Neat Tips About Of An Accounting Process Trial Balance Is List Ipsas Standards

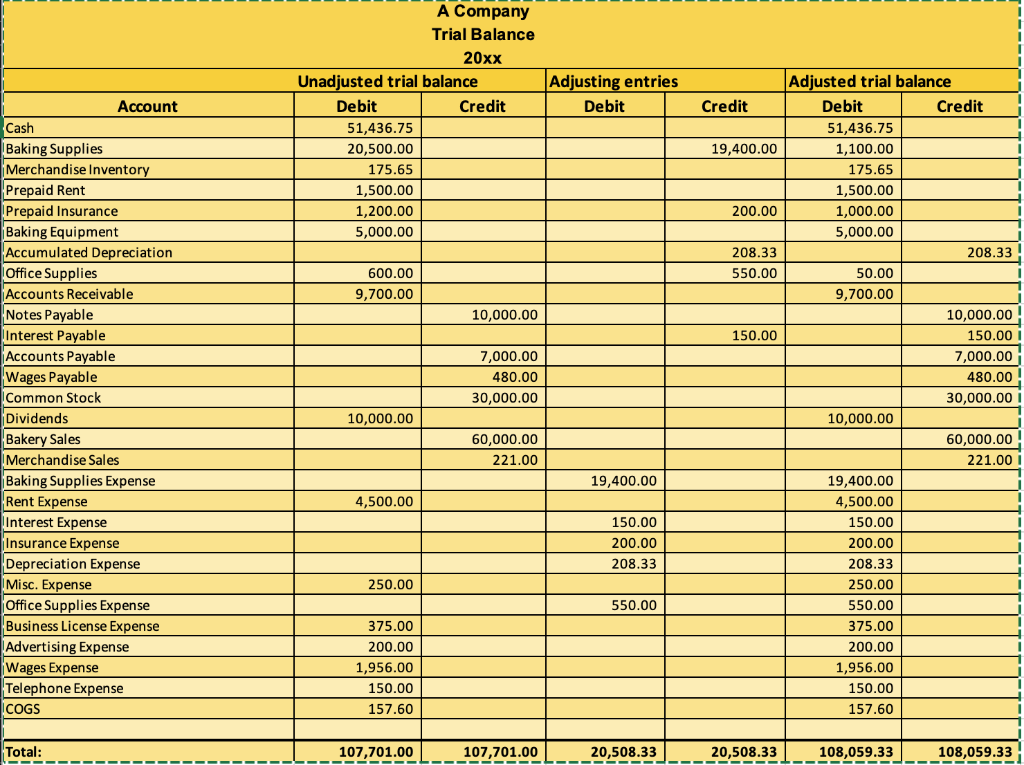

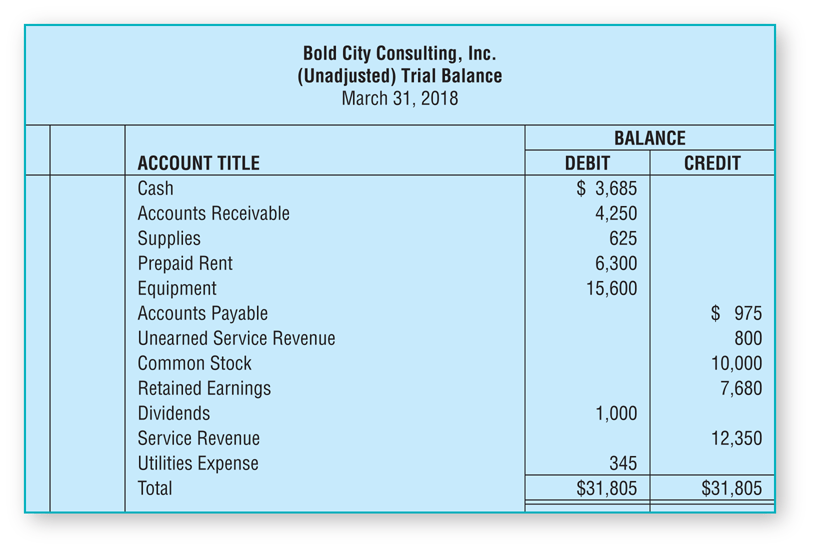

The trial balance is an accounting report that lists the ending balance in each general ledger account.

