Divine Info About Balance Sheet Should Be Prepared Cash Budget Excel

It provides a snapshot of the company’s.

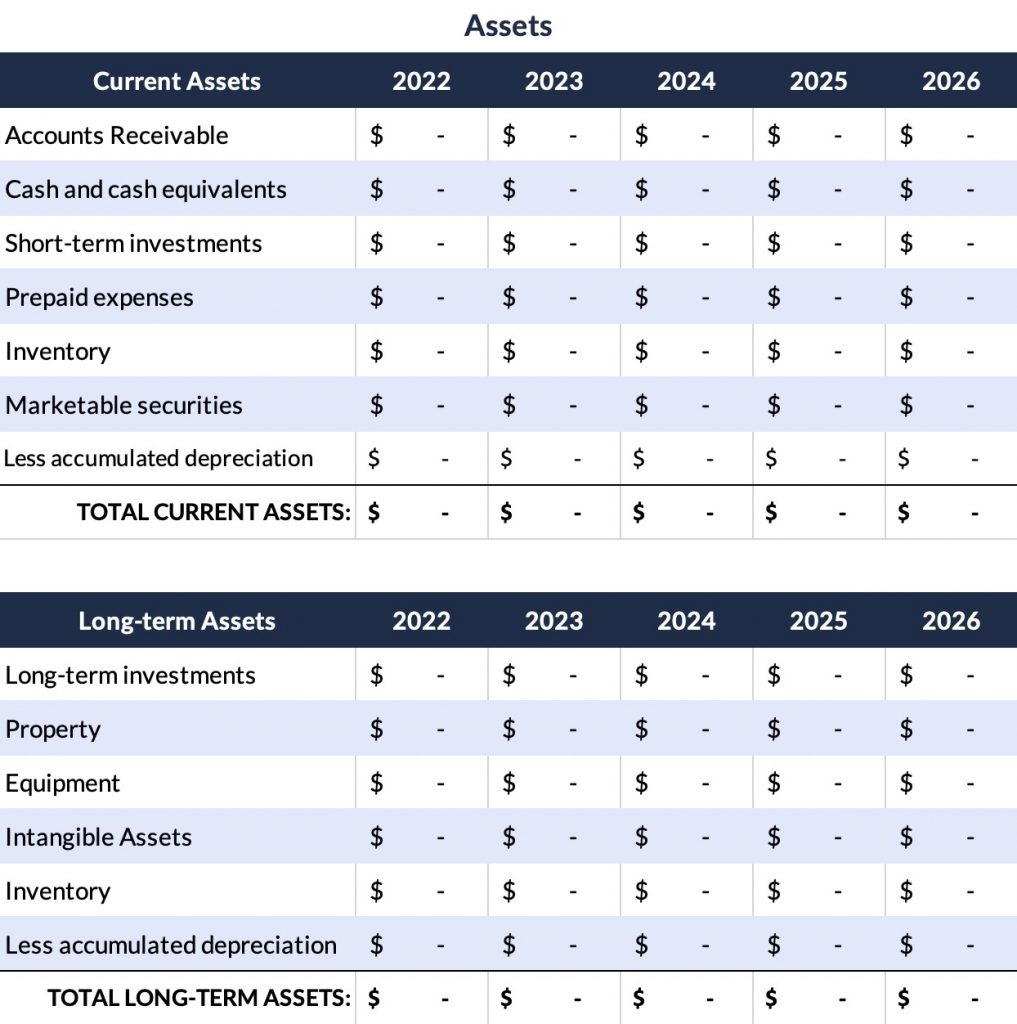

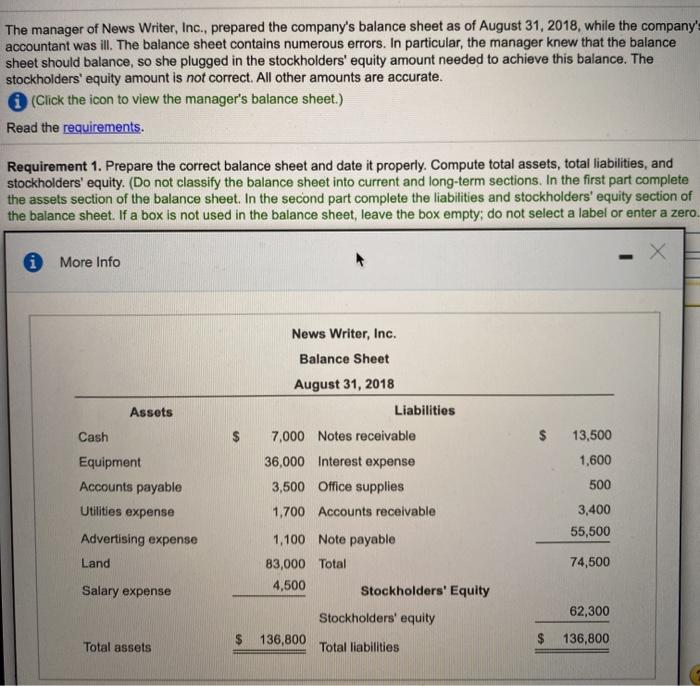

Balance sheet should be prepared. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. Even monthly balance sheets are also prepared. Accounting questions and answers.

The auditor of the company then subjects balance sheets to an audit. The balance sheet is prepared in order to report an organization's financial position at the end of an accounting period, such as midnight on december 31. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

