Outrageous Info About Debenture Interest In Income Statement Sections Of Cash Flows

According to the income tax act of 1961, the companies that issue debentures have to deduct tds on interest at a rate of interest specified.

Debenture interest in income statement. According to the income tax act, 1961, the company should deduct income tax at the recommended rate from the interest payable on the debentures if it surpasses the guided limit. The interest is a finance cost in the statement of profit or loss ($8,000), the accrued interest ($4,000) is a current liability and the loan. The company can issue various types of debentures.

A debenture is a type of bond or other debt instrument that is unsecured by collateral. As mentioned above, companies charge any accrued interest on debentures to the income statement. The debenture document contains information regarding the rate of interest, repayment amount, and the time when the company has to repay the debenture.

However, it is more more due to the accrual conceptual inside auditing. However, it is more complex due to the accrual concept in accounting. Interest on debenture is a charge opposite to the profit of the enterprise and has to be paid whether the enterprise has acquired any profit.

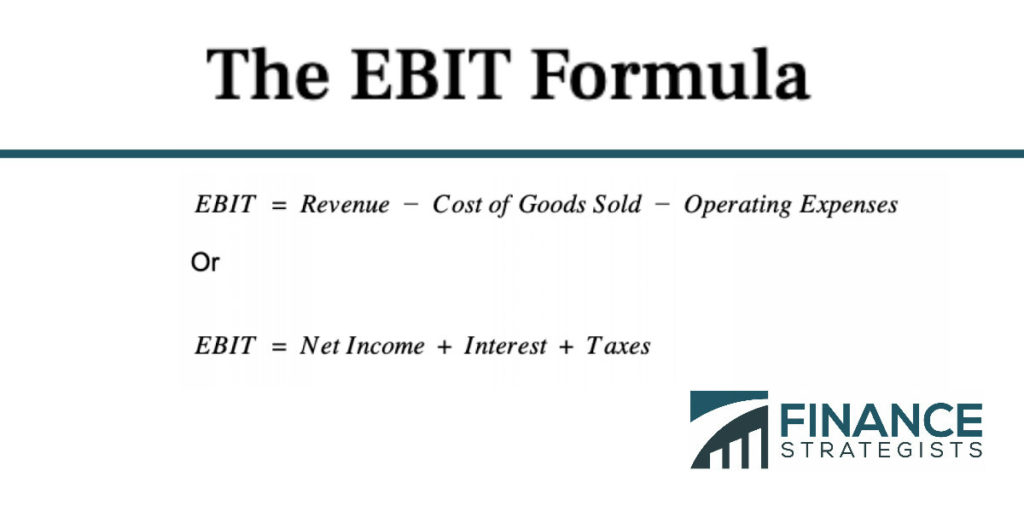

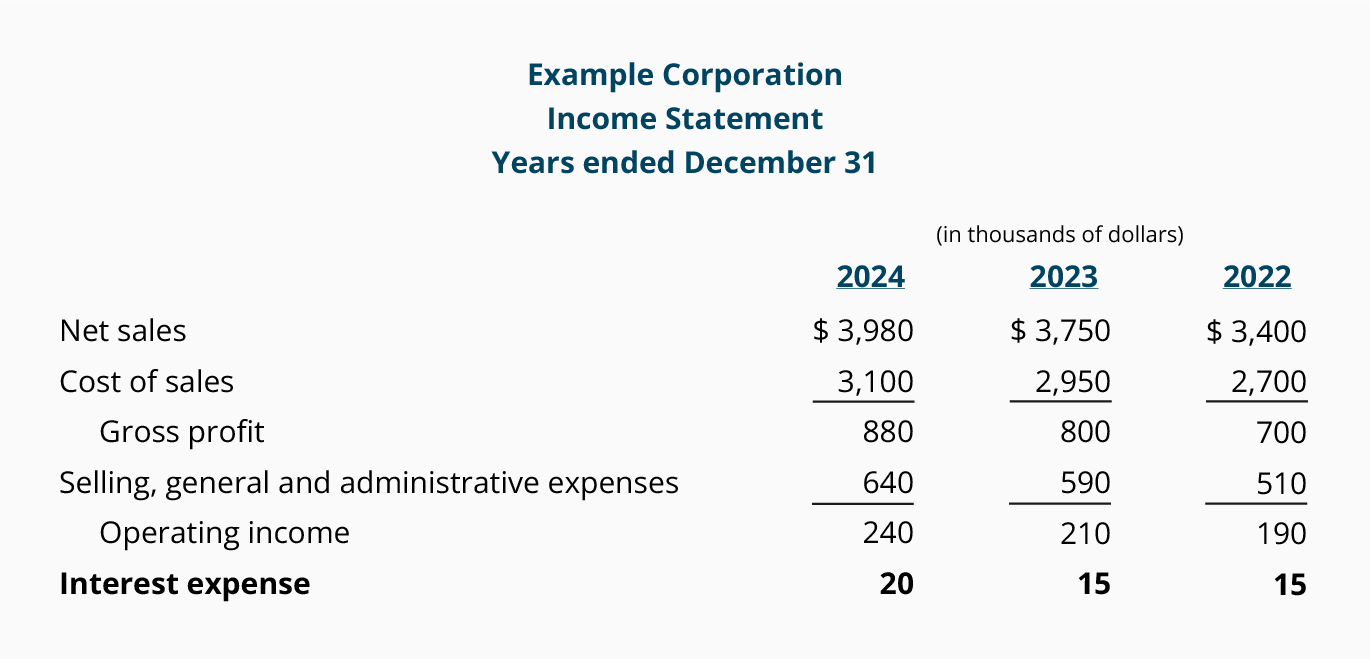

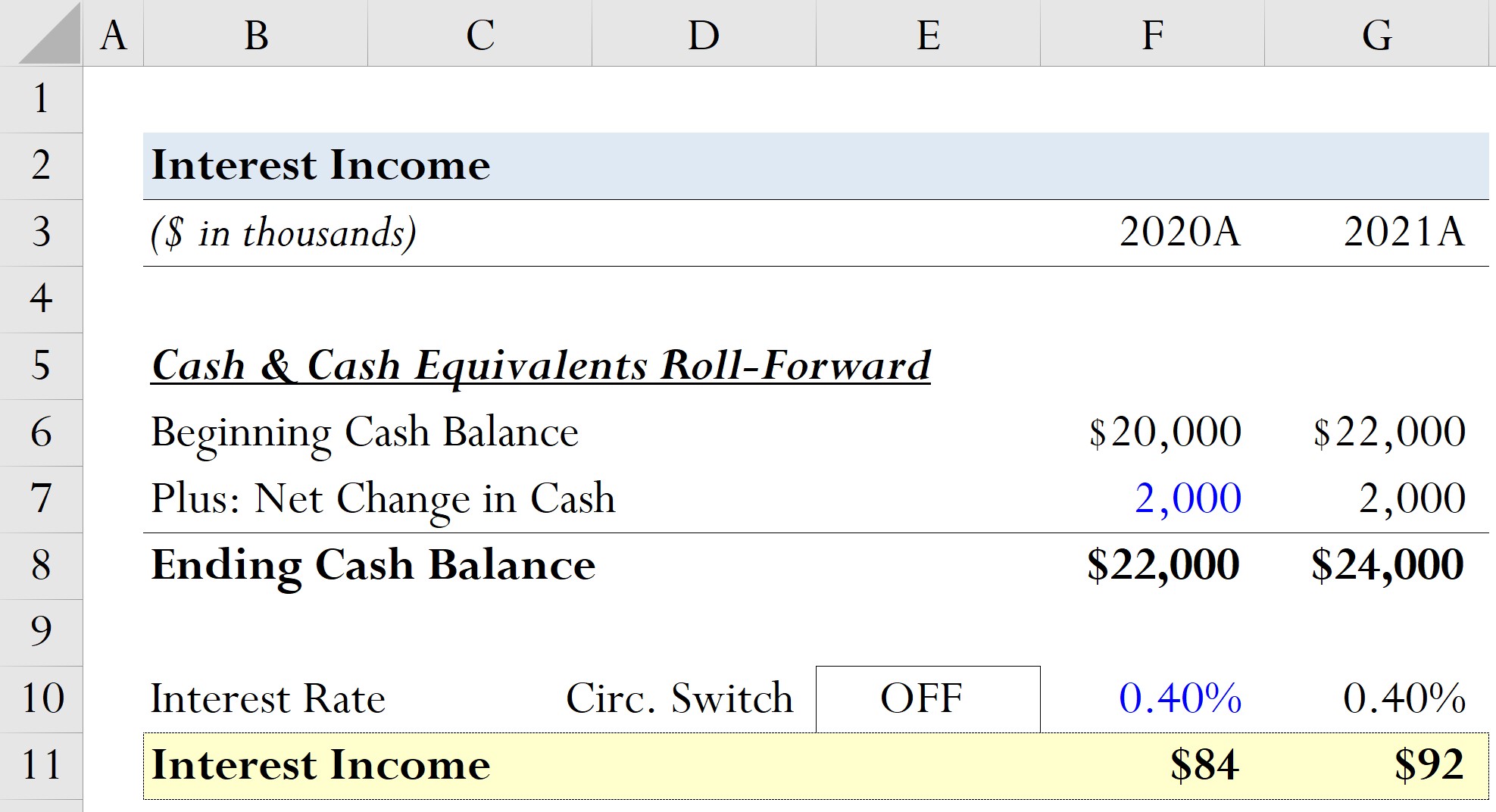

This interest is usually paid systematically at a predetermined interest rate based on the face value of the debentures. Interest expense = average balance of debt obligation x interest rate ebit and ebt interest is deducted from earnings before interest and taxes (ebit) to arrive at earnings before tax (ebt). If any of the interest for the year has not yet been paid then it is an accrual and appears as a current liability in the statement of financial position.

At the end of the lending period, issuing companies may redeem the debentures at par, premium or at a discount. Points to remember for interest on debentures: Interest on debentures is an income for the company but it's not from the main operation of the company, so it is shown as other income in statement of profit and loss.

Since, debentures are a liability. In simple terms, interest can be defined as an award where all the holders of the debentures receive the interest for investing in the company’s debentures. This is known as tds (tax deducted at source).

On transfer of interest to statement of profit and loss at the end of the year: When interest is due and tax is deducted at source: When you invest in an enterprise's debentures, you're rewarded with an interest payment.

To bank a/c (being interest amount paid to debenture holders) interest on debentures transferred to statement profit and loss. As with all expenses, in the statement of profit or loss we show the full expense for the year. To income tax payable a/c to debenture holders a/c (being interest on debentures made due and the income tax deducted as source) entry for interest being paid to debenture holders debenture holders a/c dr.

The interest on debentures is a charge to the profit of the company. Debentures represent a company's formal debt obligation, commonly issued to raise capital. Income received in advance (i.e.

What is interest on debentures? There are no legal restrictions on. They involve investors lending money to the issuer in exchange for regular interest payments and the return of the principal upon maturity.

![[SOLVED] The statements of financial position, cash flows, Course Eagle](http://courseeagle.com/images/the-statements-of-financial-position-cash-flows-income-and-movements-124859-1.jpg)

:max_bytes(150000):strip_icc()/minority-interest-income-statement-5954ad873df78cdc29246f3d.jpg)

![[SOLVED] The following trial balance was extracted from Course Eagle](https://www.courseeagle.com/images/the-following-trial-balance-was-extracted-from-the-books-of-old-nv-124855-1.jpg)