Who Else Wants Info About Owners Equity Meaning In Business Important Ratios For Credit Analysis

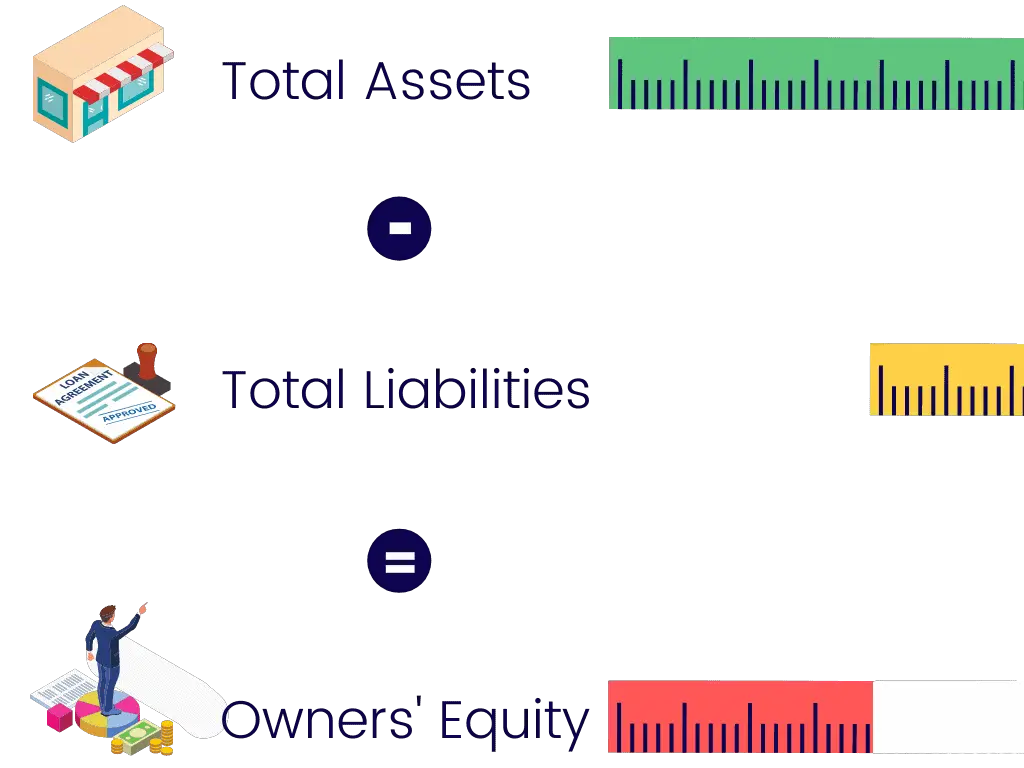

It represents an owner’s claim to whatever remains if a business sold its assets and paid its liabilities.

Owners equity meaning in business. Owner’s equity is what is left over when you subtract your business’s liabilities from its assets. There is no advantage in selling them to private equity.”. Cerberus and its private equity executives received $800 million in profits, while thousands of massachusetts health care workers’ jobs are at risk and 10 communities in the commonwealth face.

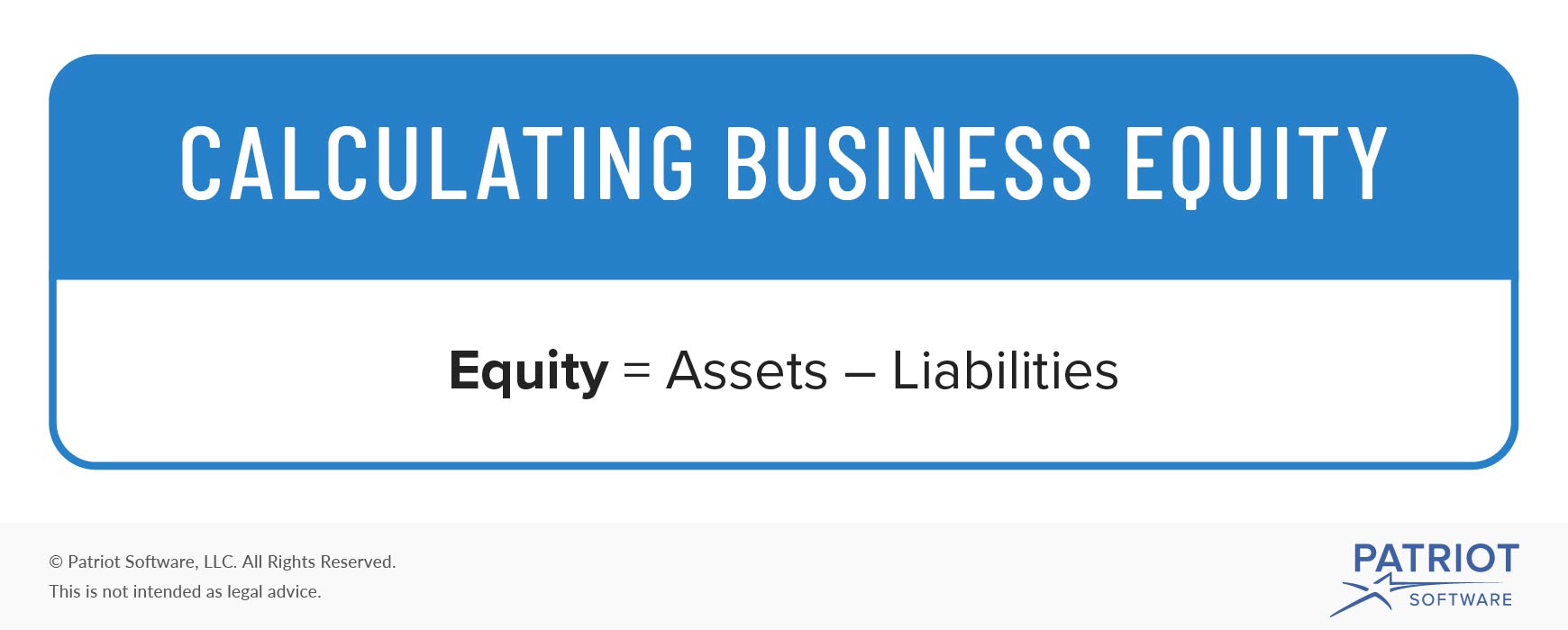

Owners' equity is the total assets of an entity, minus its liabilities. Owner’s equity is the portion of a business’s assets that the owner or shareholders possess.

What is owner’s equity? The company’s assets (resources), minus liabilities (what the company owes others), is equal to the total net worth of the company, also known as owner’s equity. There are other benefits of an esop option, according to research by the national center for employee ownership, which found that.

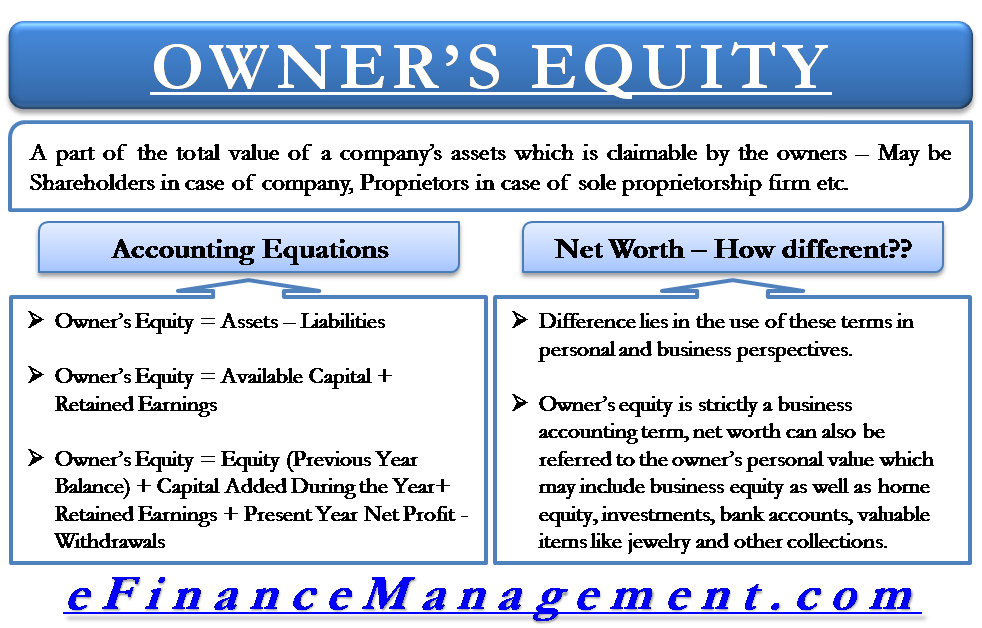

Owner’s equity is the share of a company’s net assets that the owner — or owners — can claim as their own. Depending on how a company is owned or operated, owner’s equity could be attributed to one owner or multiple owners. Owner's equity represents the owner's investment in the business minus the owner's draws or withdrawals from the business plus the net income (or minus the net loss) since the business began.

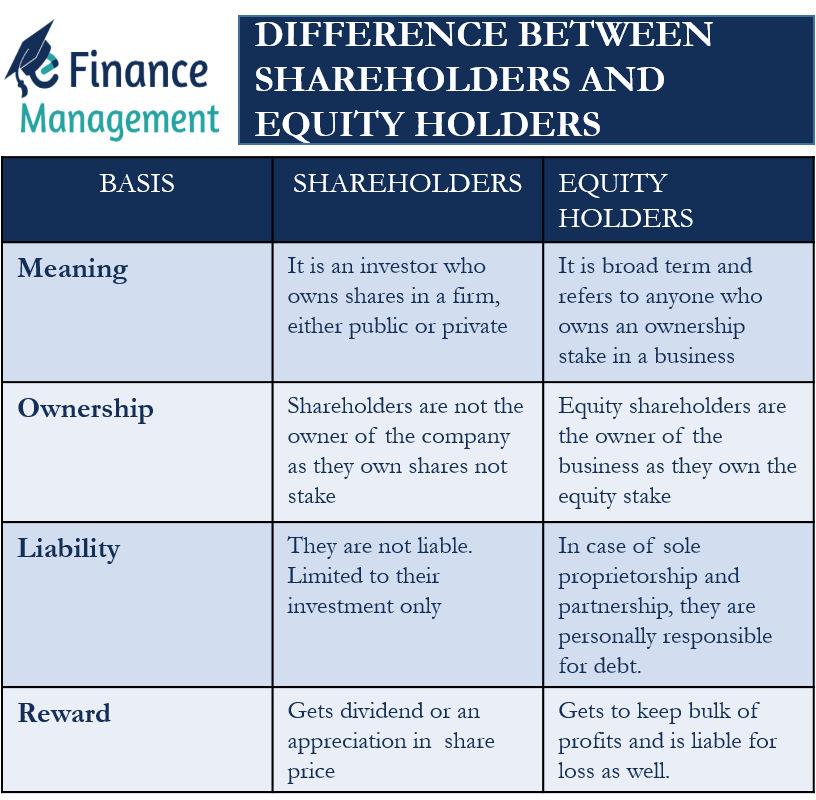

22, the romance generated $331.5 million worth of media exposure for the chiefs and the n.f.l., according to an analysis by the consulting and analytics firm apex. The term owner’s equity is most appropriately used in case of a sole proprietorship business, but it can be known as stockholders equity or shareholders equity in case the business is structured as an llc or a corporation. Owner's equity is an owner's ownership in the business, that is, the value of the business assets owned by the business owner.

February 21, 2024 1:21 pm. Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of money that would be returned to a company's shareholders if. For example, if a business.

Owner’s equity is a good indicator of the health of your business. Determining owner's equity can be useful to understand the financial standing of a company. It is also known as net worth, net assets, or shareholders' funds.

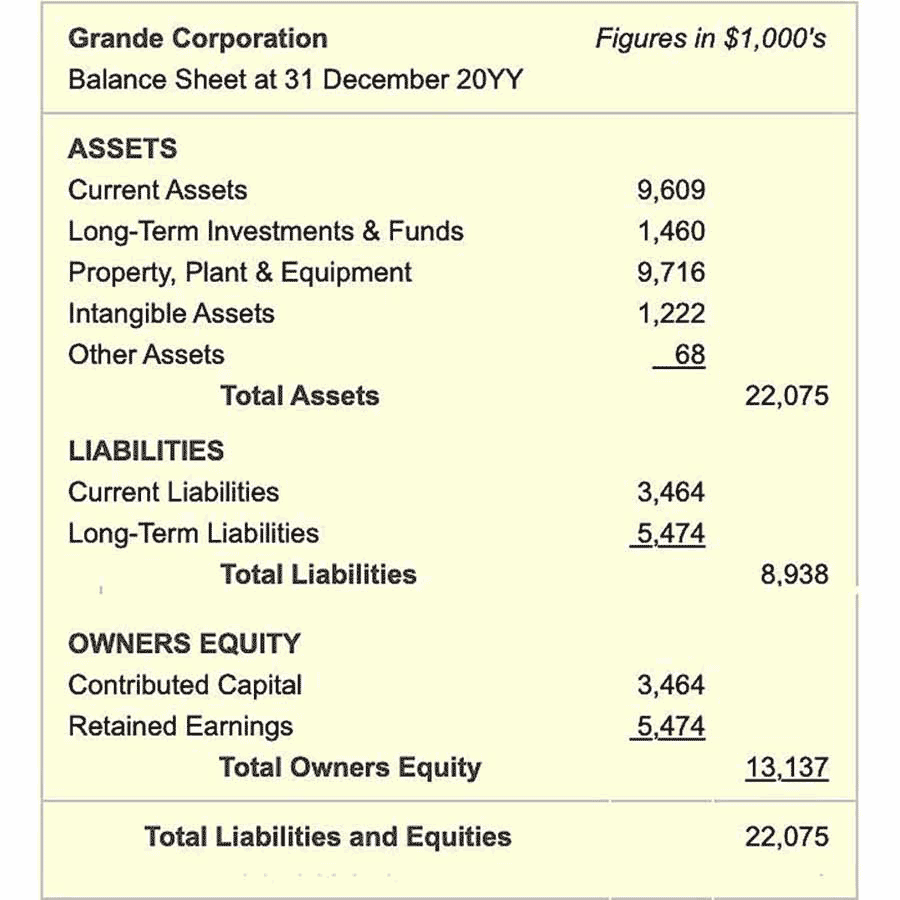

For llcs or corporations, the term used is shareholder’s or stockholder’s equity. Owner’s equity in a balance sheet During liquidation, it is the amount of assets received by the shareholder after paying off liabilities and debt.

Only sole proprietor businesses use the term owner's equity, because there is only one. The owner’s equity is always indicated as a net amount because the owner(s) has contributed capital to the business, but at the same time, has made some withdrawals. Although it’s not a death knell, negative owner’s equity can be a warning sign your business is in trouble.

It signifies an investor’s ownership in a company. This applies to you, regardless of if your business is a sole proprietorship, partnership, or corporation. Terms similar to owners’ equity.

:max_bytes(150000):strip_icc()/_equity_final-a71099b17173432f813b15202e64459d.png)

:max_bytes(150000):strip_icc()/EquityMethod_Final_4196997-4a403840ea2d4bf4aee5ff825b931e67.jpg)

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)