Outrageous Tips About Profit And Loss Account Is Also Known As Define The Term Trial Balance

P&l statements are also referred to as a (n):

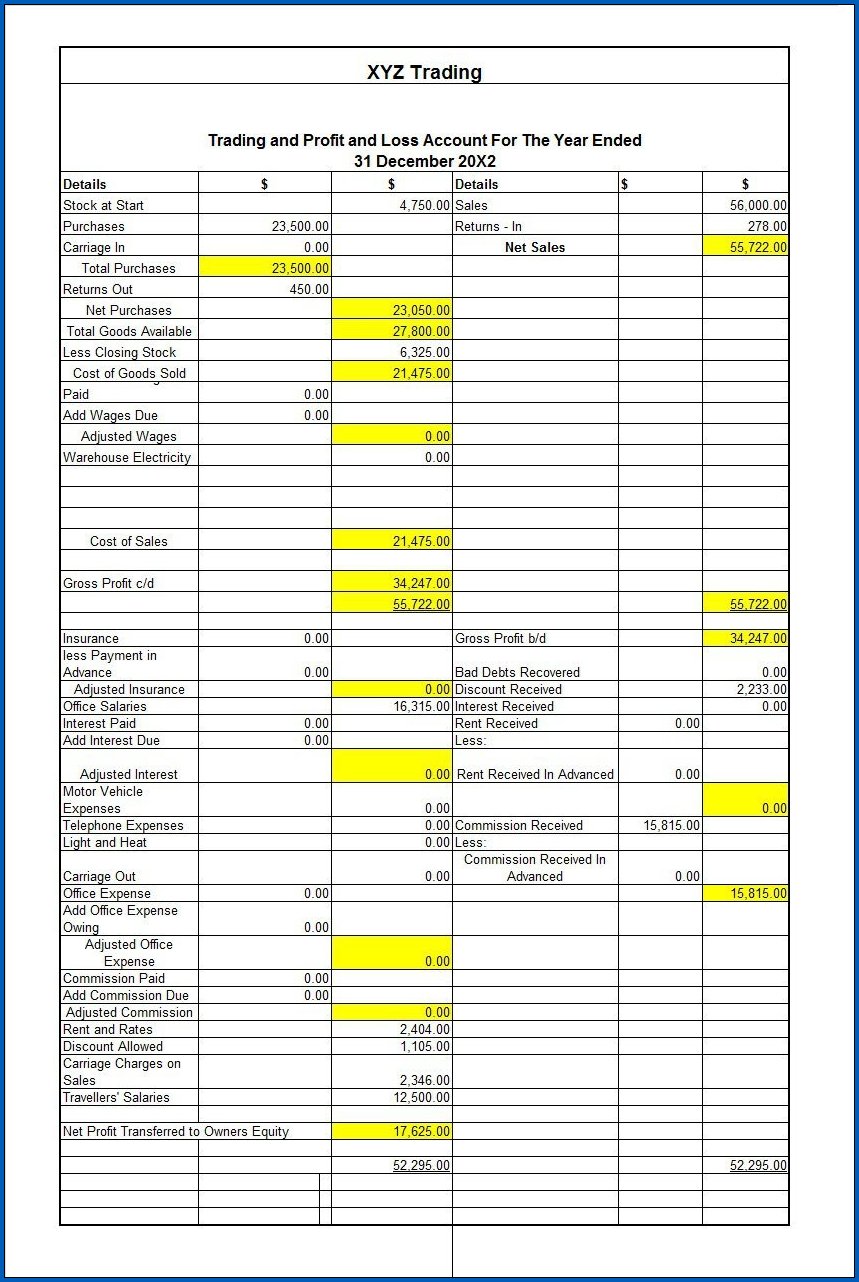

Profit and loss account is also known as. A company’s p&l is complemented by its. Also known as a profit and loss account or p&l, a profit and loss statement calculates your business’s net profit or loss for a period of time. It is prepared to determine the net profit or net loss of a trader.

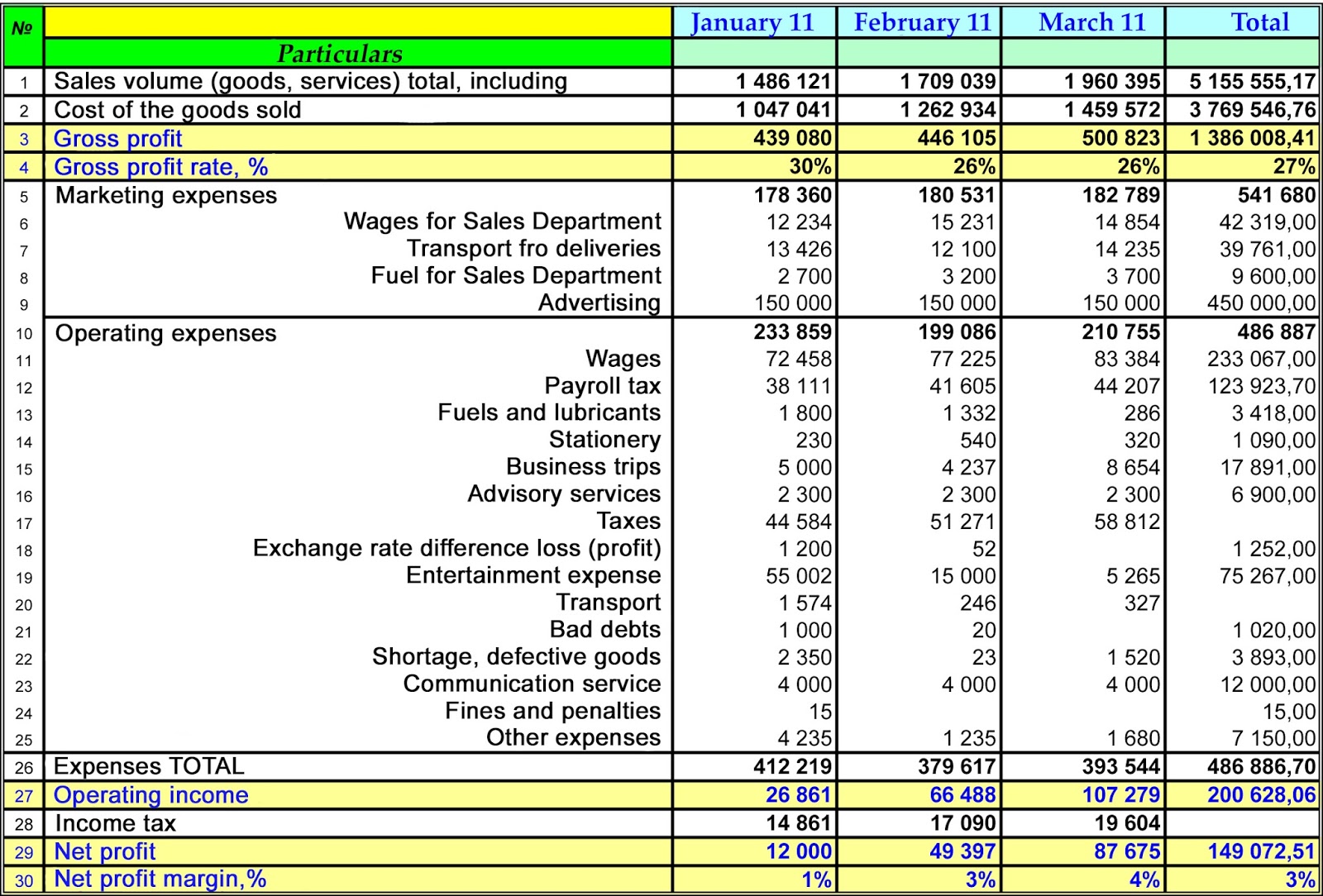

Such a period can be the entire financial year, an interim period like half financial period, or a quarter. These figures will show you whether your business made a profit or loss over that period (usually either one months or consolidated months over the course of a. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of its costs from its revenue during a specific accounting period,.

Profit and loss account is made to ascertain annual profit or loss of business. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. Understand the concept of trading account here in detail.

A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually a fiscal year or quarter. They are also known as income statements. Timing trading account is prepared first and then profit and loss account is.

A profit and loss account can give owners a sense of their business’s finances, helping them to identify inefficiencies and potential improvements. What does a profit and loss account include? It shows both turnover and profitability for.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Income statement statement of earnings statement of operations statement of income. Definition and examples of a profit and loss statement.

Financial statements are important for analyzing the performance of a business and making informed financial decisions. Why is the profit and loss statement important? A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

All companies need to generate revenue to stay in business, making the p&l. Profit and loss accounting generates a profit and loss statement, also referred to as an income statement income statementthe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over tim. Besides balance sheet and statement of cash flows, income statement is also among important financial statements which measures the financial performance of a company over a certain period.

United parcel service inc. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. A profit and loss account, in simplest terms, is a record of all the income and expenses of the business during a particular period of time.

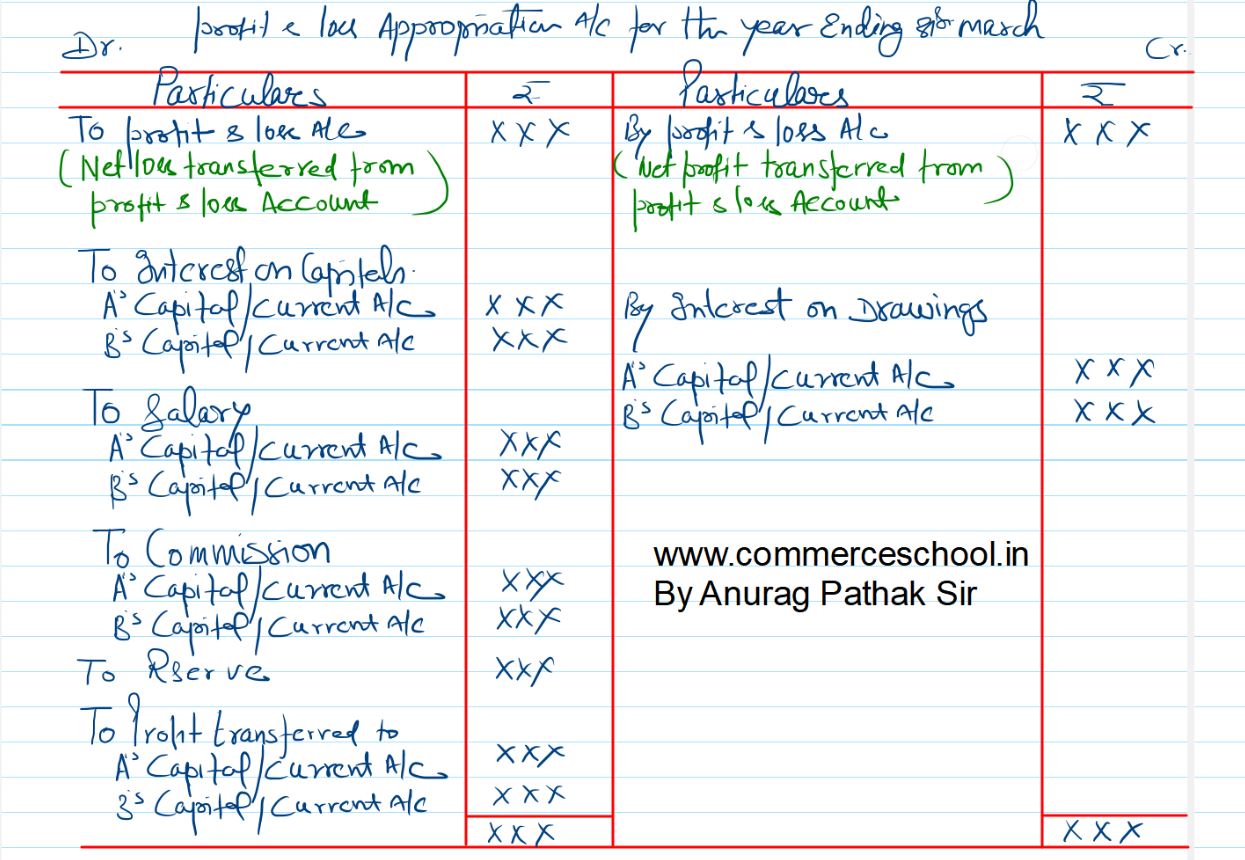

After the preparation of a trading. The p&l statement helps businesses assess their financial performance over a specific period, such as a quarter or a year. Trading account used to find the gross profit/loss of the business for an accounting period: