Spectacular Info About Liability And Stockholders Equity Ind As On Consolidation Of Subsidiary

$125,000 + $170,000 = $295,000.

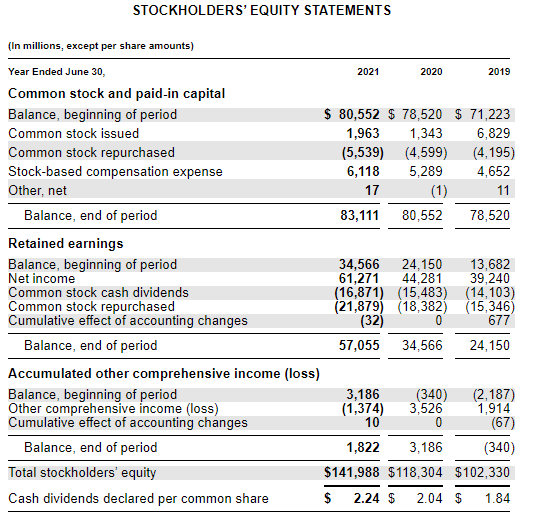

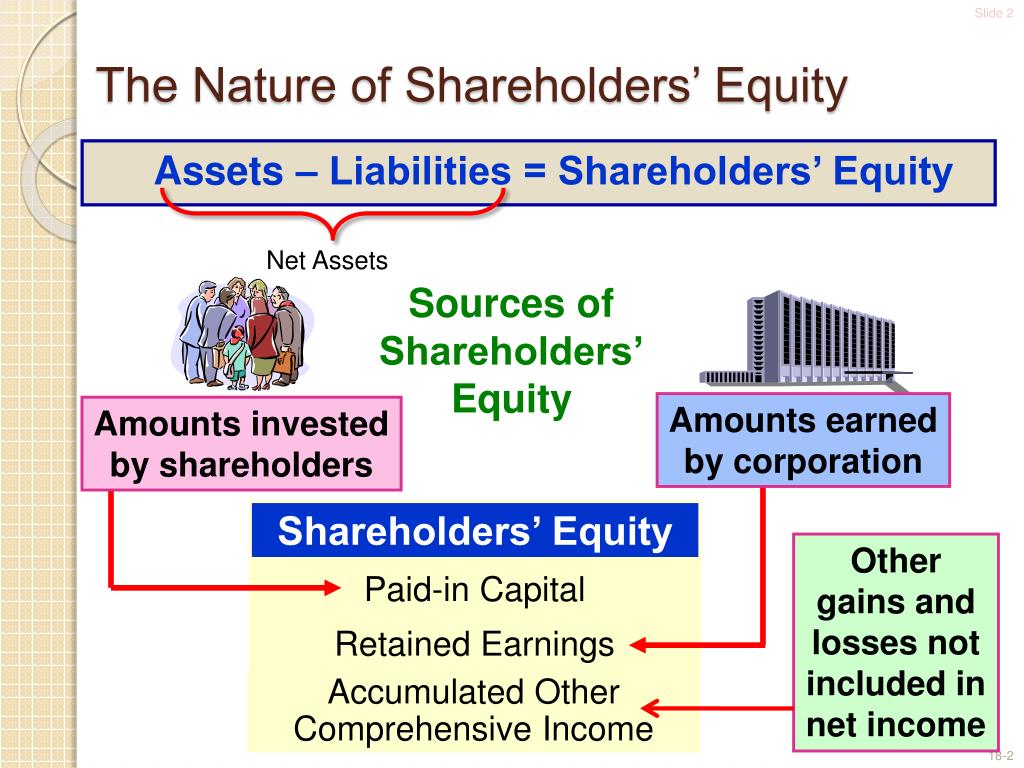

Liability and stockholders equity. It also represents the residual value of assets minus liabilities. In texas pacific land corporation v. This includes preferred equity as well as common stockholders' equity.

You might think of it as how much a company would have left over in assets if business ceased immediately. Liabilities represent a company’s debts, while equity represents stockholders’ ownership in the. That balance sheet also shows that the formula = invested capital + retained earnings.

