Sensational Info About Retained Earnings Formula In Balance Sheet And Financial Position

To calculate retained earnings subtract a company’s liabilities from its assets to get your stockholder equity, then find the common stock line item in your balance sheet and take the total stockholder equity and subtract the common stock line item figure (if the only two items in your stockholder equity are common stock and retained earnings).

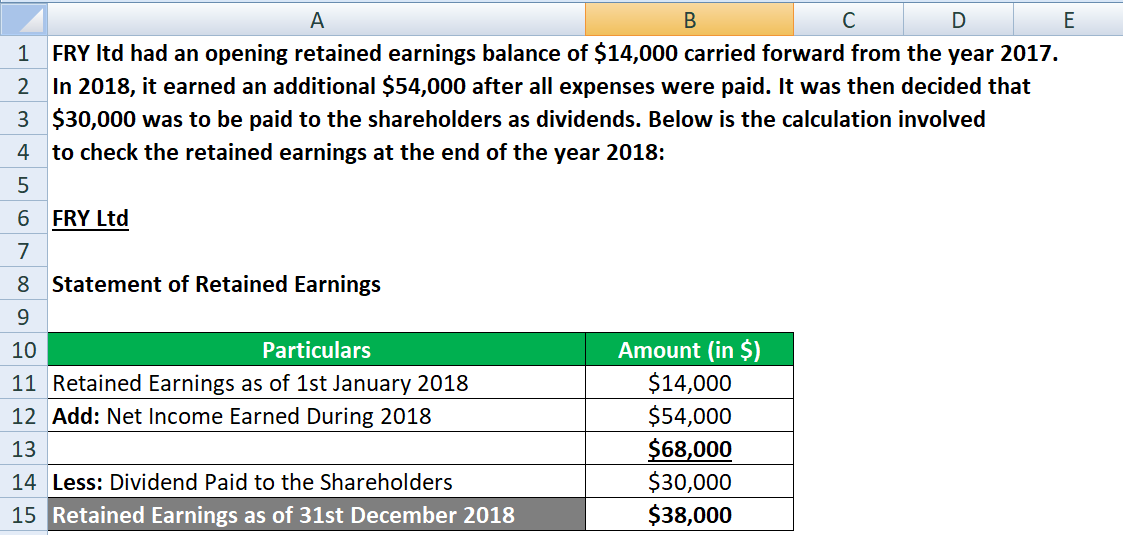

Retained earnings formula in balance sheet. The interpretation of financial statements example of the retained earnings formula abc international has $500,000 of net profits in its current year, pays out $150,000 for dividends, and has a beginning retained earnings balance of $1,200,000. 28, 2022, which is the end of the company's 2022 fiscal year. Retained earnings formula and calculation.

