Unique Tips About Reserves In Balance Sheet Meaning Prepare Profit And Loss Statement

An asset is a resource controlled by the company and is expected to have an economic value in the future.

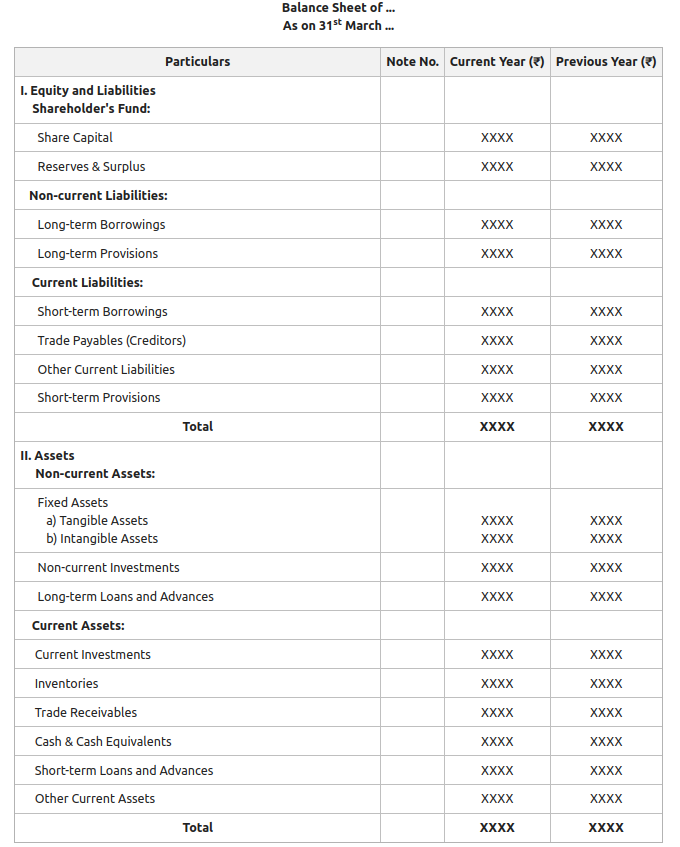

Reserves in balance sheet meaning. According to william pickles, “reserves mean the amount set aside out of profits and other surpluses, which are not embarked in any way to meet any particular. Reserves are usually set up to buy fixed assets, pay bonuses, pay an expected legal settlement,. Balance sheet reserves, also known as claim reserves, are the liabilities as stated by an insurance company on its balance sheet.

