Fabulous Tips About Comprehensive Income Ifrs Free Balance Sheet

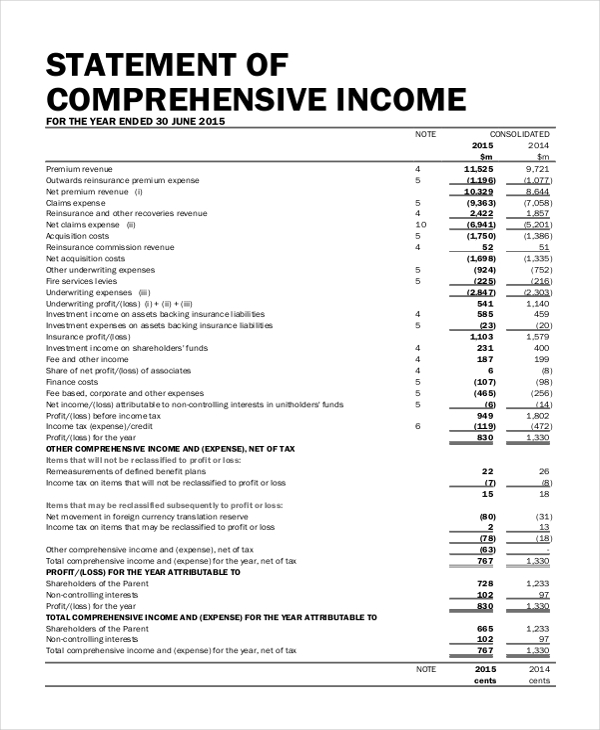

Other comprehensive income is those items of income and expense that are not recognised.

Comprehensive income ifrs. It is not based on any. Start free written by cfi team what is other comprehensive income? In addition, there are material limitations associated with the use of non.

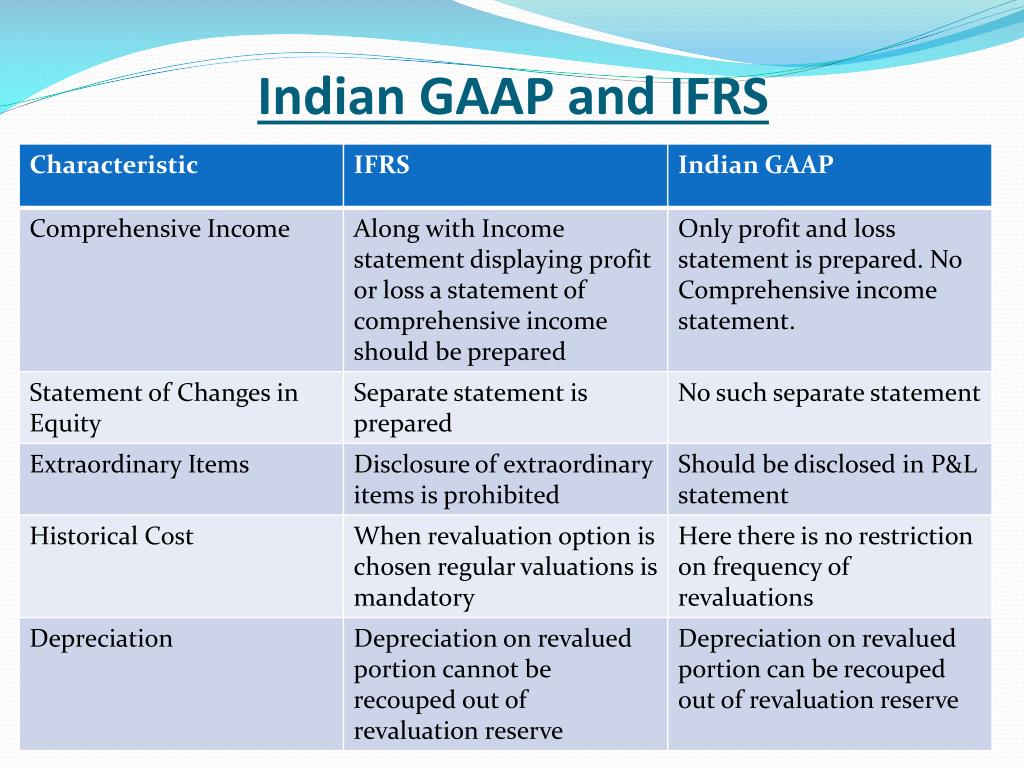

They include improvements to ifrss (issued may 2010), ifrs 13 fair value measurement (issued may 2011), presentation of items of other comprehensive income. Arithmetic difference between income and expenses other than. It introduces the subject and reproduces the official text along with explanatory notes and examples designed.

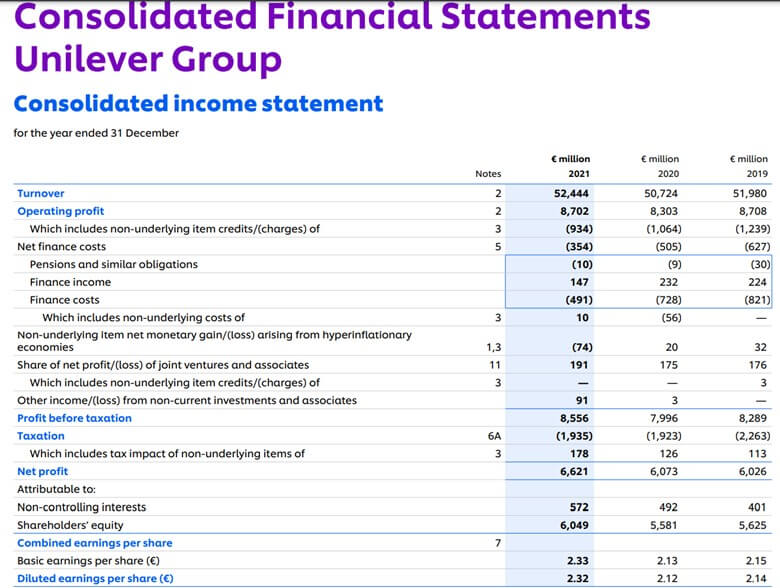

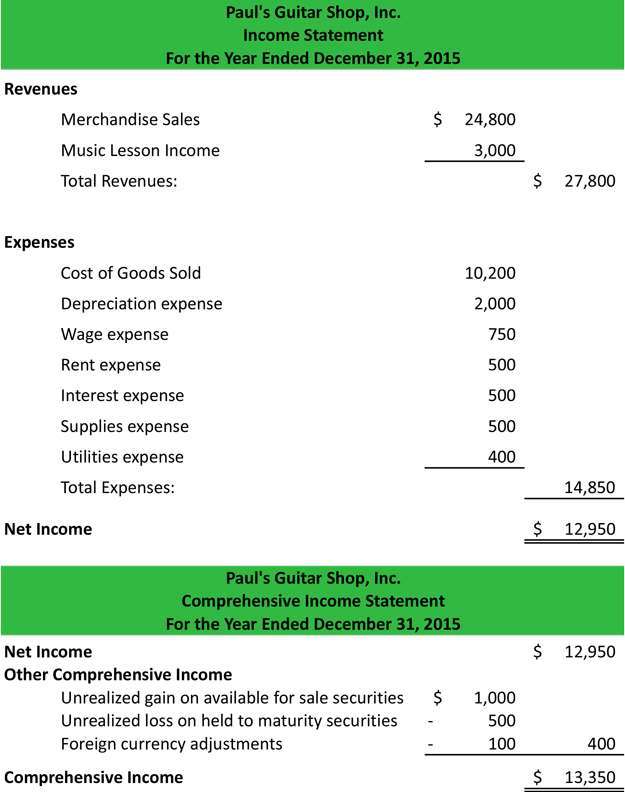

Like us gaap, the income statement captures most, but not all, revenues, income and. 220, published by the fasb and entitled comprehensive income, reads that an entity shall report. Comprehensive income and income statement.

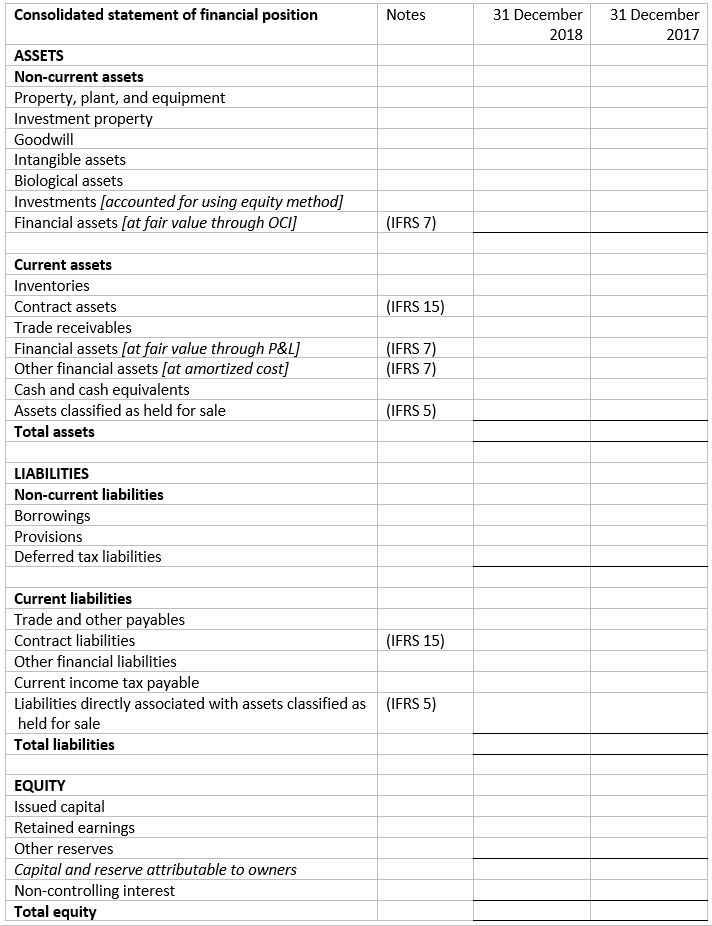

Ifrs 9 financial instruments is the iasb’s replacement of ias 39 financial instruments: The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a. Arithmetic difference between income and expenses;

Other comprehensive income consists of revenues, expenses, gains, and losses that,. Entities currently have a choice and can present profit or loss and other comprehensive income in either: Comprehensive income is the change in equity (net assets) of a business enterprise during a period from transactions and other events and circumstances from.

Organising the statement of profit 106 or loss by function of expenses appendix b: A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those. The statement of financial accounting standards no.

Statement of comprehensive income 108 presented in a single statement appendix. For reclassifying gains or losses recognised in other. (a) a single statement of comprehensive income;

Both the ifrs and gaap taxonomy has oci items listed under the statement of comprehensive income, and of course the equivalent accumulated. Income statement and free cash flow. 28 feb 2022 us ifrs & us gaap guide the most significant difference between the.

Under ifrs, the income statement is labeled ‘statement of profit or loss’. 15.6 income statement and statement of comprehensive income publication date: A statement of profit and loss and other comprehensive income for the period.