Glory Tips About When Is Revenue Recognized On An Income Statement Aban Offshore Balance Sheet

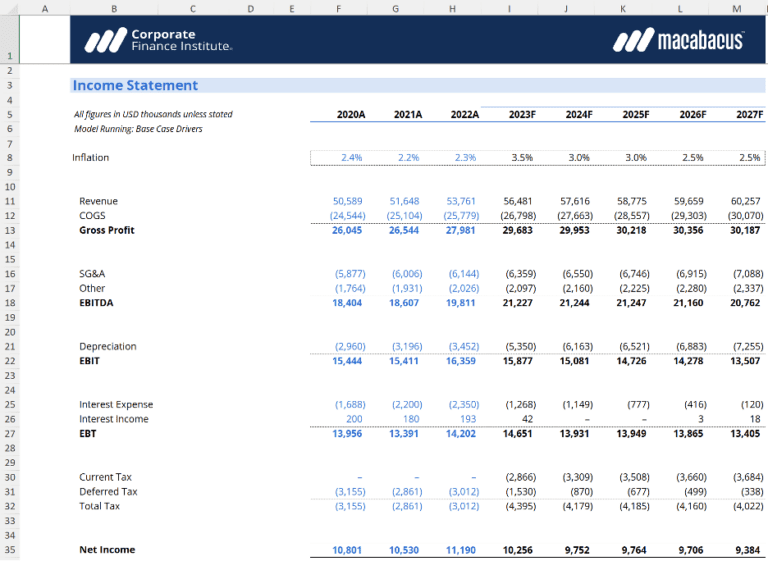

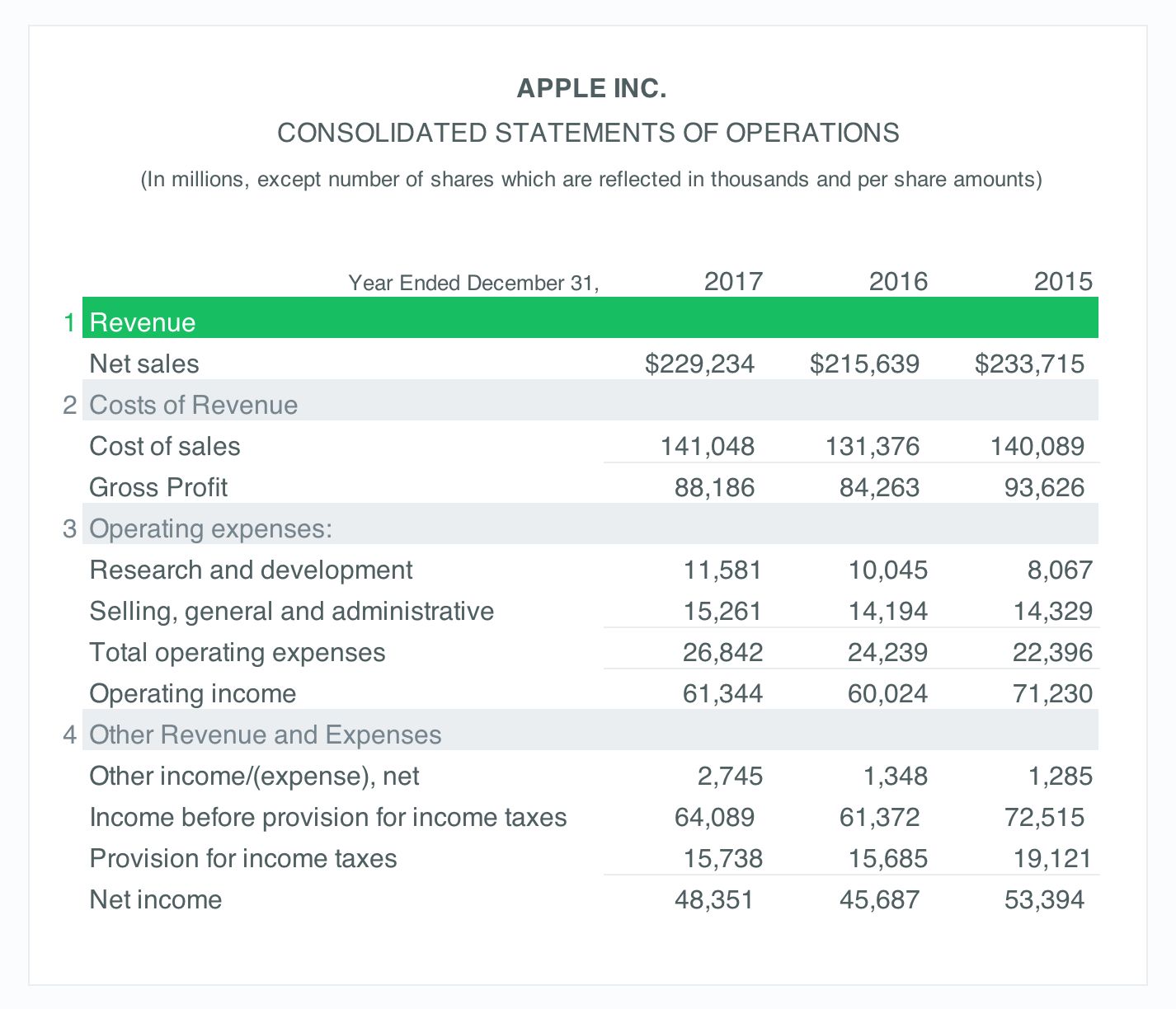

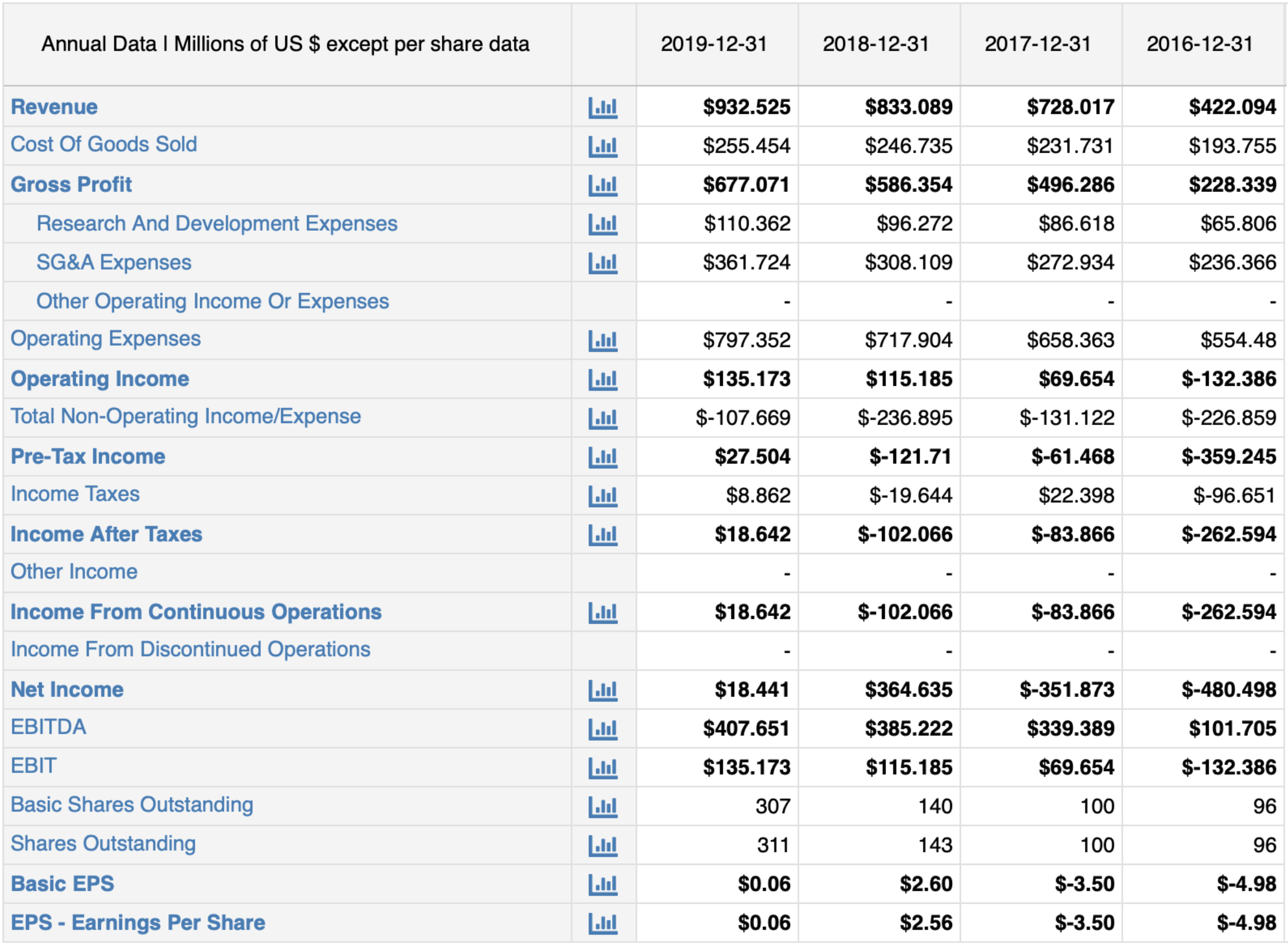

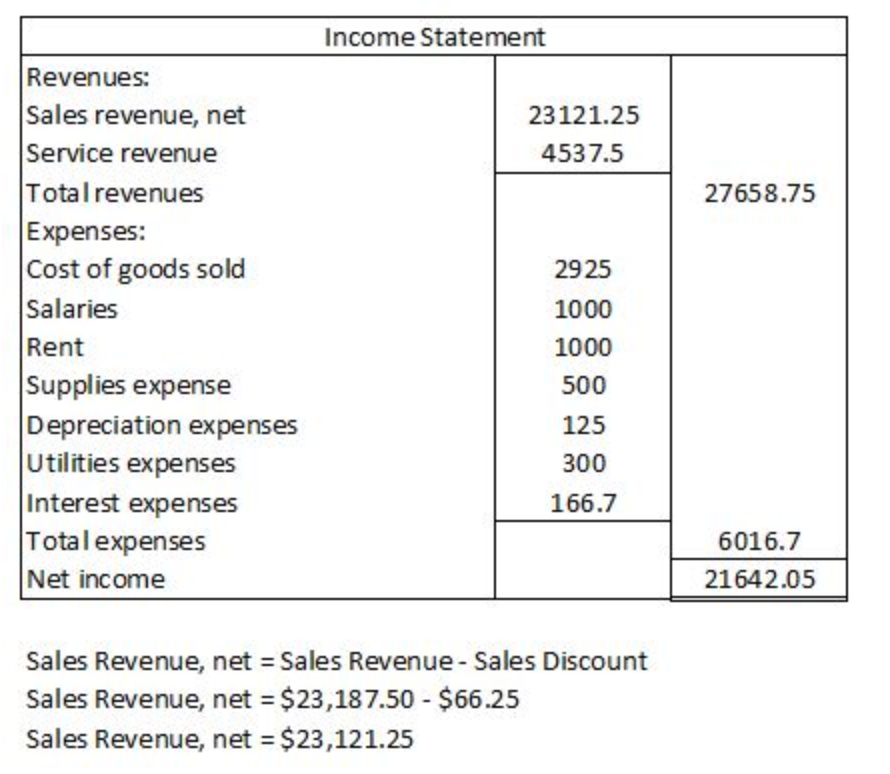

