Awe-Inspiring Examples Of Info About Ebit On Balance Sheet Monthly Profit And Loss Statement Excel

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit is the acronym for earnings before interest and taxes.

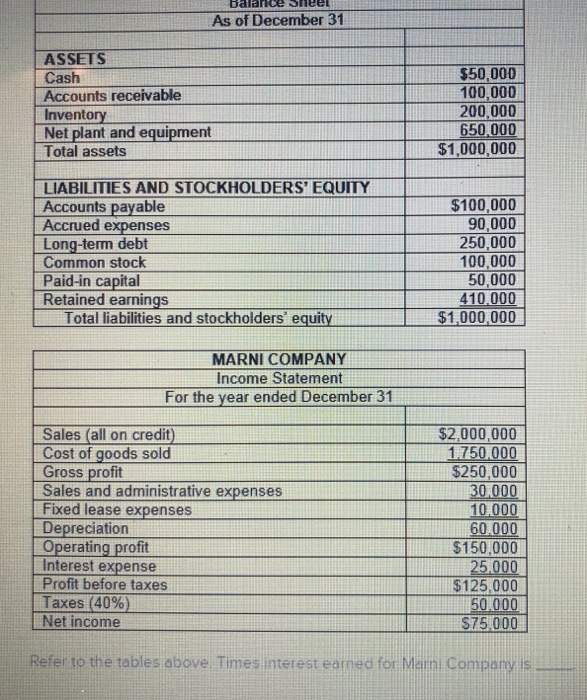

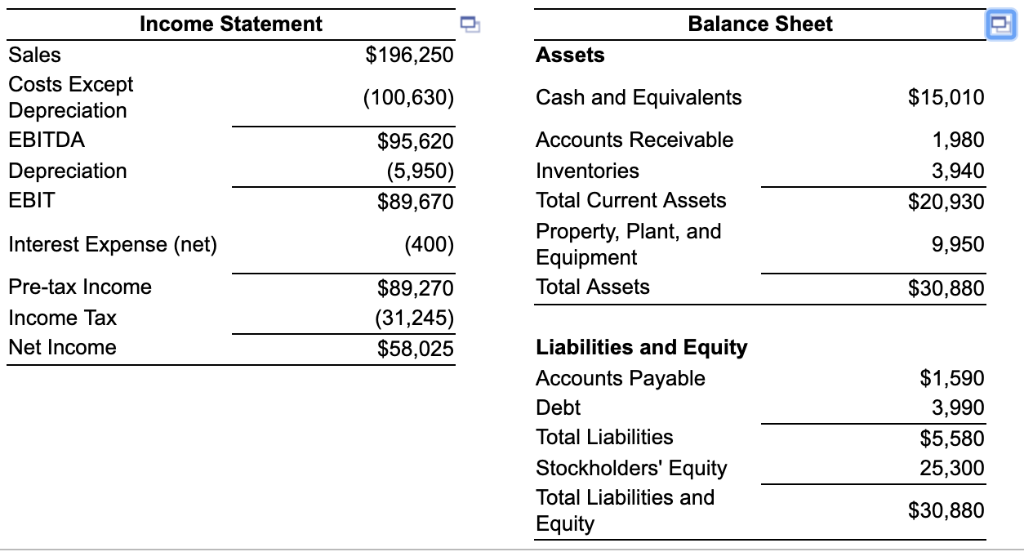

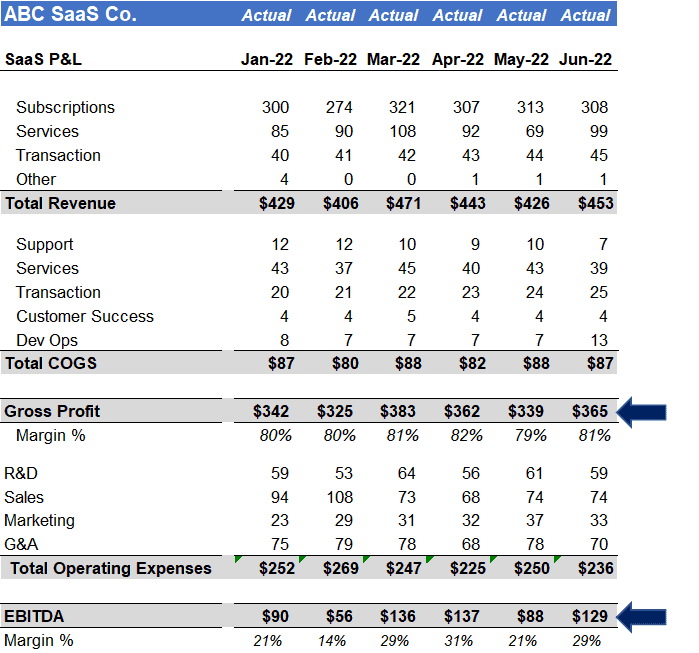

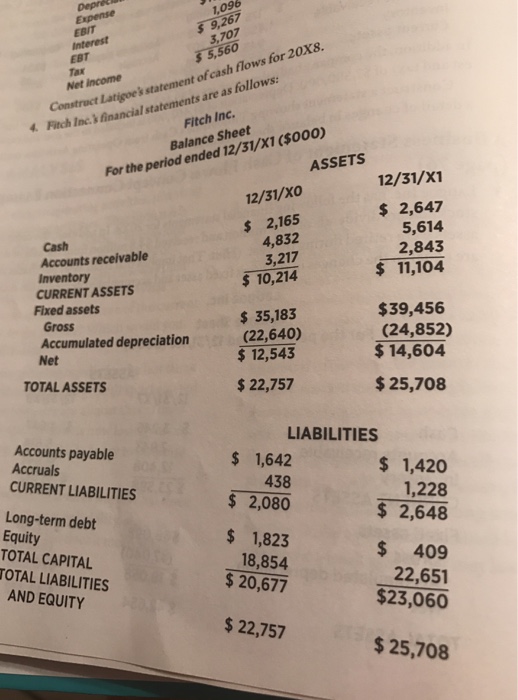

Ebit on balance sheet. Operating cash flow (or sometimes called “cash from operations”) is a measure of cash generated (or consumed) by a business from its normal operating activities. The balance sheet is one of the three core financial statements that are used to. Capital employed can be calculated from either the asset side or liability side of the balance sheet.

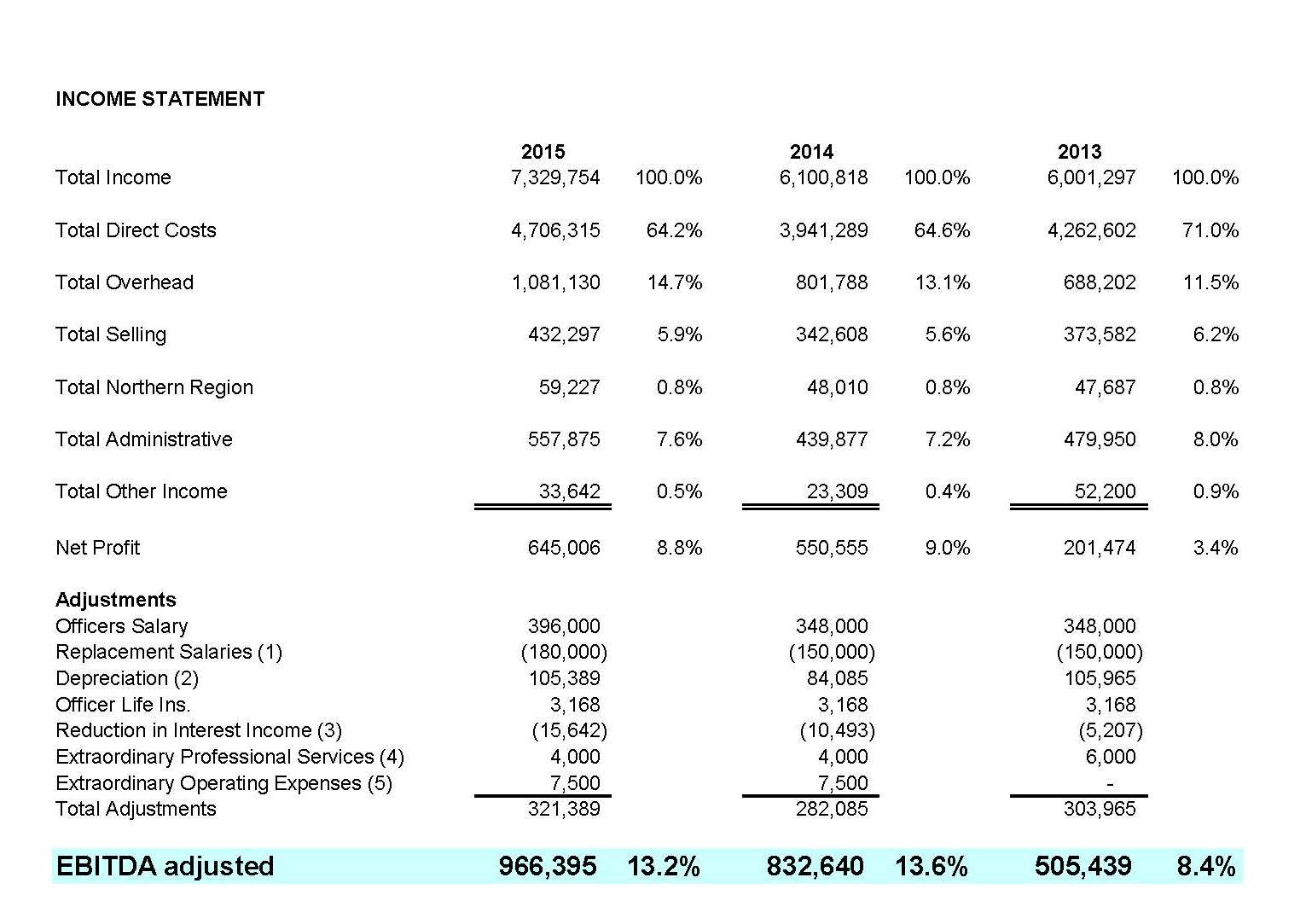

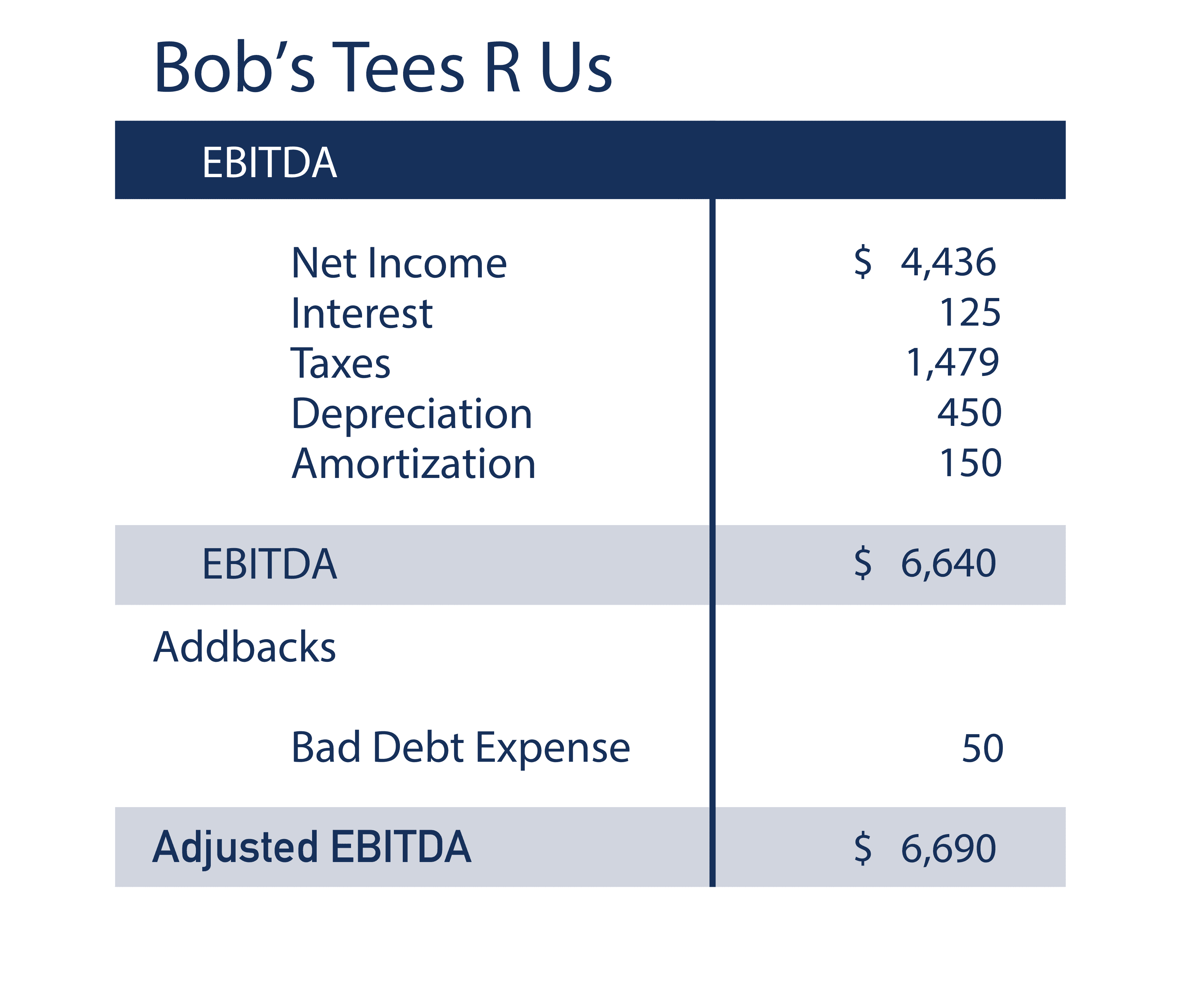

Best cash back credit cards. Ebita is an acronym that refers to the earnings of a company before interest, tax, and amortization expenses are deducted. The headline ebit figure includes 3 sources of.

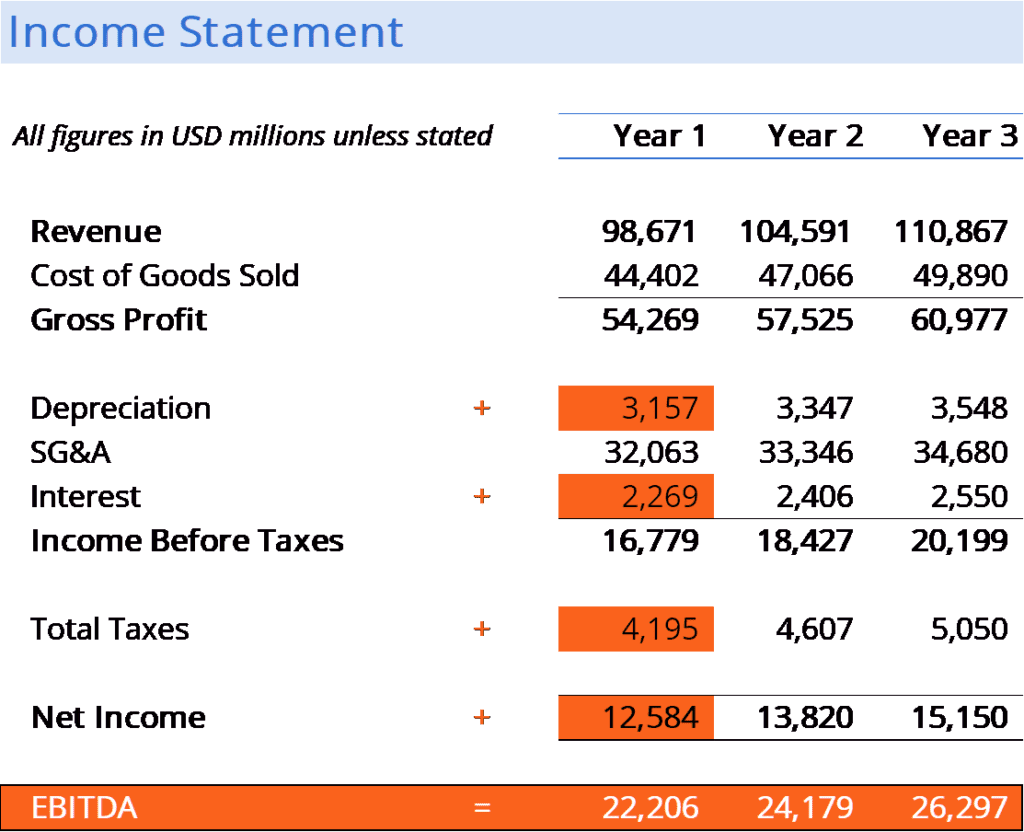

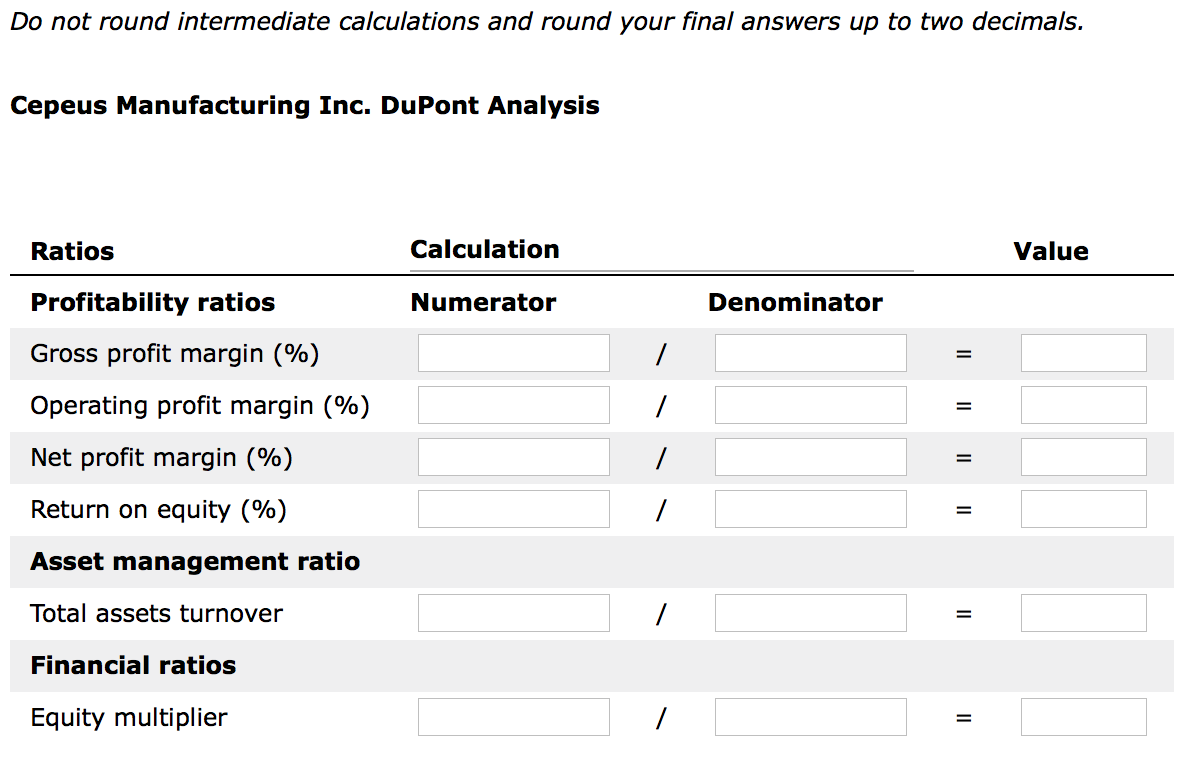

Ebitda can be calculated in multiple different ways and is extensively used in valuation. In other words, ebit is a corporation's net income assuming it had no interest expense and no income tax expense. To get a true picture of ebit for comparison purposes, review the income statement, balance sheet, and the footnotes to the financial statements.

Here are the two ebit formulas: Ebit = adjusted operating profits + profits from jvs and associates. To obtain the ebit value on the balance sheet, one must consider the value for revenue or sales from the top of the income statement.

Ebit = net income + interest expenses + taxes ebit = sales. What is a good ebit margin? This robust balance sheet underpins our confidence to invest for future earnings and growth across out regions and throughout the steel industry cycles.”.

Consolidated ebit (reported) amounted to € 4,603 million (2022: This article exposes balance sheet risks to b. Looking at the balance sheet, we ended the quarter with leverage of 1.6x net debt to ebitda.

Then later, deduct the operating expenses from the gross profit figure. Ifrs ebit was usd68.3m for the quarter, an increase of 7% vs. Arriving at an ebit margin of 26.

It is used to share a company’s operational earnings and ability to generate a profit. Best balance transfer credit cards. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Ebit can be defined as earnings before interest and taxes. Ebit, or operating profit, measures the profit generated by a company's operations. Ebit helps businesses that have fixed assets—or large purchases like land and equipment—demonstrate their true earnings without accounting for the debt associated with those fixed assets.

To be frank both intel's conversion of ebit to. Because it can be used to estimate cash flow, ebitda can provide some idea of whether the target company is capable of generating. The exclusion of depreciation and amortization in the ebitda formula (and inclusion in ebit) is the differentiating factor between the two metrics, with the percentage differential between the two metrics normally contingent on.

:max_bytes(150000):strip_icc()/McDonalds-a114d966ba2047978e84ef9db2dabbff.jpeg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)