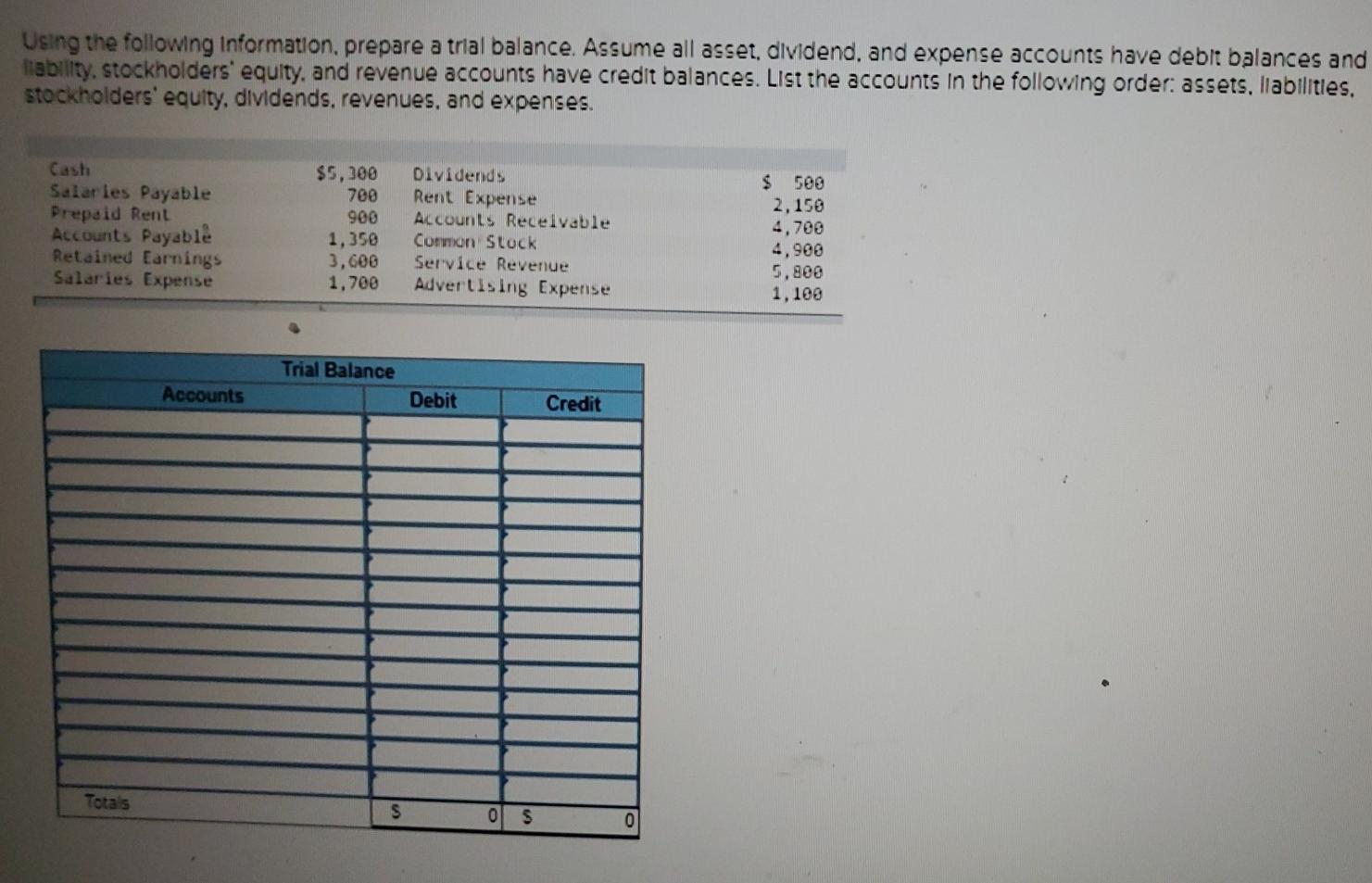

Stockholders' equity is the total value of assets owned by an investor after deducting and settling liabilities. By definition, a company's assets minus its liabilities equals its stockholders' equity (also known as net equity). When the account balances are totaled, they conform to the following independent equations:

Stockholders equity (also known as shareholders equity) is an account on a company’s balance sheet that consists of share capital plus retained earnings. The liabilities and stockholder equity turns out to be sar 20,000. As a result accountants often refer to stockholders' equity as the difference (or residual) of assets minus liabilities.

Shareholder equity (se) is a company's net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be liquidated and all its debts are paid. Stockholders’ equity is the value of a firm’s assets after all liabilities are subtracted. The amount of stockholders' equity is exactly the difference between the asset amounts and the liability amounts.

Shareholders' equity is an important metric for investors. Stockholders' equity formula. Shareholders' equity is the net amount of a company's total assets and total liabilities as listed on the company's balance sheet.

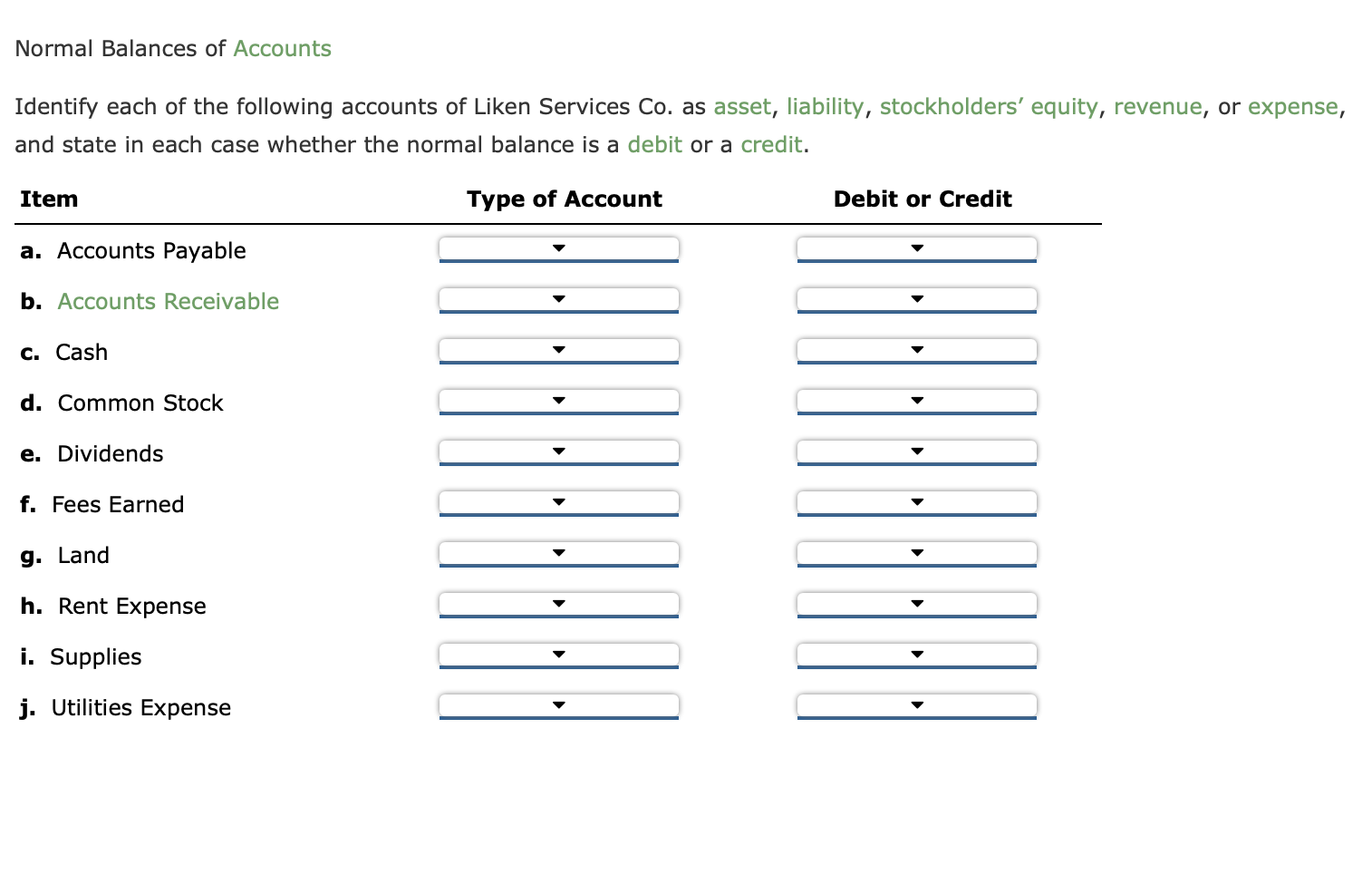

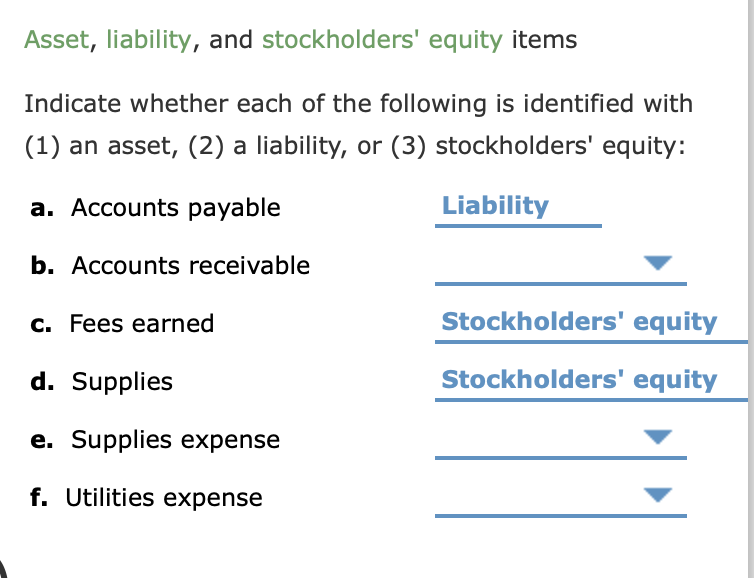

Stockholders' equity refers to the assets remaining in a business once all liabilities have been settled. It is represented by common stock. Asset accounts increase on the debit side, while liability and stockholders' equity accounts increase on the credit side.

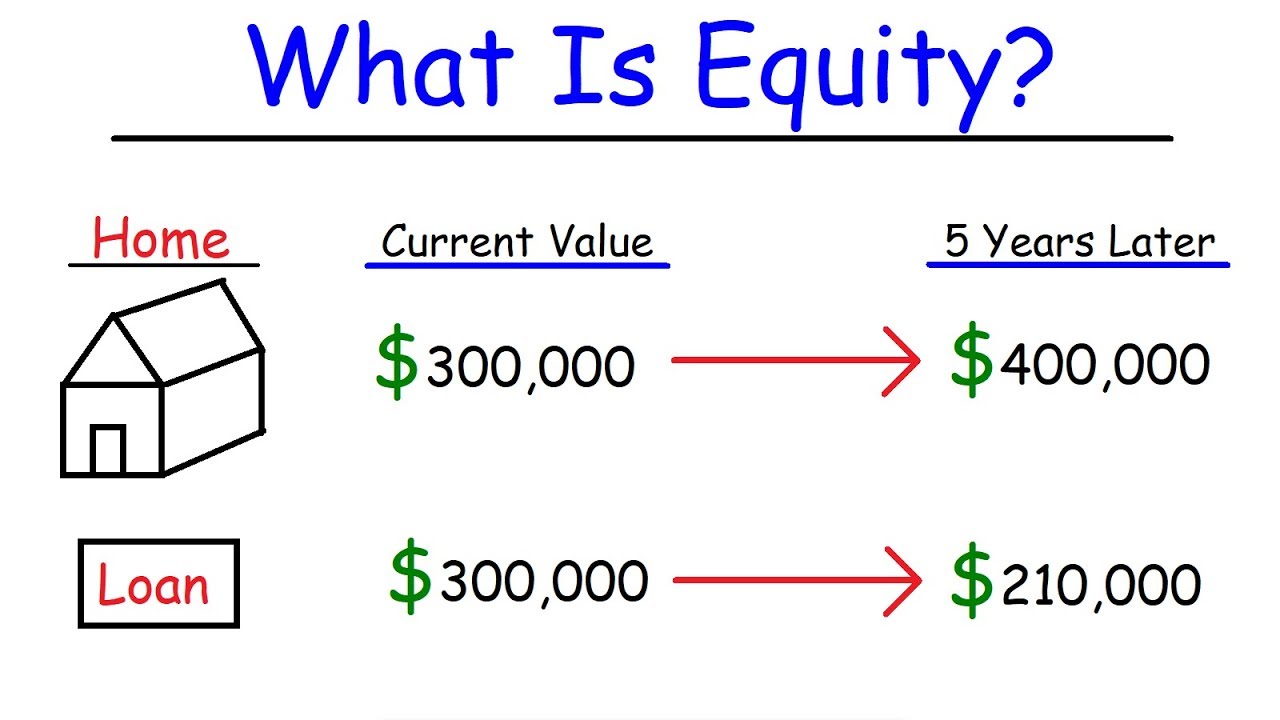

The equity will be as follows: Equity, also known as owner’s equity, is the difference between the total assets and total liabilities of a business. A corporation is a form of business that is a.

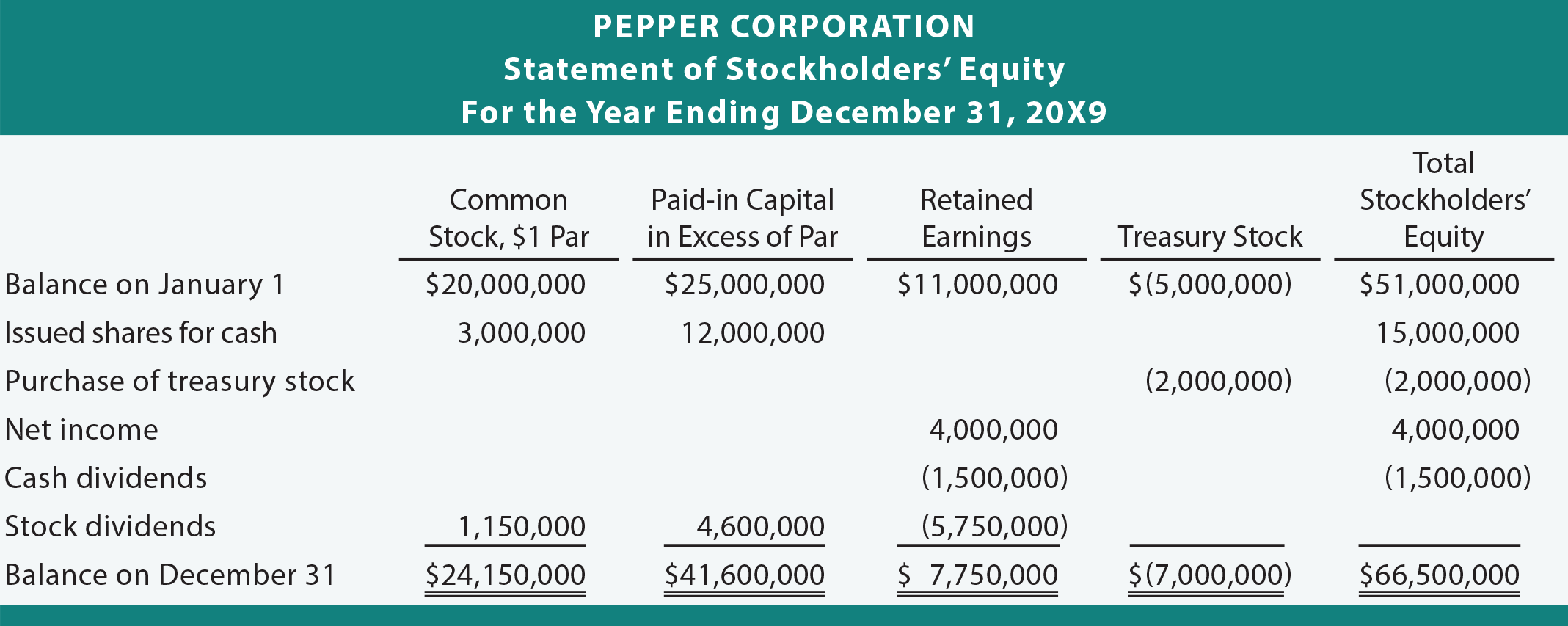

The stockholders' equity accounts of a corporation will appear in the chart of accounts, general ledger, and balance sheet immediately following the liability accounts. For example, if a business has total assets worth $100,000 and total liabilities of $30,000, the owner’s equity in the business. In the general ledger most of the stockholders' equity accounts will have credit balances.

Amazon.com’s balance sheet view amazon’s investor relations website to view the full balance sheet and annual report. Both liabilities and shareholders' equity represent how the assets of a company are financed. This figure is calculated by subtracting total liabilities from total assets;.