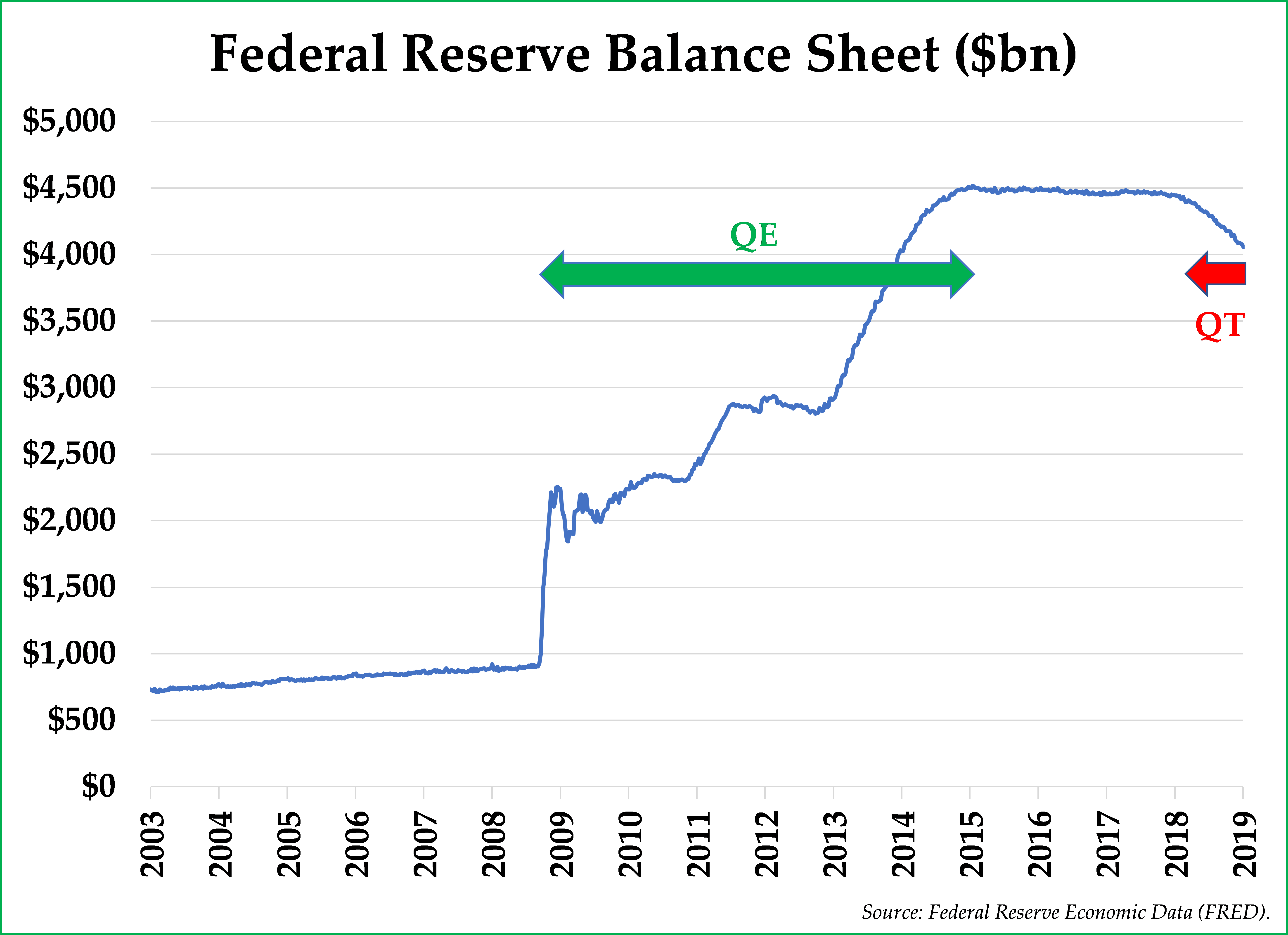

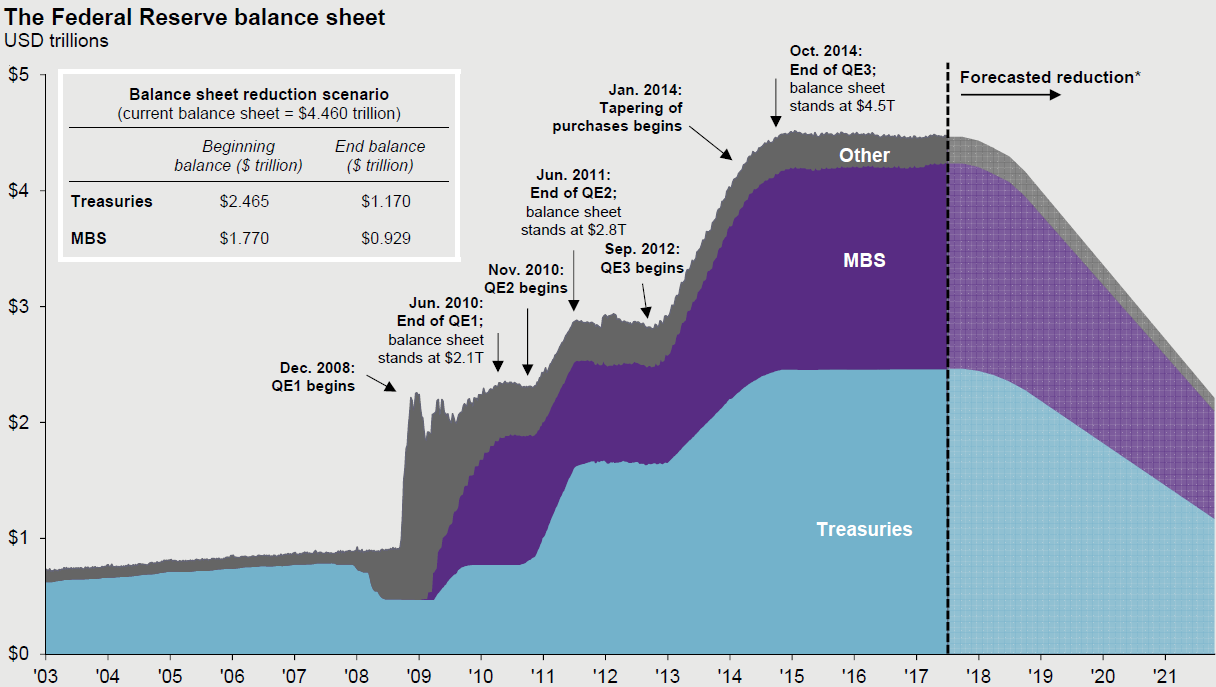

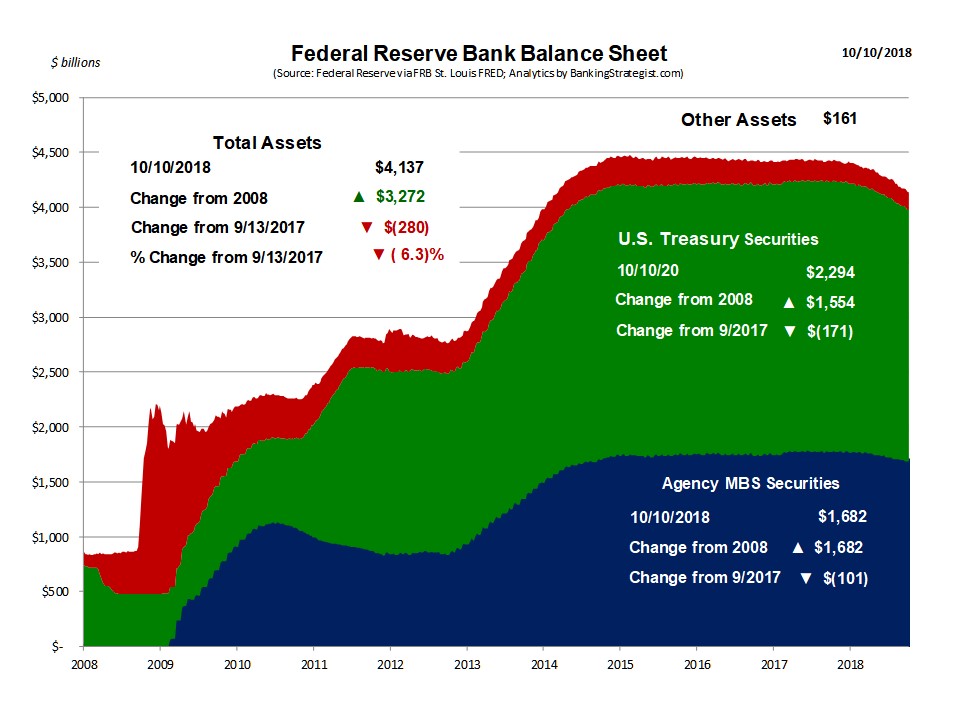

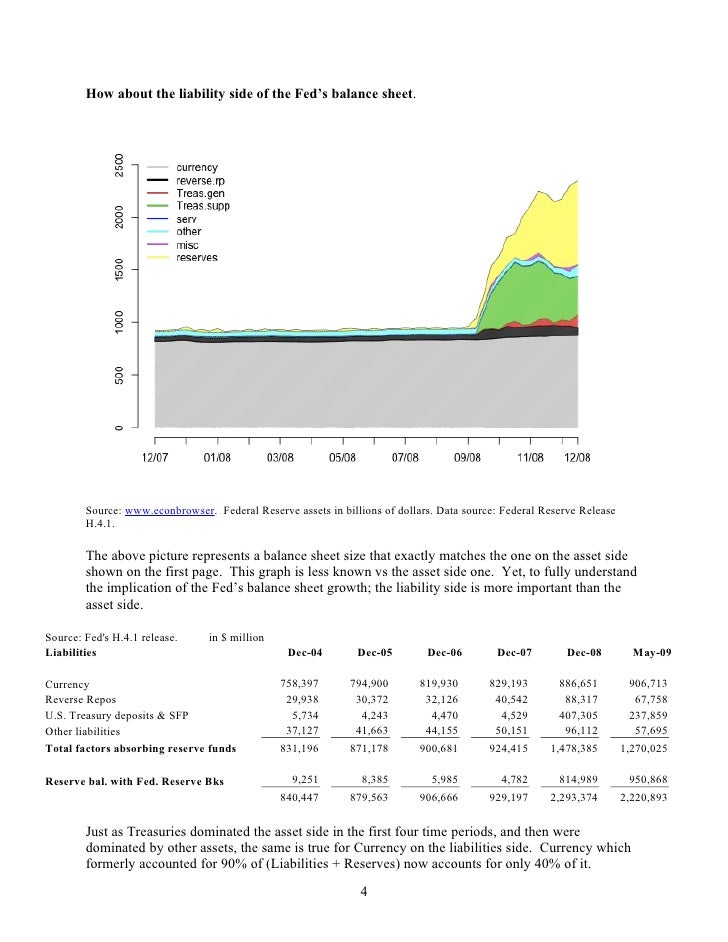

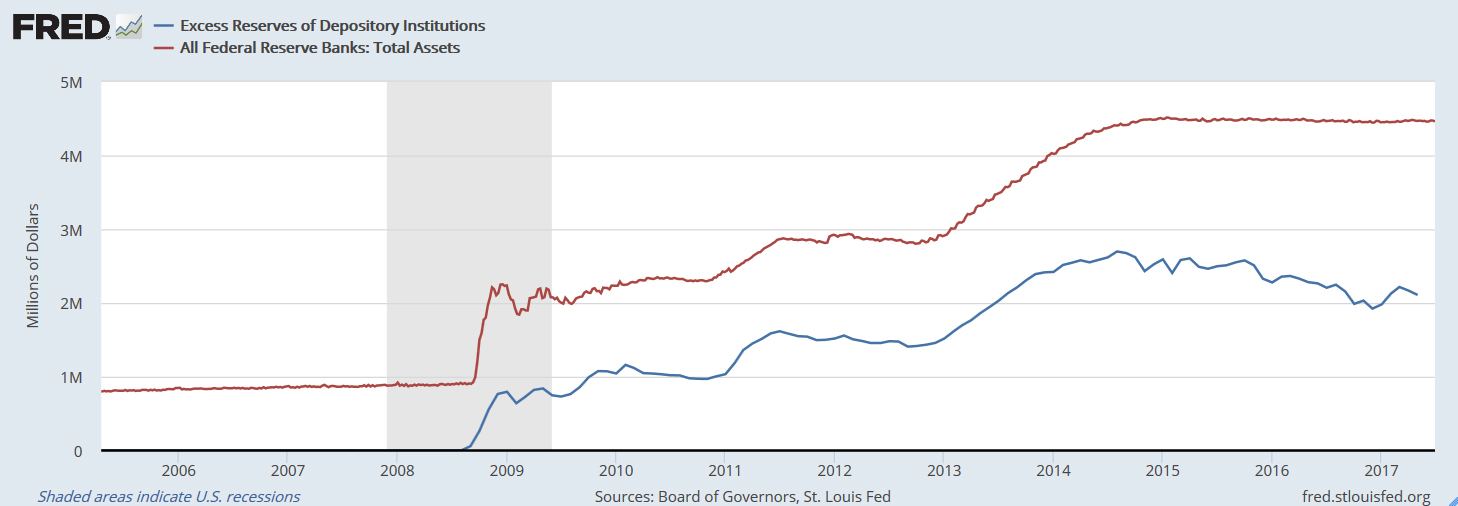

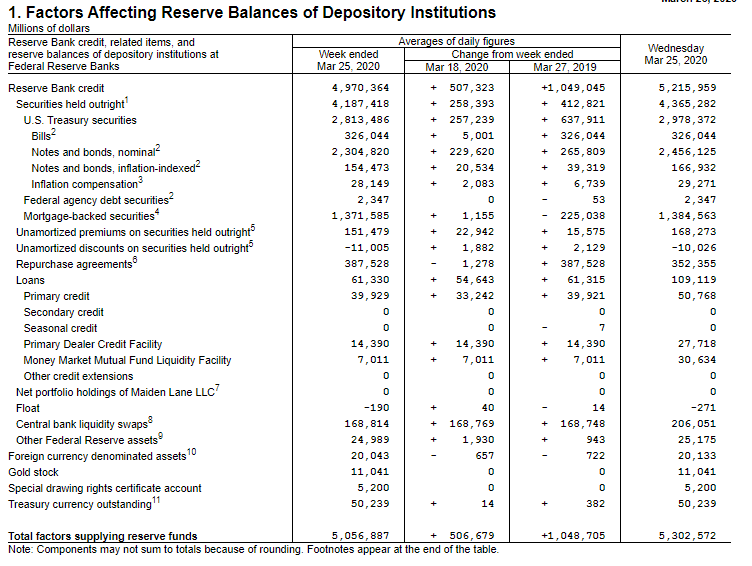

Now, claims reserves are the second name of. The fed discloses it weekly in table 5 of its h.4.1. Reserves are part of profits or gain that has been allotted for a specific purpose.

Cash reserves are funds that companies set aside for use in emergency situations. Revaluation reserve is an accounting term used when a company creates a line item on its balance sheet for the purpose of maintaining a reserve account tied to. Reserves are recorded as liabilities because reserves.

In accounting, the surplus means the retained earnings amount that you record on the entity's balance sheet. The reserves position doctrine, although not enthusiastically embraced by many central banks, led to the quantities on the central bank’s balance. Typical examples of assets include plants, machinery,.

Balance sheet reserves, also known as 'claims reserves', are accounting entries that reflect money a company sets aside to pay future obligations. The balance sheet of the federal reserve bank like any balance sheet, the fed's shows its assets and liabilities. What is balance sheet reserves?

Company reserves are the profits that sit in the company’s accounts, ready for use later. The reserving policy of an insurer can significantly impact its profits. It appears in the statement of financial position (balance sheet) under liabilities and owners’ equity side (the right.

Reserve accounting represents the company’s accumulated profits, which have been earned over the years, authorized by the board of directors. On a balance sheet, accountants record reserves as liabilities under the reserves and surplus header. The revenue reserve is the reserve created out of the company’s profits generated from its operating activities during a period and retained to expand its business or meet.

The purpose of creating these reserves is to mitigate potential risks and. Balance sheet reserves are typically classified as liabilities on a company’s balance sheet.

:max_bytes(150000):strip_icc()/BalanceSheetReserves_Final_4201025-49fe811c4d2540a9b2fae7650ce4be8d.png)

:max_bytes(150000):strip_icc()/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)