Top Notch Info About Cost Of Goods Sold Profit And Loss Statement Calculate Net Income On

![53 Profit and Loss Statement Templates & Forms [Excel, PDF] Profit And](https://www.bdc.ca/PublishingImages/definitions/cost-of-goods-sold-exemple.jpg)

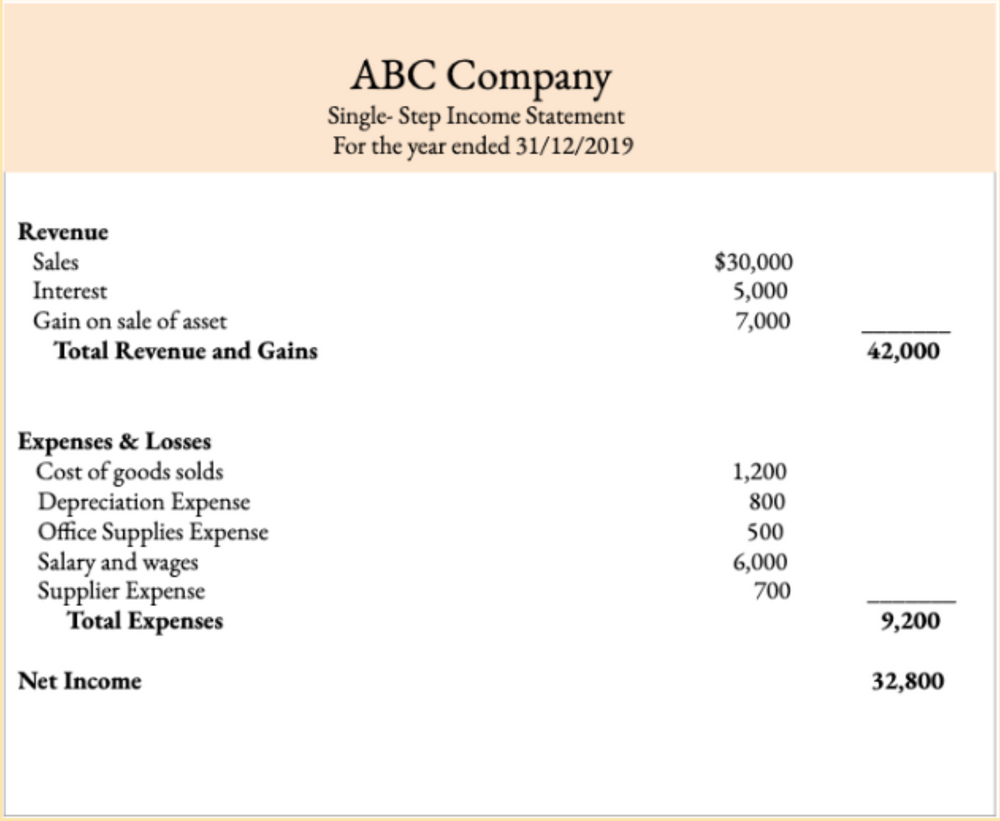

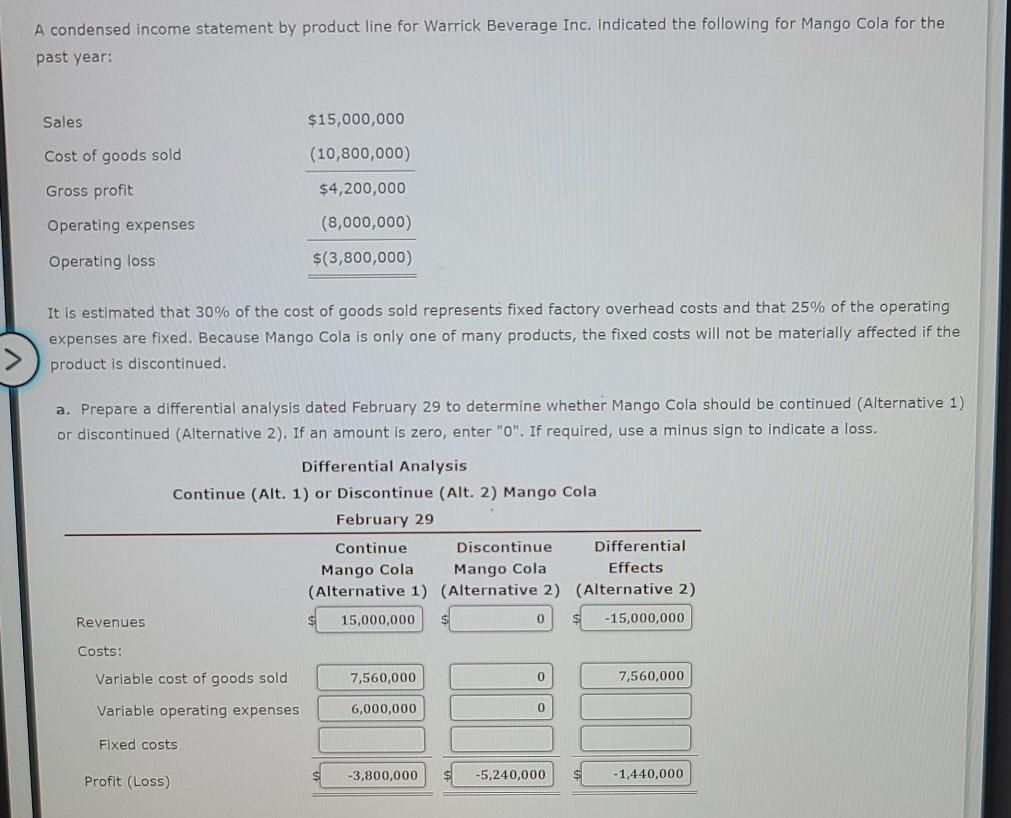

Here’s how calculating the cost of goods sold would work in this simple example:

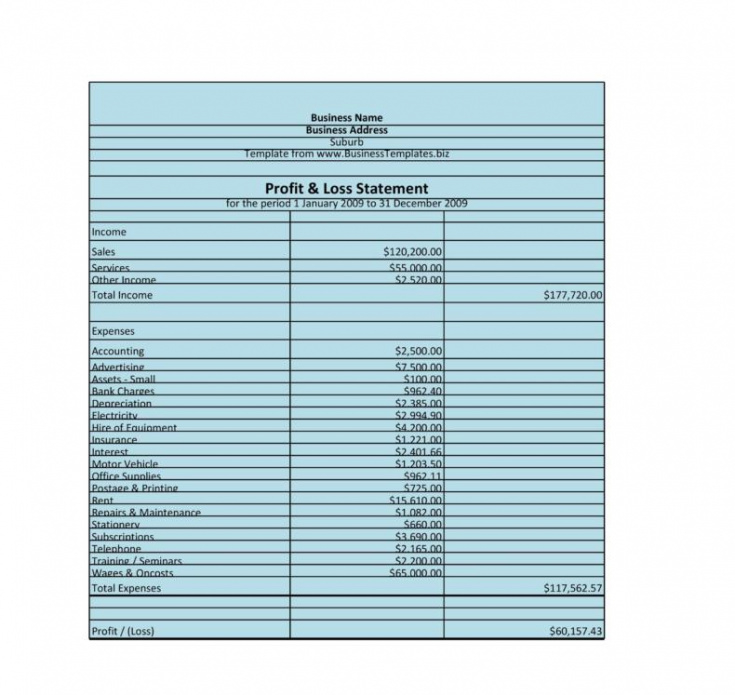

Cost of goods sold profit and loss statement. A p&l statement (sometimes called a statement of operations) is a type of financial report that. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. So our sales would be $400 and our cost of the goods we sold (cost of sales) would amount to $300.

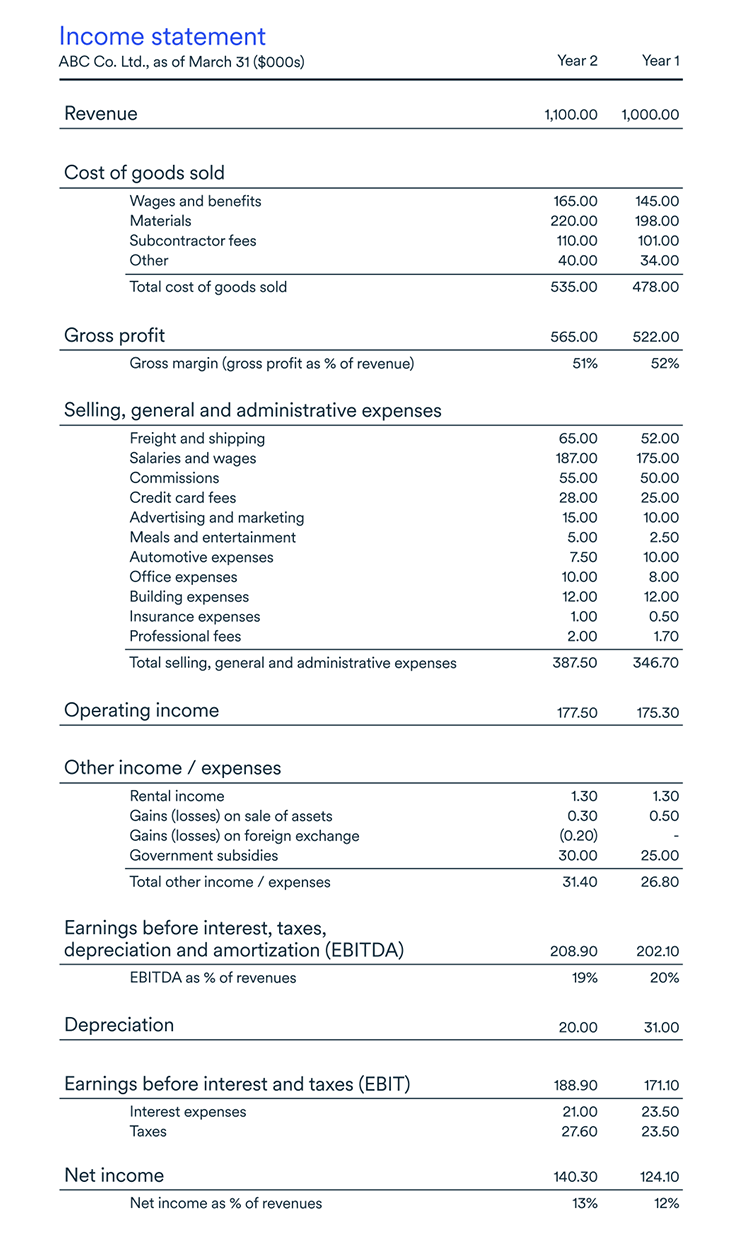

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. Cogs is deducted from your gross receipts to figure the gross profit for your business each year. The cost of goods sold per dollar of sales will differ depending upon the type of business you own or in which you buy shares.

Cost of goods sold (cogs) is significant for every business, as this number appears in the company’s profit and loss statement (p&l) aka i ncome statement and plays a vital role in calculating net income for a business. Cogs is deducted from revenue to find gross profit. Cost of goods sold is an expense charged against sales to work out a gross profit (see definition below).

The gross profit for a company is calculated by subtracting the cost of goods sold for the. Operating expenses salaries $10,000 rent $10,000 utilities $ 5,000 depreciation $ 5,000 Gross margin, operating margin, ebitda margin, net profit margin.

To calculate her cost of goods sold for the month, her formula would be: As a case in point, cost of goods sold is often featured in the second line of a business’s income statement or profit and loss statement. Cost this is the amount the business paid to buy the goods they are selling.

Cost of goods sold ($ 20,000) gross profit $ 80,000. The main categories that can be found on the p&l include: Realized profits and loss.

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. These costs are called cost of goods sold (cogs), and this calculation appears in the company's profit and loss statement (p&l). They’re used to report income for a specific accounting period, such as a year, quarter, or month.

Manage operating costs → e.g. A profit & loss statement can be prepared by a bookkeeper, accountant, or accounting software (like quickbooks). Costs can only be expensed and shown in the p&l after the goods have been sold and their revenues.

The p&l statement is one of three. Cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly. Cogs show up on a business’s income statement or profit and loss statement.

On the income statement , the cost of goods sold (cogs) line item is the first expense following revenue (i.e. Calculate cost of goods sold. The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to the company's total costs and expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF] Profit And](https://i.pinimg.com/originals/c2/2b/92/c22b92d6bb3d5a06982417eaf4bcacee.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)