Exemplary Info About Prior Period Adjustment Disclosure Example Direct And Indirect Cash Flow

Even though the company is a small company, it must still apply the recognition and measurement requirements of full frs 102 (section 1a only.

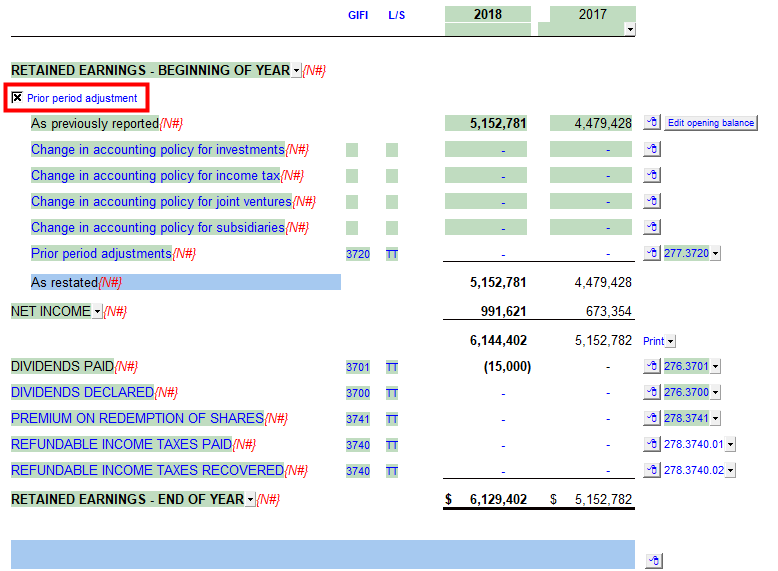

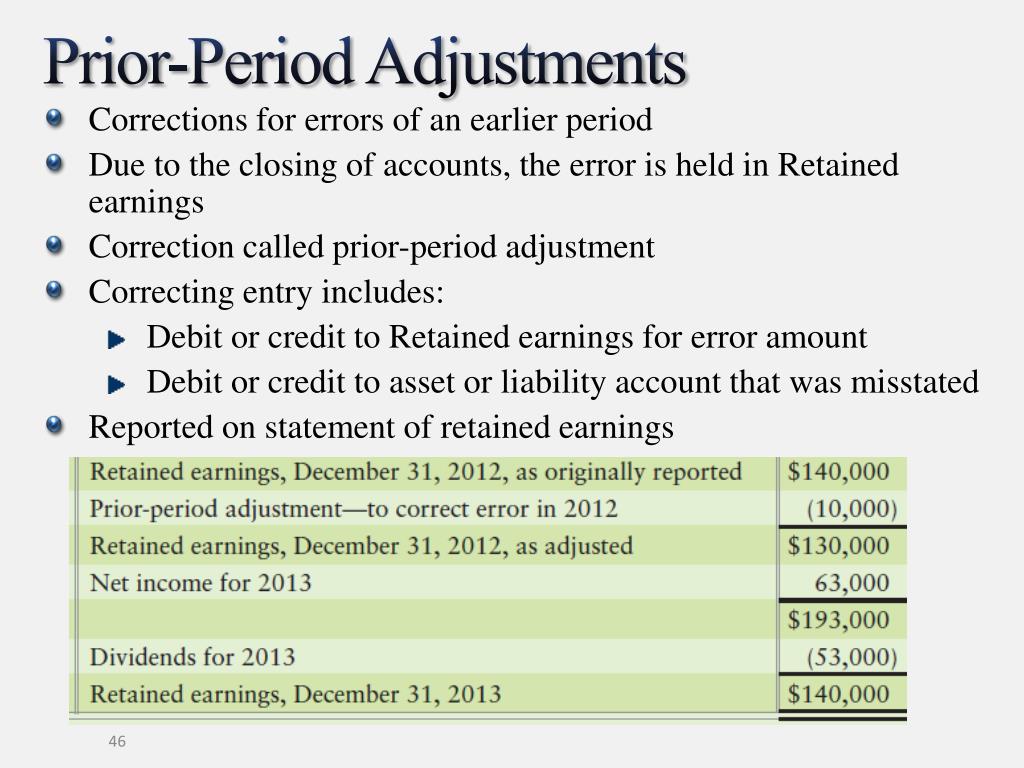

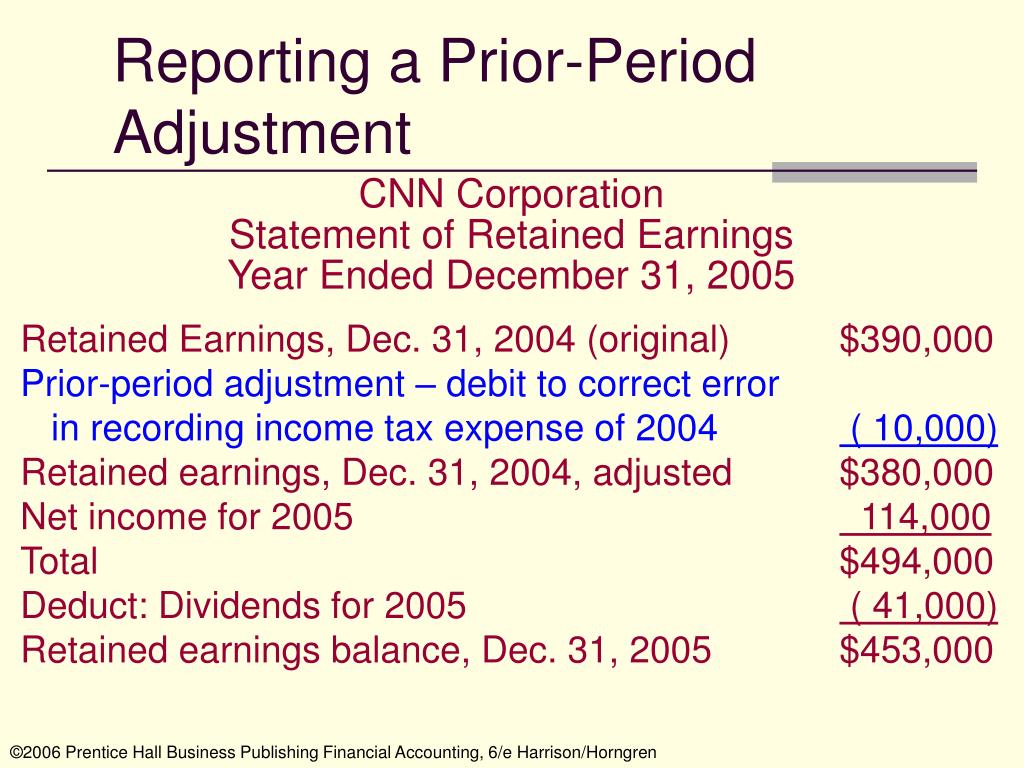

Prior period adjustment disclosure example. A prior period adjustment is the correction of an accounting error that occurred in the past and was reported on a prior year’s financial statement, net of income taxes. The auditor also should evaluate whether the financial statements. Disclosing prior period errors.

What is a prior period adjustment? Pensions and other employee benefits. The purpose of this factsheet is to provide guidance on the accounting and disclosure of.

The period prior thereto,if such prior period is presented with the financial statements being reported upon. (a) the nature of the prior period error; An appendix illustrating example disclosures for the early adoption of ifrs 9 financial instruments, taking into account the amendments arising from ifrs 9 financial.

