First Class Tips About Saas Income Statement And Balance Sheet Ppt

2021 irs filing requirements income thresholds.

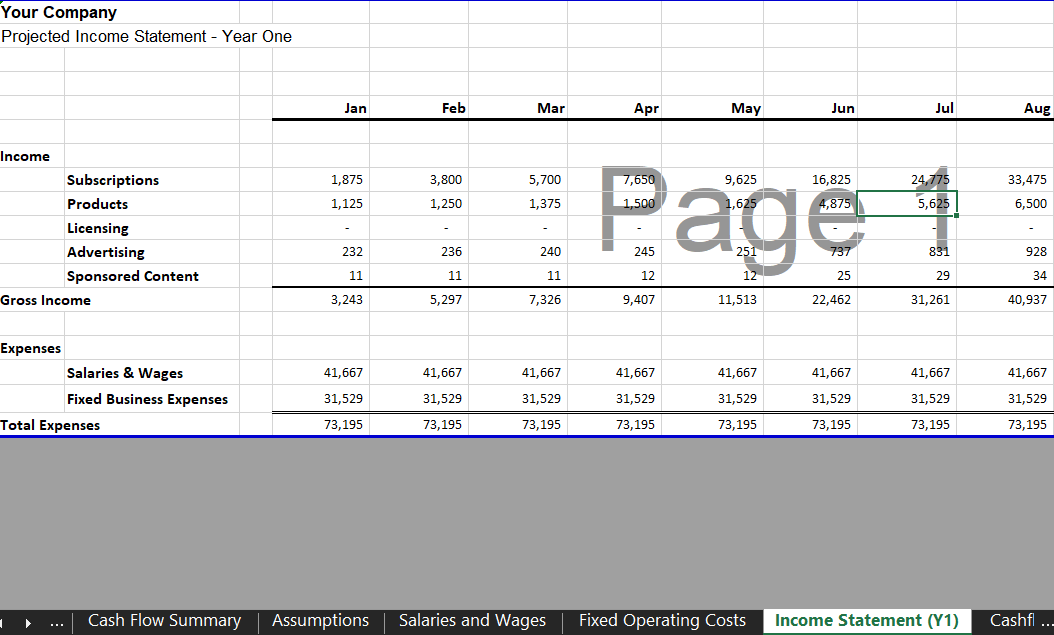

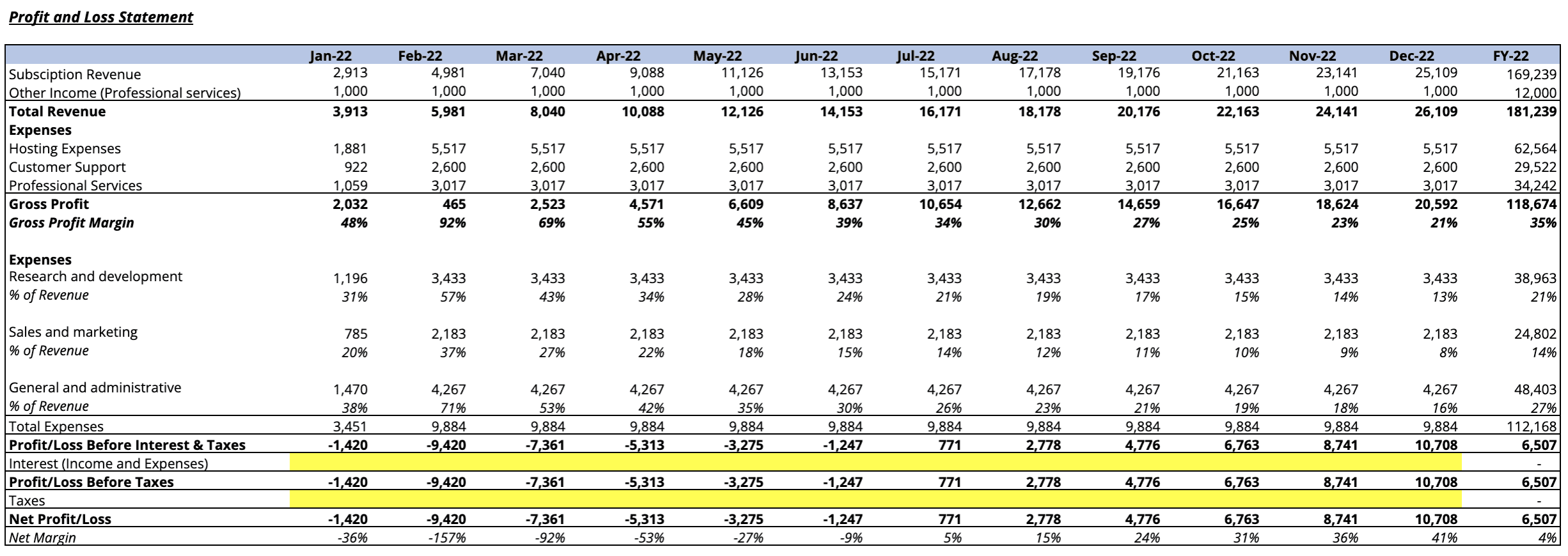

Saas income statement. It meticulously details your company's revenue and. Saas capital has an example. Key components of a saas financial model.

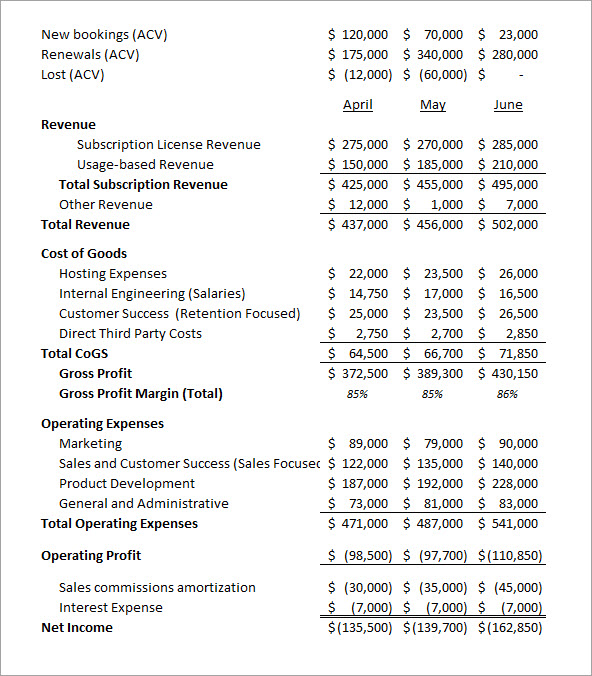

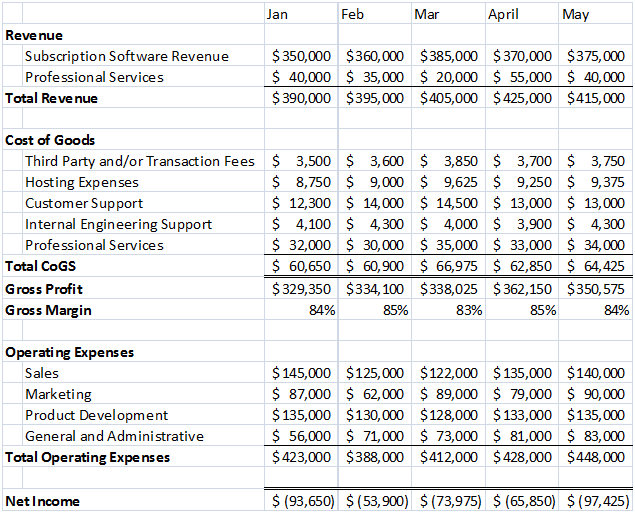

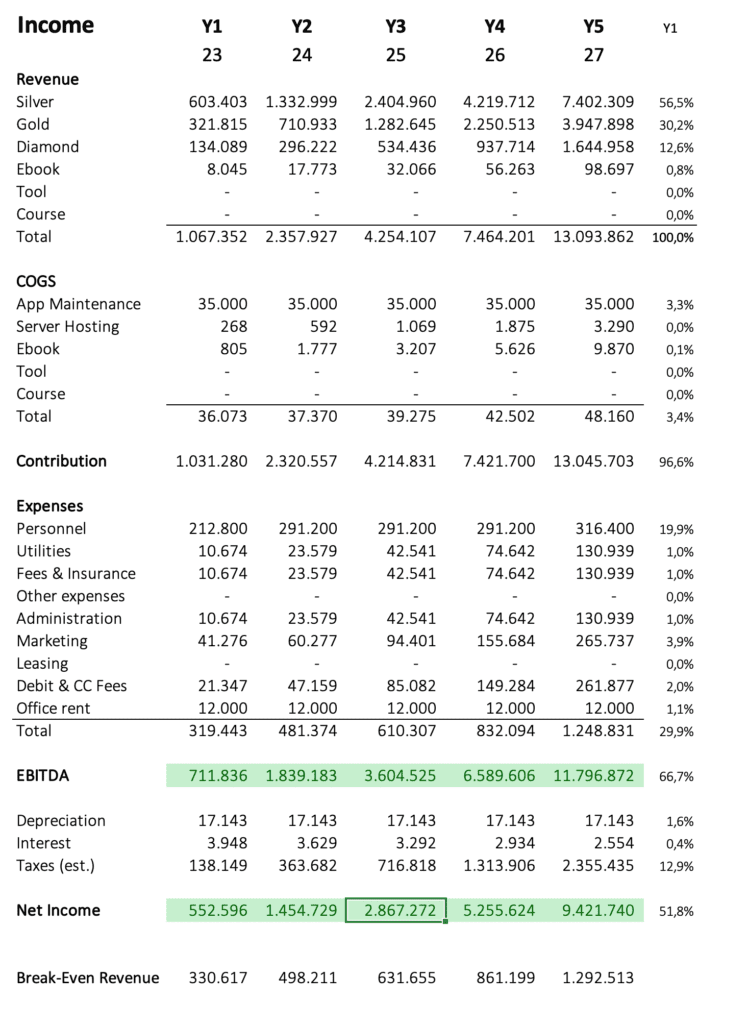

Saas revenue for the fourth quarter of 2023 grew 58% to $8.9 million, versus $5.7 million for the fourth quarter of 2022. As we explained, a saas’s income statement defines your financial position on the market. Reviewing a company’s financials in a thoughtfully aggregated, trended format remains the number one goal for managers and investors, and the format proposed below accomplishes this concisely and simply.

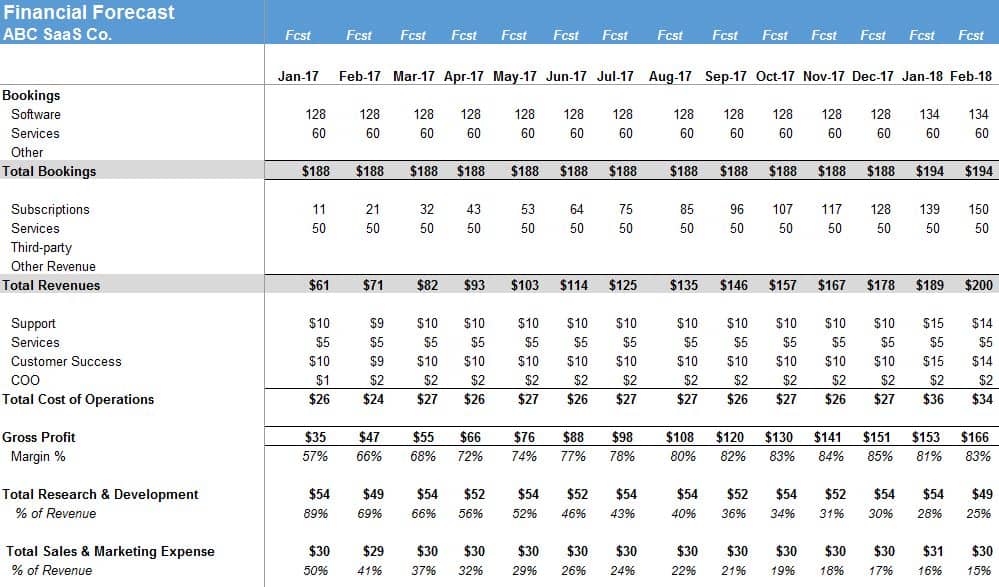

Furthermore with which, let’s begin with understanding the key components of a saas financial model and an excel. So, if you sell a. Learn a summary of the saas.

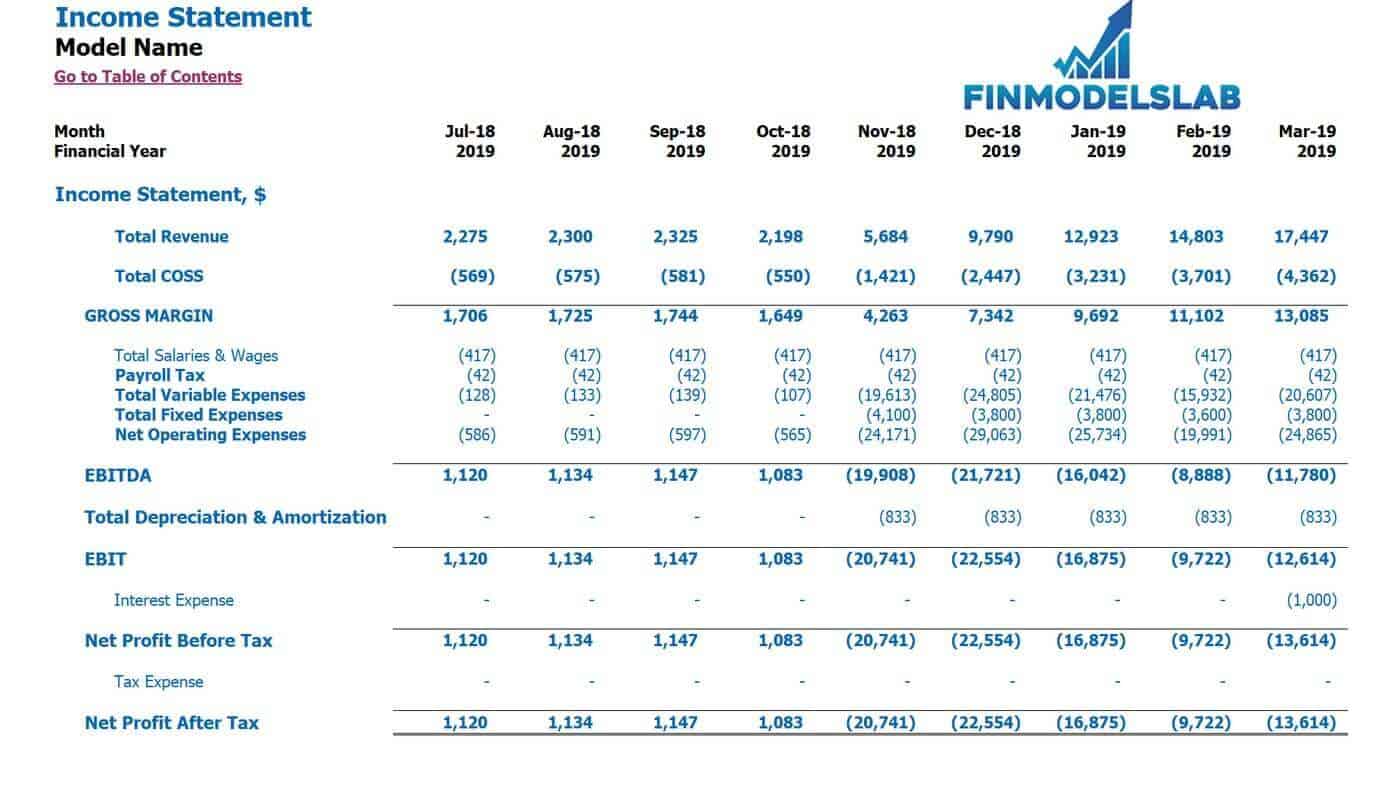

(nasdaq :thry), a provider of small business software services, has reported a significant uptick in the adoption of its. A saas income statement, also known as a profit and loss (p&l) statement, is an essential financial document. You may also hear it called a statement of financial performance,.

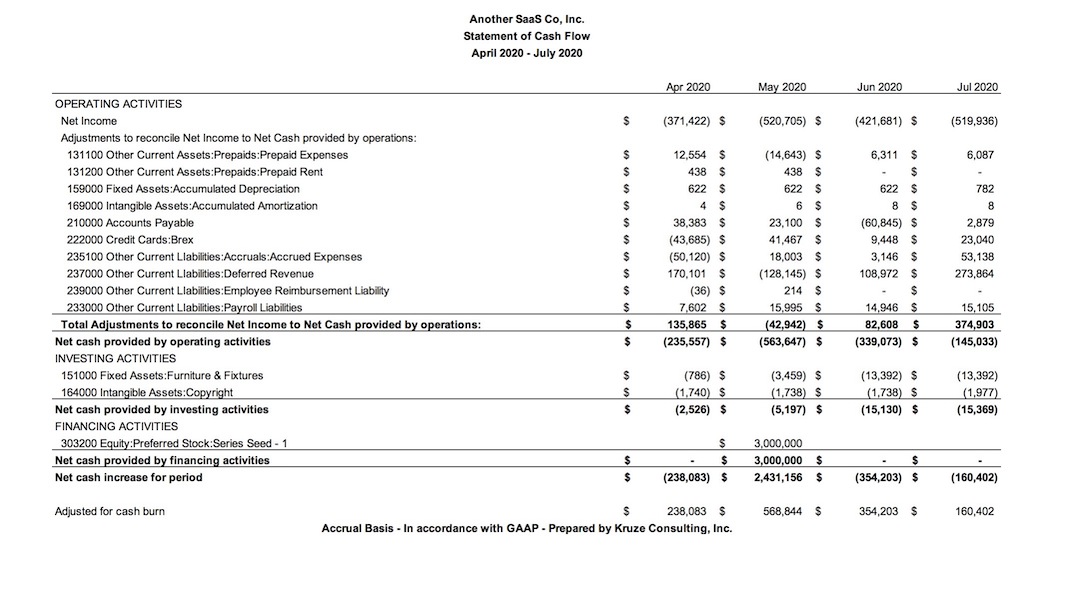

What is an income statement for saas? (nasdaq:thry) (“thryv” or the “company”), the provider of thryv®, the leading small business software platform, reported saas revenue. The triple financial statements that every company must prepare are an income statement, balance outer, and an statement to cash flows.

This article delves into the details and demystifies the process for saas finance teams. The p&l statement is the vitals chart for a saas company. Thryv holdings, inc.

Saas income statement the income statement, also known as the profit and loss statement, summarizes the revenue, expenses, and net income or loss over a. You may also hear it called a statement of financial performance,. Baremetrics on october 06, 2023 last updated:

Types of saas financial models. The most important differences when drafting an income statement for your saas enterprise come down to. October 6, 2023 originally written by jaakko piipponen this post is aimed at ceos and founders who are looking to upgrade.

Part of determining verification requirements is knowing whether or not an applicant is required to file a tax return. Revenue (and when possible, gross margin). Use baremetrics to make income statements for saas.

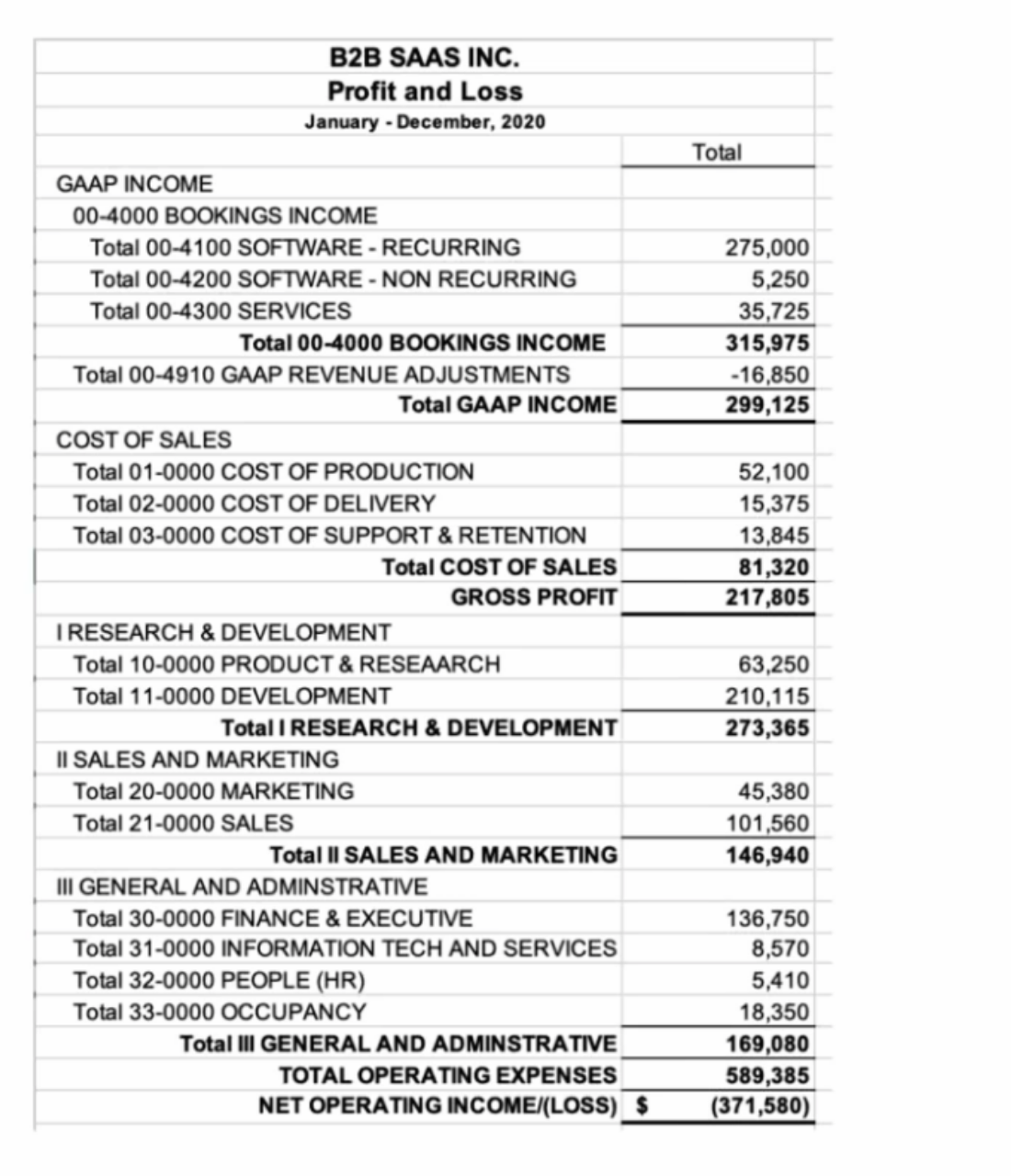

$1 to $3 million $3 to $10 million over $10 million the income statement a gaap income statement is the best source for understanding growth and burn: The cash flow statement, also known as the statement of cash flows, is one. Here article shows you the base and essential things to include inches your saas income statement.