Breathtaking Info About Which Accounts Are Not Considered In Trial Balance Iso Internal Audit Report

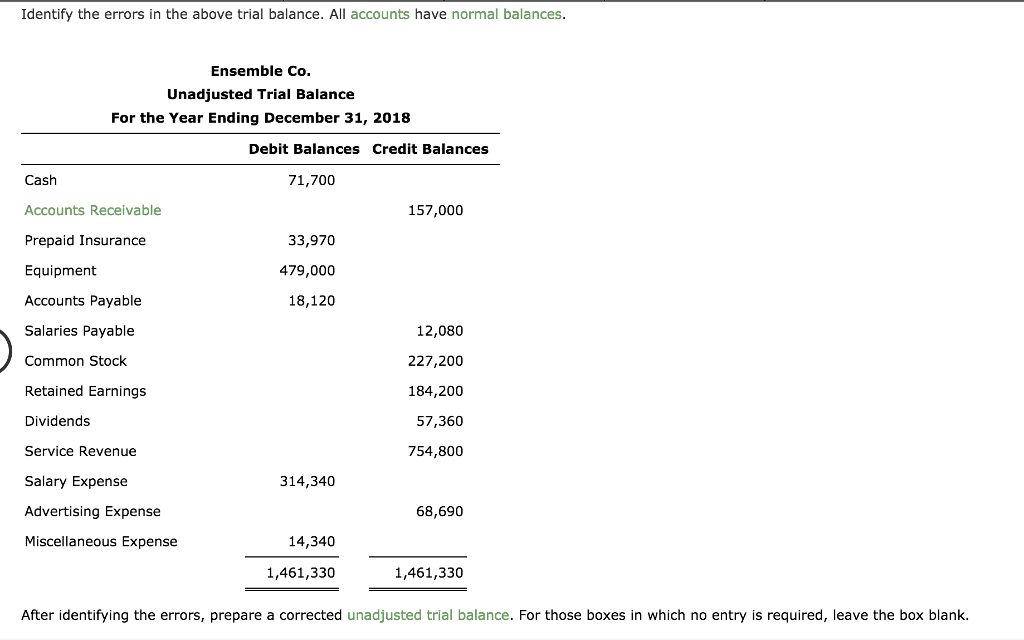

While the trial balance is a useful tool in the accounting process, it has its limitations.

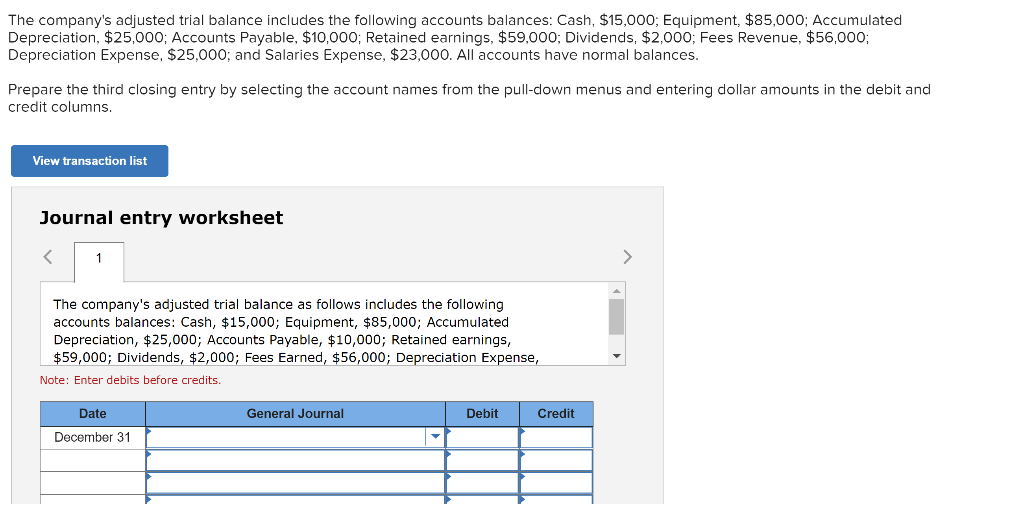

Which accounts are not considered in trial balance. The trial balance is not an account; The financial information, which is classified and grouped in the various ledger. A trial balance and a balance sheet may seem similar as they both are the description of accounts and not the accounts themselves.

This statement comprises two columns:. The limitations of using a trial balance are: The important idea is that companies use some numbering system.

It is simply a list of all the debit and credit balances. A trial balance is a listing of all accounts (in this order: Trump has already pleaded not guilty to 34 felony counts of falsifying.

If the final balance in the ledger account (t. If this step does not locate the error, divide the difference in the totals by 2 and then by 9. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit.

The main limitation is that a balanced trial balance does not guarantee that. Both are statements and are prepared at a. That case is set to be first to proceed to trial, with a judge setting jury selection for march 25.

April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. Let's go into greater detail about each of these elements: The trial balance is composed of various components of general ledger accounts.

Trial balance errors refer to those mistakes hidden in the accounting process that the trial balance sheet cannot identify. Trial balance is a bridge between accounting records and financial statements. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each.

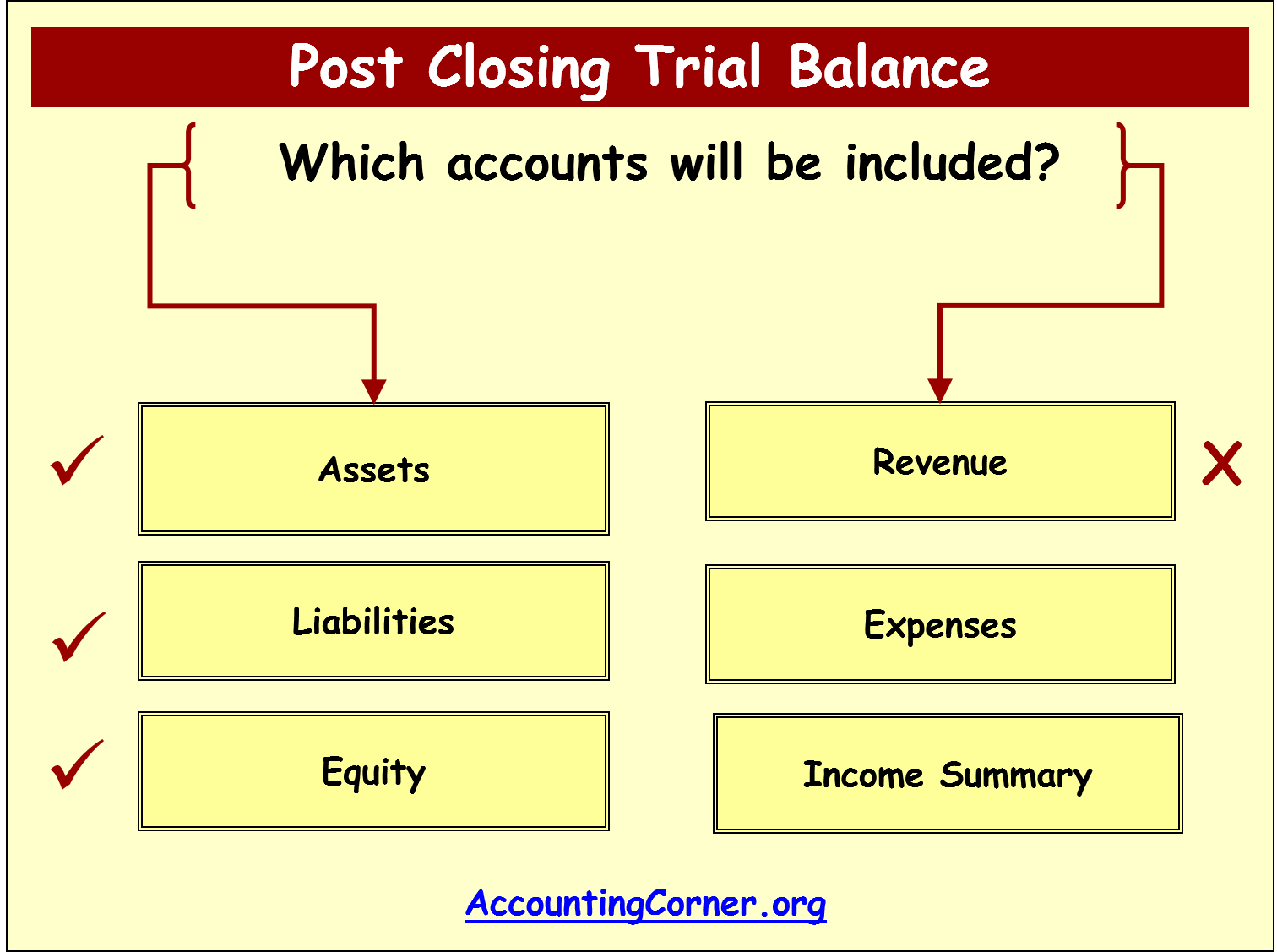

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Not having all trial balance accounts included in the general ledger (in error) not recording all necessary entries to include in the trial. A trial balance is a financial accounting document that lists the balances of all the general ledger accounts of a company at a specific point in time.

Accounts without a running balance are left out of the trial balance report to save space and confusion. Asset, liability, equity, revenue, expense) with the ending account balance. Here, all expense and revenue account registered in the trial balance is carried to the profit and loss account, and all liabilities, assets, and capital account is carried to the.

Asset, liability, equity, revenue, expense) with the. It is called a trial balance because the. The trial balance is not impacted by any account that has a zero balance.