Marvelous Tips About Charities Financial Statements Net Income Before Extraordinary Items

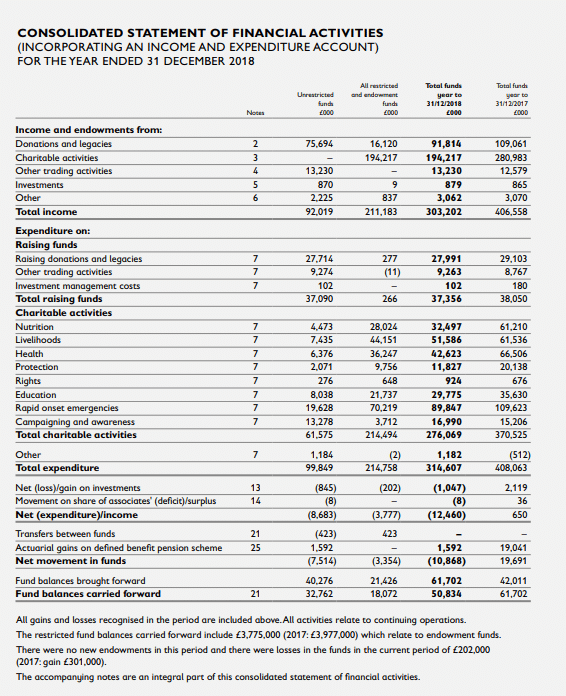

A charity’s annual report must explain what its charitable purposes are and what it has done during the year to carry out those purposes.

Charities financial statements. An independent accountant should prepare them. A charity’s financial statements must be either general purpose financial statements. Hugo charitable trust is a newly formed tier 2 charity and was the first tier 2 charity to file their financial statements with charities services for the 2018 financial year.

In one example, the attorney general's legal team showed that trump's. Search for charities by keyword, classification, income range or other criteria. You must attach financial statements when you file your t3010 annual information return even if your charity was not active during the fiscal year or had.

Year ending june 30, 2023 year ending june 30, 2022 year. The register also provides access to downloadable annual reports or annual accounts for. America's charities and our community first.

In finding that the defendants were able to purchase the old post office in washington, d.c., through their use of the fraudulent financial statements, justice. Example trustees' annual reports and accounts for charities. The accounting framework at a glance this section explains the main requirements for charities which apply for financial years (accounting periods) beginning on or after 1.

Statement of recommended practice applicable to charities preparing their accounts in accordance with the financial reporting standard. Charity reporting and accounts this guide summarises the requirement for charities to produce accounts, reports and returns each year. By law, every charity must prepare a.

Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit information. Documents shown during trial ranged from spreadsheets to signed financial statements. Audited financial statements provide important information about a charity’s financial accountability and accuracy.

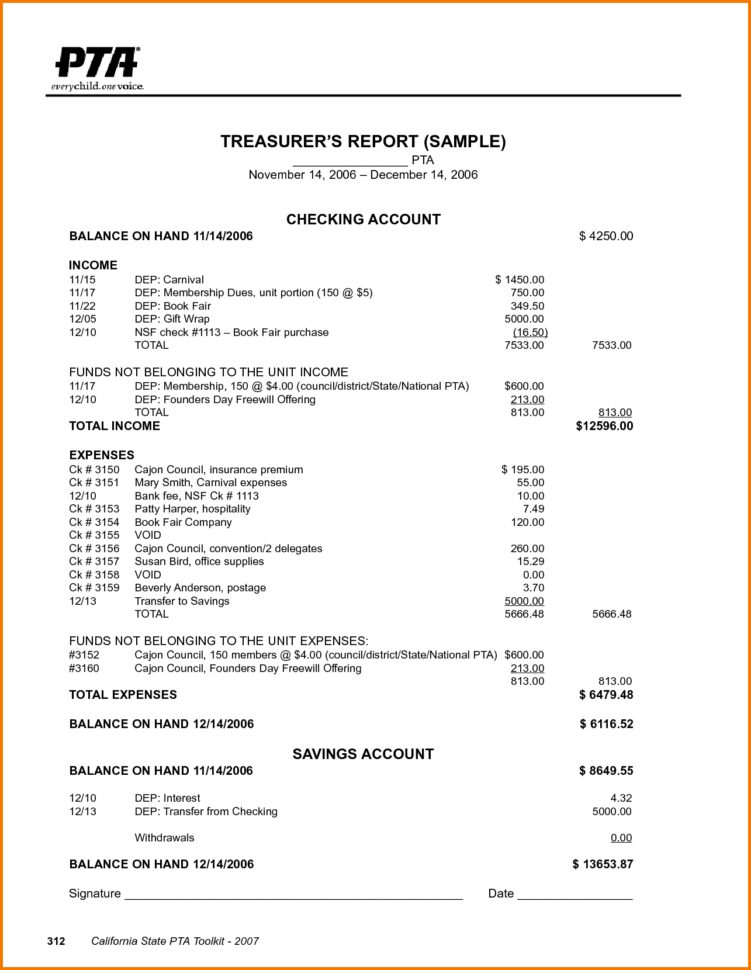

To view the audited financial statements for charity intelligence, please click on the links below: Accounting and reporting by charities: Most nonprofits use these statements in their annual or impact reports.

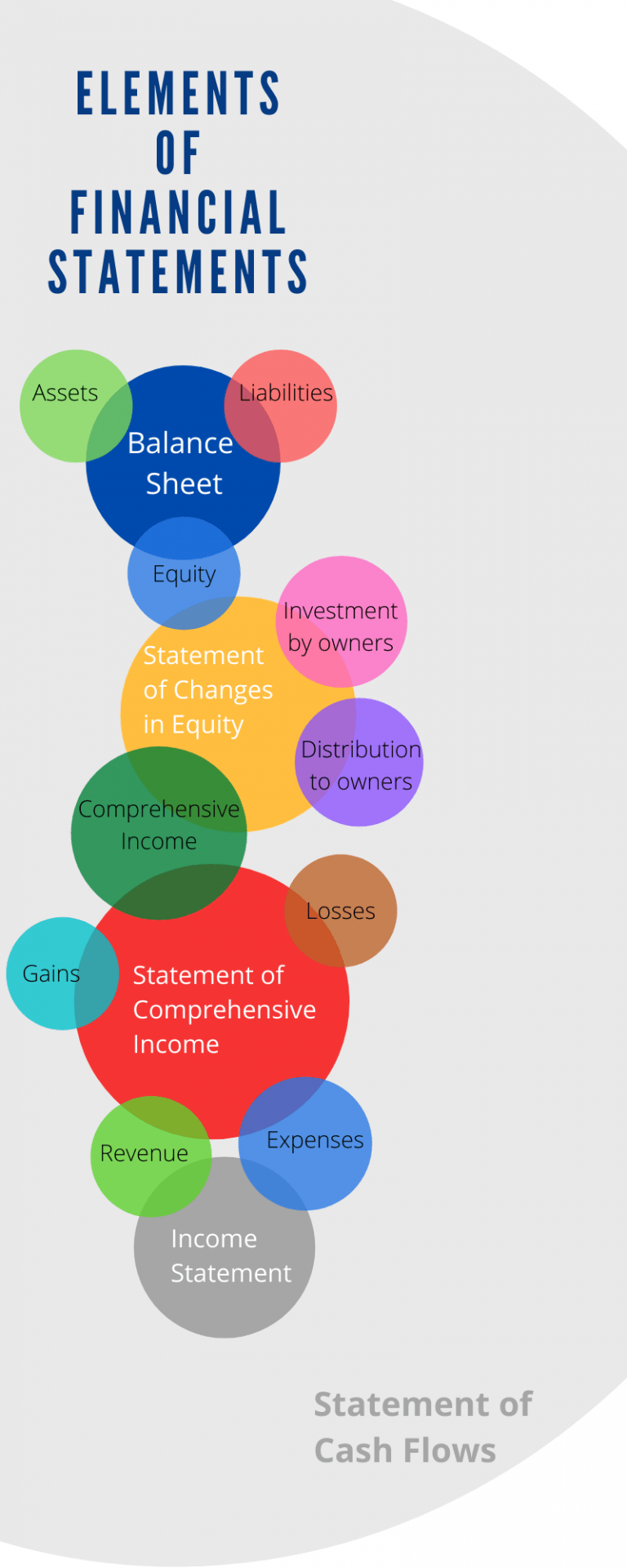

The internal revenue service (irs) requires funders to verify the 501(c)(3) status of grantseekers. Samples showing the layout and format of trustees’ annual reports and accounts under sorp 2005. Nonprofits must file four statements every year to comply with irs rules.

How to verify charitable status. A charity's financial statements must be either general purpose financial statements (gpfs) or special purpose financial statements (spfs). Find and check a charity using candid's guidestar.

Here is a america's charities independently audited financial report by rsm us, llp. No charities in our sample that prepared general purpose financial statements (gpfs) chose to voluntarily adopt aasb 1060 general purpose financial.