Glory Info About Debit In Balance Sheet Profit And Loss Statement 2020

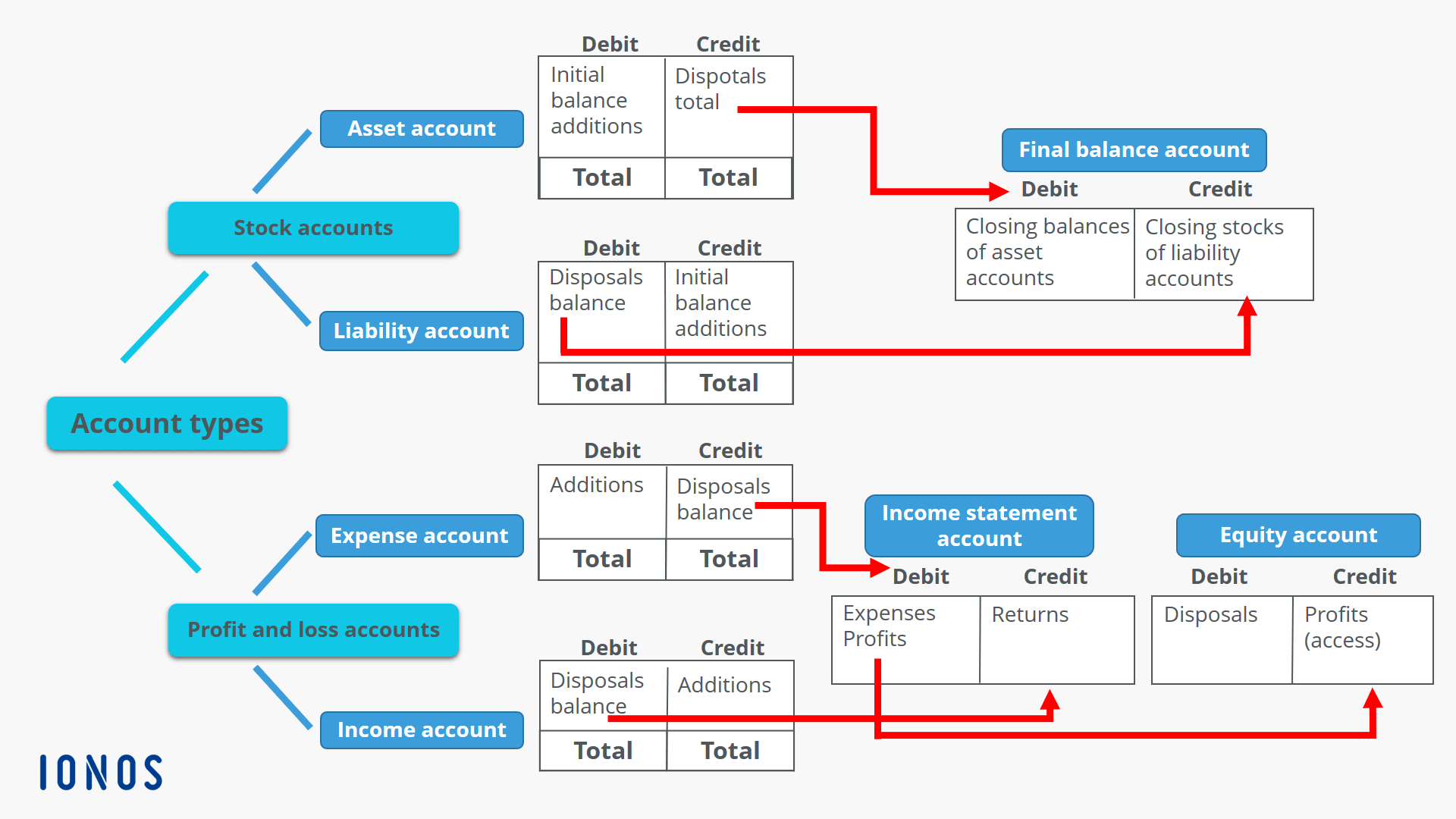

Debit balance of profit and loss account shown in the balance sheet at the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from capital.

