Ideal Info About Projected Cash Flow Statement Format Purchase Of Fixed Assets

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

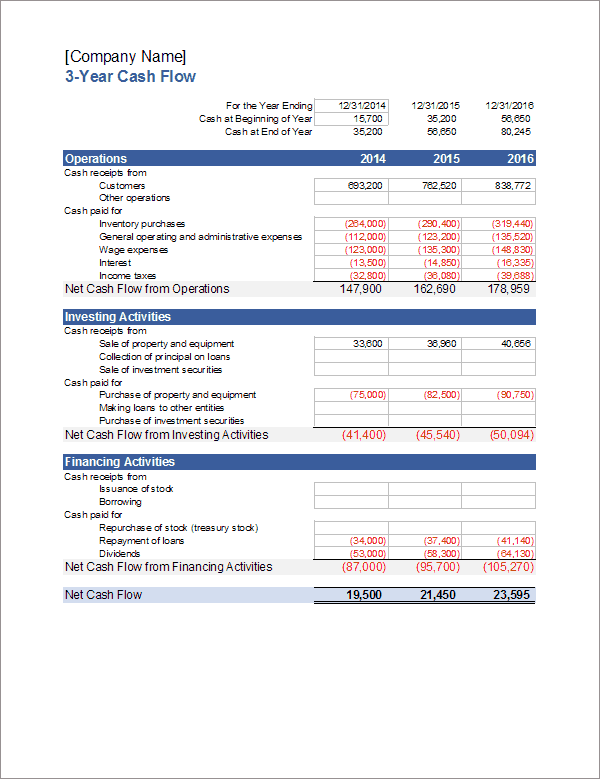

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Projected cash flow statement format. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. In the direct cash flow forecasting method, calculating cash flow is simple. This article considers the statement of cash flows of which it assumes no prior knowledge.

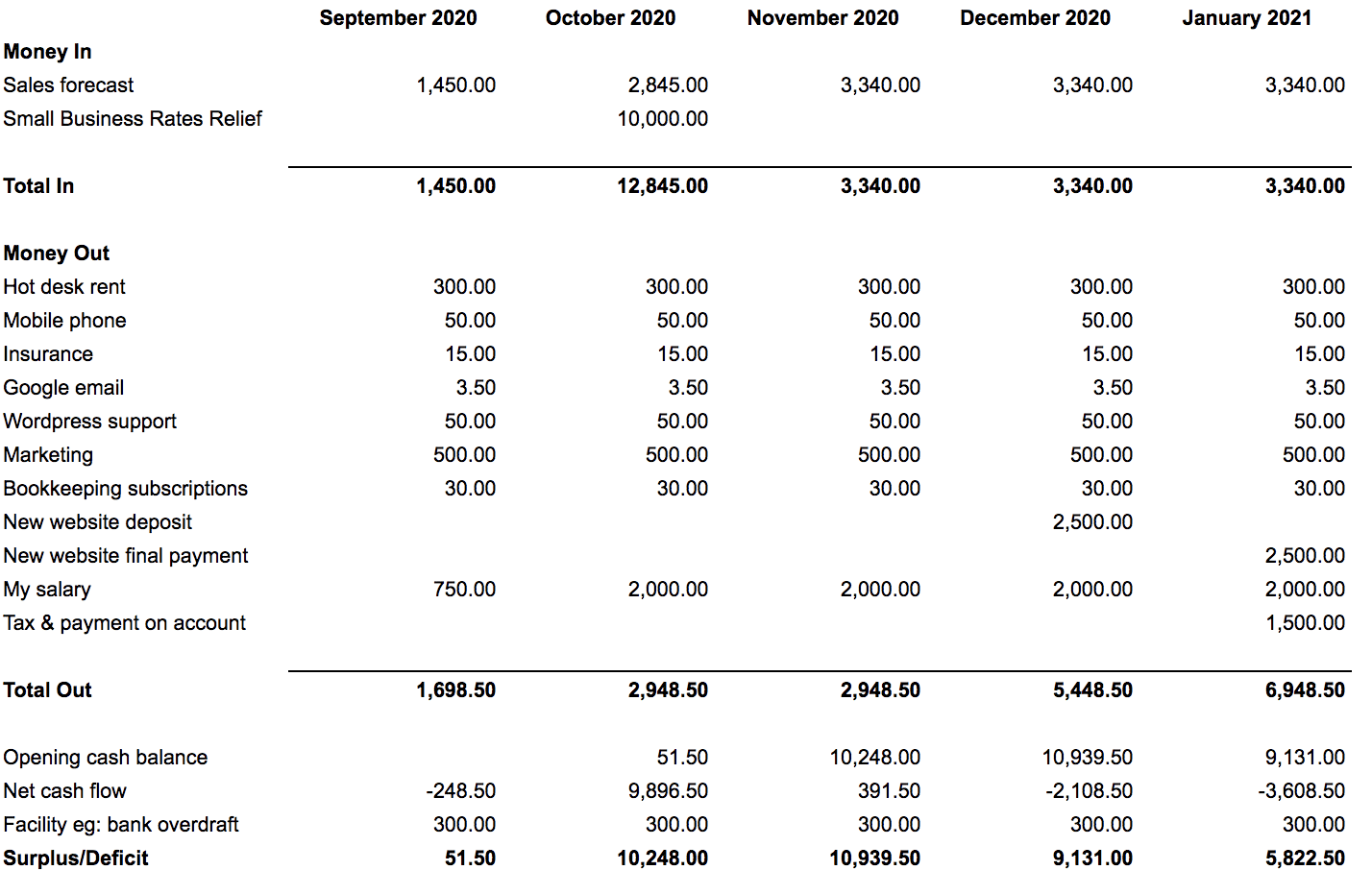

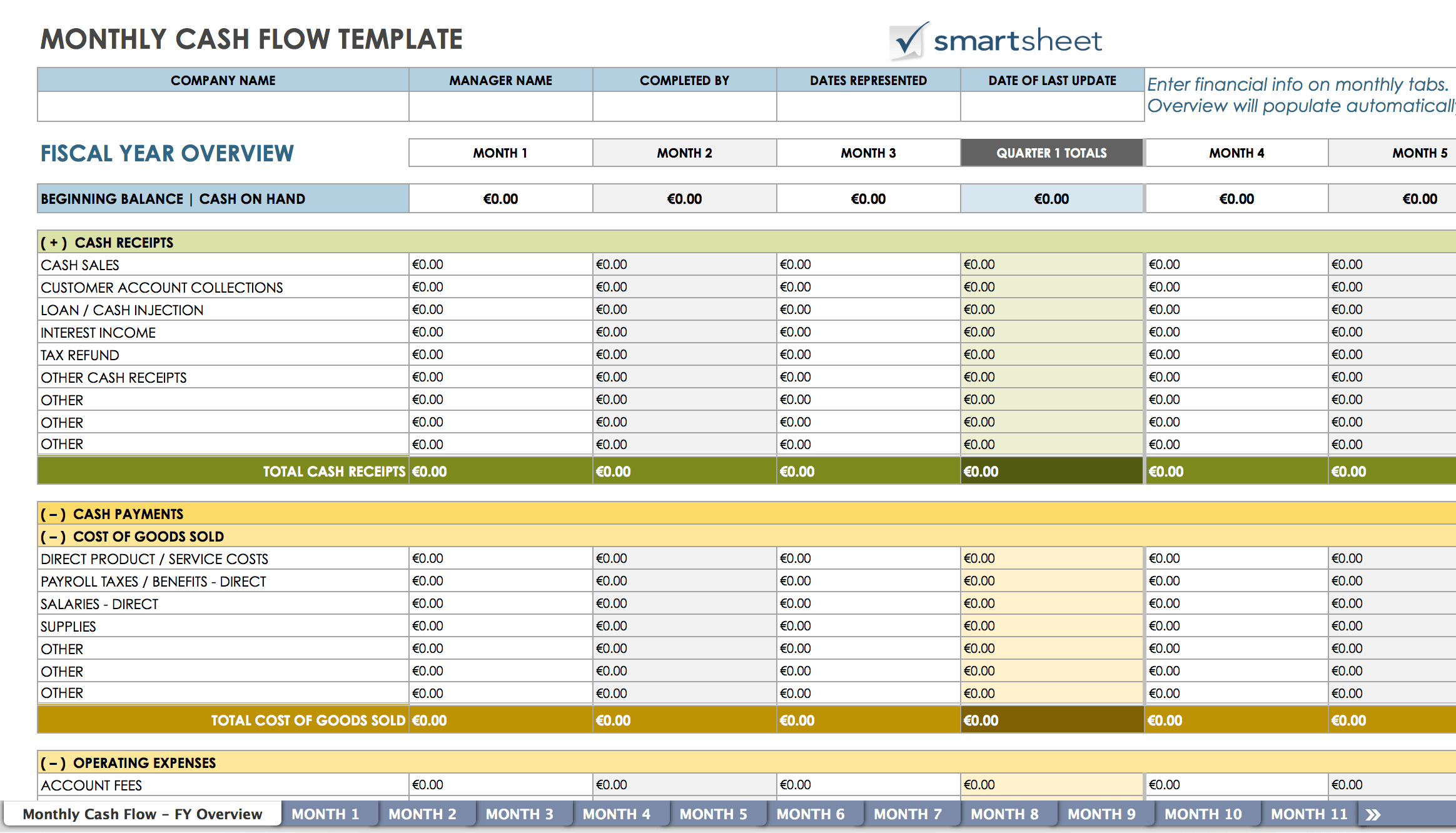

This simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Download a statement of cash flows template for microsoft excel® | updated 9/30/2021. Forecast expected payments to suppliers and vendors.

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. The template includes space to list revenue and expenses, and allows you to track cash flow for a project over 12 months. Following that, we will create the format for the projected balance sheet.

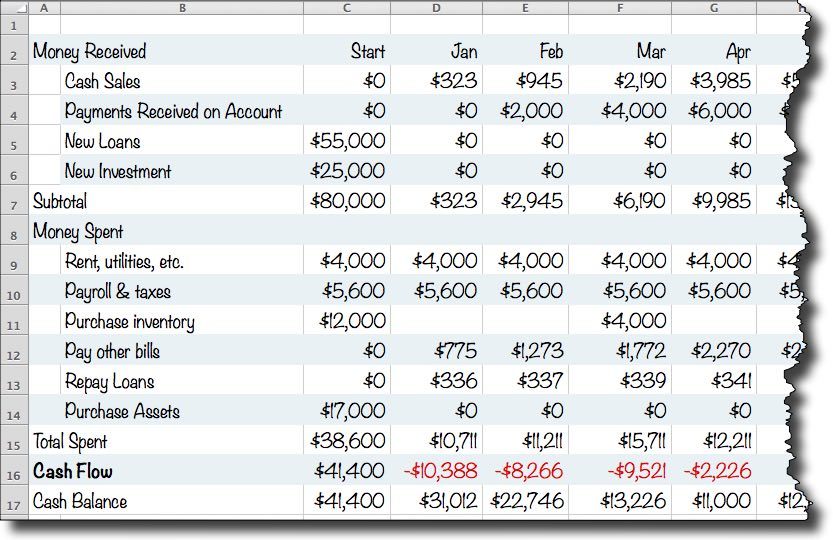

Mine when, how much, and for how long cash deficits or surpluses will exist for a farm business during an upcoming time period. Estimate future sales and collections from customers. This value can be found on the income statement of the same accounting period.

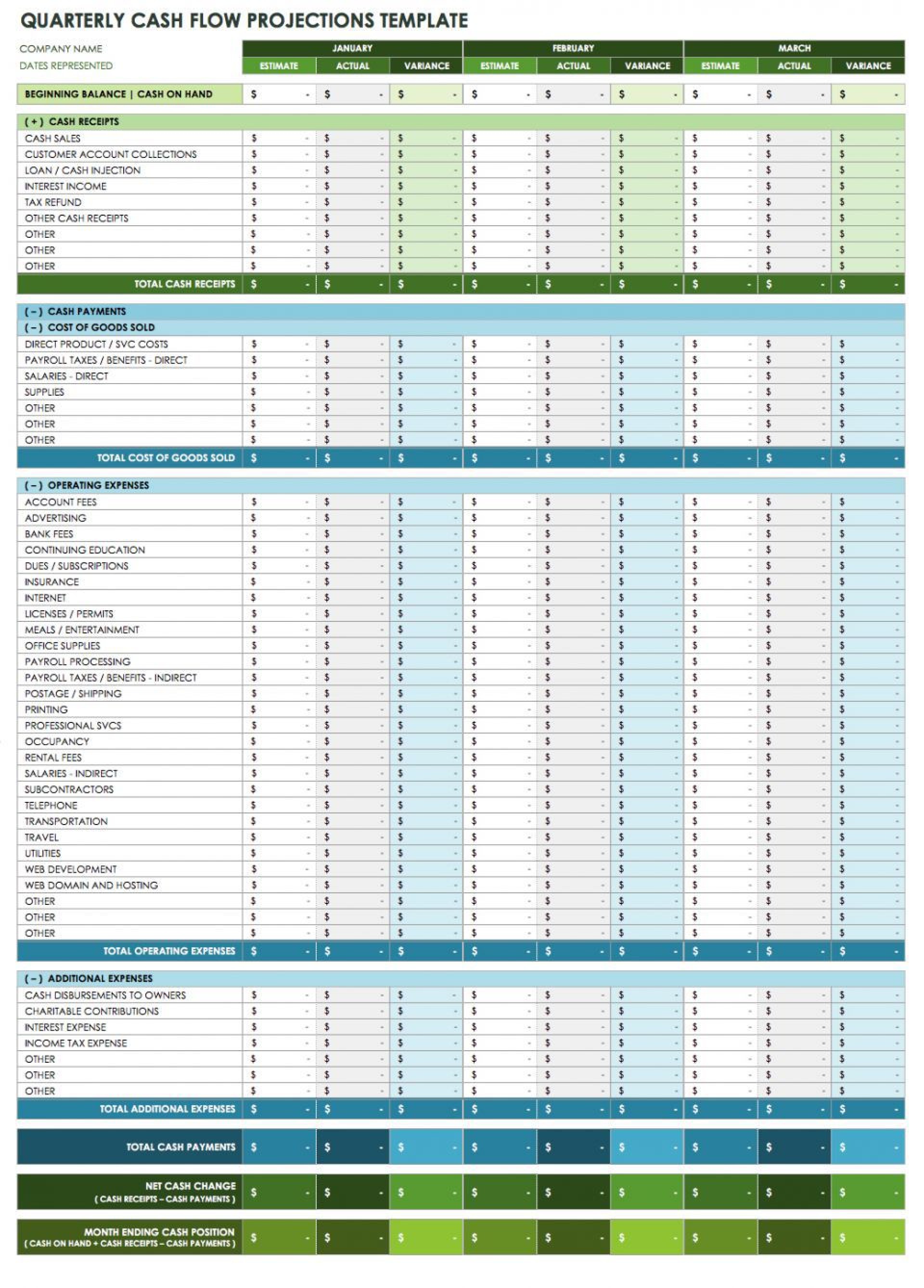

The main idea to create a cash flow projection format is to calculate cash inflows and outflows. Discover how to create projected financial statements for effective financial planning, covering data analysis, forecasting, approval processes, and stakeholder presentations. How do you prepare a projected cash flow statement?

Firstly, we will create the income statement. A cash flow projection statement is a forecast of a business's future cash inflows and outflows. It uses cash to determine the net cash position at the end of each.

Deduct all outbound cash flows via operating, investing, and financing activities. Steps to prepare a projected cash flow statement: Gather and analyze financial data such as income, expenses, assets and liabilities.

Add all the annual cash inflow from operating, investing, and financing activities. And then evaluate how much cash one is left with after the period.

Enter your beginning balance for the first month, start your projection with the actual amount of cash your business will have in your bank account. Forecasting cash flow and cash balance. 1 identify the time period for the cash flow projection list all sources of cash inflows estimate the amount for each cash inflow source

Create cash flow projection format in excel: The cash flow statement format is divided into three main sections: A cash flow projection estimates the money you expect to flow in and out of your business, including all of your income and expenses.