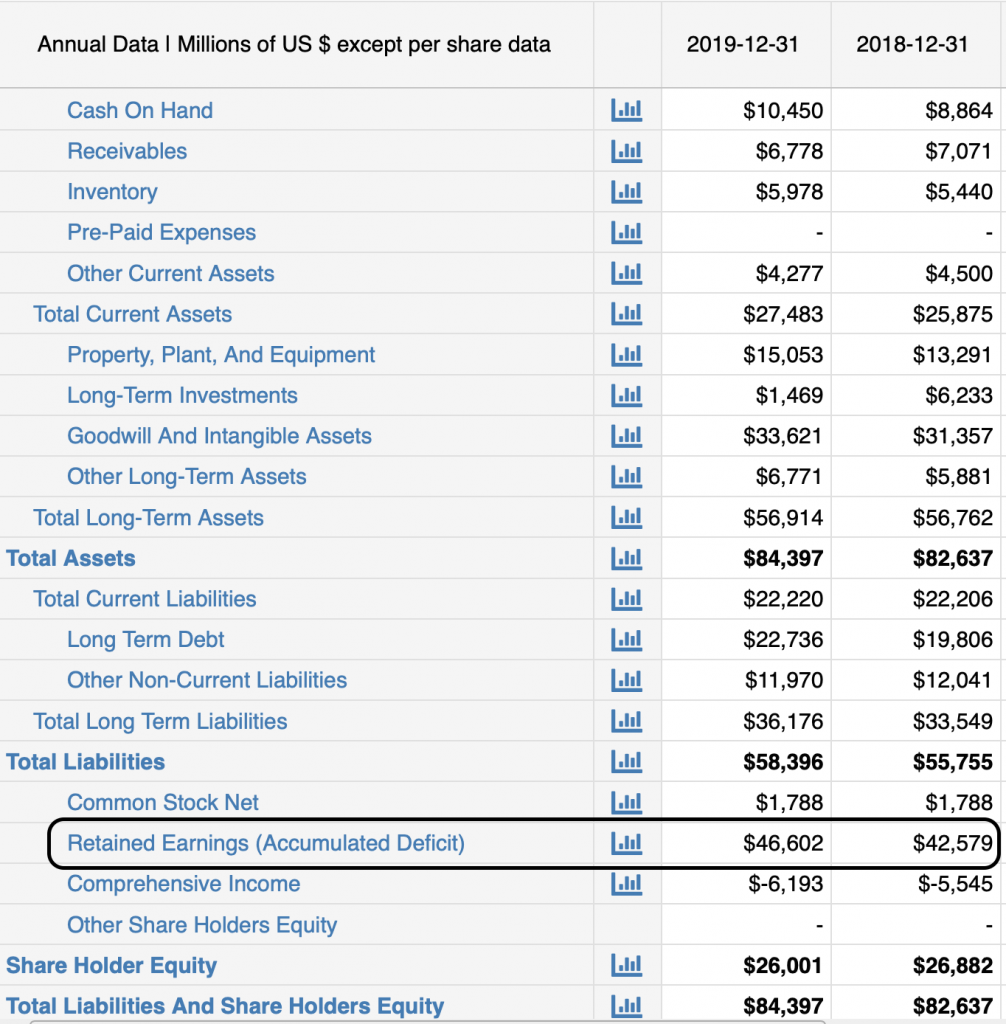

This is any accumulated surplus recorded at. For manual calculations, you should take into consideration the following variables: In the same period, it reported $60 billion in shareholder equity and $100 billion in net income.

The retained earnings figure is not always a positive number. Its retained earnings calculation is: The formula to calculate retained earnings is:

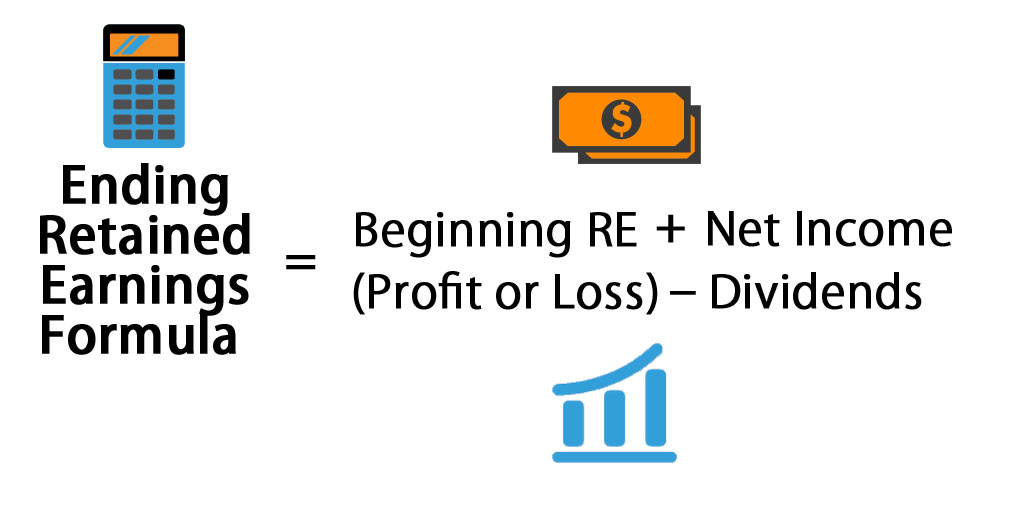

Calculating retained earnings is a pretty straightforward process. Retained earnings represent the net earnings a company has saved or reinvested since its inception, after distributing dividends to shareholders. The formula to calculate retained earnings is:

Understand what retained earnings are in a balance sheet and know its formula. Retained earnings are noted on the balance sheet under accumulated income from the previous year minus shareholder dividends. Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial.

