Peerless Tips About Contribution Margin Approach Income Statement Investing Activities

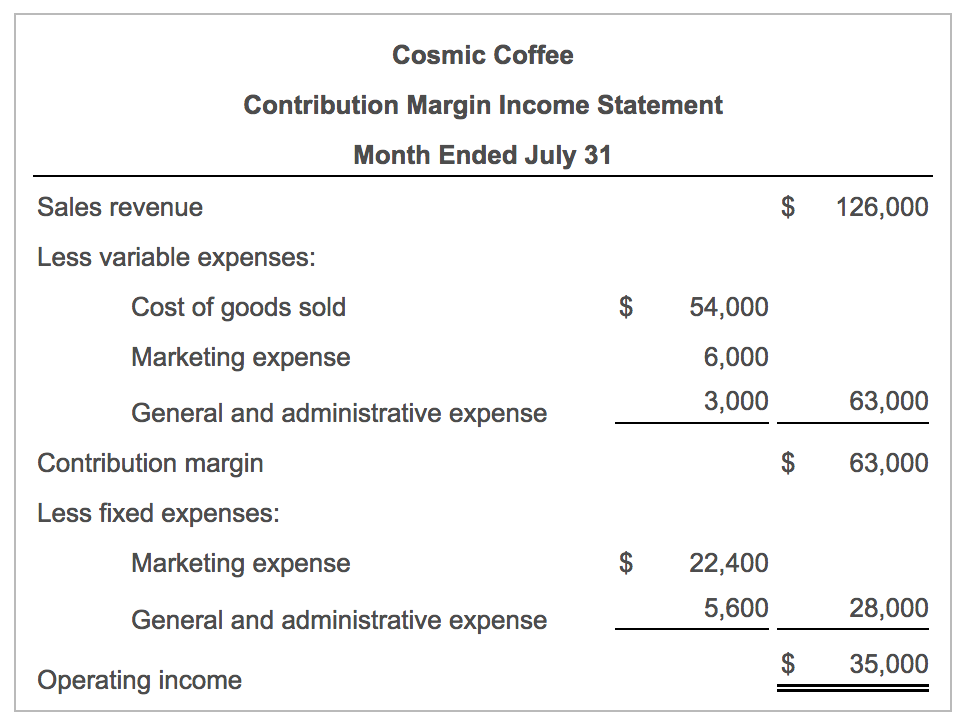

A contribution margin income statement is a document that tallies all of a company’s products and varying contribution margins together.

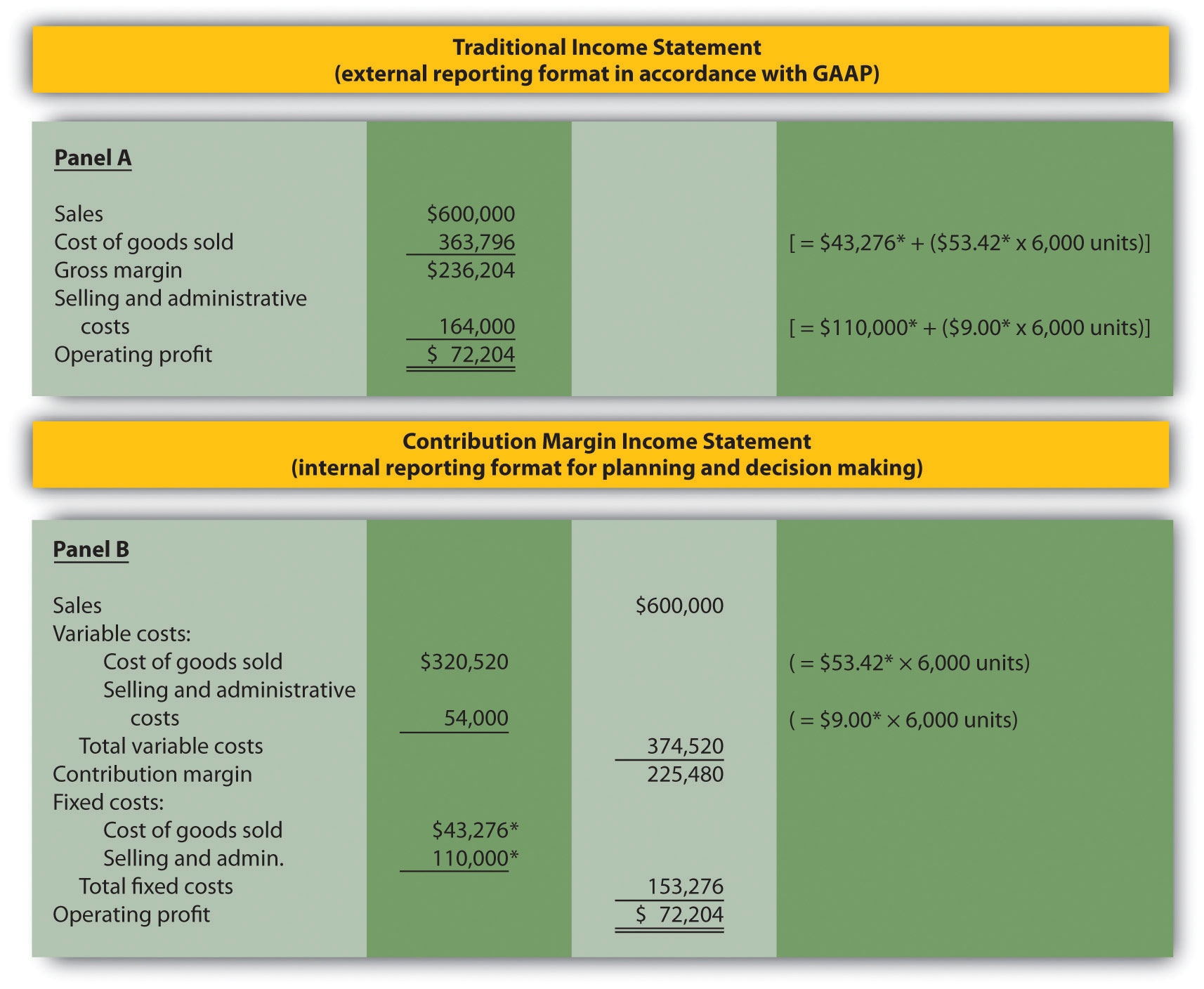

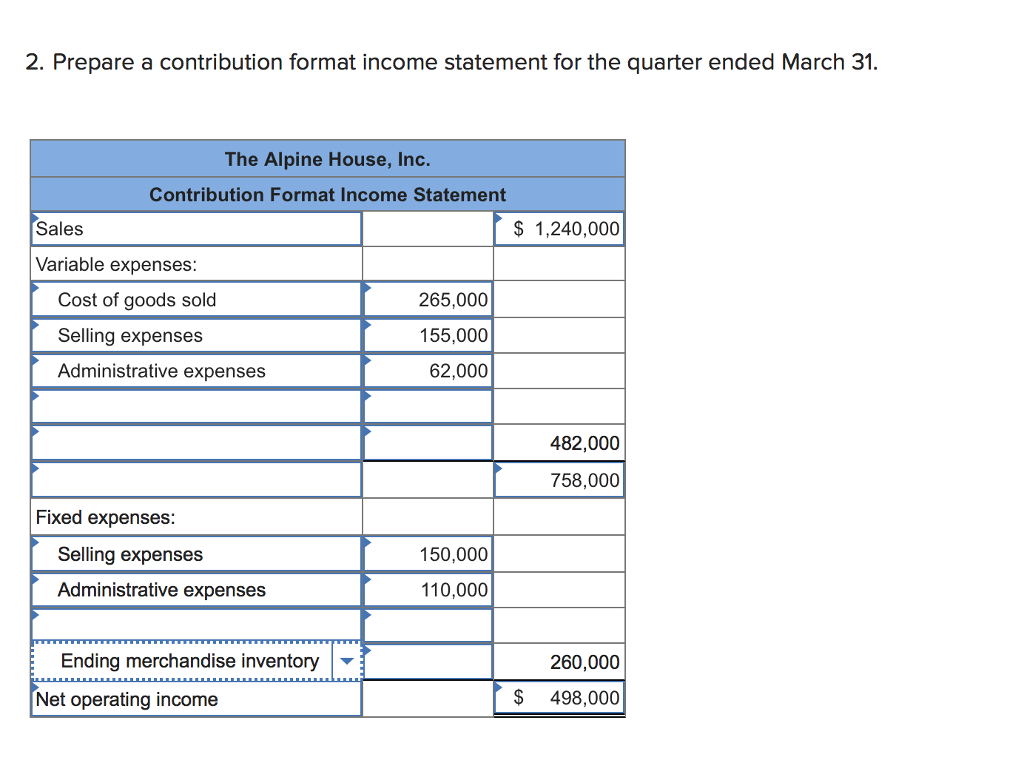

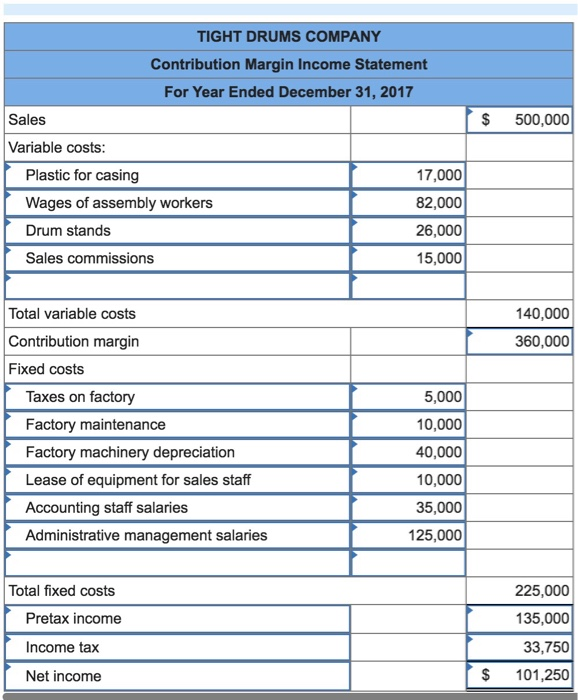

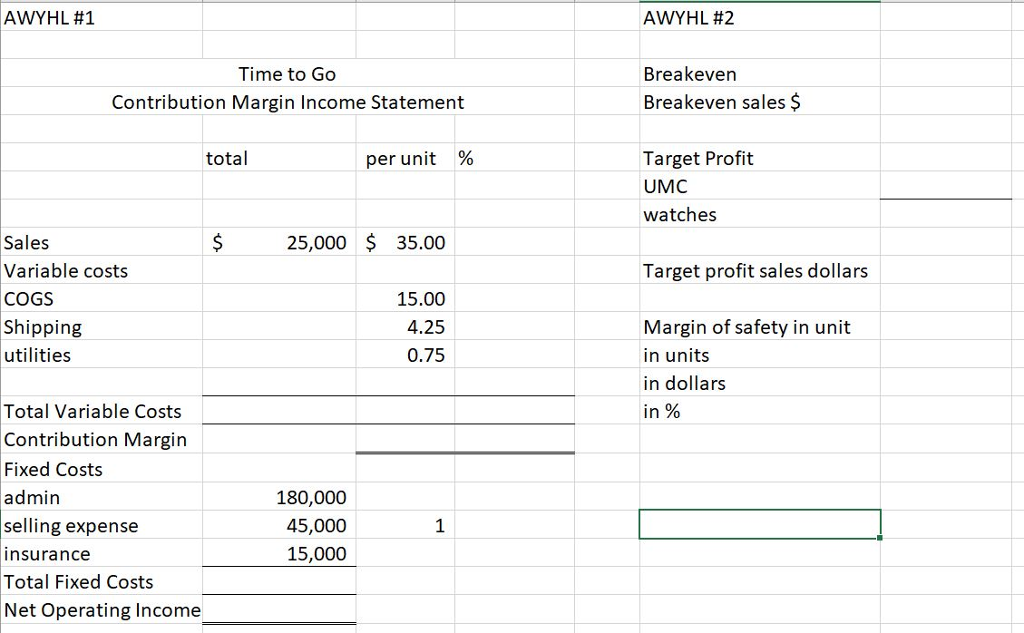

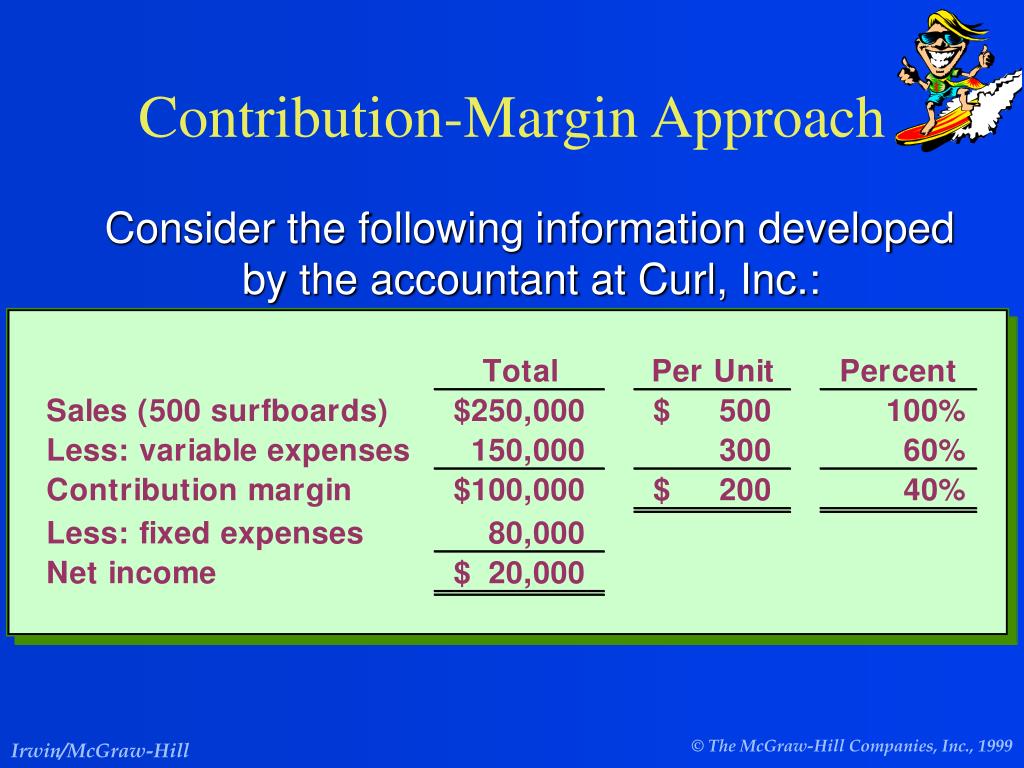

Contribution margin approach income statement. The contribution margin format is used to prepare segmented income statements. This statement tells you whether your efforts for the period have been profitable or not. The contribution margin is derived by subtracting the variable expenses incurred by the company for the period from the total sales of the company, and when the fixed expenses are subtracted from the.

Key takeaways the contribution margin represents the portion of a product's sales revenue that isn't used up by variable costs, and so contributes to covering the company's fixed costs. Revenue minus variable costs equals the contribution margin. The contribution margin income statement is a useful tool when analyzing the results of a previous period.

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin. The contribution margin income statement shows fixed and variable components of cost information. The contribution margin is the revenue from a product minus direct variable costs, which results in the incremental profit earned on each unit of product sold.

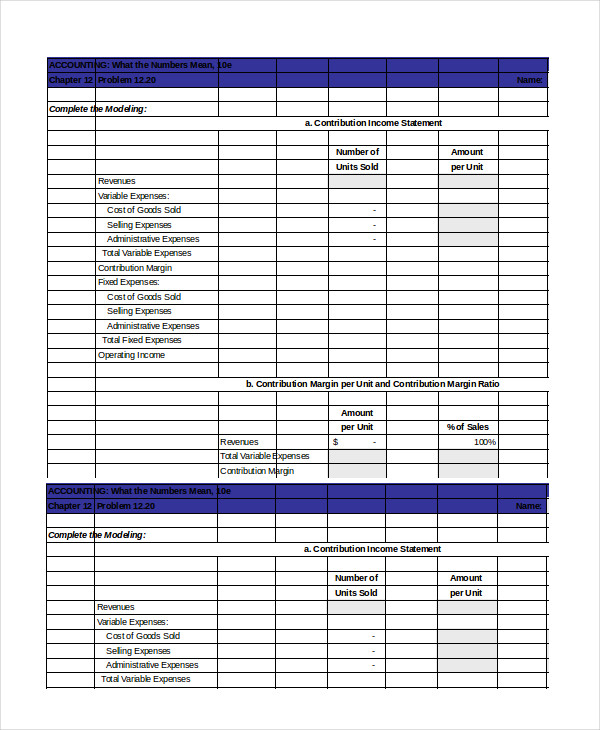

Contribution margin income statement refers to the income statement which is used for the purpose of calculation of the contribution margin of the company where the contribution margin is derived by the way of subtracting the variable expenses incurred by the company for the period from the total sales of the company and when the. Contribution margin can be expressed in a number of different ways, including per unit and as a percentage of sales (called the contribution margin ratio). It ranks costs behaviorally, regardless of the function corresponding to the charges, and reflects the interaction of variable and fixed costs.

What is the contribution margin income statement? We'll learn the format of each, as well as some important. What is a contribution margin income statement?

The point of zero profit or loss) is based on the cvp analysis concepts known as contribution margin and contribution margin ratio. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. A contribution margin income statement separates fixed and variable business expenses and shows the revenue generated after those two categories of expenses have been paid.

Your variable expenses of $0.90 per unit amount to 33.33% ($0.90/$3.00) of sales of $3.00 for each of your units sold. (i) decisions to increase or decrease individual product production [or discontinue production in. Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount.

The contribution approach is a presentation format used for the income statement, where all variable costs are aggregated and deducted from revenue in order to arrive at a contribution margin, after which all fixed costs are deducted from the contribution margin in order to arrive at the net profit or loss. The contribution margin 12 represents sales revenue left over after deducting variable costs from sales. A contribution margin is essentially a company's.

When calculated for a single unit, it is called unit contribution. A contribution margin income statement refers to an income statement that is used to calculate the company’s contribution margin. What it is, how to calculate it, and why you need it by amy gallo october 13, 2017 ross m.

The contribution margin minus fixed costs equals operating profit. Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period. A contribution margin is essentially a company's revenues minus.