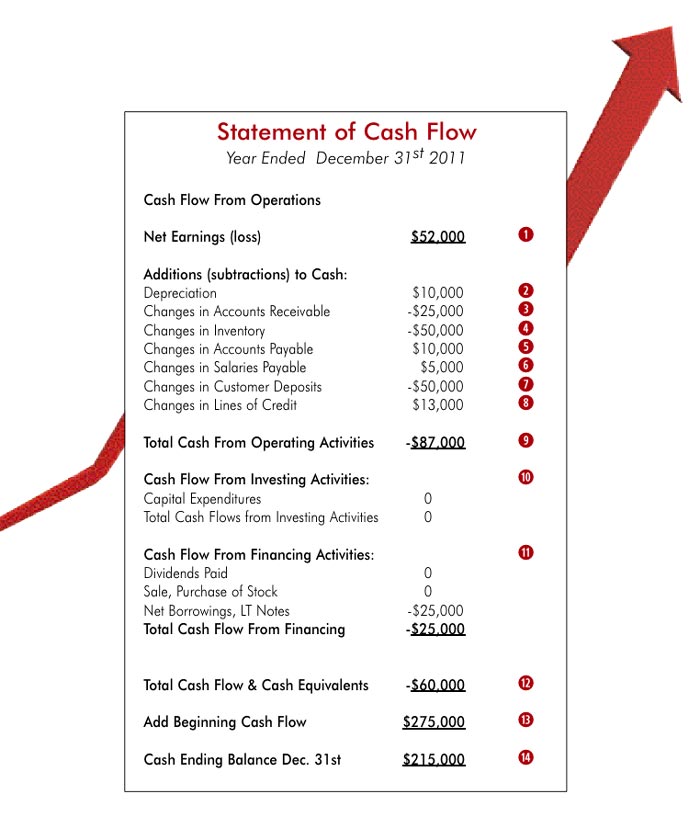

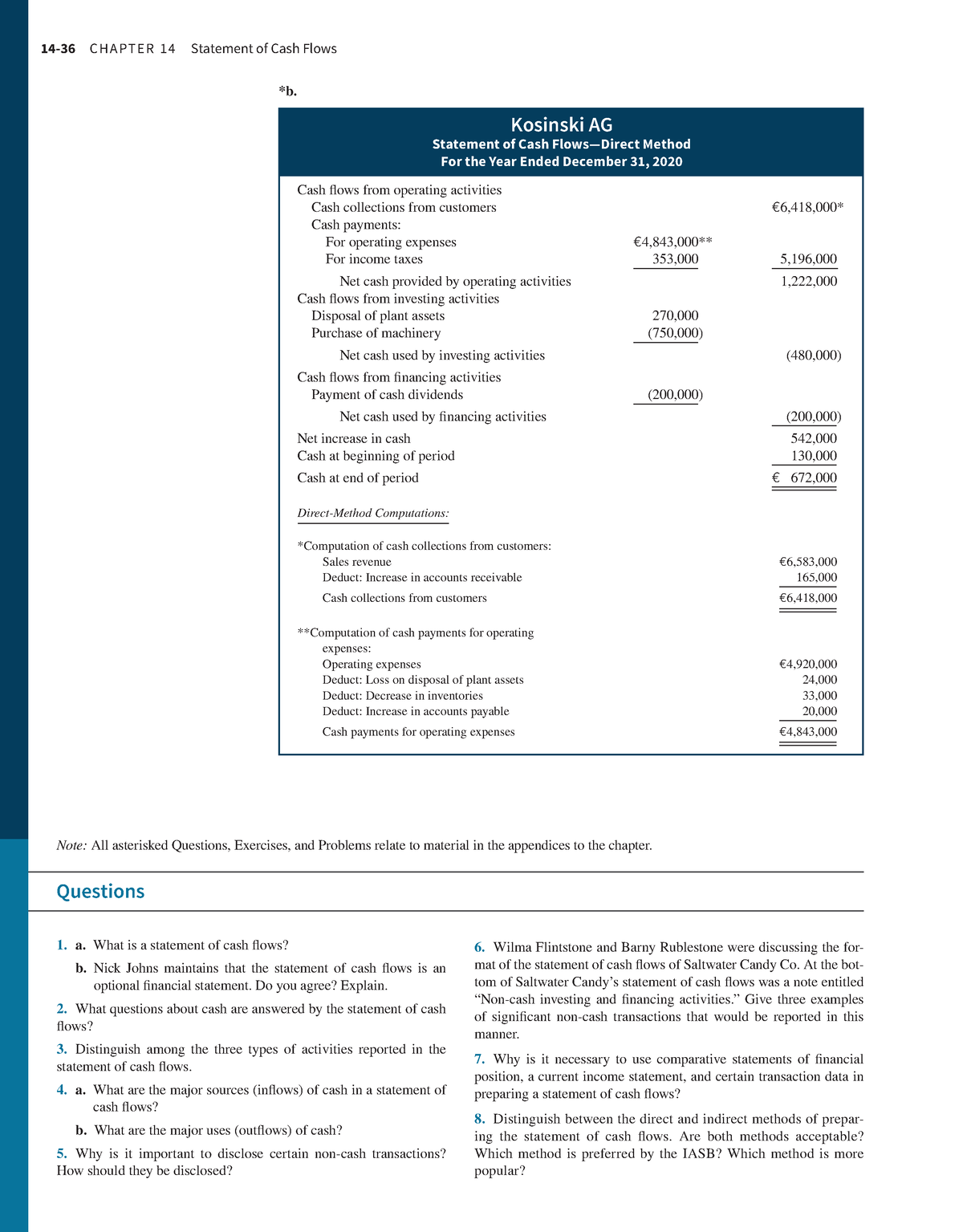

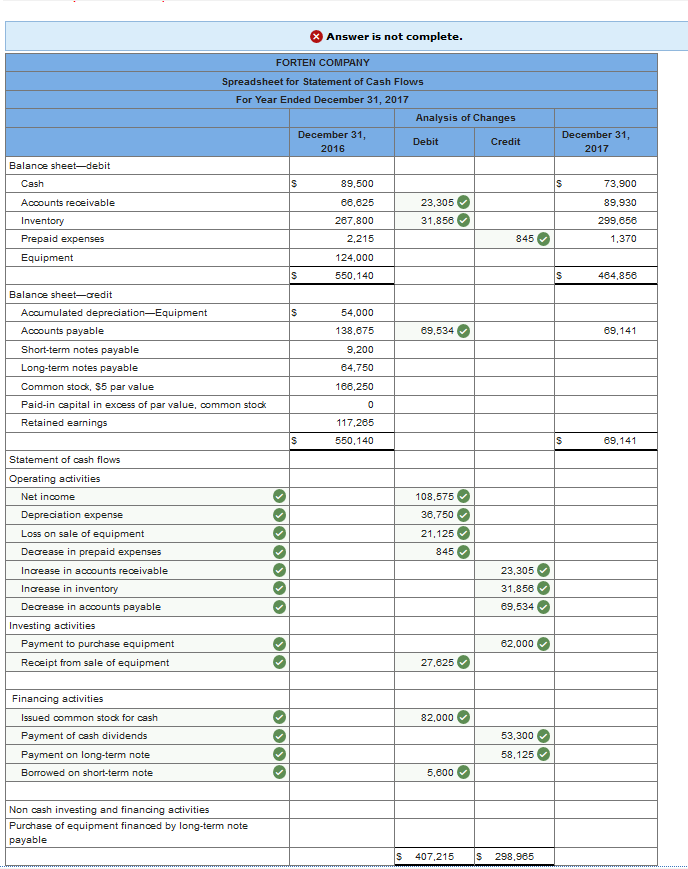

Adjustments to reconcile net income to net cash provided by operating activities: To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: This article considers the statement of cash flows of which it assumes no prior knowledge.

When using a cash flow statement, you can calculate total cash flow by subtracting total cash outflow from total cash inflow in each section. It is relevant to the fa (financial accounting) and fr (financial reporting) exams. How does an increase in notes payable affect cash flow in the statement of cash flows?

Accounts payable represent a change in the cash flow on the cash flow statement. Notes payable includes the amount that has to be paid by the company. Add the three numbers for cash flows from/used for operating, investing, and financing activities and label it as “increase in cash” if it is positive or “decrease in cash” if it is negative.” add the net cash flows amounts from the three types of activities.

Increases in net cash flow from financing usually arise when the company issues share of stock, bonds, or notes payable to raise capital for cash flow. Without payables and credit, you have to pay for. Increases in net cash flow from financing usually arise when the company issues share of stock, bonds, or notes payable to raise capital for cash flow.

Notes payable affect the financing activities and operating activities sections of cash flow statements. The repayment accounting entries are to debit notes payable by the principal amount of the note and credit cash. Adjustments for cash flows from investing and financing activities recognized in net income adjusted to arrive at cash flows from operating activities may include.

An increase in accounts payable increases the cash flow since the money hasn't yet left the company. Subcategory, cash flows from operating activities:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)