Matchless Info About S Corp Profit And Loss Statement Restaurant Balance Sheet Template

Subchapter s (s corporation):

S corp profit and loss statement. A profit and loss statement and a balance sheet: When the shareholder reports s corp losses and deductions, they are initially used to reduce stock basis. A subchapter s (s corporation) is a form of corporation that meets specific internal revenue code requirements, giving a corporation with 100 shareholders or less the.

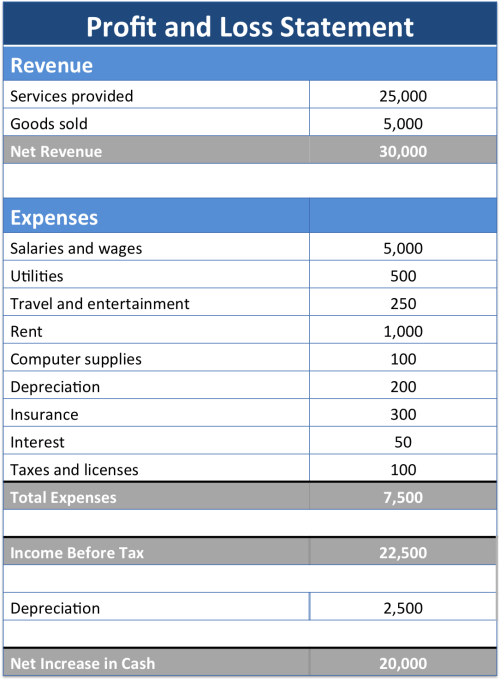

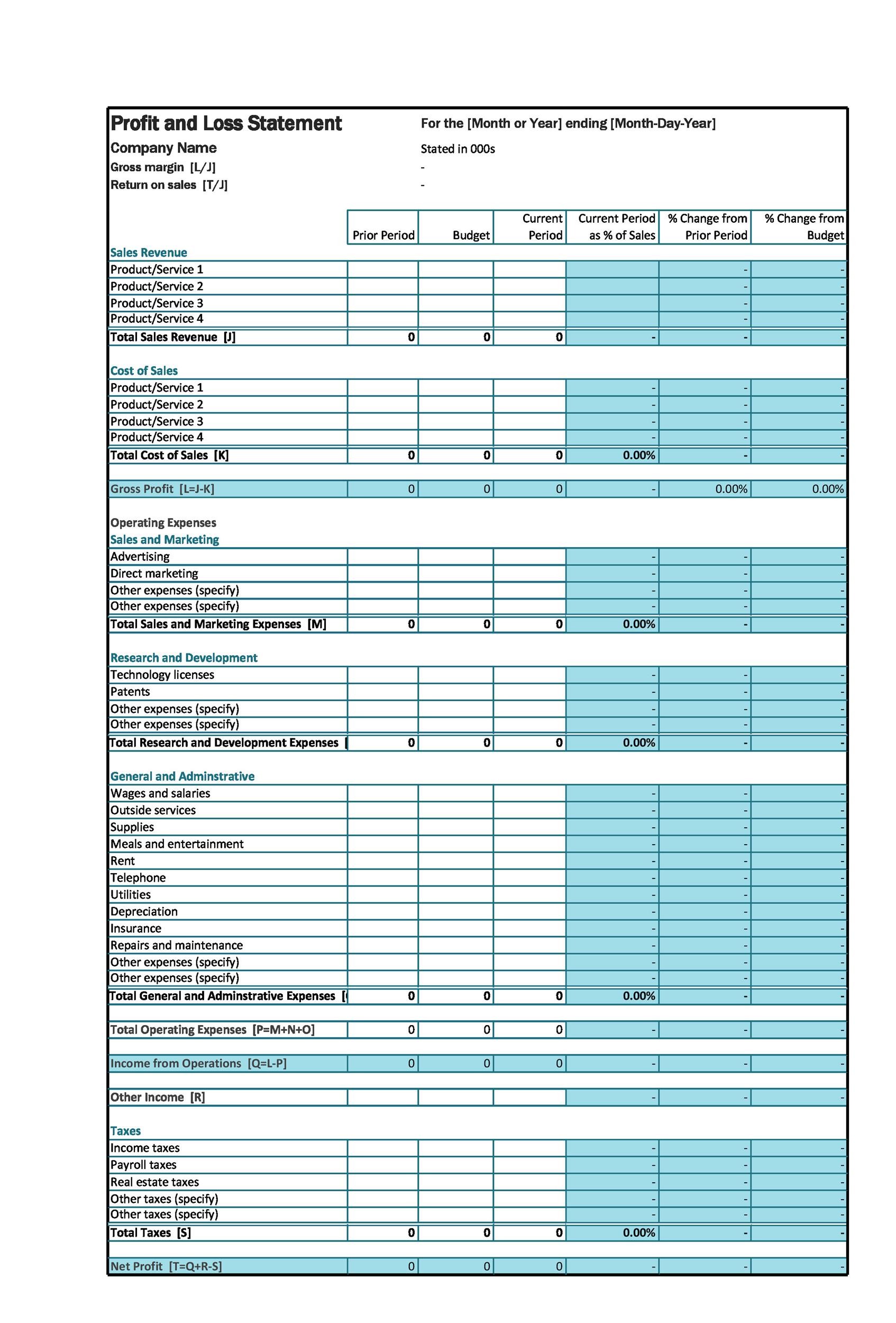

If the statement reveals the amount of revenue is higher than your expenses, your business is profitable; A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. However, the latter is not reduced if the debt in question was forgiven, discharged, or satisfied during the corporate tax year.

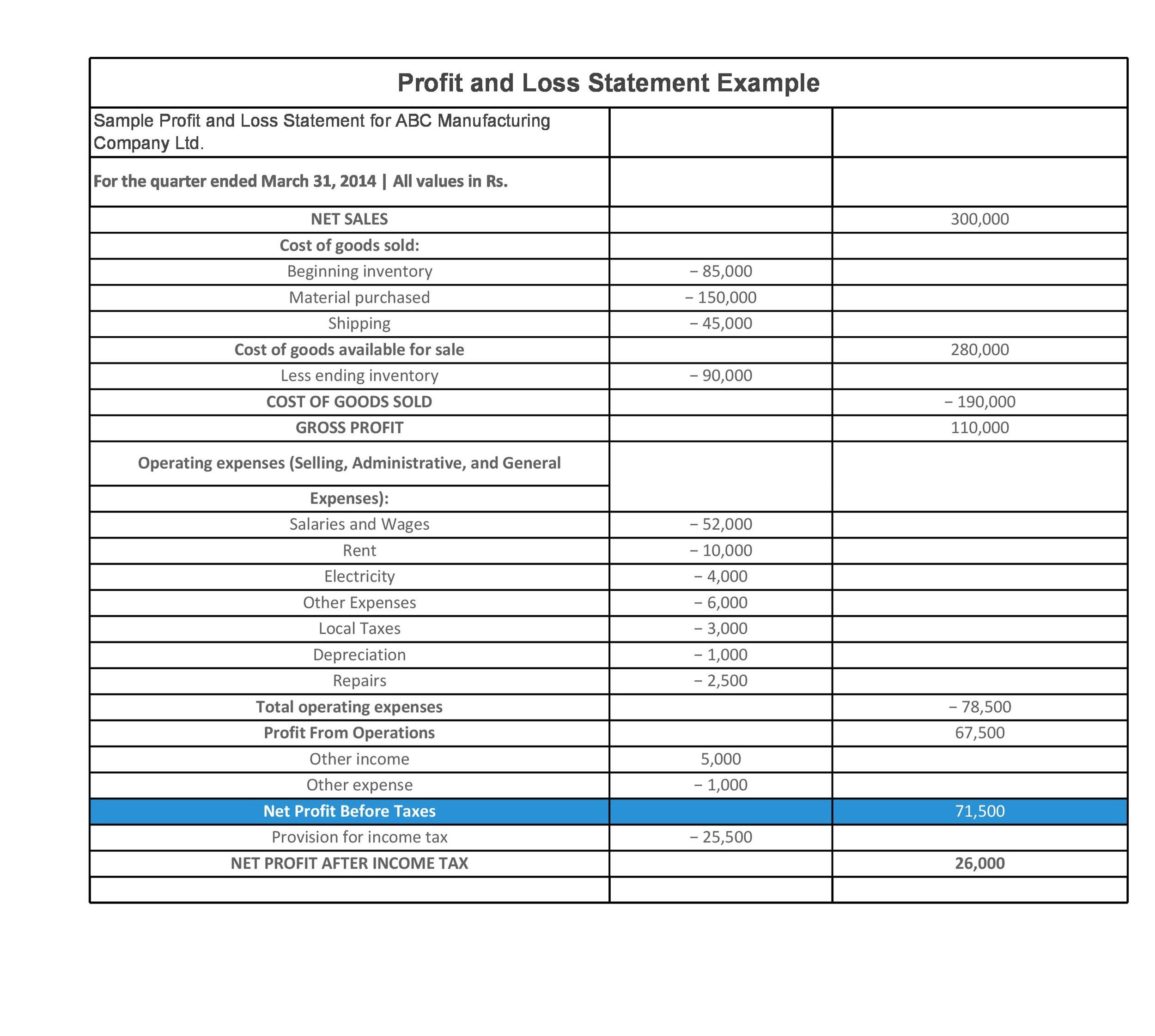

You’ll indicate on the form whether you use cash or accrual accounting. If an s corporation with two equal shareholders loses $200,000, each shareholder reports a $100,000 loss from the s corporation on his or her personal return. A sample profit and loss statement demonstrates a company’s ability to make money, drive sales, and control costs.

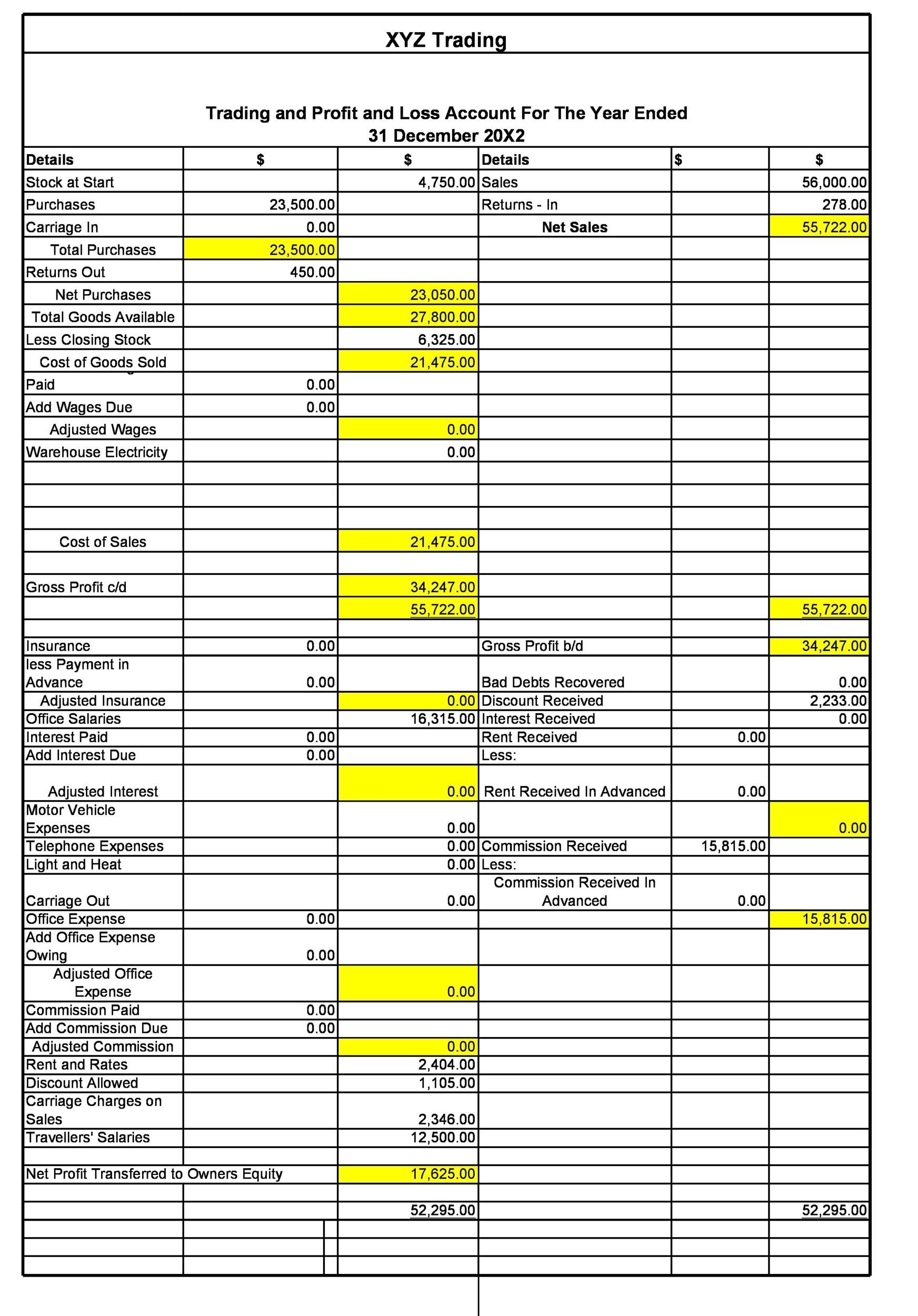

The difference is the balance sheet provides a. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. What is the profit and loss statement (p&l)?

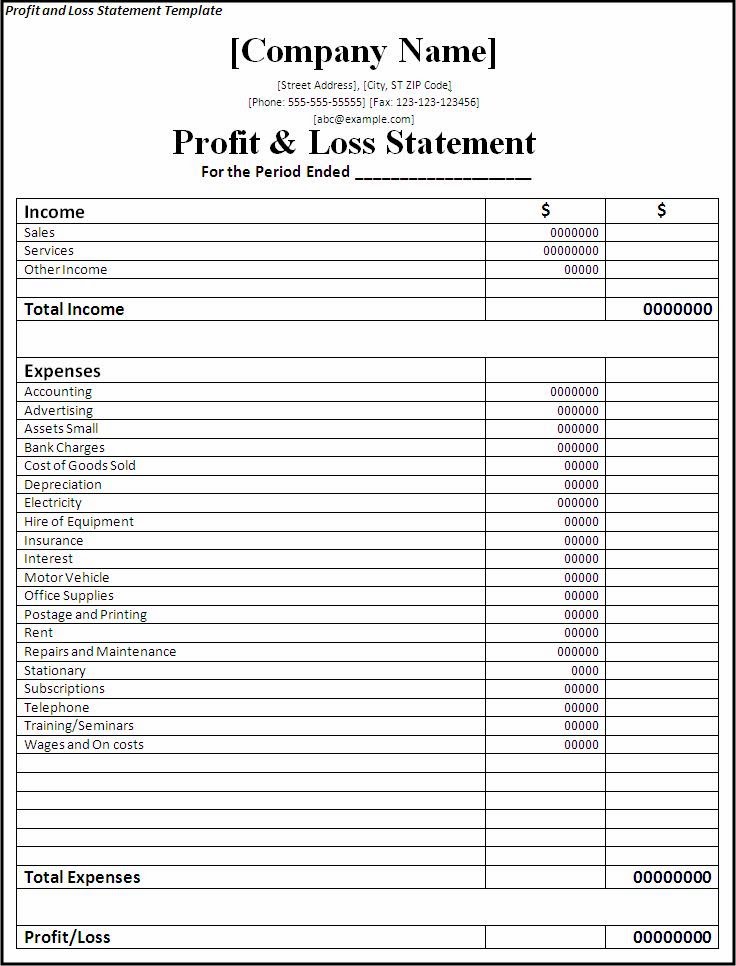

A profit and loss statement template, sometimes referred to as a p&l template or income statement, is a financial report that lists a company’s costs, income, and profits for a given period. Get your profit and loss statements to your tax preparer as soon as possible in january. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Creating one is a standard way to compile historical data for your business to tell its financial story over time. The result is either your final profit (if.

Once stock basis is eliminated, additional losses are applied to the debt basis. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. An s corporation reports total income and expenses at the company level and passes through a share of net profit or loss to its individual shareholders.

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to the company's total costs and expenses. You’ll sometimes see profit and loss statements called an income statement, statement of operations, or statement of earnings.

These templates are created based on. In order for the shareholder to claim a loss, they need to demonstrate they have adequate stock and/or debt basis. A couple of tips, however, about generating this profit and loss statement should be made.

A p&l statement is similar to a balance sheet. It’s usually assessed quarterly and at the end of a business’s accounting year. It shows your revenue, minus expenses and losses.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)