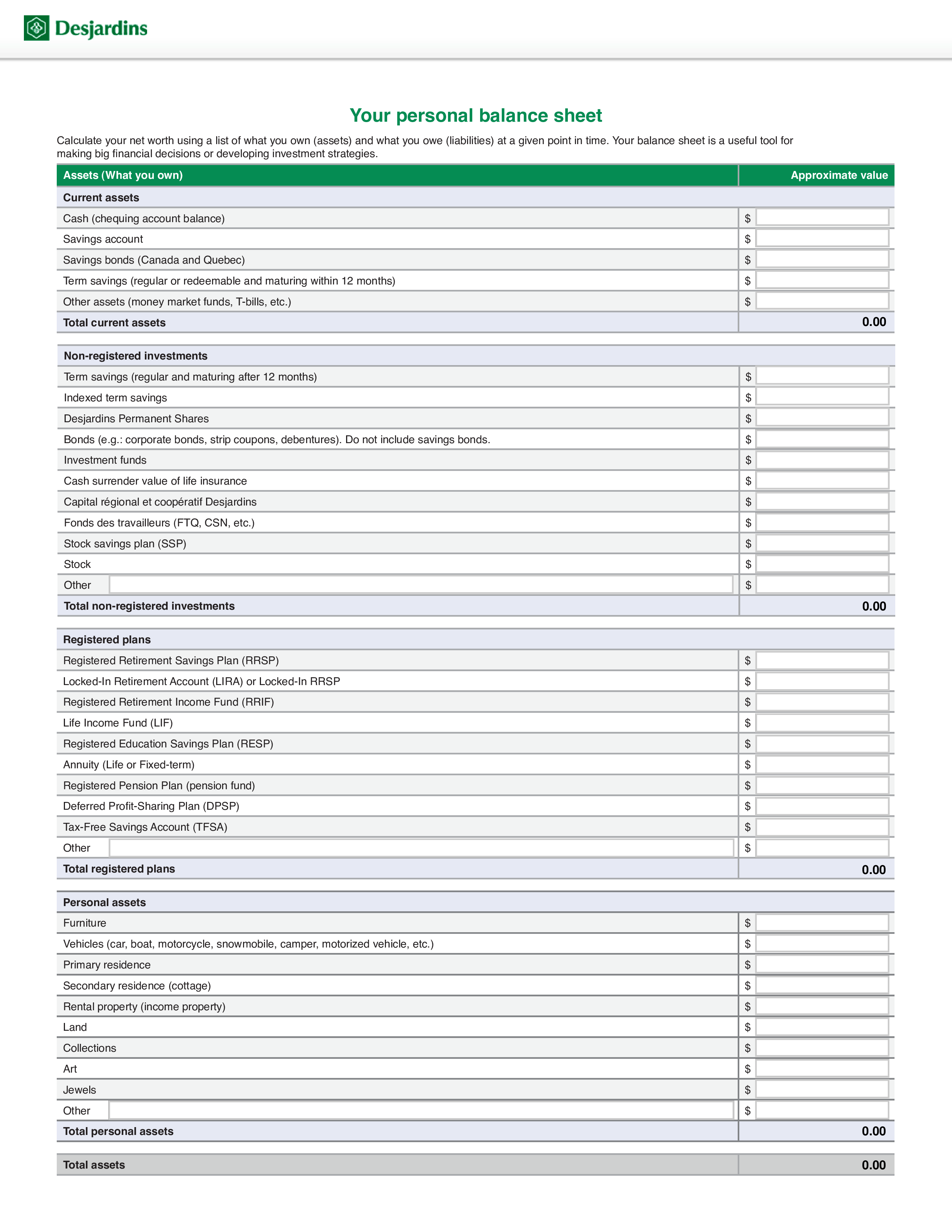

It is made for use within the company. A balance sheet includes a summary of a business’s assets, liabilities, and capital. The balance sheet is organized into two sections, namely:

The balance sheet should be prepared. Line 1 is the firm’s cash account. After the income statement and the statement of owner's equity.

The preparation of the balance sheet is on the same pattern as of the trade entities. The report can be used by business owners, investors, creditors, and. Follow this guide for preparing a balance sheet.:

It depicts liabilities and assets as during the end of the year. The balance sheet should be prepared a. A balance sheet is one of the financial statements of a business that shows its financial position.

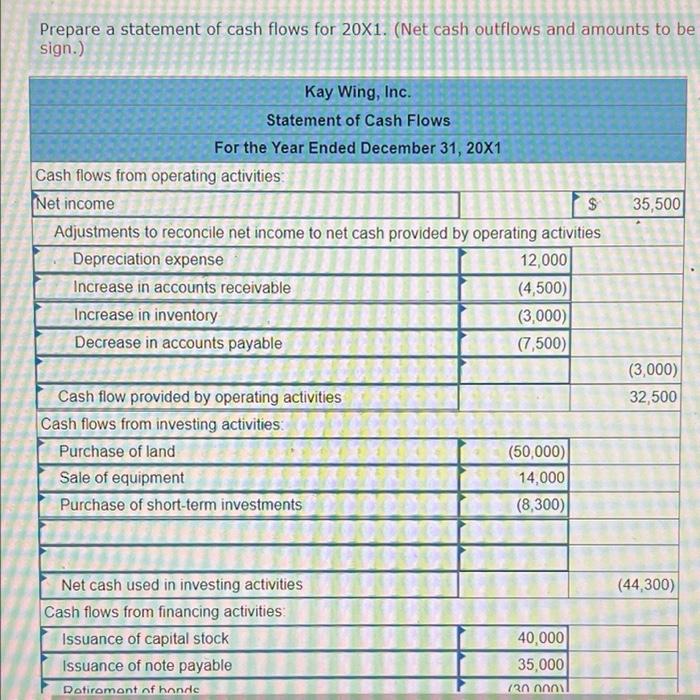

To begin, we look at the accounting records and determine what assets the business owns and the. The three financial statements are: After the income statement and before the.

The frequency of preparation depends on the volume of business and financial reporting patterns of any. It is made for the. As a general rule, the total assets of your company should always.

Let’s create a balance sheet for cheesy chuck’s for june 30. The balance sheet is prepared by the management of the company. Each of the financial statements provides important financial.

The balance sheet is a financial statement that is an important component of a company’s final account. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Before the income statement and after the statement of stockholders' equity b.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)