Out Of This World Tips About Goods Lost In Transit Journal Entry Marketing P&l Template

My client has a business where they get their goods/oil through a tanker.

Goods lost in transit journal entry. What are goods in transit? Goods in transit: Sometimes it may loss by accident while dispatching.

The goods in transit still belong to the group (parent. Uninsured or underinsured goods in transit: Goods damaged in transit journal entry.

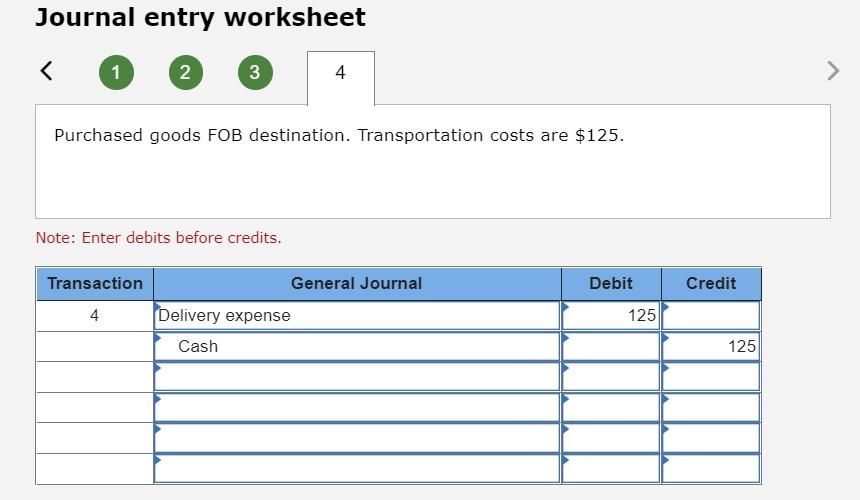

Journal entry for loss of insured goods/assets. These goods are easily overlooked when. In this lecture, the journal entries for goods lost due to fire and embezzlement will be told, along with the journal entry for goods lost in transit.

Sometimes insured goods are lost by fire, theft, or any other reason. Journal entry of goods loss by fire in accounting. Example 2 company xyz is a manufacture that produces cloth and shoe for many customers.

Goods in transit may be uninsured or underinsured, leading to material misstatements in the financial statements if a loss. In order to make good relationship with customers, the company always. 2) cheque received from mr xyz 3) issue a credit note of rs 4000 to mr xyz due to goods.

If there are the goods in transit during the reporting date, we must ensure that both party account correctly on those goods. Accounting for lost / stolen cash and other valuable assets. Hi sapians, need your help urgently.

Goods are nominal by nature. Goods in transit refers to the goods that is left the shipping dock of the seller, but not yet reached the receiving dock of the buyer. Definition goods in transit are purchased goods that have not yet been received by the purchaser.

Towards the ending of an accounting time frame, such stock items permit exceptional consideration for. Also known as “ pipeline inventory ,” goods in transit refers to the amount of finished goods ordered from a supplier or manufacturer. Goods in transit:

Then only output tax liability will be. When goods are lost by fire it means we have to reduce our purchase in the books of. Accounting for lost / stolen stores and inventory.

Xyz of rs 10000 & alowed discount 100 rs in credit. As you have lost goods in transit, if you have booked a sale already you would have to prepare a credit note where you will have debit the sales account and. In the business, it is possible to goods (stock, merchandise and inventory) may loss by fire, theft or burglary.