Simple Info About Accounts Receivable On Income Statement What Does A Balance Sheet Show About Business

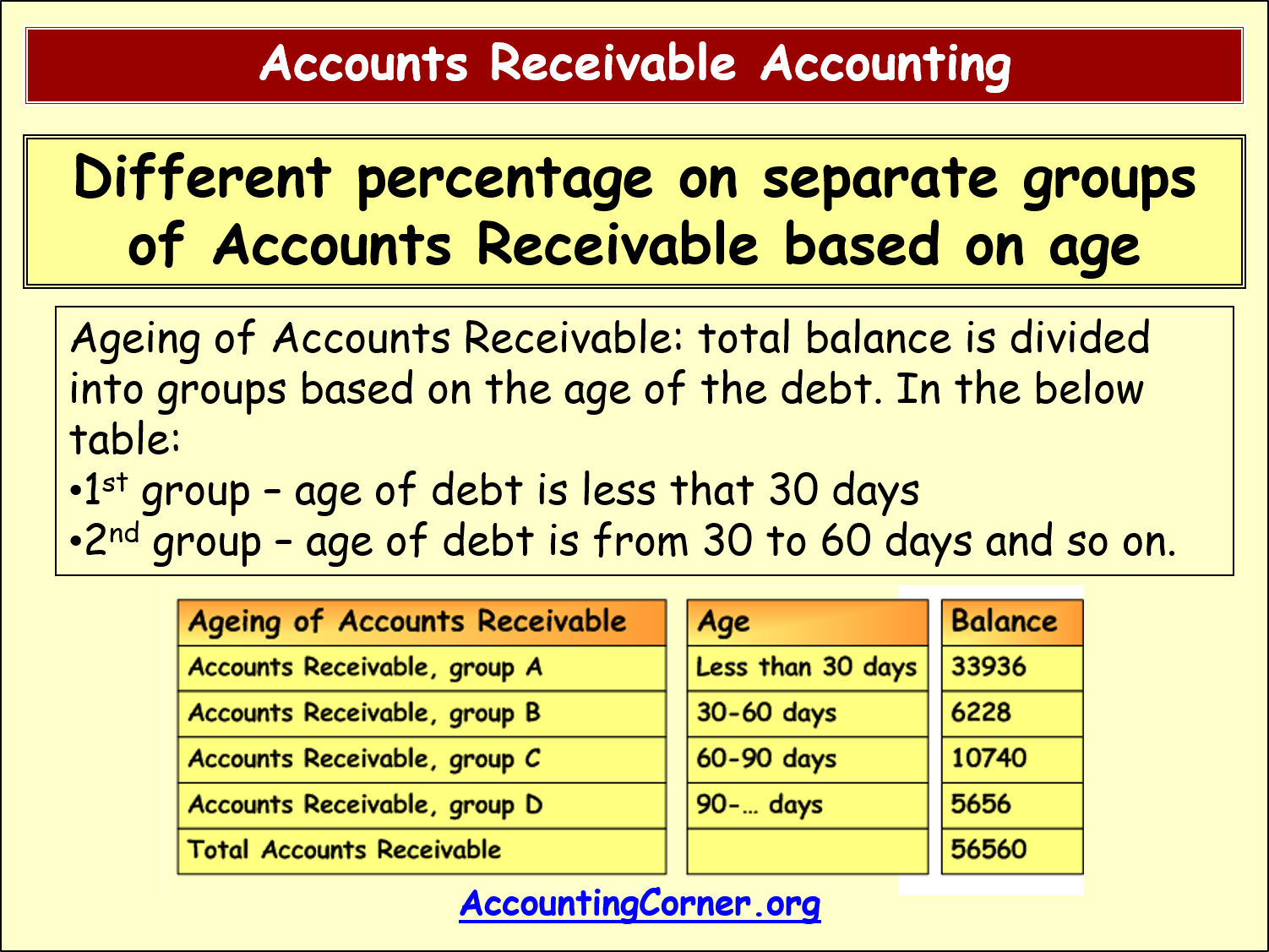

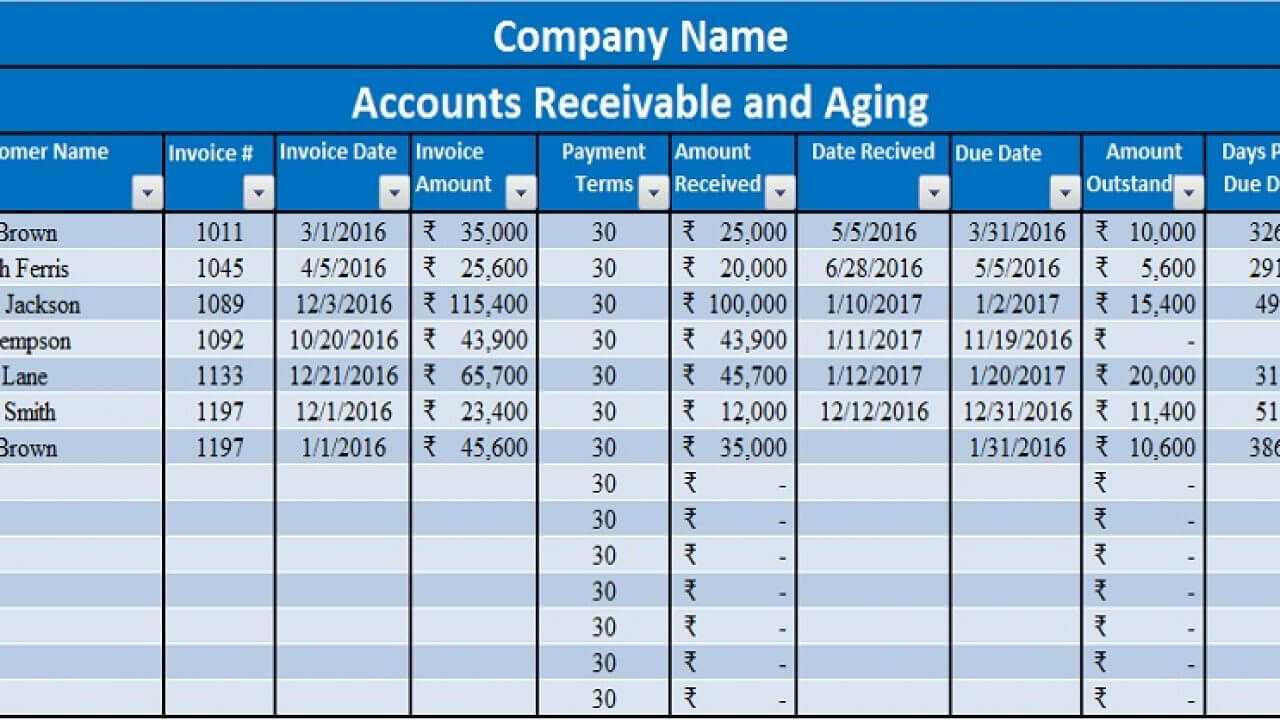

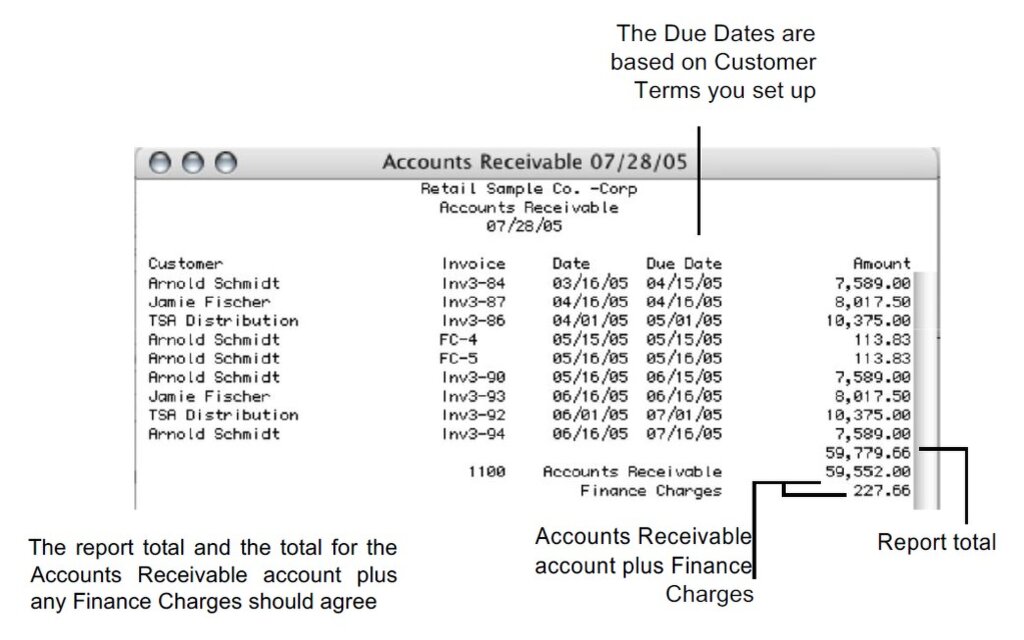

Accounts receivable aging is a periodic report that categorizes a company's accounts receivable according to the length of time an invoice has been outstanding.