Of an accounting process trial balance is. The primary purpose of a trial balance is to ensure that the company’s accounting records are in balance. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. A us judge ordered trump on february 16, 2024 to pay.

Definition a trial balance is a bookkeeping tool that consolidates all the ledger accounts of a business into one report, showing the debits and credits made to each account. A new york judge has ordered donald trump and his companies to pay $355 million. What is a trial balance?

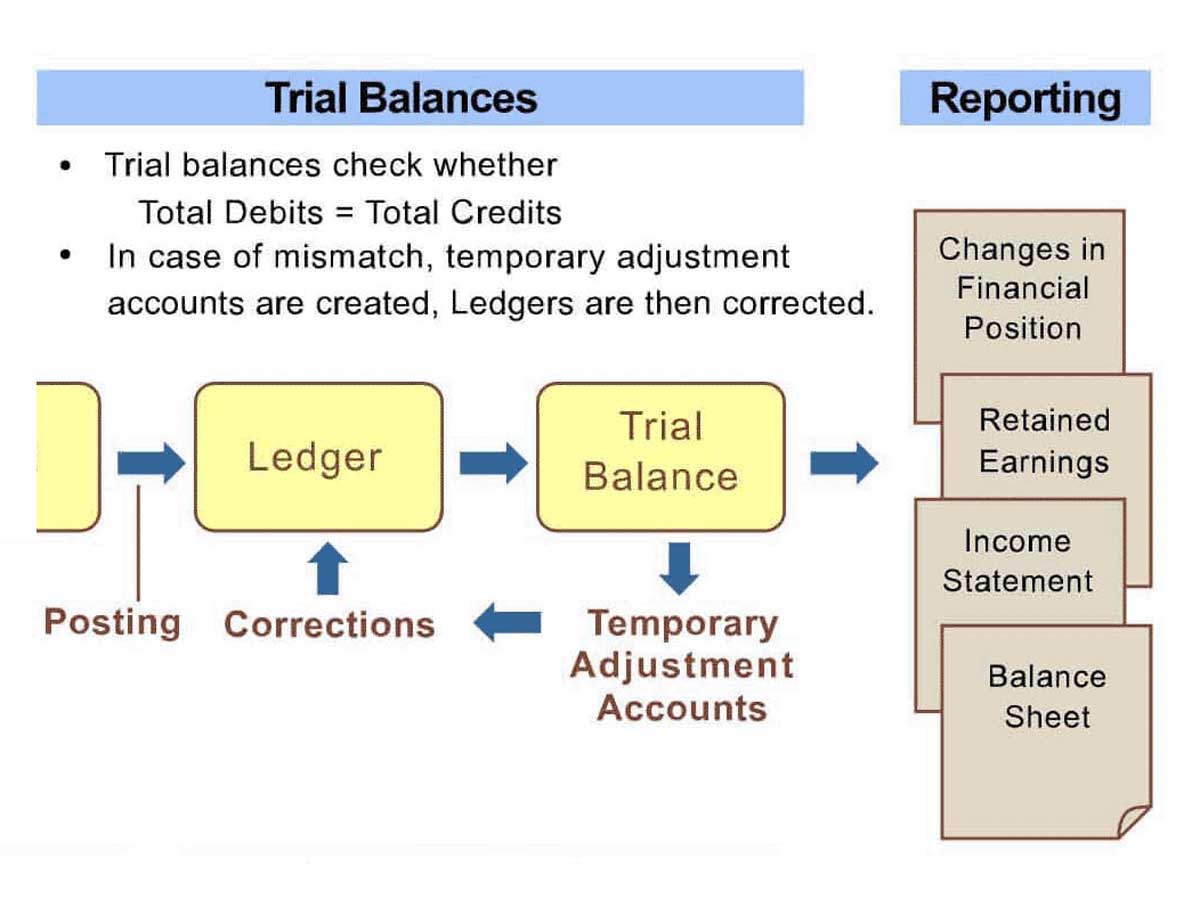

The debits and the credits are then totaled to verify their balance. This balancing step in the accounting process helps ensure the accuracy of the financial statements. Key points about an accounting.

The balances are usually listed to achieve equal. By kate christobek. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other.

It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. A trial balance is a worksheet that lists all general ledger ending account balances into two columns either a debit or a credit. Understanding the trial balance report.

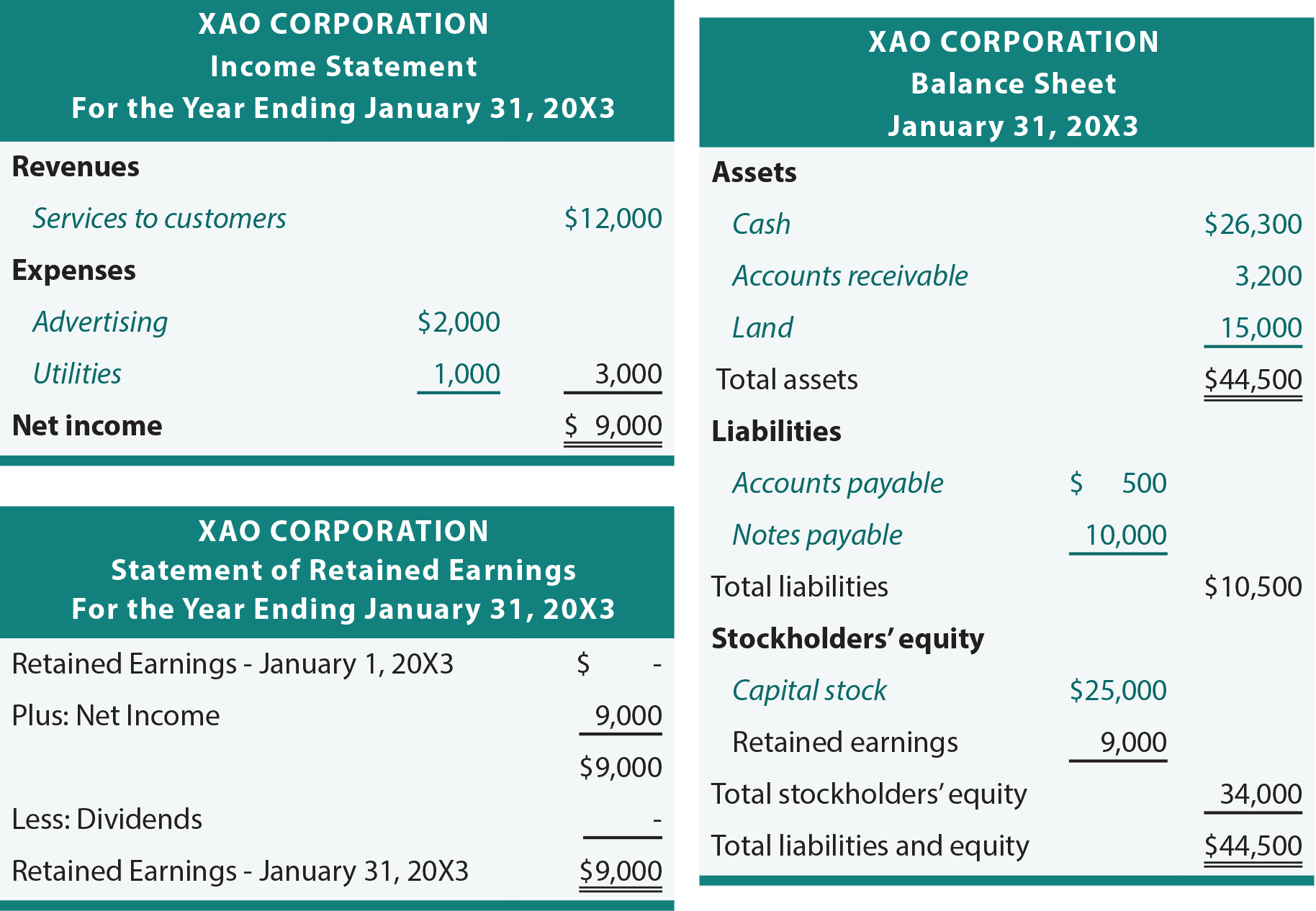

This statement comprises two columns: This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. How the trial balance interacts with balance sheets, income statements, etc.:

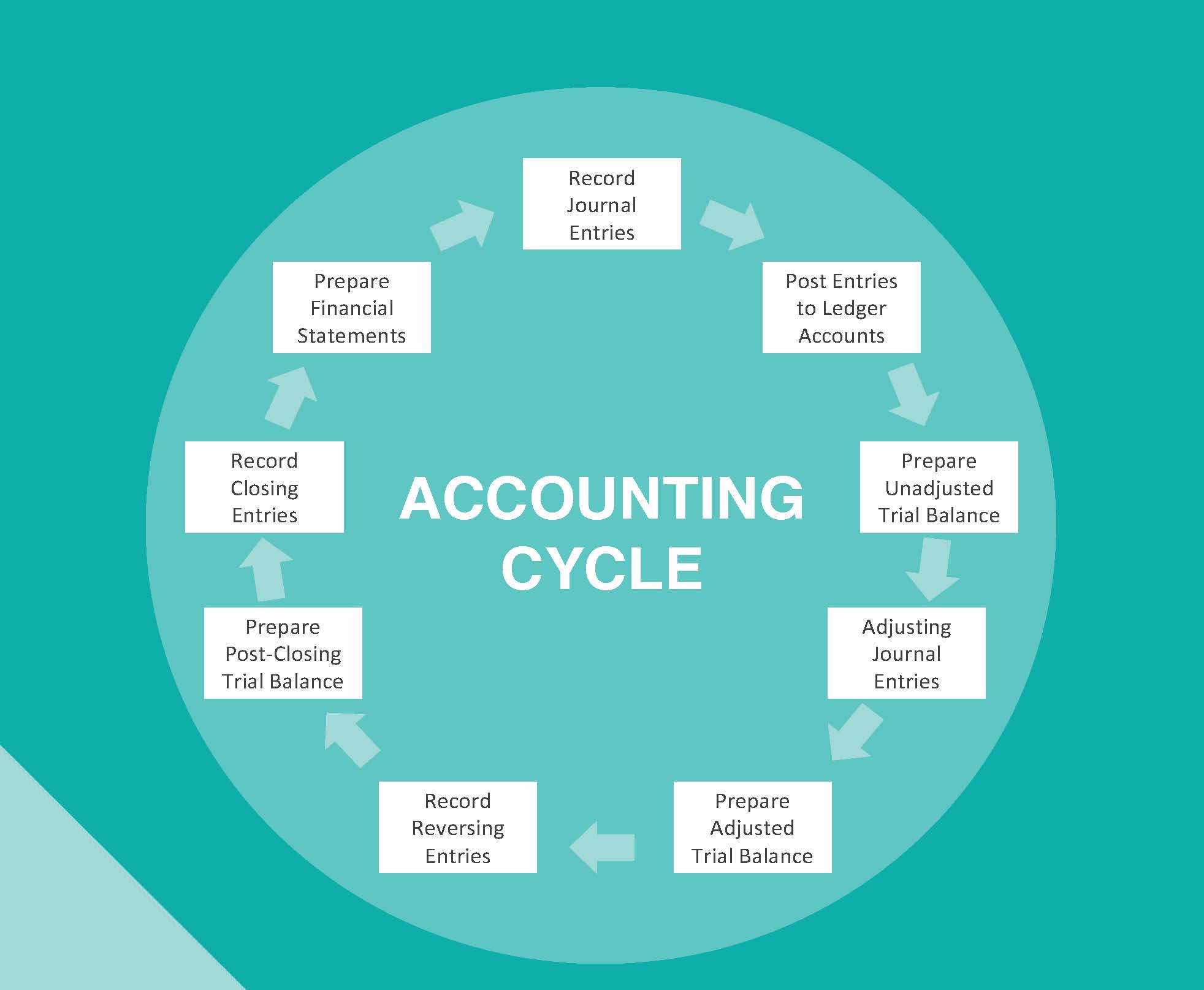

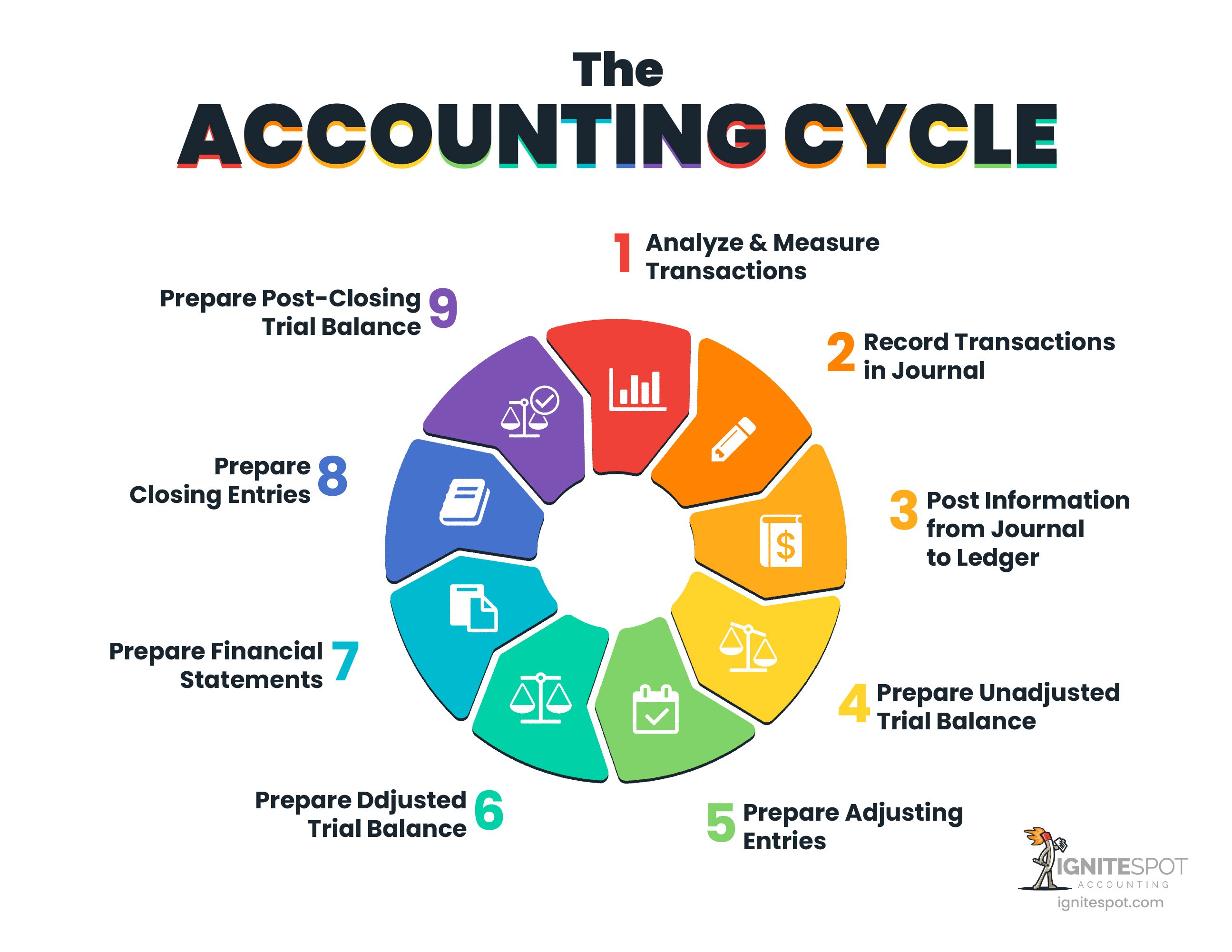

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. It is a worksheet that accountants use to ensure that the company's bookkeeping system is mathematically correct. The trial balance is the next step in the accounting cycle.

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. A trial balance in accounting is a foundational tool that validates the accuracy of financial records. It is the first step in the end of the accounting period process.

A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit totals, meaning the gl accounts are in balance,. Balancing in a trial balance. A company prepares a trial balance.

The total debit balance of all asset accounts should equal the total credit balance of all liability and equity accounts. The trial balance lists every general ledger account (both revenue and capital) by their closing balances at. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

![What Is Accounting? Introduction to Business [Deprecated]](https://s3-us-west-2.amazonaws.com/courses-images/wp-content/uploads/sites/143/2016/09/22182604/11322953266_46d8906a42_k.jpg)