Simple Info About Difference Between Balance Sheet And Cash Flow Statement What Is A Consolidated

Do dividends go on the balance sheet?

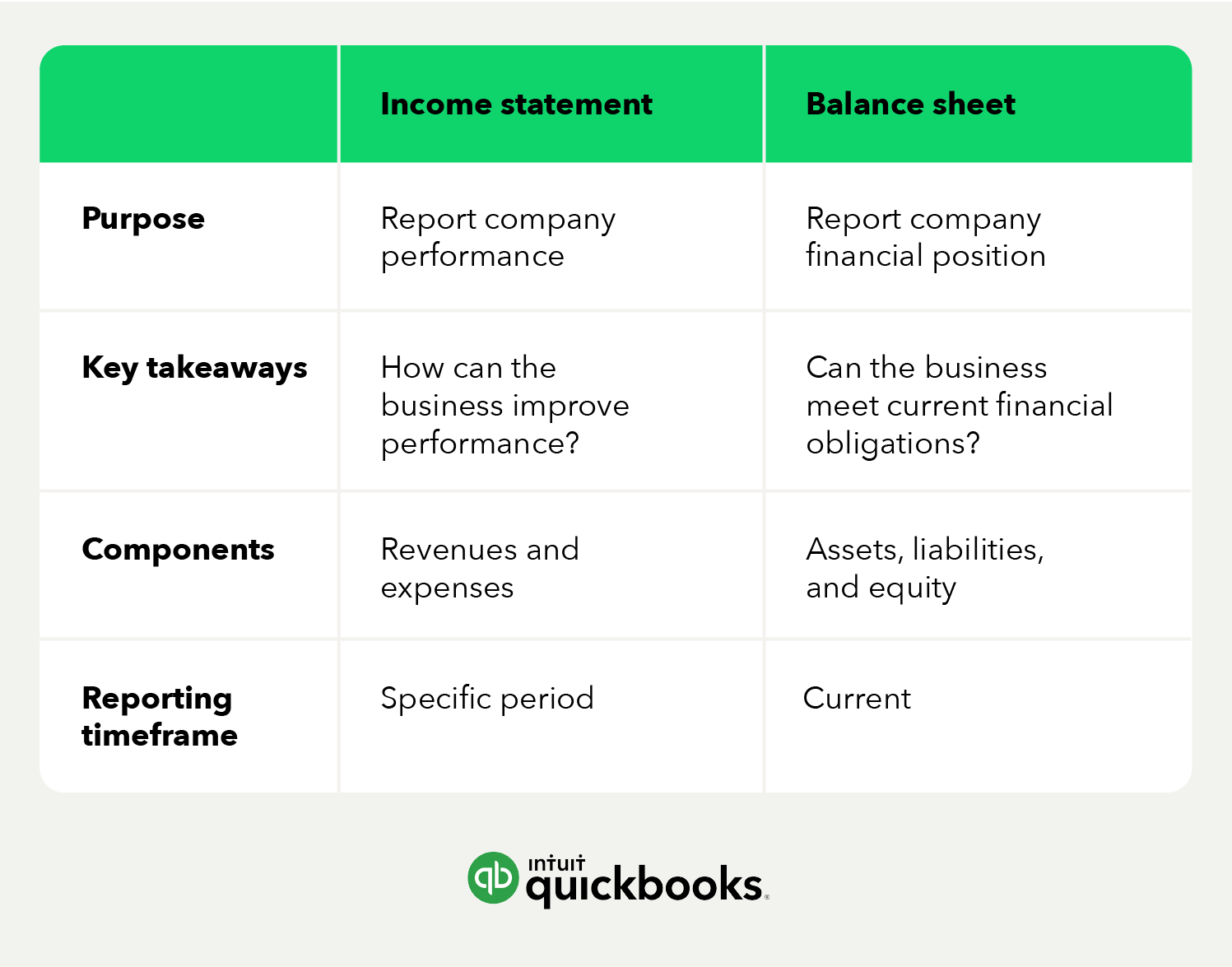

Difference between balance sheet and cash flow statement. The difference between these two indicators is the owner's or stockholders' equity, and it is also shown on the balance sheet. On the balance sheet, it feeds into. Income statements, balance sheets, and cash flow statements are important financial documents for all businesses.

Key differences between the balance sheet and cash flow statement. The three financial statements are: A balance sheet and a cash flow statement are two important financial statements that businesses use to track their financial health.

Net income & retained earnings net income from the bottom of the income statement links to the balance sheet and cash flow statement. Key differences the biggest difference between a financial statement and a balance sheet is the scope of each. To prepare the statement of cash flows for clear lake sporting goods, we need the beginning cash balance from the balance sheet, net income and depreciation expense.

Balance sheet vs. Financial statements vs. Although the balance sheet and cash flow statement are two critical financial statements companies must use, there are several key differences between.

Reviewed by scott powell what are the three financial statements? Here's what you need to know about. A balance sheet provides a snapshot of a company’s financial position, while a cash flow statement shows the movement of cash in and out of the company.

Somer anderson fact checked by ariel courage the cash flow statement and the income statement are integral parts of a corporate balance sheet. It’s evident that the cash flow statement and balance sheet offer two very. The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance.

The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential. 6 rows a balance sheet is a precise representation of the assets, liabilities, and equity of the. The balance sheet provides a snapshot of a company’s.

The balance sheet mainly focuses on the company’s financial position at one particular period, whereas the cash flow statement report examines the company’s. Comparing cash flow statement vs balance sheet: A balance sheet shows what a company owns in.

Why do shareholders need financial. (1) the income statement, (2) the balance sheet, and (3) the cash. What’s the difference between a cash flow statement and an income statement?

A cash flow statement shows the flow of cash in and out of a company over a period of time, including cash from operating activities, investing activities, and financing activities.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)

![[Ultimate] Difference Between Balance Sheet and Cash Flow Statement](https://i.pinimg.com/originals/eb/78/b7/eb78b7fc2d01a284c36cc4ca3ca7bace.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)