Accounts receivable on income statement. Financial reports understanding accounts receivable by pradeepa h january 15, 2021 13 min read in this article, you will learn: It refers to the amount of money owed by customers for goods or services that have been sold but. Accounts receivable on an income statement.

In this article, we'll break. Accounts receivable refers to the money that a company is owed by its customers for products or services already rendered. This money is typically collected after a.

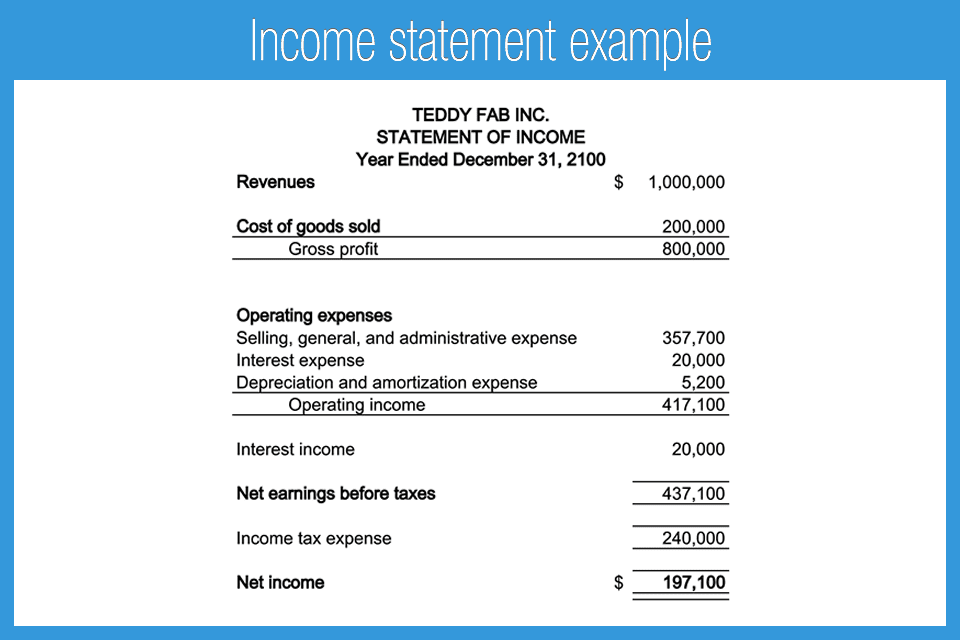

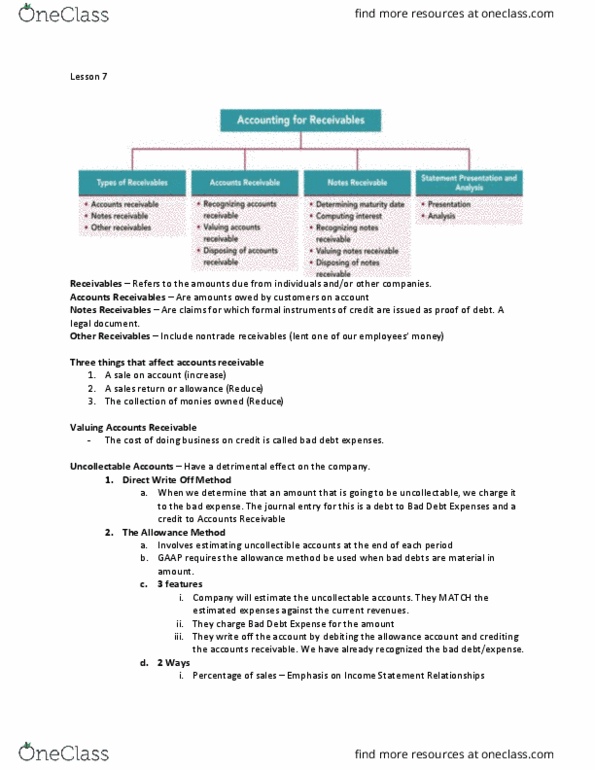

Are you wondering where accounts receivable fits into an income statement? (in december joe had made an entry to accounts receivable and to sales.) b. Compute bad debt estimation using the income statement.

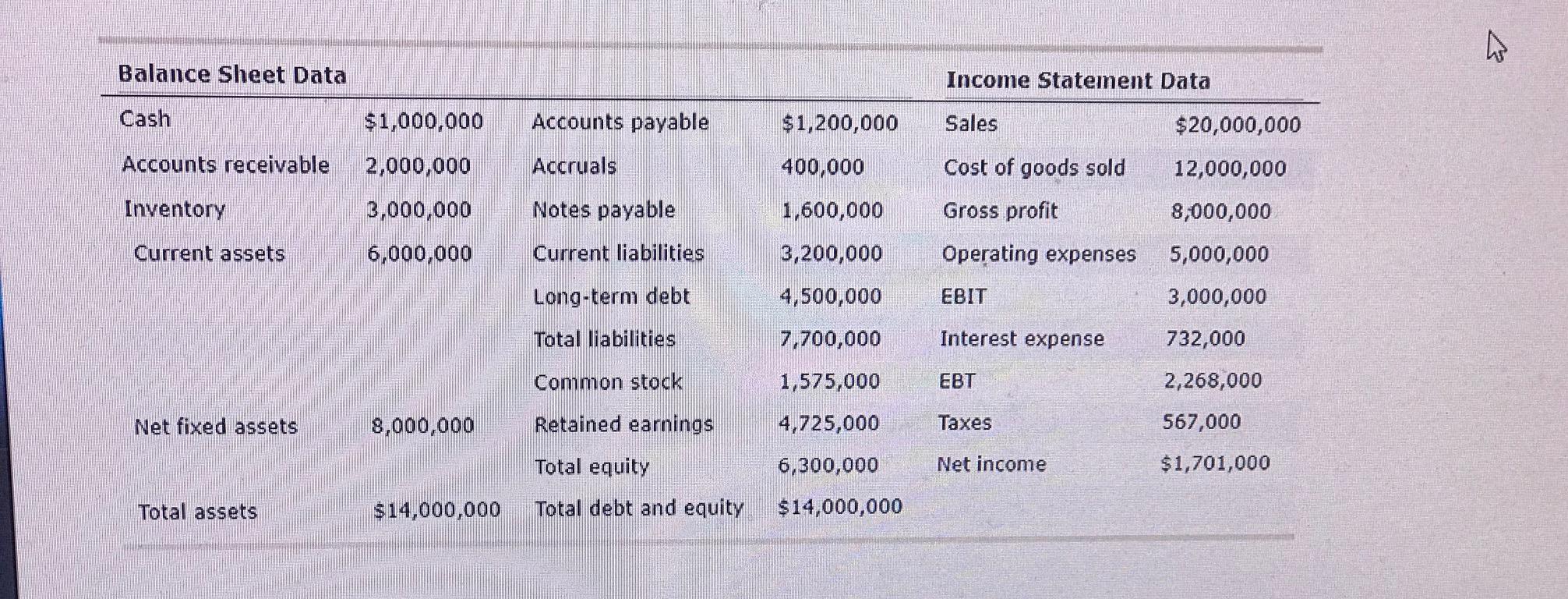

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. Yes, accounts receivable (ar) is an asset account on your balance sheet. What is accounts receivable?

As such, it is an asset, since it is convertible to cash on a future date. Accounts receivable is an essential part of a company’s financial statement. Now marilyn turns to the second part of the income statement—expenses.

When you sell on credit, you give the customer an invoice and don’t collect cash at. Accounts receivable is the amount owed to a seller by a customer. Accounts receivable is the amount of credit sales that are not collected in cash.

For businesses that use accrual accounting (as opposed to cash basis accounting ),. A guide to understanding ar, including its role, benefits, key formulas,. This records the increase in assets ( accounts receivable) and also recognizes revenue.

The accounts receivable does not go on the income statement on its own. It is an essential part of any business, as it. The accounts receivable turnover ratio formula is as follows:

On top of that, accounts receivable. Learn how accounts receivable (a/r) is recorded on a balance sheet and why it matters for a company's health and cash flow. Accounts receivable turnover ratio = net credit sales / average accounts receivable.

First, they debit accounts receivable and credit sales revenue for the same amount. Jared king published on november 14, 2023 subscribe: Accounts receivable on an income statement is a way to measure the financial performance of a company over time.

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)