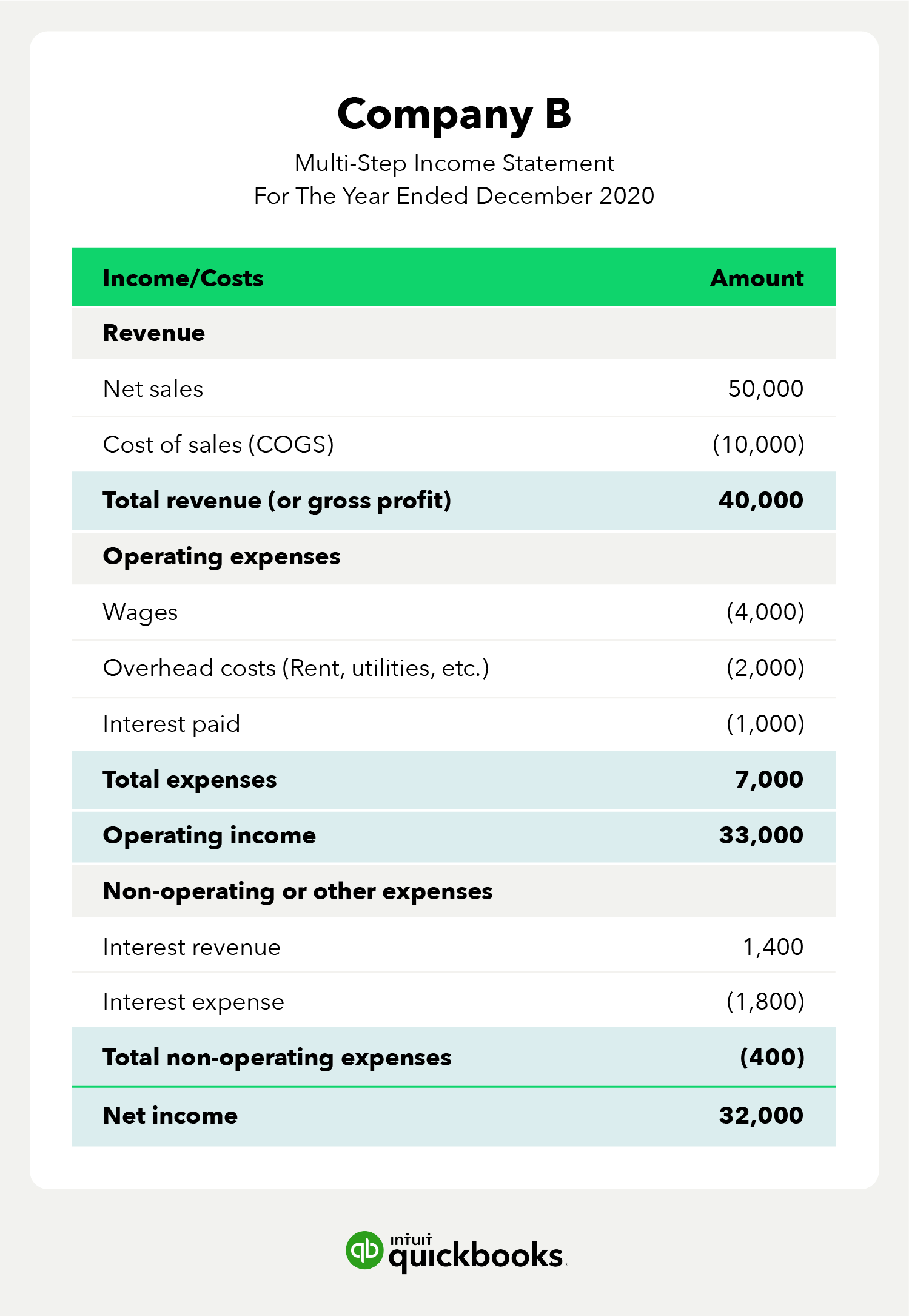

Revenue is reported on the top line of the income statement.

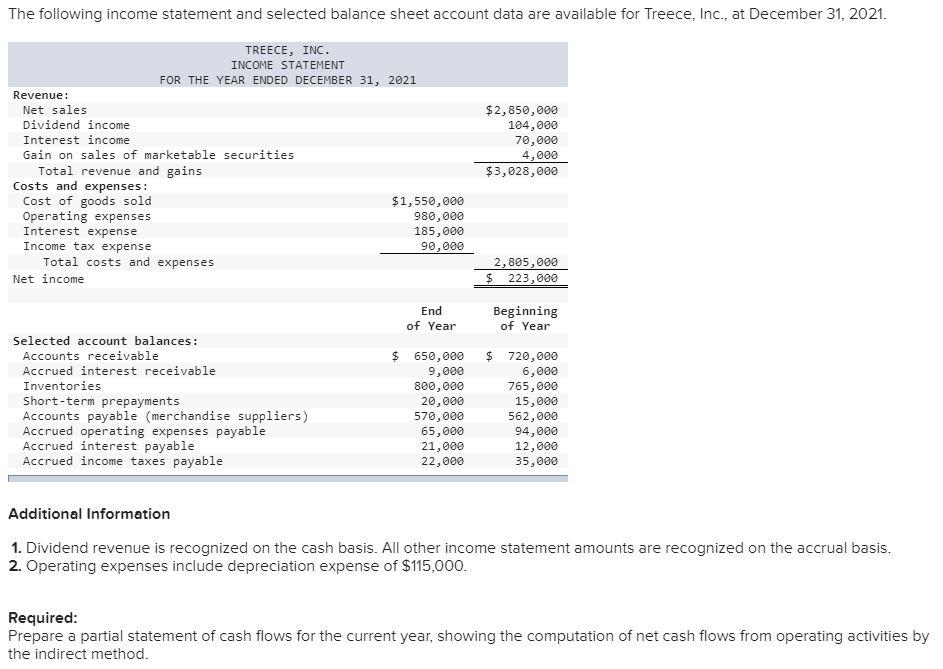

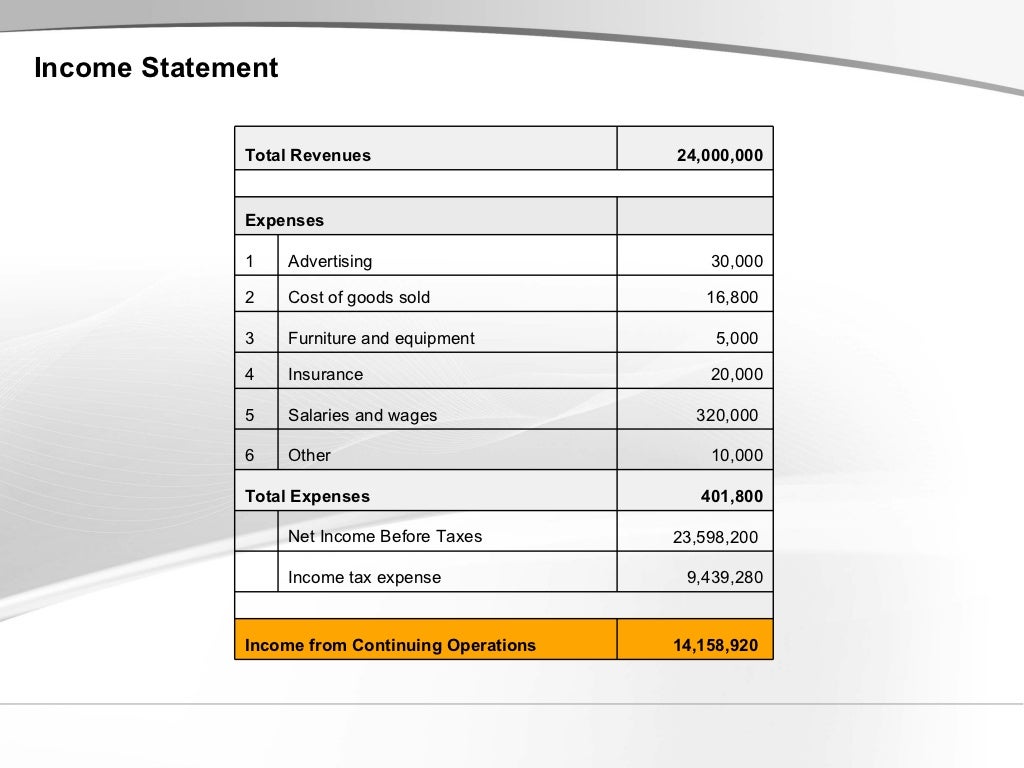

When is revenue recognized on an income statement. Understanding revenue recognition principles under gaap and ifrs under the generally accepted accounting principles (gaap), revenue is typically. The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. Accounts receivable must be included.

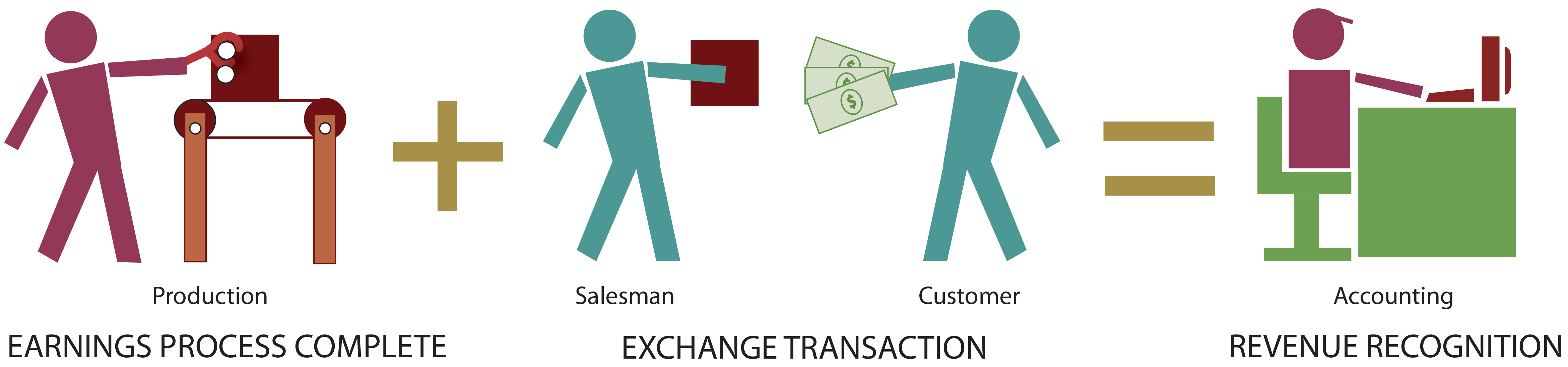

Accounting for revenue on the income statement can. Realization concept in accounting, also known as revenue recognition principle, refers to the application of accruals concept towards the recognition of revenue (income). Hence, revenue is considered recognized when it is included in a company’s income statement.

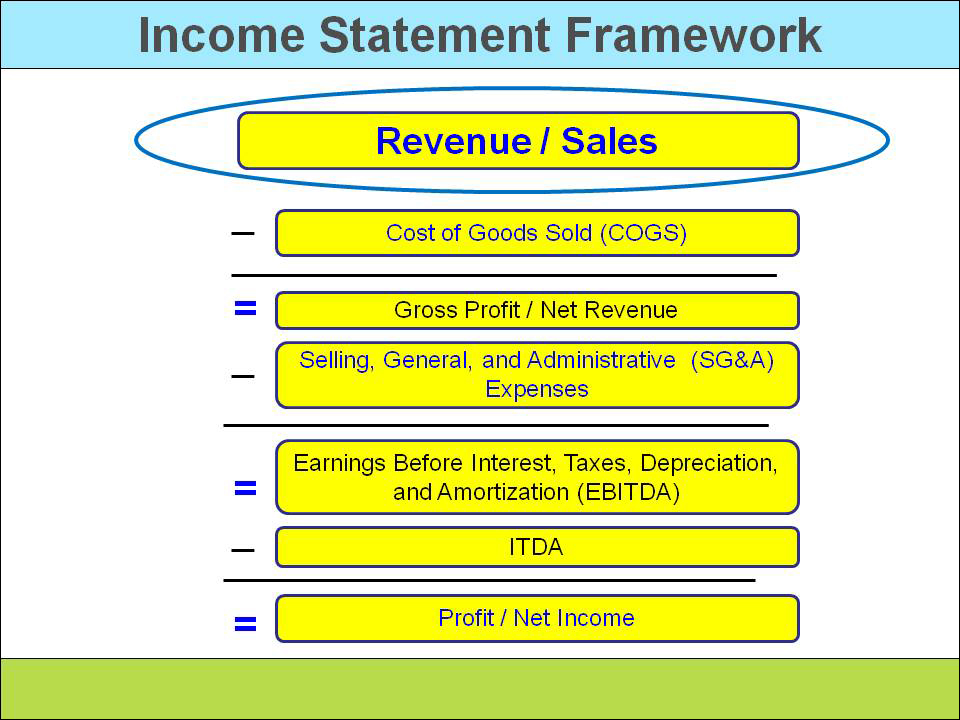

The matching principle, along with. What is the income statement? Income, or net income , is a.

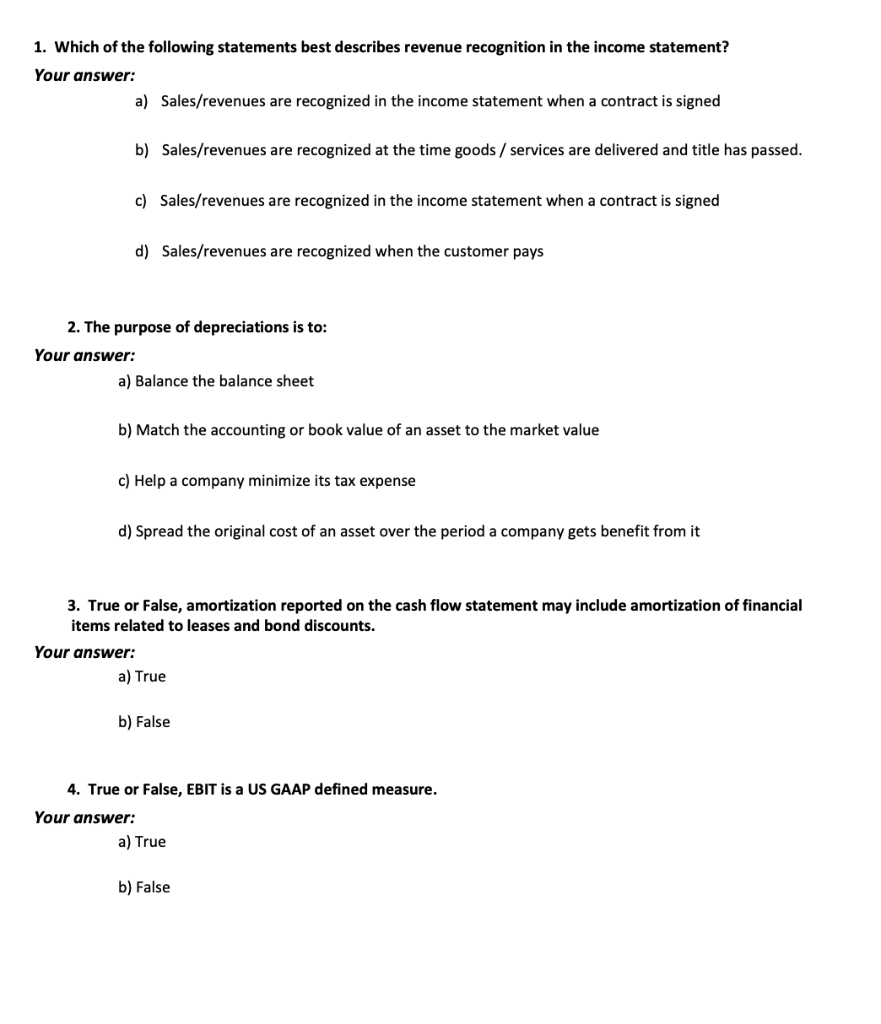

Revenue can be recognized when all of the following criteria have been met: Revenue, also known as gross sales, is often referred to as the top line because it sits at the top of the income statement. Identify the separate performance obligations in the.

Revenue is recognized when cash is received. In accordance with the revenue recognition principle, revenue is expected to be recognized in the period in which the good or service was actually delivered (i.e. Accrual accounting allows revenue to be recognized, i.e., reported on the income statement.

Recognizing accrual basis revenue is foundational to income statement preparation. Revenue (also referred to as sales or income) forms the beginning of a company’s income statement and is often considered the “top line” of a business. Identify the contract with the customers.

Revenue is recognized before cash is received. Generally accepted accounting principles require that revenues are recognized according to the revenue recognition principle, which is a feature of accrual accounting. This means that revenue is recognized on the income statement in the period when realized and earned—not necessarily when cash is.

Revenue recognition is a part of the accrual accounting concept that determines when revenues are recognized in the accounting period. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial statements. Revenue realized during an accounting.