Marvelous Tips About Financial Statements Not Prepared On A Going Concern Basis Sample Balance Sheet Excel

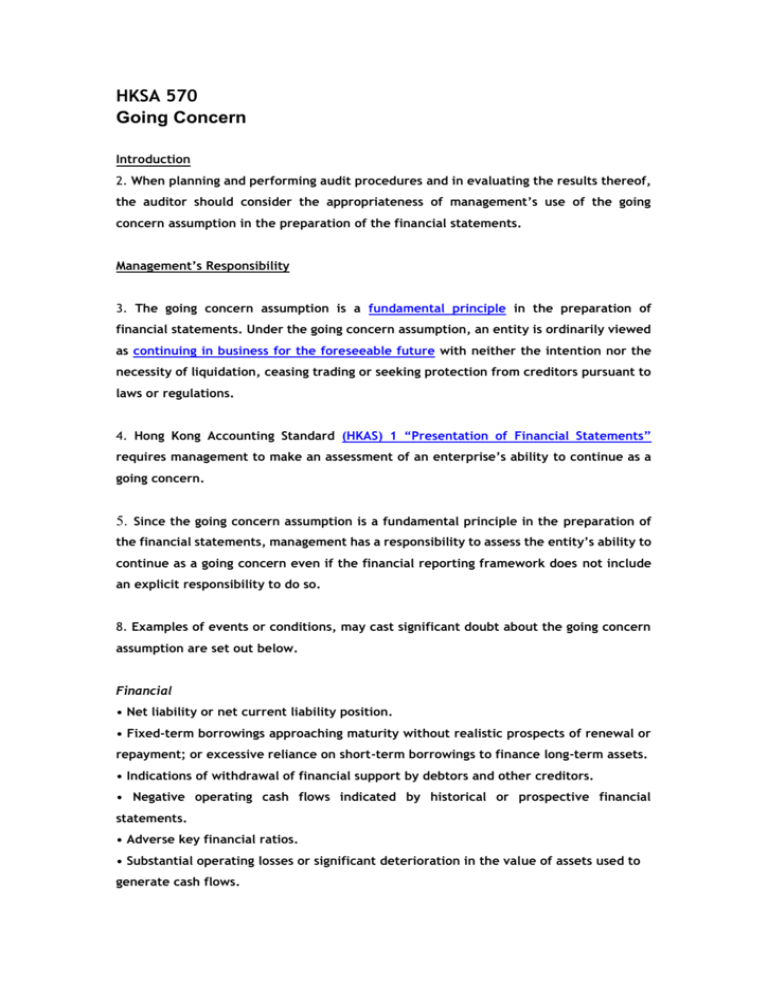

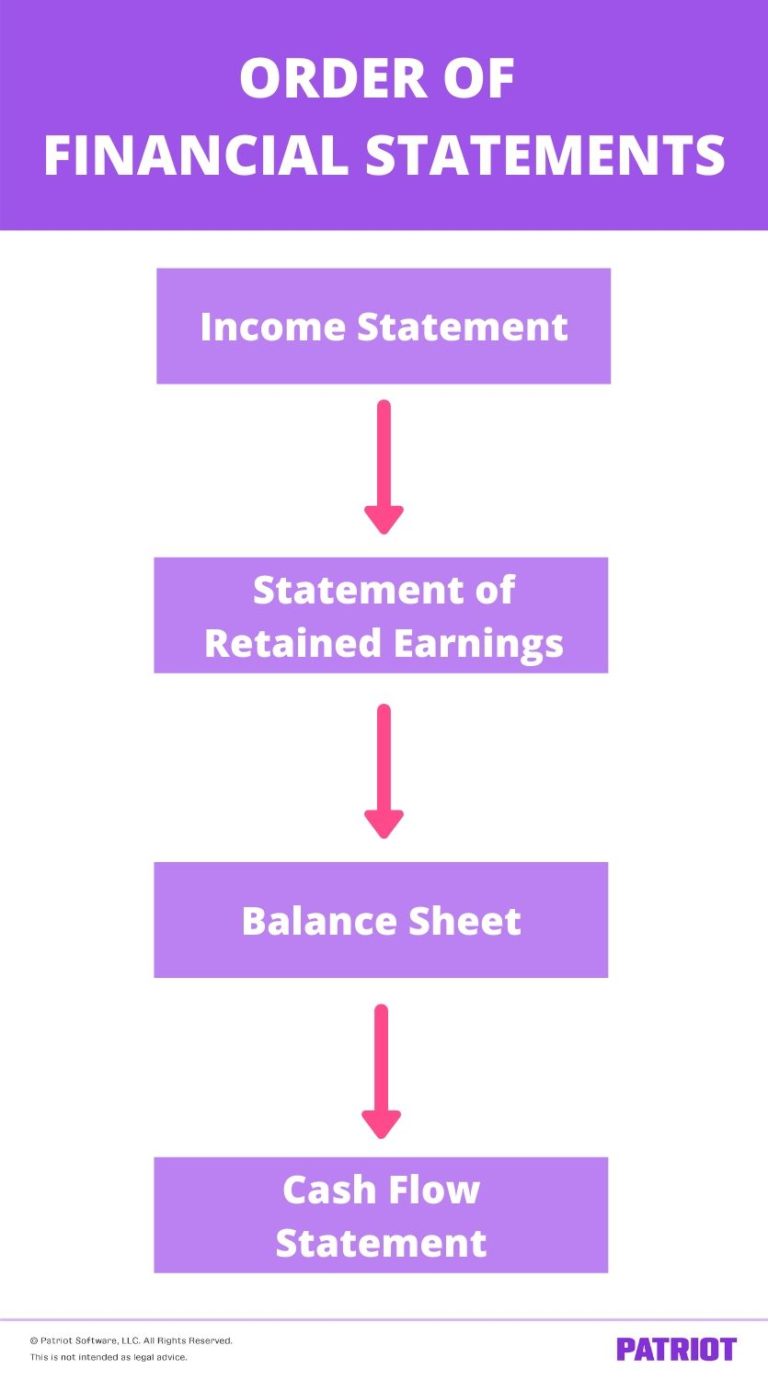

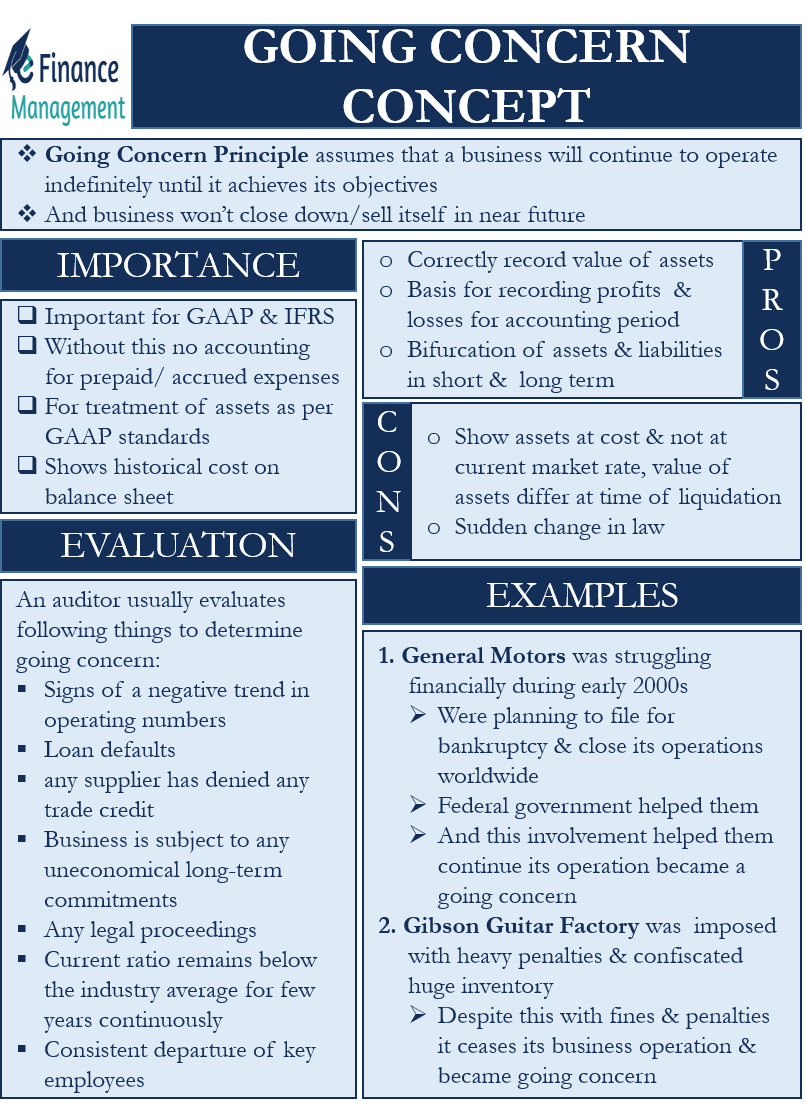

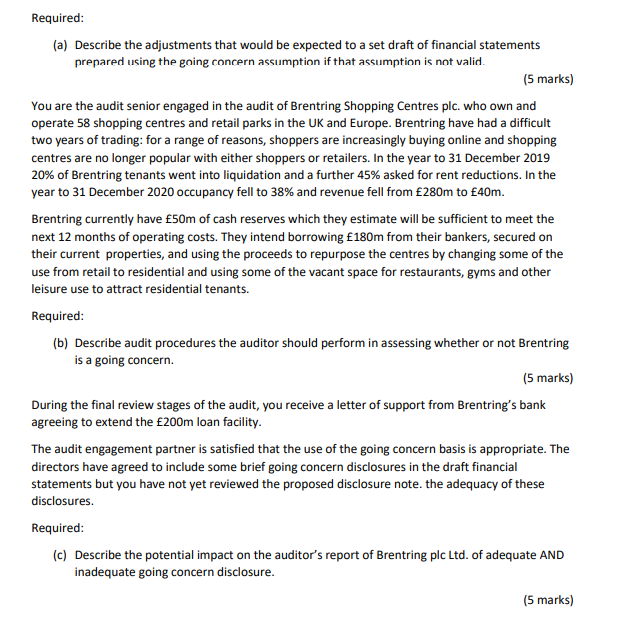

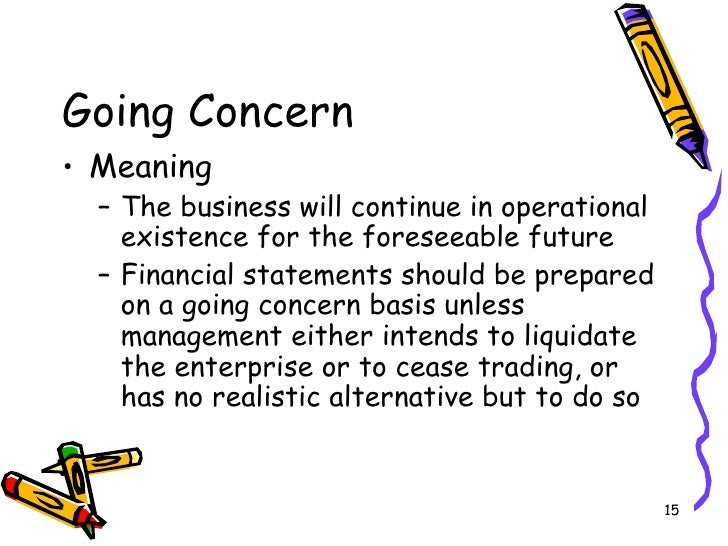

The financial statements are normally prepared on the assumption that an entity is a going concern and will continue in operation for the foreseeable future.

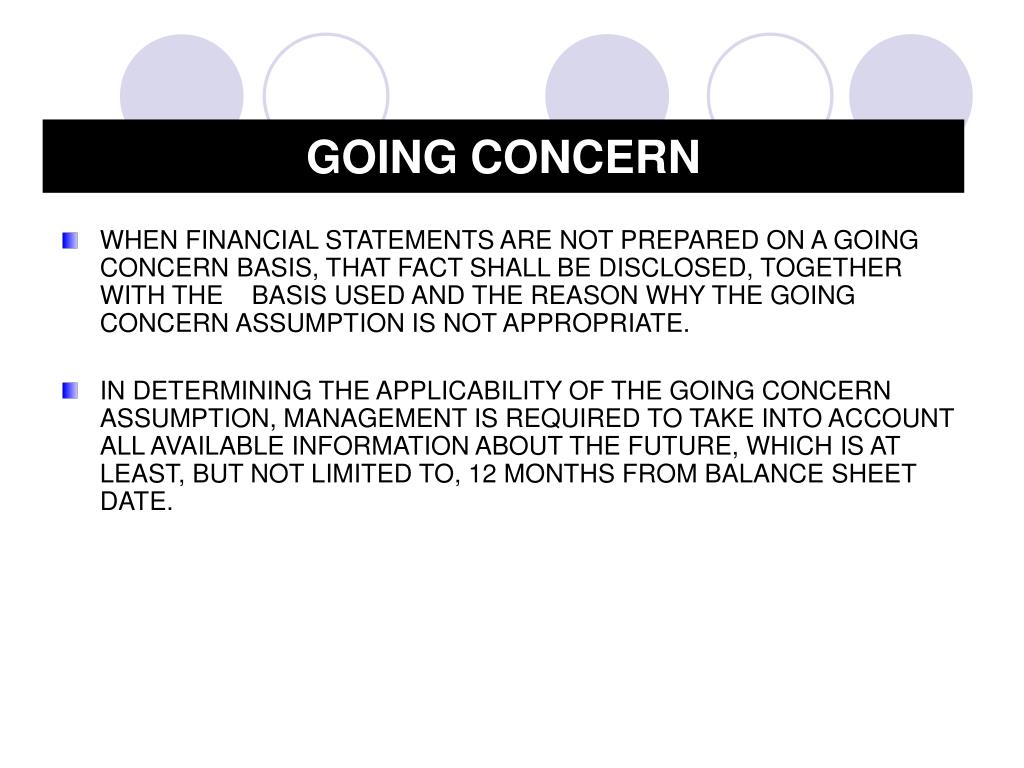

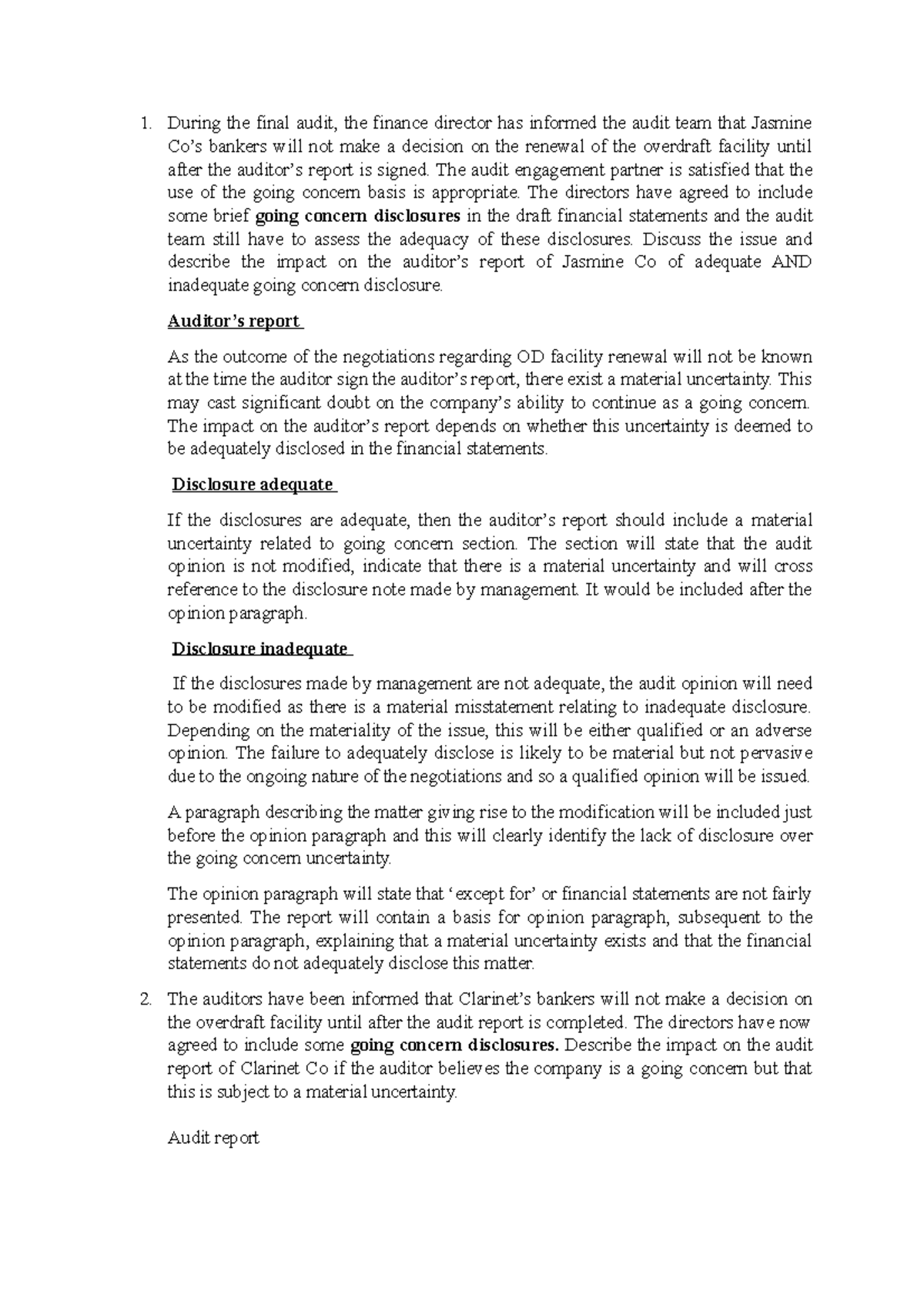

Financial statements not prepared on a going concern basis. In order to avoid the entity’s credit rating suffering any further decline, the directors have refused to make disclosures in the financial statements and have prepared the. In its february 2021 meeting, the committee discussed a submission asking firstly, whether an entity can prepare financial statements for prior periods on a going. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the.

Paragraph 14 of ias 10 states that ‘an entity shall not prepare its financial statements on a going concern basis if management determines after the reporting period either that it. That is, the financial statements must not be prepared on a going concern basis if, before they are authorised for issue, circumstances were to deteriorate so that. Going concern cannot prepare financial statements (including those for prior periods that have not yet been authorised for issue) on a going concern basis.

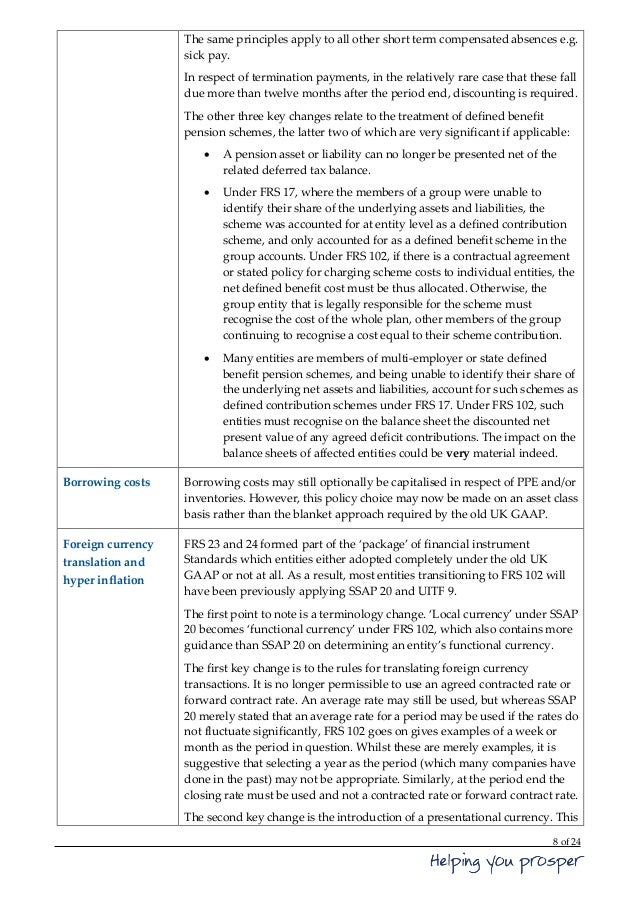

Ias 1 presentation of financial statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their. Ias 1.25 requires the entity to disclose this fact and the reasons. Ias 1 states 'when preparing financial statements, management shall make an assessment of an entity’s ability to continue as a going concern.

An entity shall not prepare its financial statements on a going concern basis if management determines after the. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no.

The committee members generally agreed with the conclusion that all of the three years’ financial statements described could not be prepared on a going concern basis. Paragraph 25 of ias 1 requires the entity to disclose the fact that the financial statements have not been prepared on a going concern basis and the reasons why the entity is. The financial statements should generally not be prepared on a break up basis but rather on a basis that is consistent with ifrs but amended to reflect the fact that the ‘going.

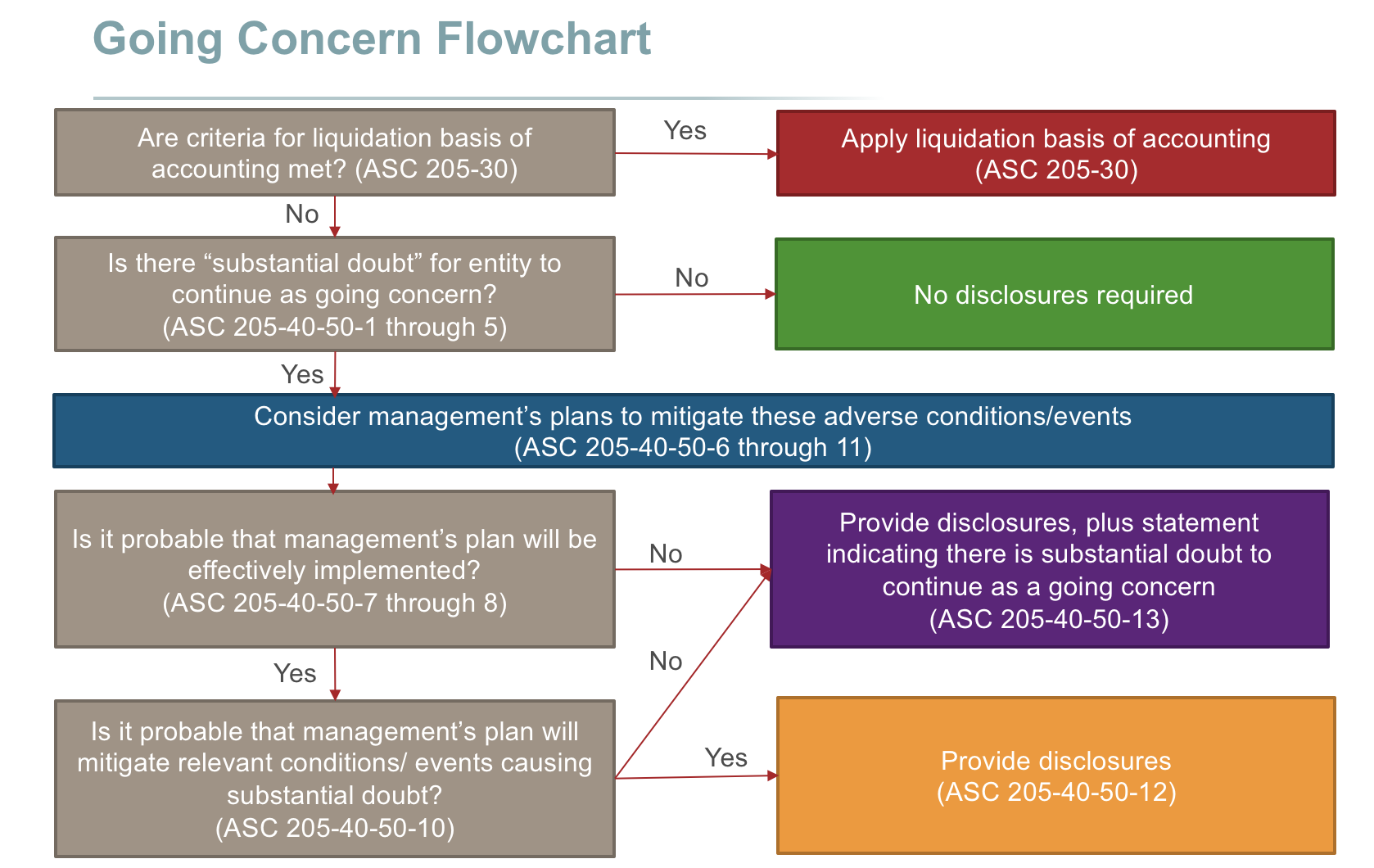

Similarly, us gaap financial statements are prepared on a going concern basis unless liquidation is imminent. If management conclude that the entity has no alternative but to liquidate or curtail materially the scale of its operations, the going concern basis cannot be used and the financial. Preparing financial statements when the going concern basis is not appropriate.

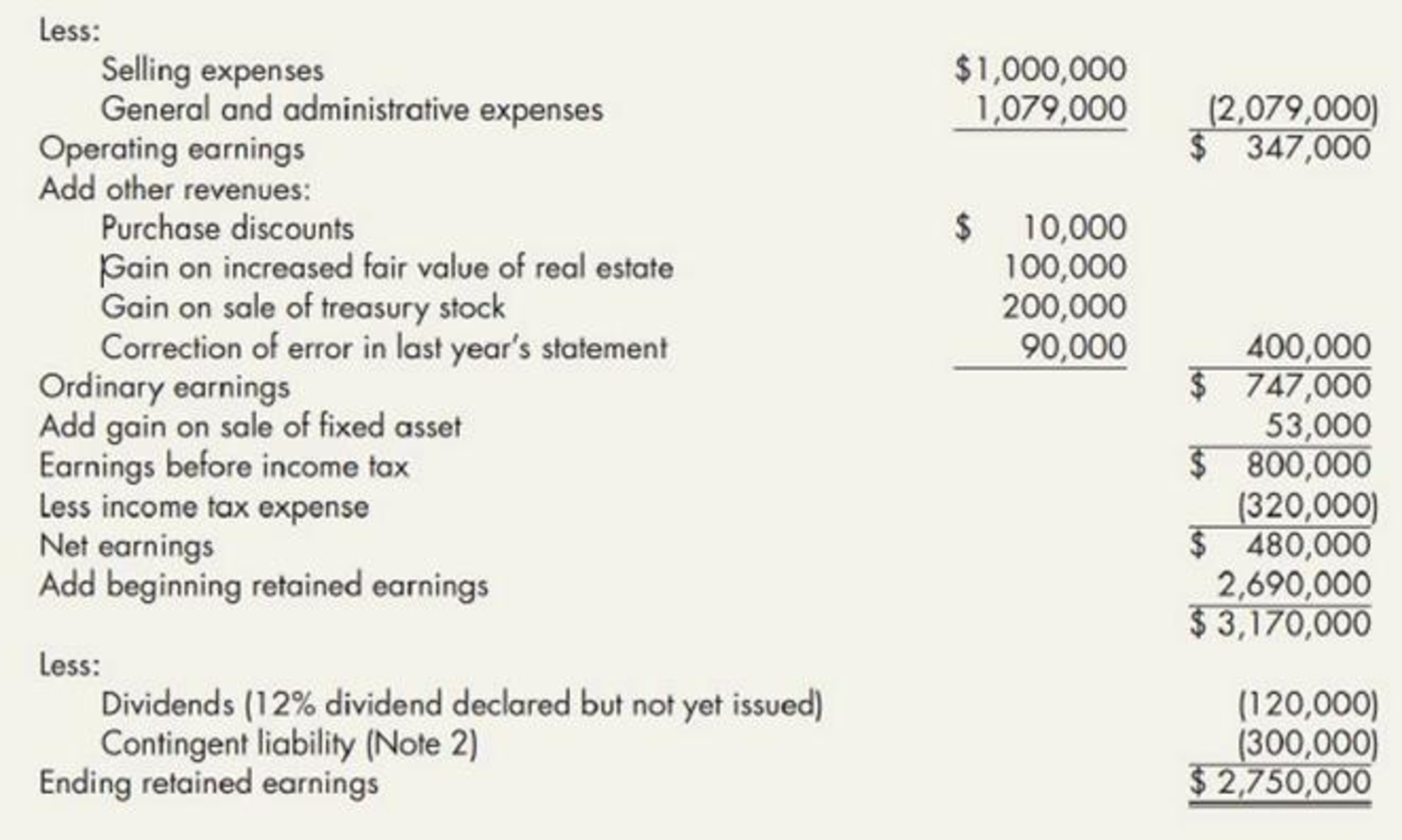

If the entity is not a going concern, the financial statements are required to be prepared on an alternate basis. This guide summarises management’s responsibilities for assessing going concern and the associated practical implications for financial reporting under ifrs. Presentation of financial statements.

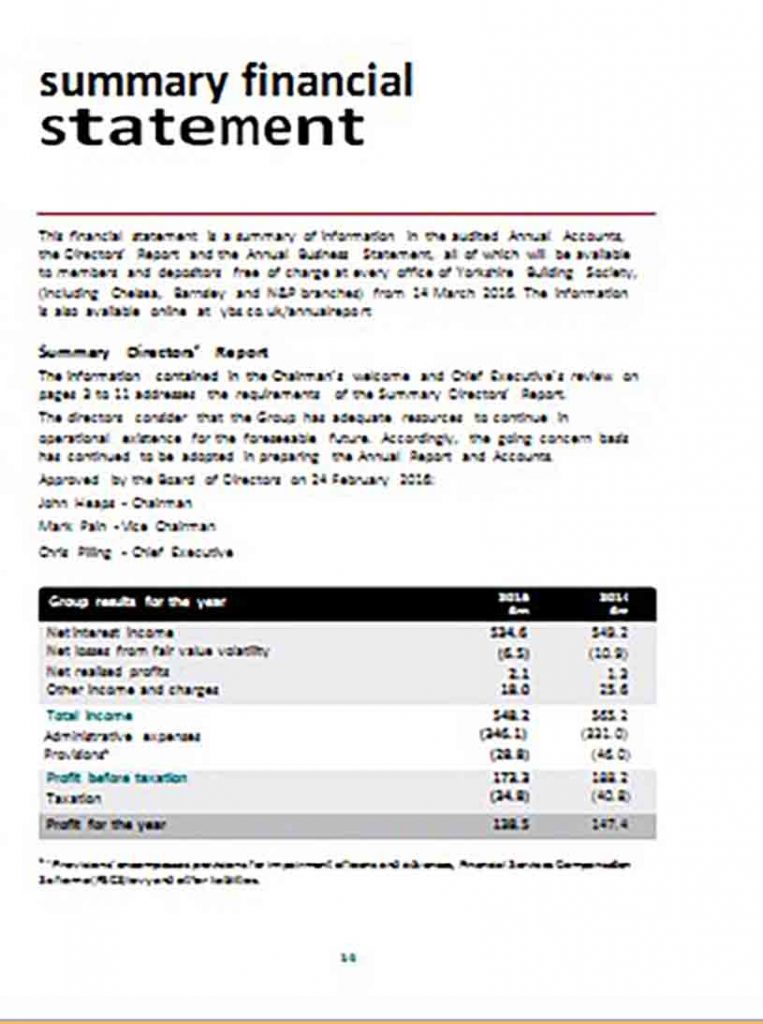

Presentation and consideration of annual activity reports and audited financial statements of kanifing municipal council for the years ended from 31. Both ias 1 ‘presentation of financial statements’ and ias 10 ‘events. In its february 2021 meeting, the committee discussed a submission asking firstly, whether an entity can prepare financial statements for prior periods on a going.

Applying paragraph 14 of ias 10, the entity can no longer prepare its financial statements on a going concern basis.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)