Starting retained earnings + loss dividends paid/net income = total retained earnings. Learn its uses and how to compute it through the given sample calculations. The formula is as follows:

Retained earnings are essential for financial analysts as they provide insight into a company's financial performance and health. Here's a breakdown of the components of the formula. What are retained earnings?

You can use a basic accounting formula: Retained earnings are shown in two places in your business’ financial statements: The retained earnings formula provides a way to calculate a company's retained earnings at the end of a specific period:

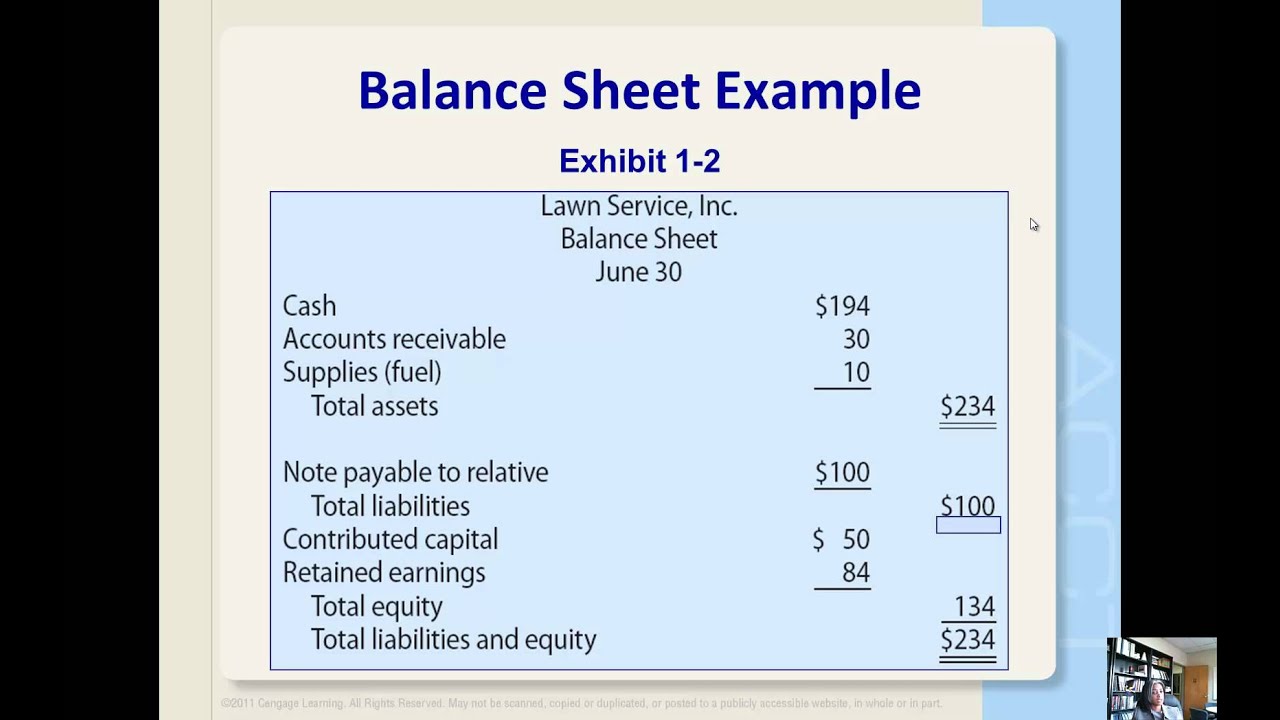

Where re = retained earnings. Accounting software can calculate retained earnings. A balance sheet is made up of assets, liabilities and stockholder equity.this balance sheet is used to ensure the assets on your company’s books are equal to the sum of your company’s liabilities and stockholder equity.

Essentially, they are the cumulative profits that have been ‘retained’ within the business over time. A company can calculate its retained earnings by using a balance sheet. Retained earnings on balance sheet example the following is an example of retained earnings calculation: