Divine Tips About Difference In Trial Balance Fasb Consolidated Financial Statements

Trial balance is a type of accounting report which is used to check.

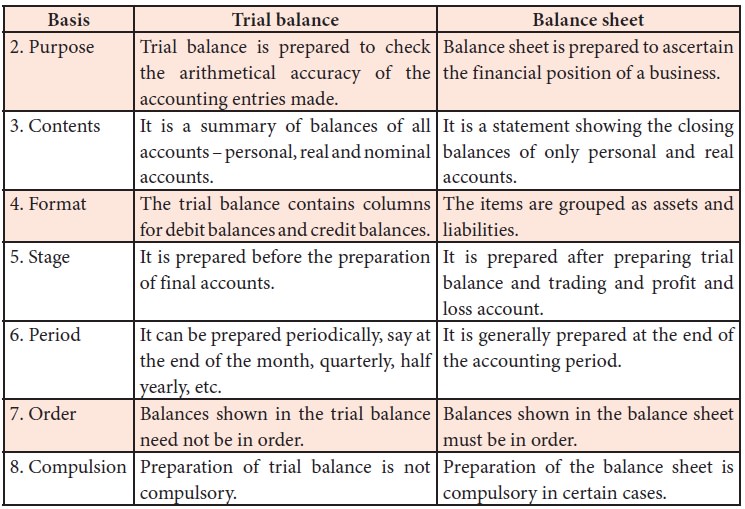

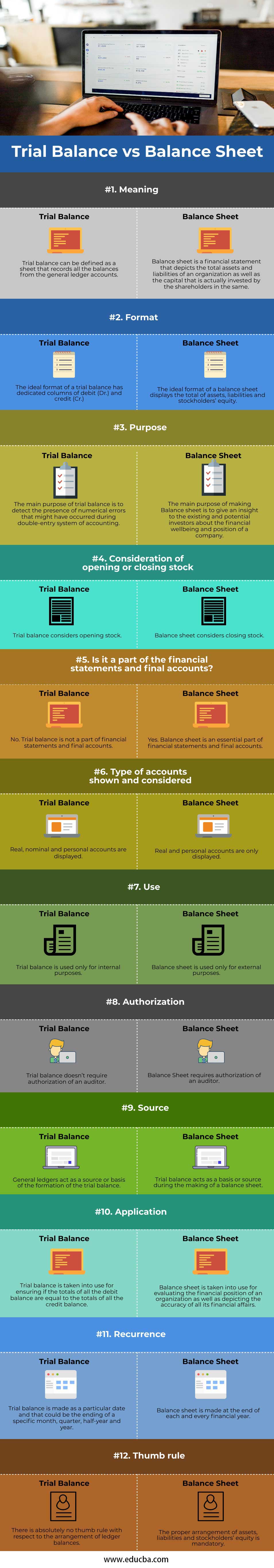

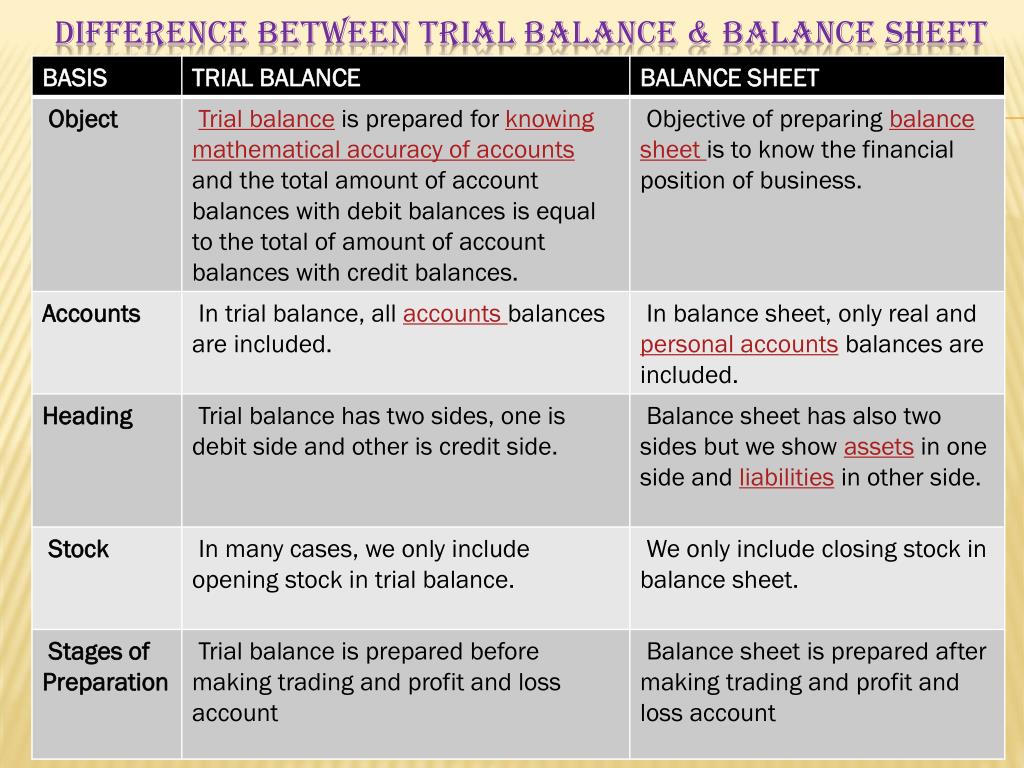

Difference in trial balance. Updated on march 14, 2023 fact checked why trust finance strategists? A trial balance is used to ensure that debits and credits are balanced, while a balance sheet shows a company’s financial position. The trial balance lists all of the accounts in the general ledger and their balances (or all of the.

Judge arthur f. Divide the difference by 2. The trial balance has a much more limited use, where the totals of all debits and credits are compared to verify that the books are in balance.

Balance sheet vs trial balance balance sheet 1. What is trial balance? A trial balance is an internal.

A trial balance includes a list of all general ledger account totals. It records both debit balance as well as credit. For example, some clinical trials showed that the balance improvement observed after balance training could be associated with fatigue reduction (17, 49).

A trial balance is an important step in the accounting process, because it helps identify. In addition, it should state the final date of the accounting periodfor which the report is created. A trial balance is an internal report that remains in the accounting department.

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their. In addition check through the trial balance to see whether the amount is included but missed from the column additions. Although ledger and trial balance are both integral parts of the same accounting cycle, there is still a considerable difference.

An unadjusted trial balance is a summary of the general ledger accounts before making any adjustments while the finished product is the adjusted trial balance. It is a statement that shows a detailed listing of assets, liabilities, and capital demonstrating the financial condition of a company. Trial balance is a statement that assembles the balances of all ledger accounts in a definite format.

Trial balance refers to a part of a financial statement that records the final balances of the. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit. Each account should include an account number, description of the account, and its final debit/credit balance.

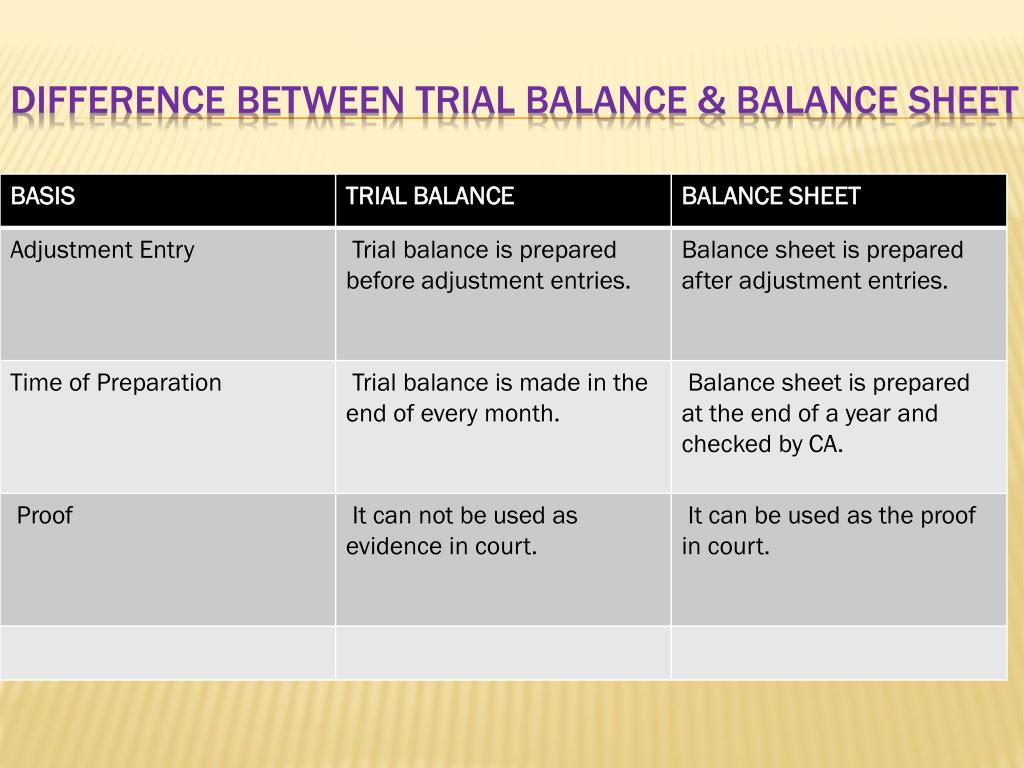

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Business finance difference between trial balance and balance sheet [with table] in the world of finance and accounting, there are two terms that hold.

![Difference between Trial Balance and Balance Sheet [With PDF] Trial](https://everythingaboutaccounting.info/wp-content/uploads/2021/03/Difference-between-Trial-Balance-and-Balance-Sheet-1-1024x536.png)