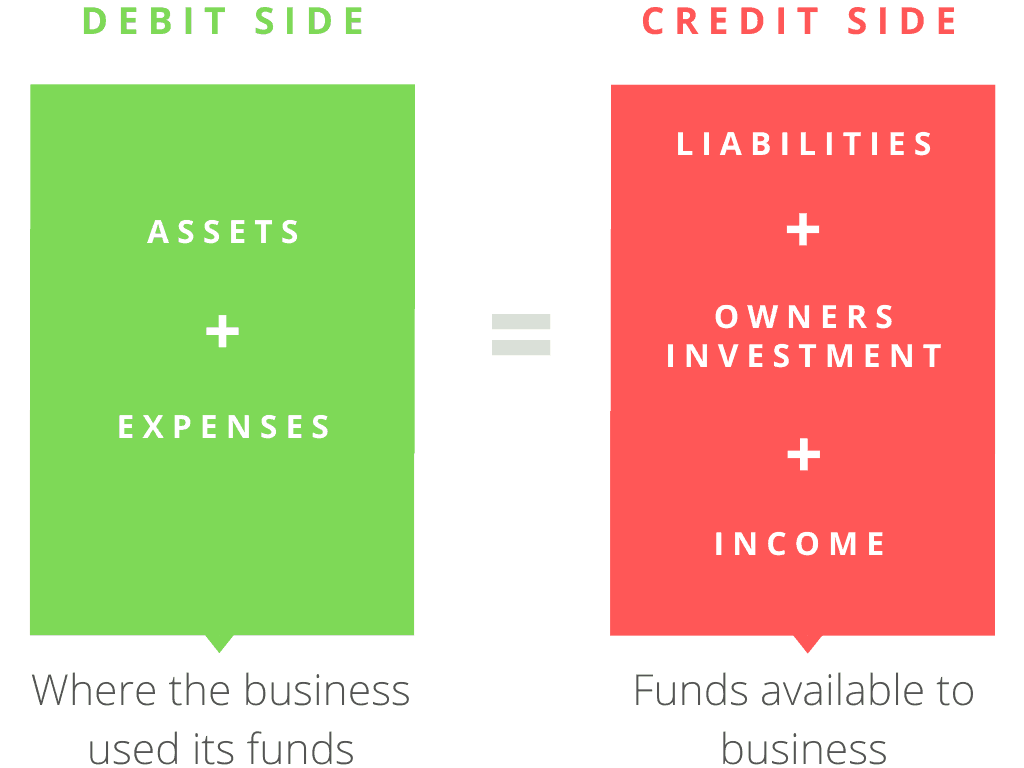

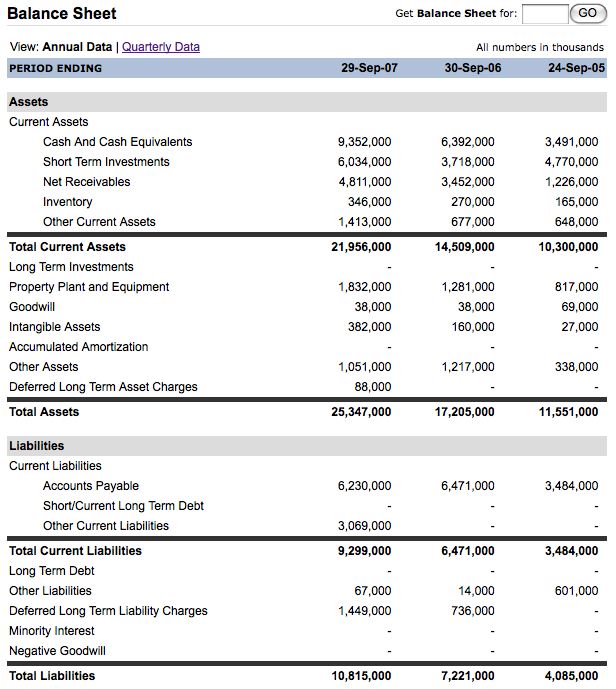

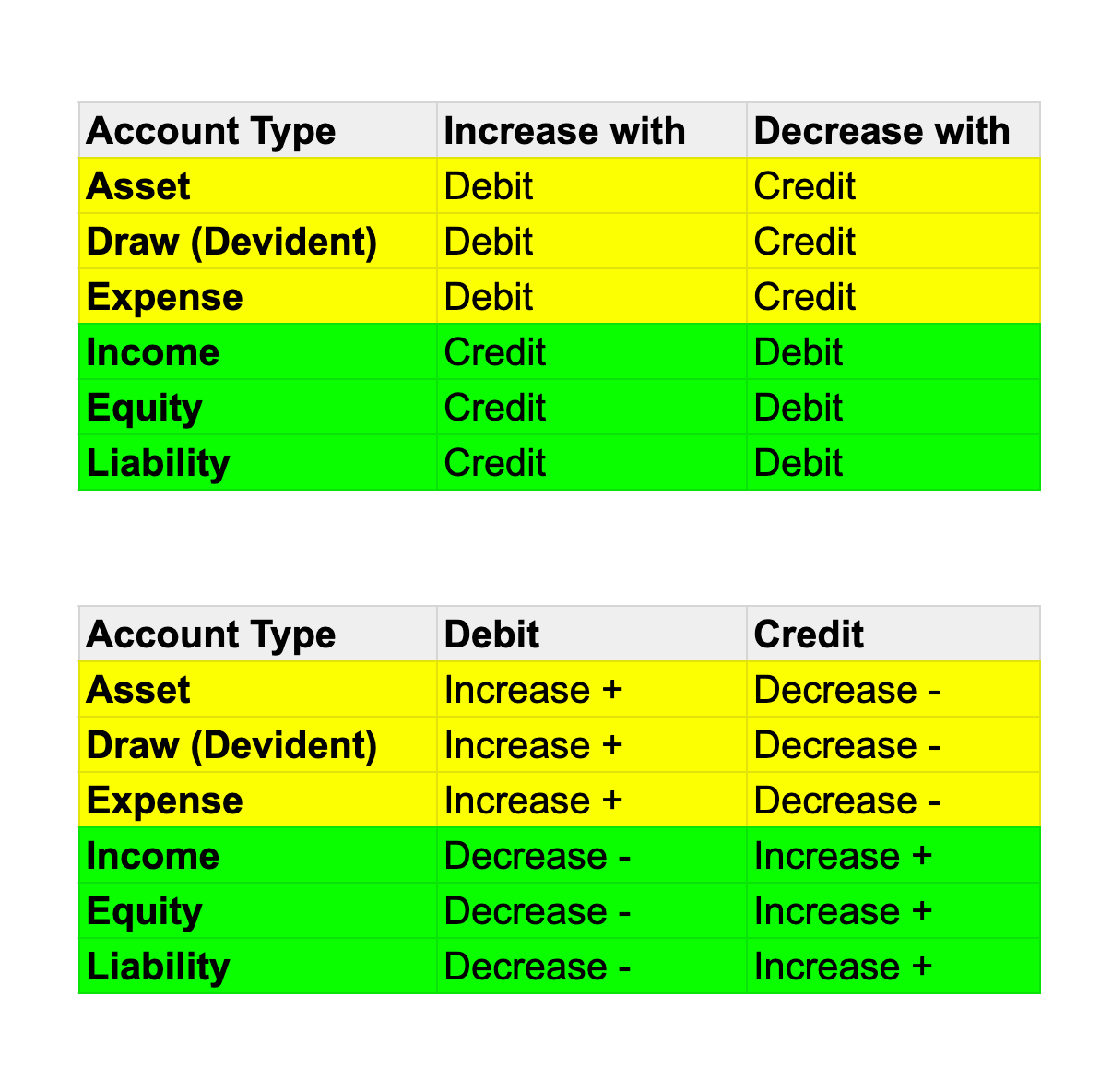

Debit in balance sheet. Assets = liabilities + equity. A debit increases the balance and a credit decreases the balance. It serves as a reduction to the total amount of stockholders' equity.) definition of debit balance in accounting and bookkeeping, a debit balance is the ending amount found on the left side of a general ledger account or subsidiary ledger account.

You buy an asset, such as office. It can also be referred to as a statement of net worth or a statement of financial position. On a balance sheet or in a ledger, assets equal liabilities plus shareholders' equity.

A debit balance is an amount that states that the total amount of debit entries in a general ledger is more than the total amount of the credit entries. The format of the basic accounting equation can help you understand the normal or expected balances for. A company’s balance sheet is a snapshot in time.

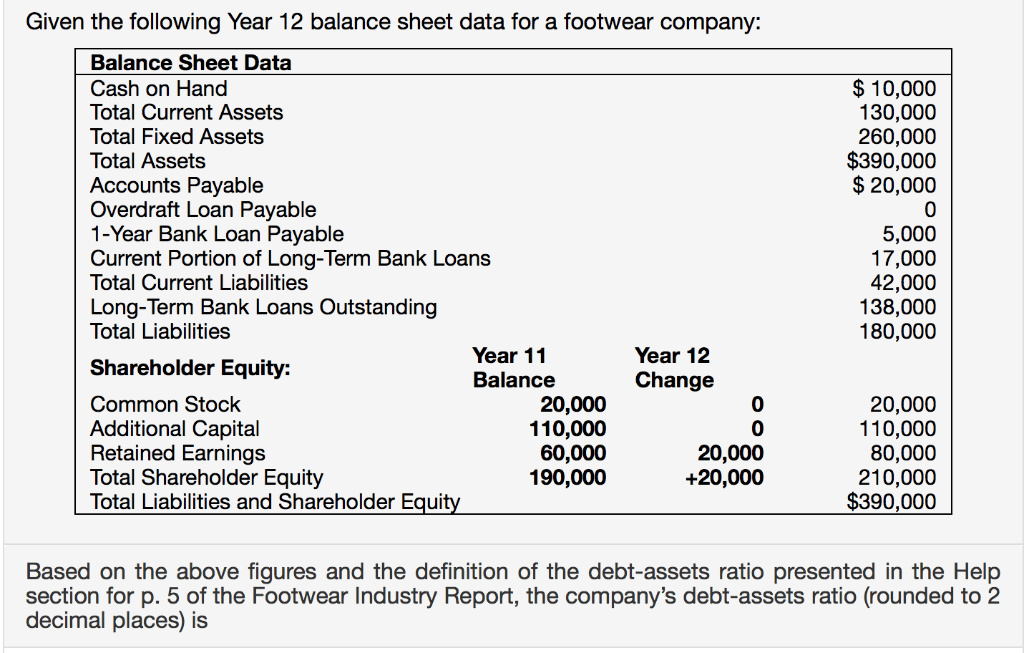

You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. In fundamental accounting, debits are balanced by. Debits = credits this is yet another extremely important accounting equation to remember.

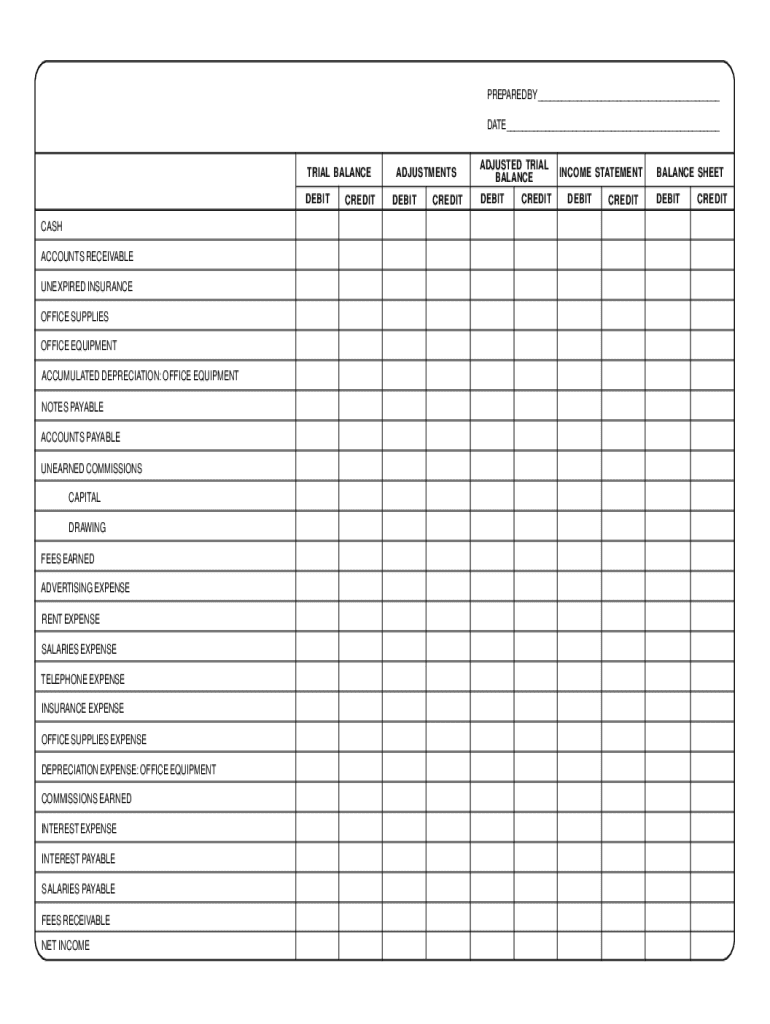

When you complete a transaction with one of these cards, you make a payment from your bank account. To begin, enter all debit accounts on the left side of the balance sheet and all credit accounts on the right. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

As such, your account gets debited every time you use a debit or credit card to buy something. Normal debit and credit balances for the accounts. In a balance sheet, total debt is the sum of money borrowed and is due to be paid.

This discussion defines debits and credits and how using these tools keeps the balance sheet formula in balance. Policymakers said slower qt could ease shift to ample. If the borrower is repaying the debt with regular installment payments, then the debit balance should gradually decline over time.

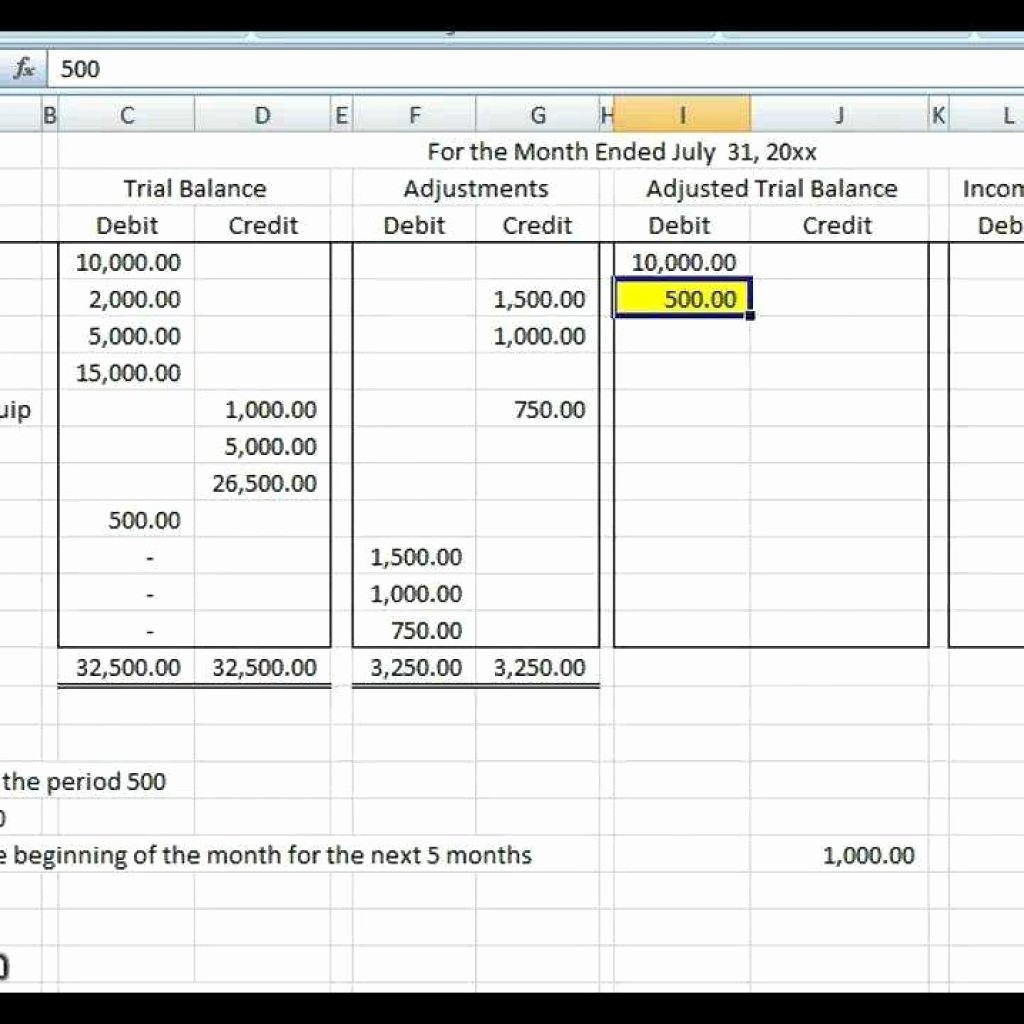

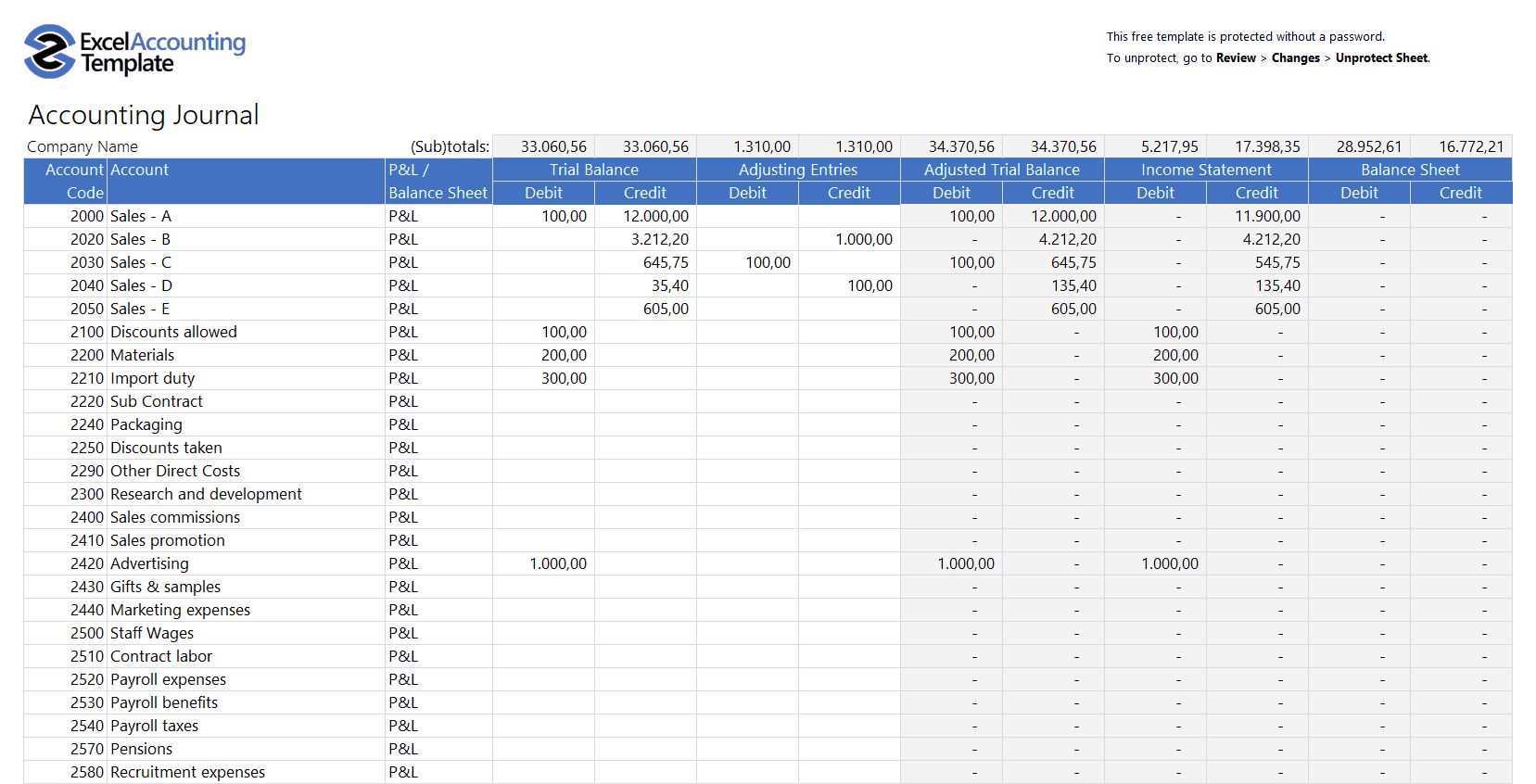

The combination of all the various debits and credits to date can be summed up in the trial balance. Raising capital via equity offerings allows the firm to increase net assets and thereby potentially avoid balance sheet covenant violations. Part of that system is the use of debits and credit to post business transactions.

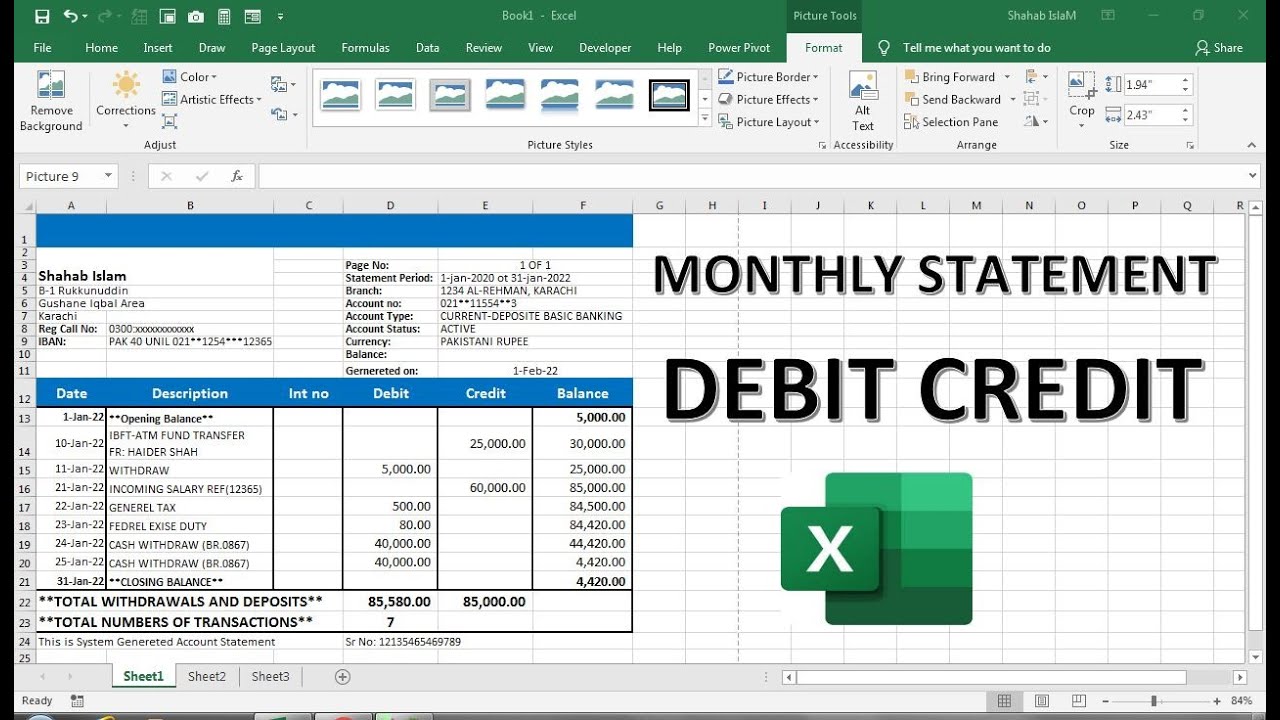

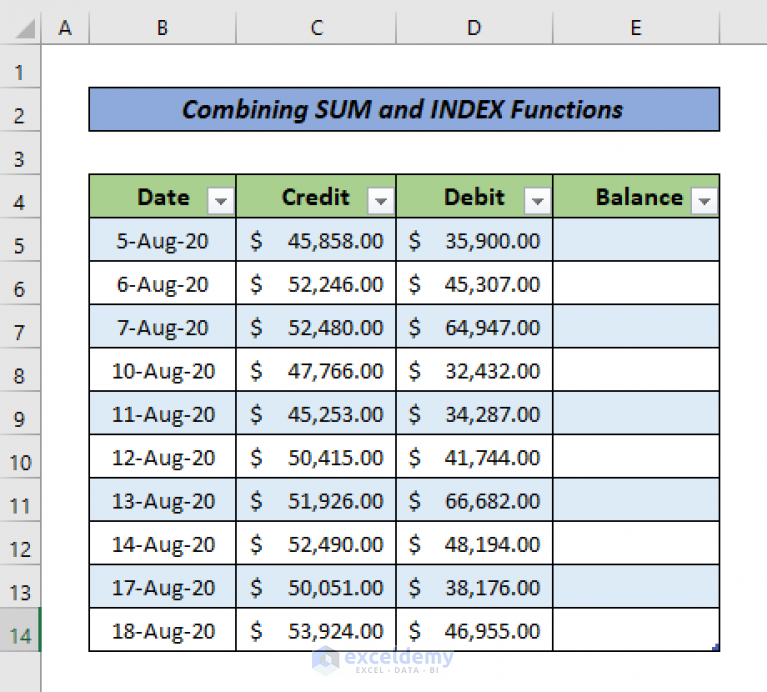

Apply a formula with sum function to create debit credit balance sheet. You can check your credit card balance over the phone, online, or mobile app. The bluevine business checking account lets account holders earn a 2.00% apy on balances up to $250,000.

An increase in the value of assets is a debit to the account, and a decrease is a credit. It is different from debit entry. The balance sheet is based on the fundamental equation: