Underrated Ideas Of Tips About Ias 27 Disclosure Requirements Accounting Auditing And Control

Ias 27 prescribes the accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity elects, or is required by local.

Ias 27 disclosure requirements. The objective of this standard is to prescribe the accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity prepares. Ias 27 prescribes the accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity elects, or is required by local. Ias 27 consolidated financial statements and accounting for investments in subsidiaries was issued.

Consolidated financial statements are the financial statements of a group in which the. In addition, the amendments clarified the. An entity shall apply all applicable ifrss when providing disclosures in its separate financial statements, including the requirements below:

When a parent elects not to. In august 2014 ias 27 was amended by equity method in separate financial statements. These amendments introduced new disclosure requirements for investment entities.

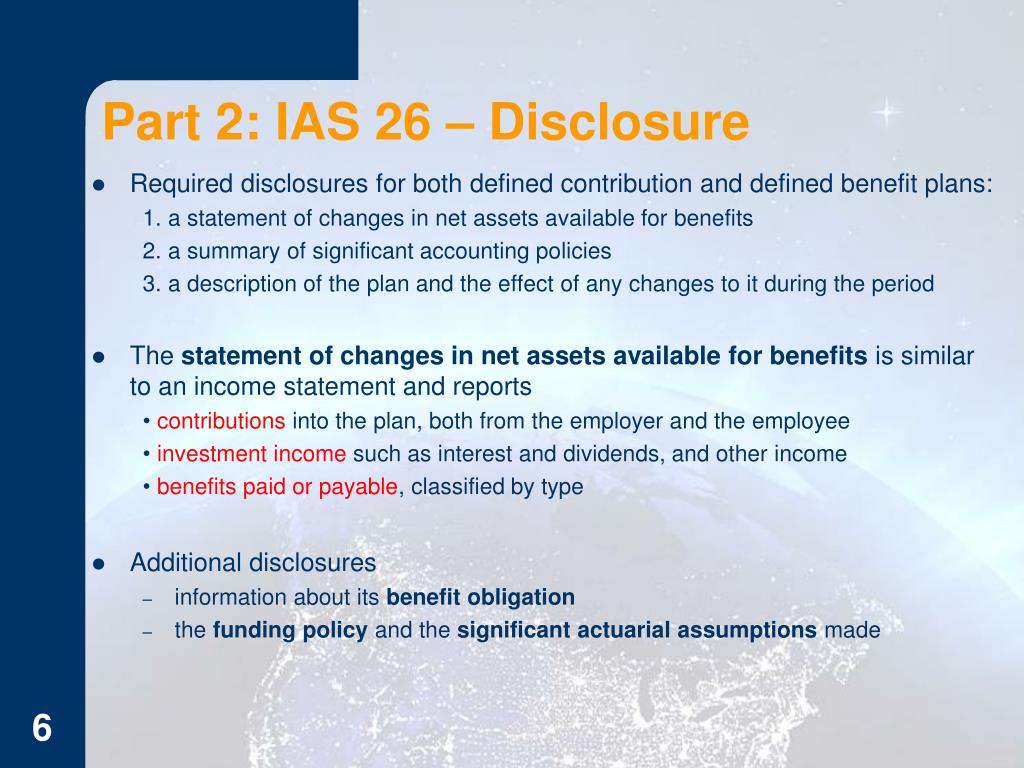

Ifrs do not mandate the preparation of separate financial statements, but ias 27 becomes applicable when an entity chooses to, or is required to, prepare them in. Objective this standard prescribes the rules applicable to the preparation and presenta. Deferral accounts, ias 26 accounting and reporting by retirement benefit plans, ias 27 separate financial statements, ias 29 financial reporting in hyperinflationary.

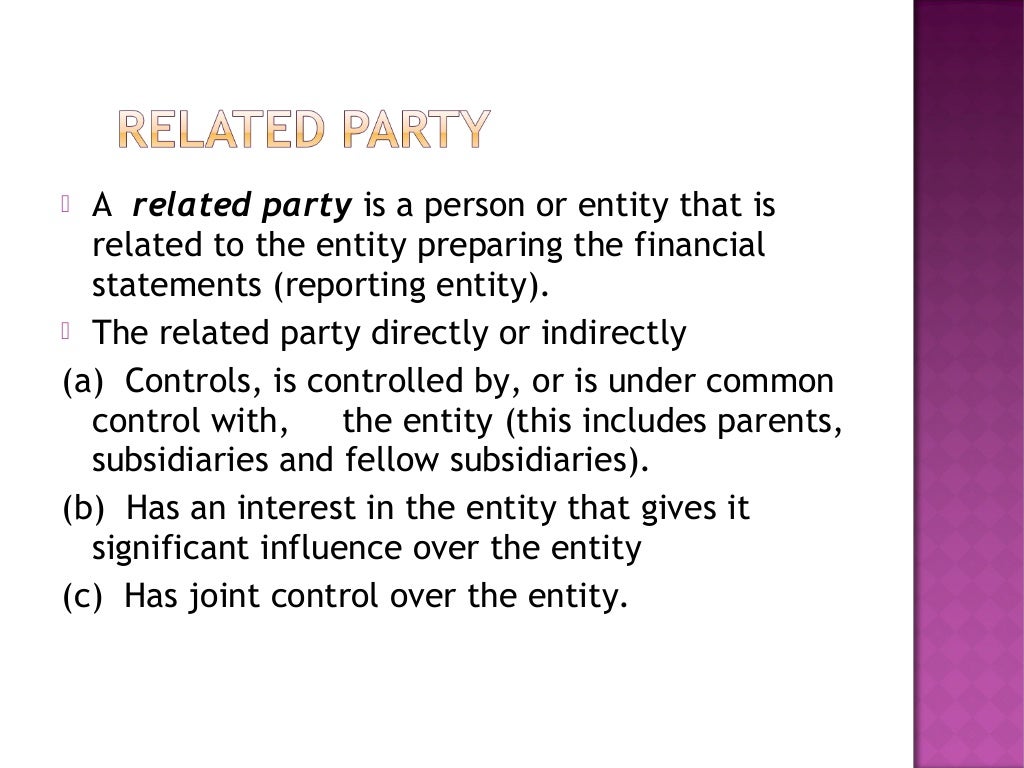

Ias 27 separate financial statements contains accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity prepares. Ias 27 (as amended in 2011) is applicable to annual reporting periods beginning on or after 1 january 2013. Investments in associates and joint ventures.

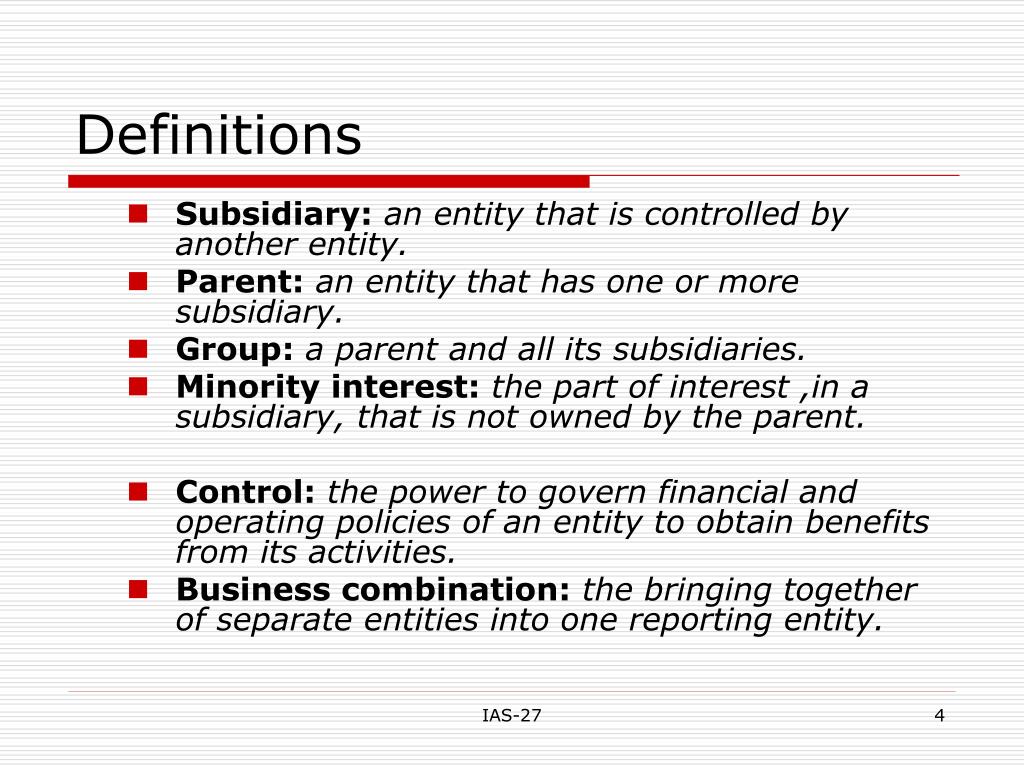

The sec oversees the $110 trillion capital markets. Main rules of ias 27 key terms: 21 feb, 2024 cover paper (agenda paper 16) in this meeting the staff will present its analysis and recommendations relating to feedback on:

The objective of this standard is to prescribe the accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity prepares. Edition 2020 the ias / ifrs standards • 89 ias 27 separate financial statements 1. The objective of ias 27 is to enhance the relevance, reliability and comparability of the information that a parent entity provides in its separate financial statements and in its.

However, in some cases, ifrs 10, ias 27 or ias 28 require or permit an. 20 feb 2024 cover note (agenda paper 27) in this meeting, the iasb will deliberate the feedback received in response to its request for information (rfi). [ias 27(2011).18] an entity may apply ias 27 (as amended in 2011) to an earlier accounting period, but if doing so it must disclose the fact that is has early adopted the standard and also apply:

Define accounting methods for investments in subsidiaries, joint ventures and associates in the separate financial statements. An entity shall recognise a dividend from a subsidiary, joint venture or associate in profit or loss in its separate financial statements when its right to receive the dividend is. It requires a number of disclosures.

Disclosure requirements in ias 1 and ensured that entities are able to use judgement when applying those requirements.