Awesome Tips About Purpose Of Balance Sheet Reconciliation Classified Categories

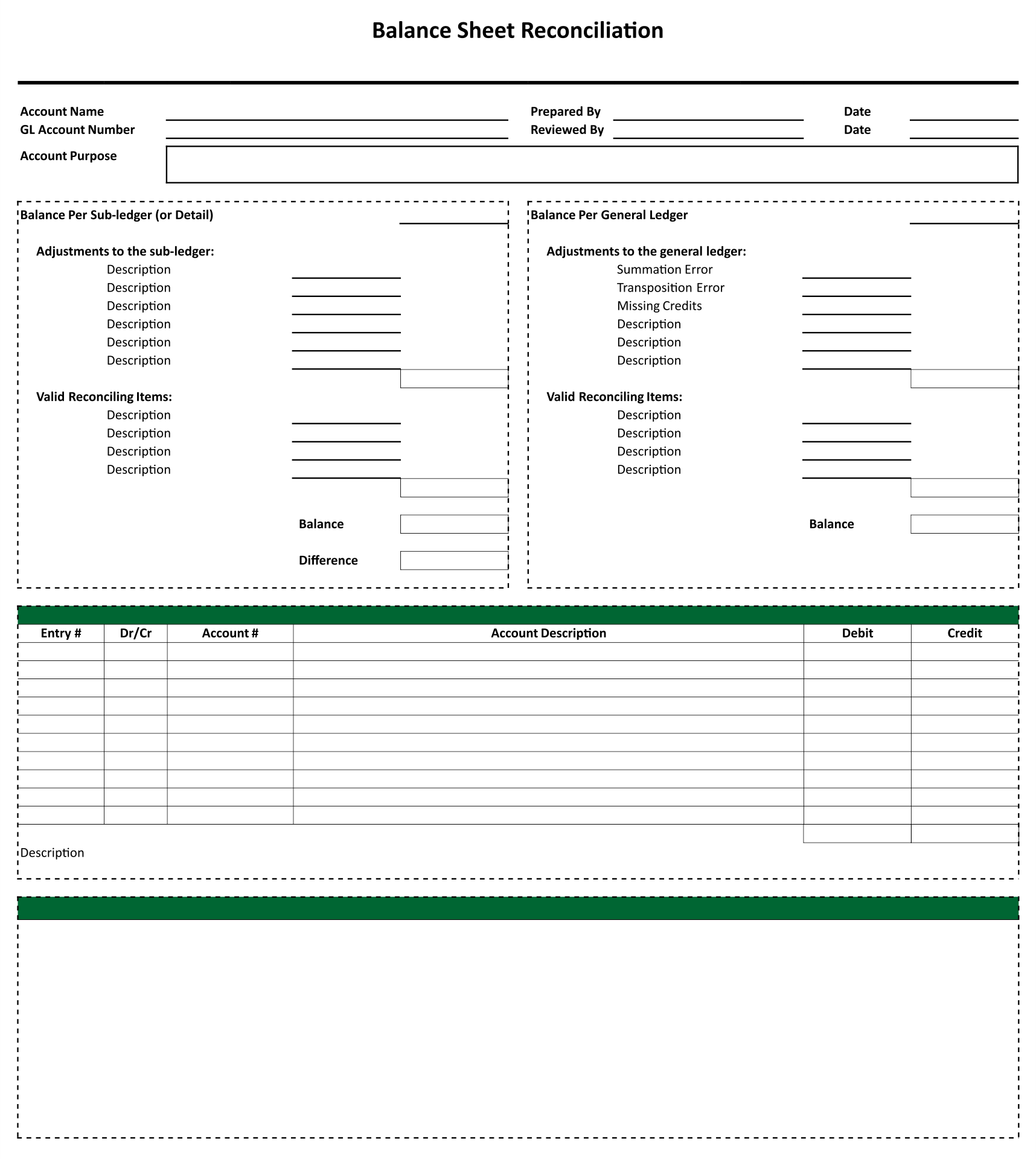

A balance sheet reconciliation is the process of verifying the balances reflected on the balance sheet against supporting documentation.

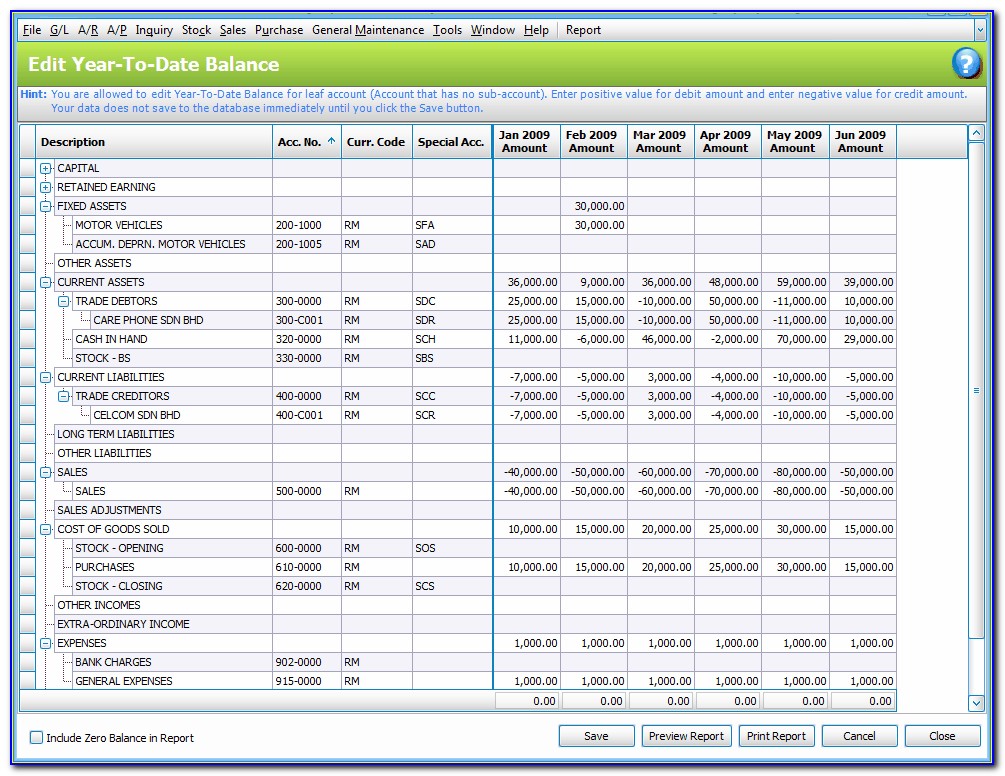

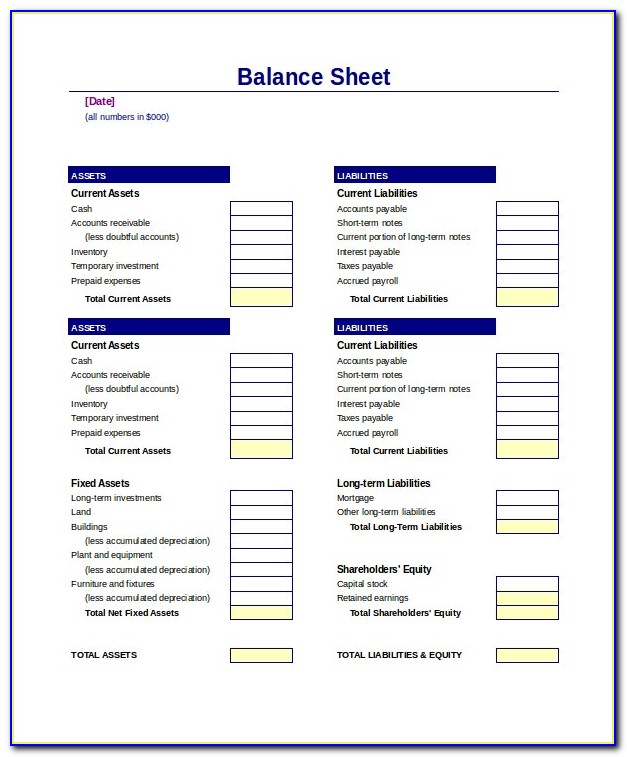

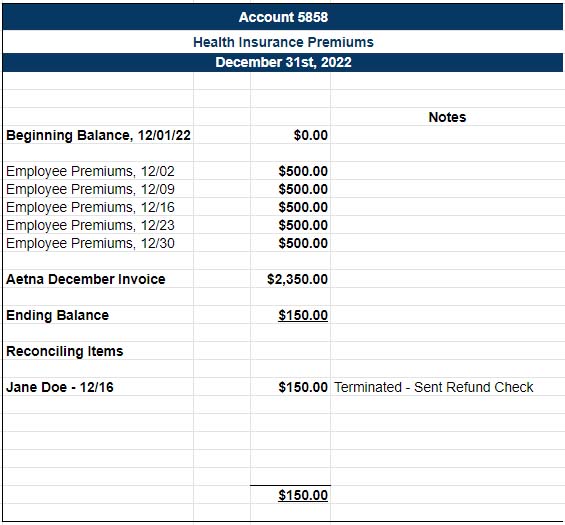

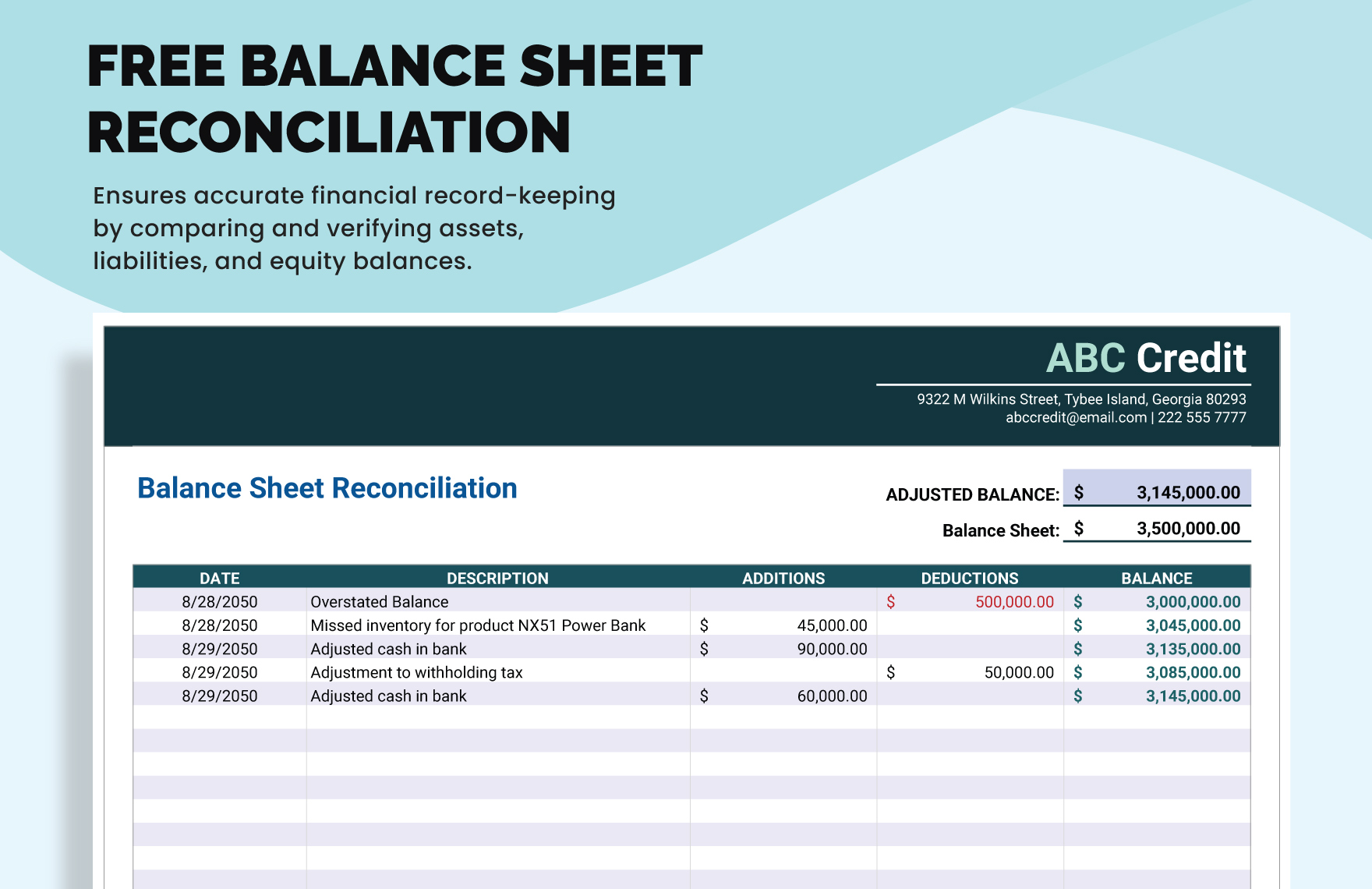

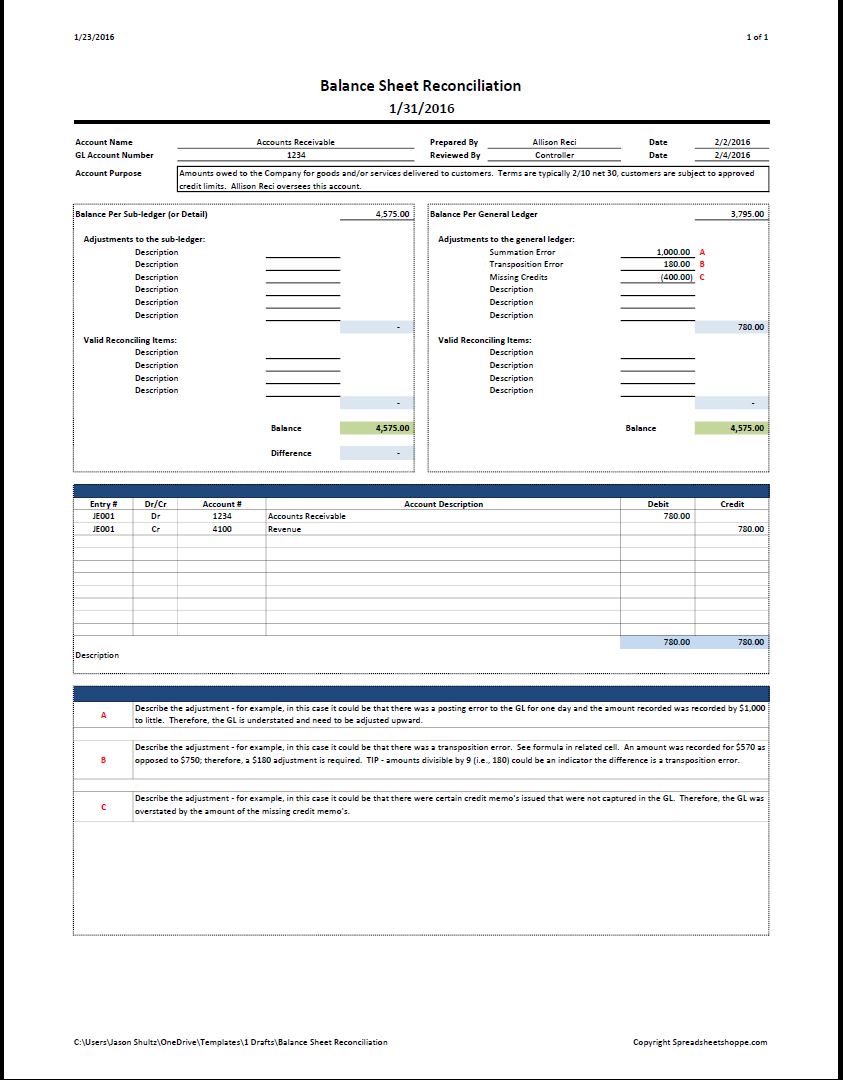

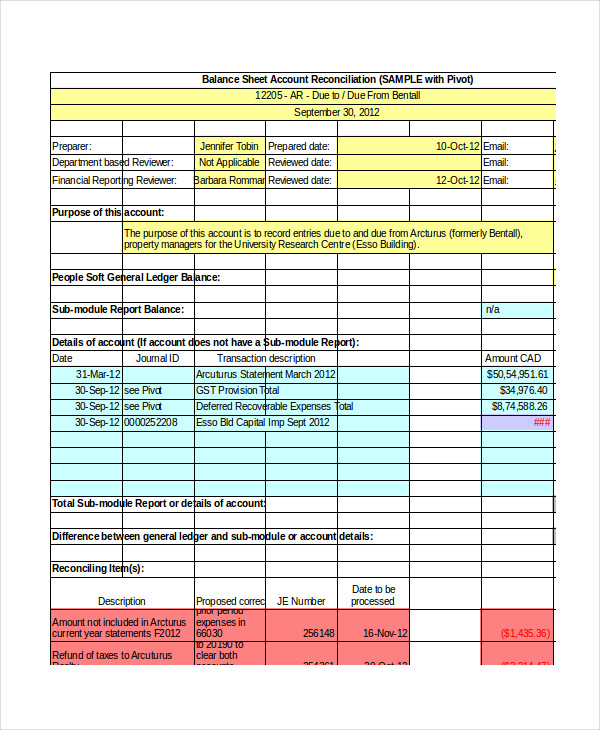

Purpose of balance sheet reconciliation. It involves comparing the balances in the balance sheet with the general ledger and supporting documents such as bank statements, credit card statements, and invoices. It involves comparing the balances of various accounts listed in the balance sheet to external documentation, such as bank statements and general ledger entries. Account reconciliation works by comparing general ledger account balances for balance sheet accounts to supporting sets of records and bank statements and maintaining rolling schedules with beginning balance, additions, reductions, and ending balance for specific accounts.

Its purpose is to identify and correct any discrepancies between them. In order to effectively verify the accuracy of a balance sheet reconciliation, audits and reports should be completed. Once approved, the reconciliation should be maintained in accordance with administrative guide policy 3.8.1:

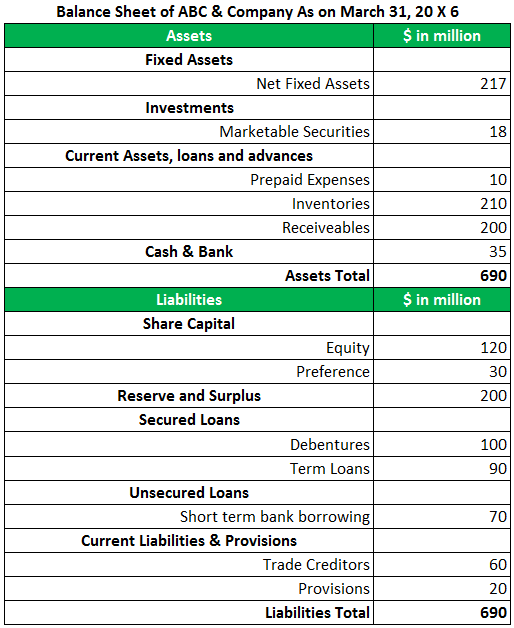

Reconciliation is an accounting process that ensures that the actual amount of money spent matches the amount shown leaving an account at the end of a fiscal period. Types of reconciliation types of balance sheet reconciliations include: A balance sheet account balance reconciliation is the comparison of one or more asset or liability balances on the statement of financial position (also known as the “balance sheet”) to another source of financial data, such as a bank statement, a subledger or another system.

Identify weaknesses in internal controls; Before the closing process can typically begin, the information in the general ledger is verified against some type of supporting schedule or document. The purpose of a balance sheet reconciliation is to ensure that all accounts included on a company's balance sheet agree with their associated general ledger account balances.

Balance sheet reconciliation is the process of closing balances of all individual company accounts that are a part of the company’s balance sheet. Here, balance sheet account reconciliation is a critical practice. It helps identify errors, omissions, and discrepancies in financial records, preventing inaccuracies in.

Balance sheet reconciliation can be defined as a process of verifying the accuracy of information presented in the balance sheet. Reconciliation in accounting is the process of verifying and adjusting the balances of two sets of financial statements to ensure that they agree. It’s the process that ensures the harmony between a company’s financial records and its actual financial position.

Balance sheet reconciliation is simply a process that ensures the accuracy of a company’s financial statements. Balance sheet reconciliation is an essential accounting practice that verifies the accuracy and consistency of financial statements. Balance sheet reconciliation is the process of ensuring your balance sheet information is accurate.

Reconciliation also confirms that accounts in a general. Balance sheet reconciliations help you: They’re almost identical processes, save for their scope and the type of transactions being reconciled.

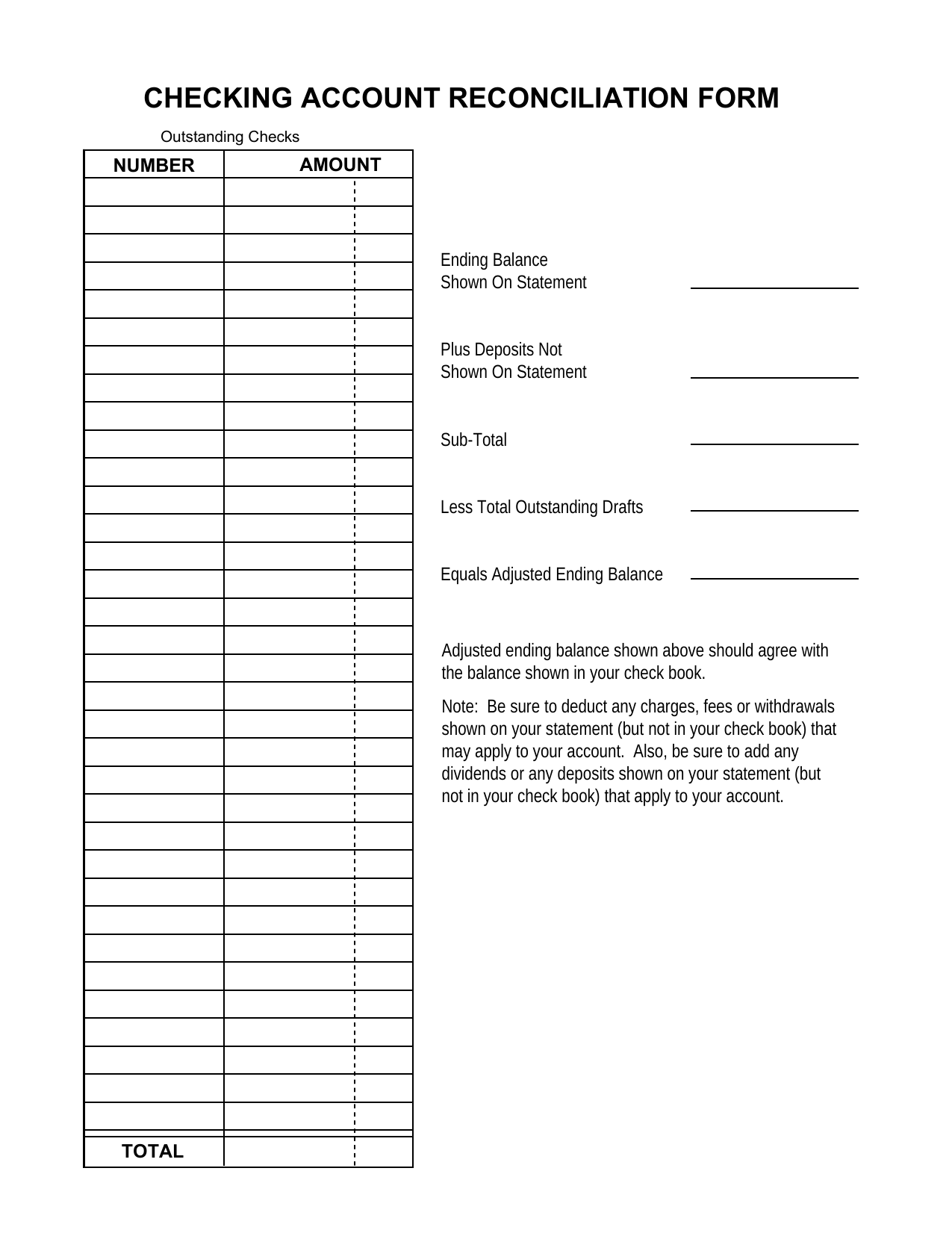

The following instructions provide best practice guidance for individuals responsible for reconciling balance sheet account balances on a quarterly basis. A guide to account reconciliation. Detecting missing, duplicated, or untimely transactions.

Reconciling your balance sheet lets you verify that all of your entries are recorded and classified. Examples of balance sheet reconciliations Accountants must reconcile credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, subscriptions, deferred accounts, and other.