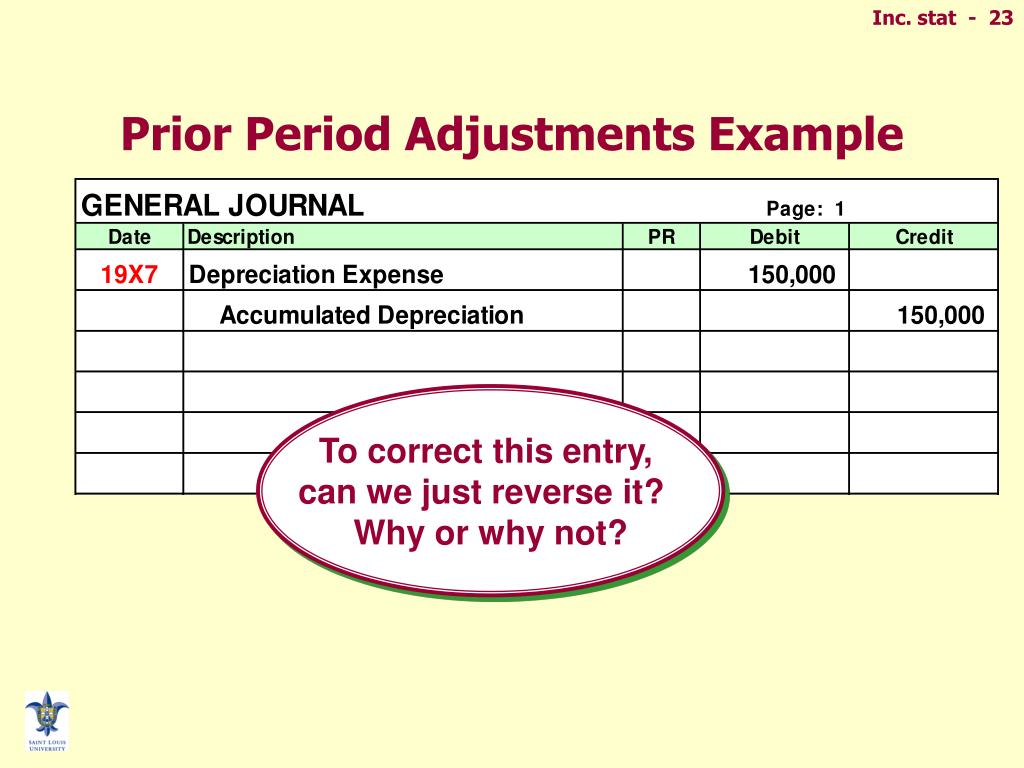

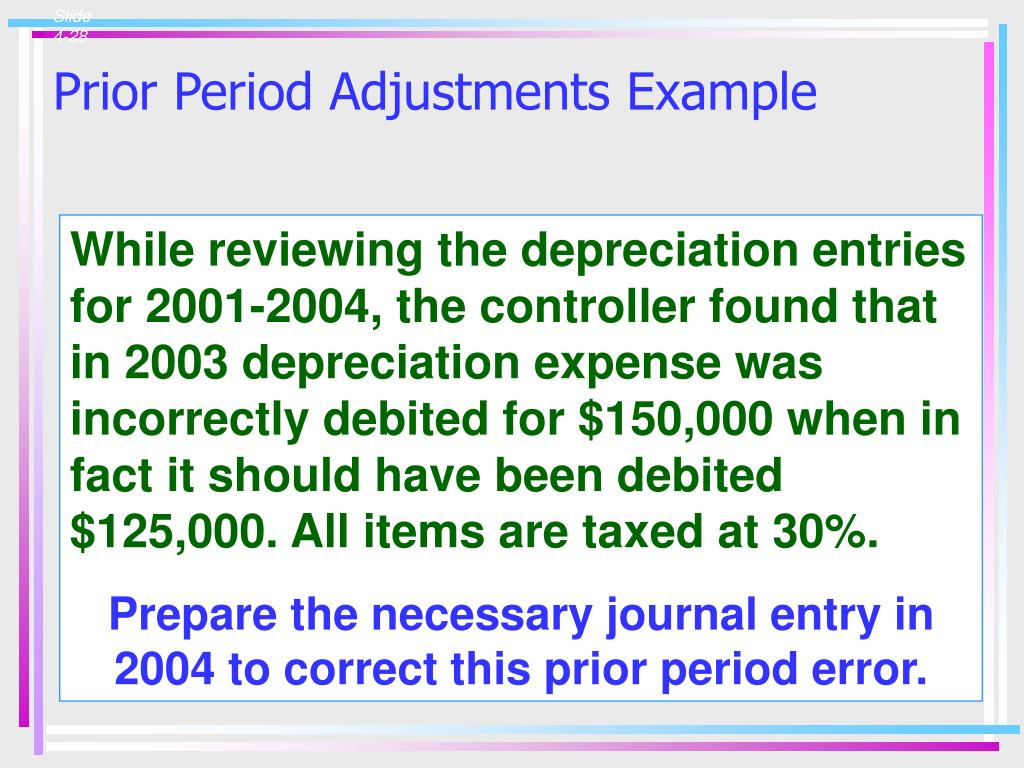

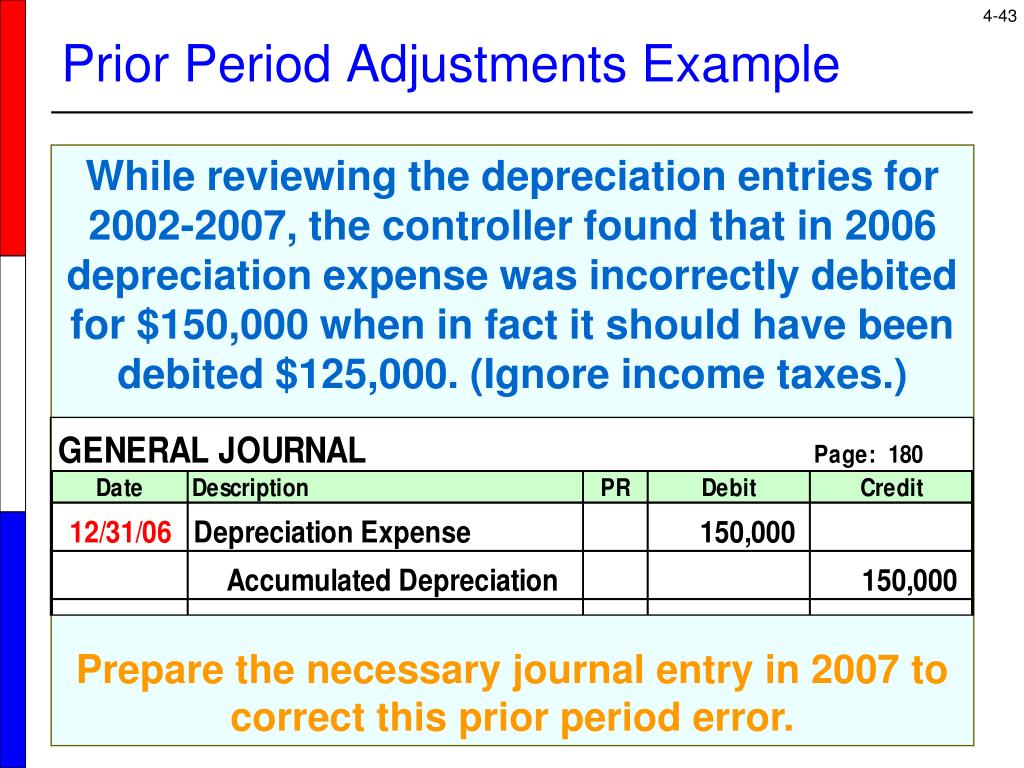

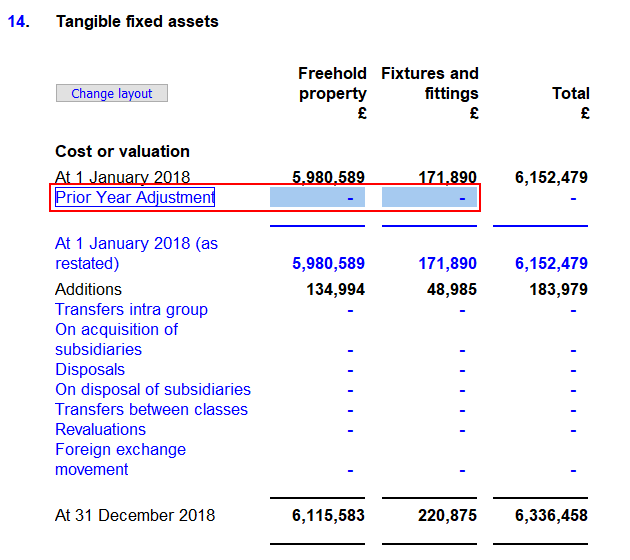

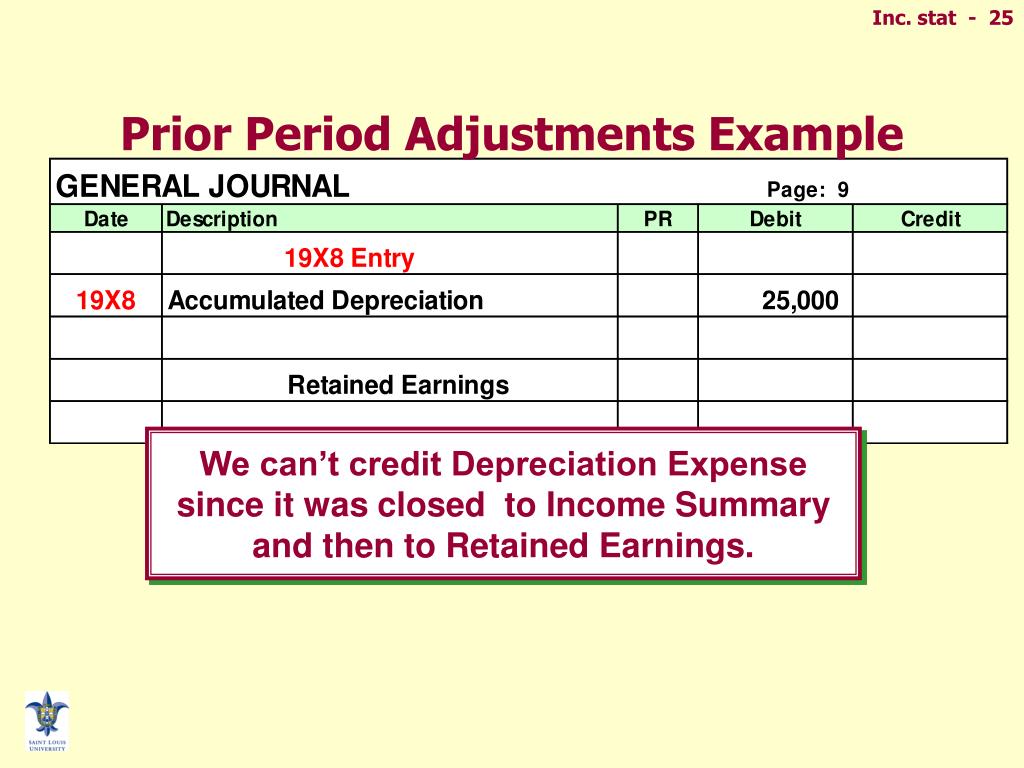

Restating the comparative amounts for the prior period(s) in which the error occurred 2. The omission of depreciation of office building in the previous year’s financial statements represents a prior period accounting error which must be accounted for. Prior period errors and adjustments.

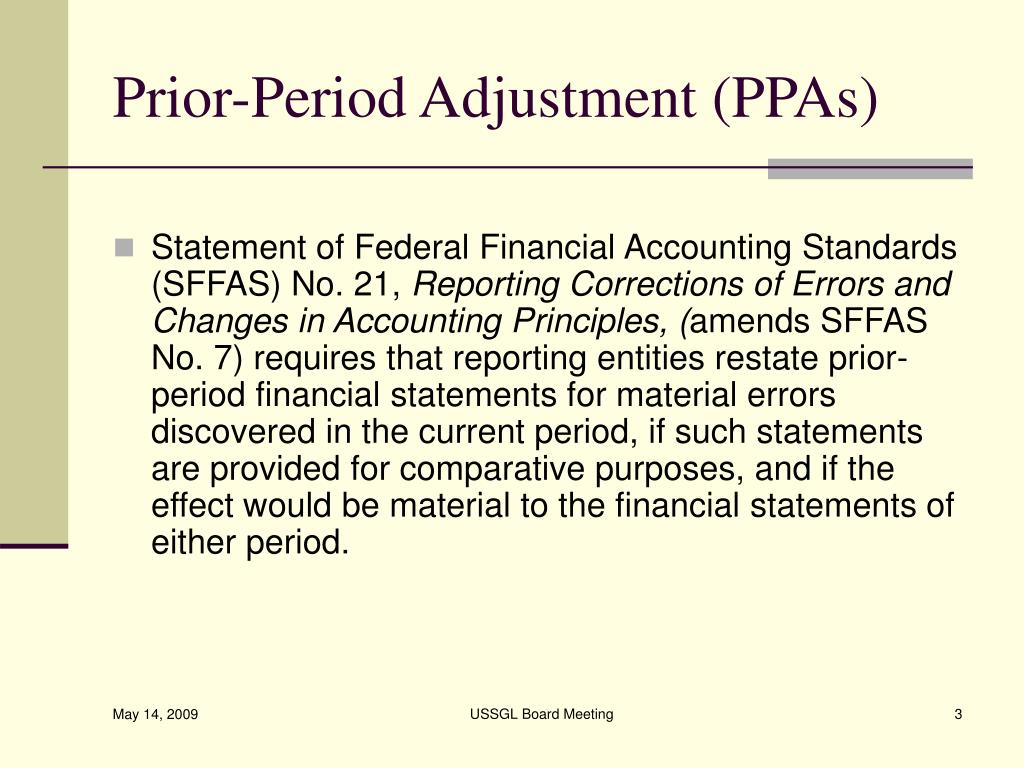

Prior period errors are omissions from, and misstatements in, an entity's financial statements for one or more prior periods arising from a failure to use, or. An entity shall correct material prior period adjustments/errors retrospectively in the first set of financial statements approved for issue after their discovery either by the following ways: Prior period adjustments can arise due to a variety of reasons, including errors, changes in accounting principles, changes in estimates, or corrections of prior period.

If the error occurred before the earliest prior. Prior period adjustment example company a has prepared a financial statement for the year 202x. Disclosure of prior period errors.

A prior period adjustment is a transaction used to modify an issue that arose in a prior reporting period. The company erroneously recorded its costs of equity securities sales as an intangible asset in its financial statements as of april 30, 1988. According to ias 8 (accounting policies, changes in accounting estimates, and errors), prior period.

Prior year adjustment is the correction of prior period errors. Example of correction of prior period errors. Disclosure of prior period errors (for entities adopting full frs 102) 10.23 an entity shall disclose the following about material prior period errors:

Two years later, in 202x+2, they just realize that operating expenses were. Paragraph 10.23 of frs 102 requires the following to be disclosed about material prior period errors: