Brilliant Strategies Of Tips About Accrual Income Statement Example Balance Sheet In Financial

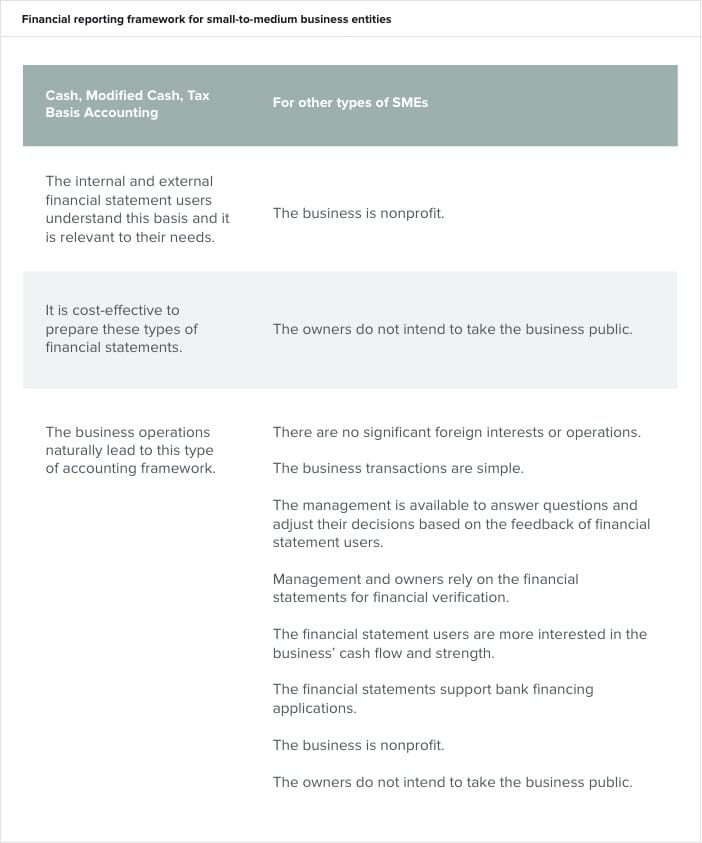

Tax expenditure documents promote transparency and accountability.

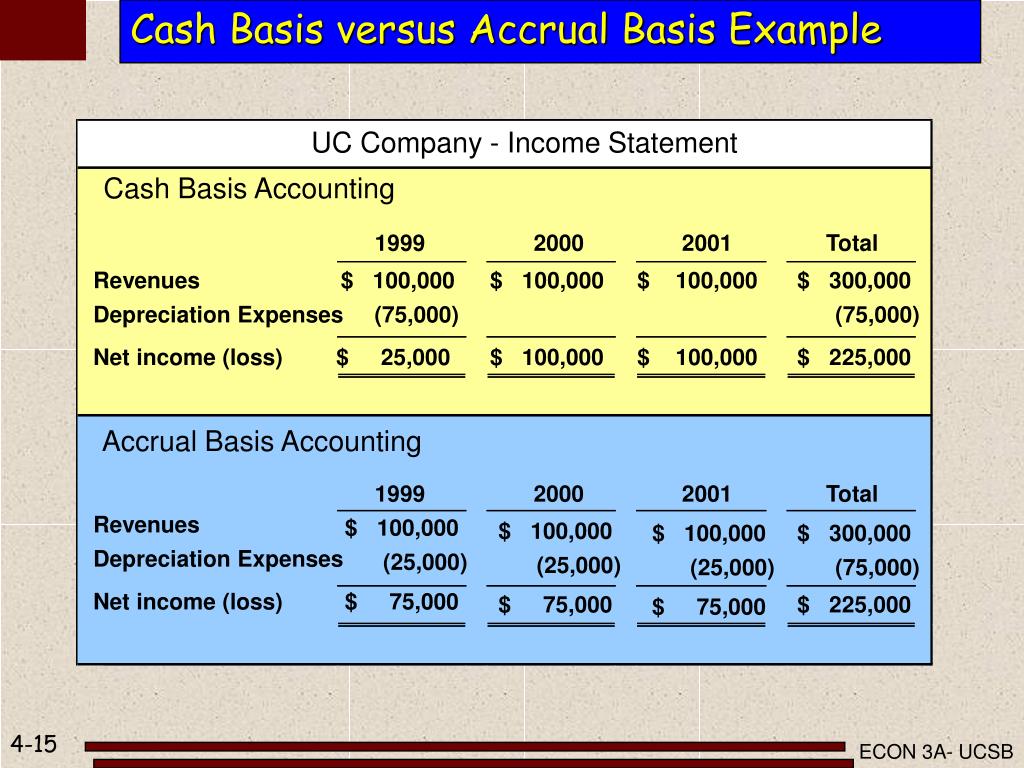

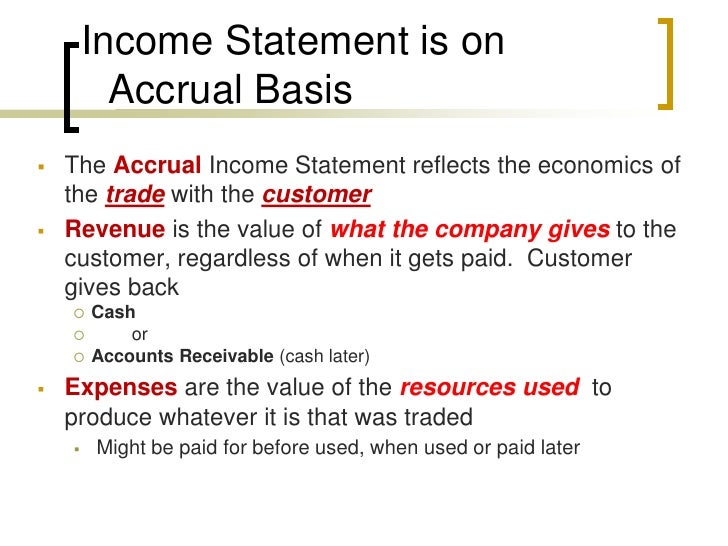

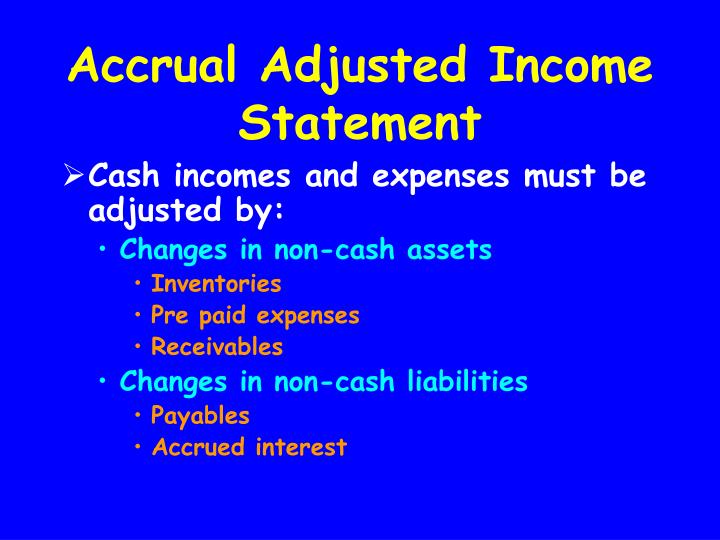

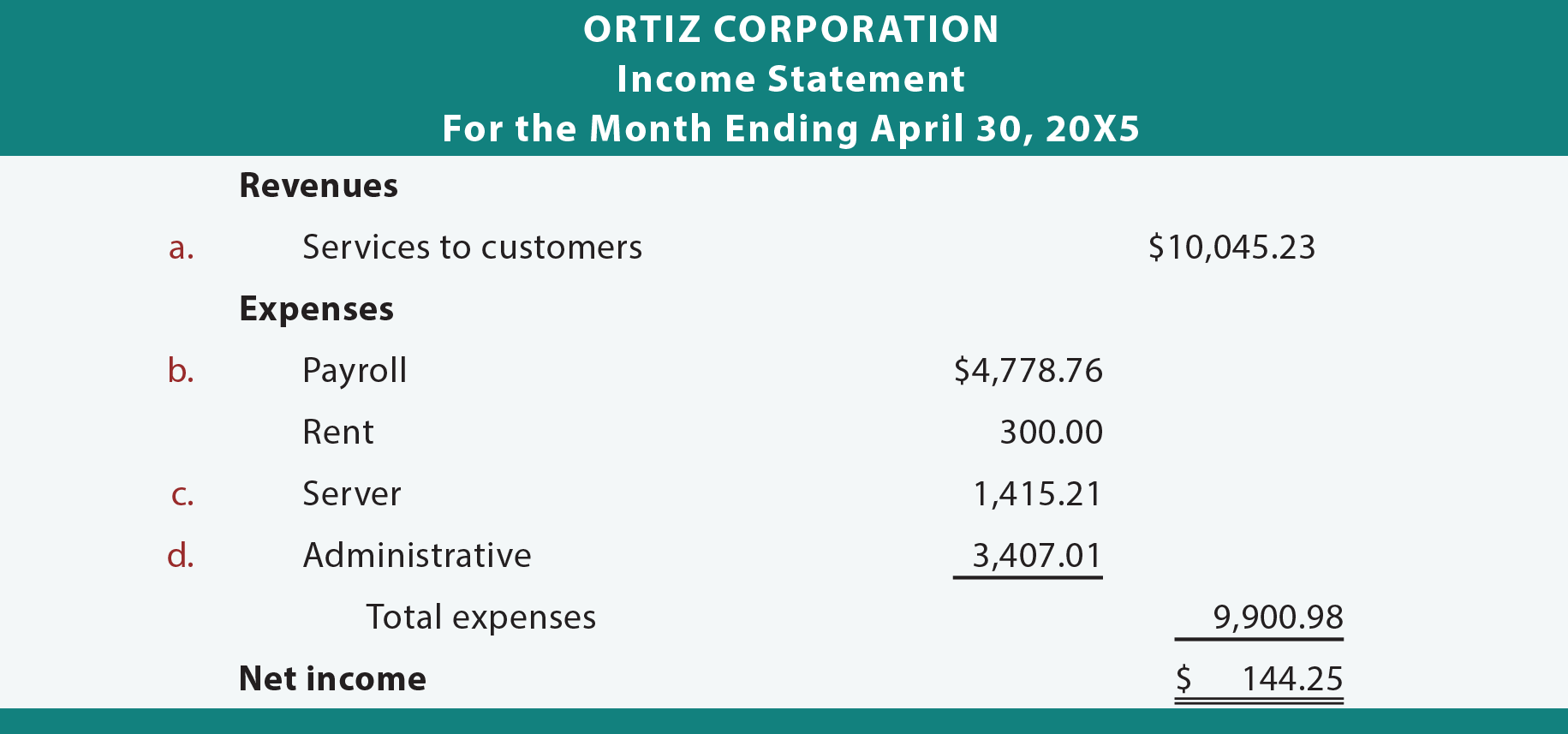

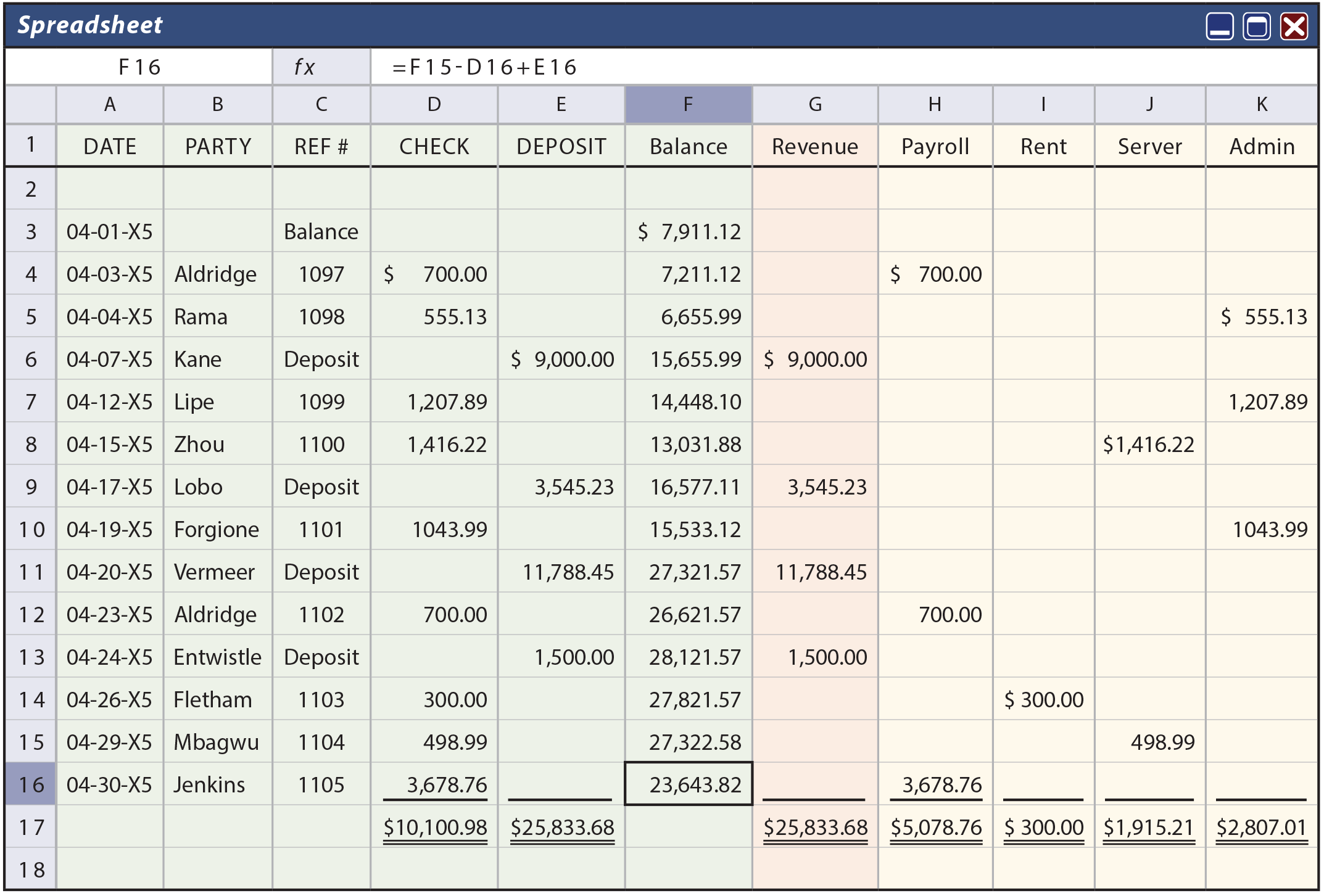

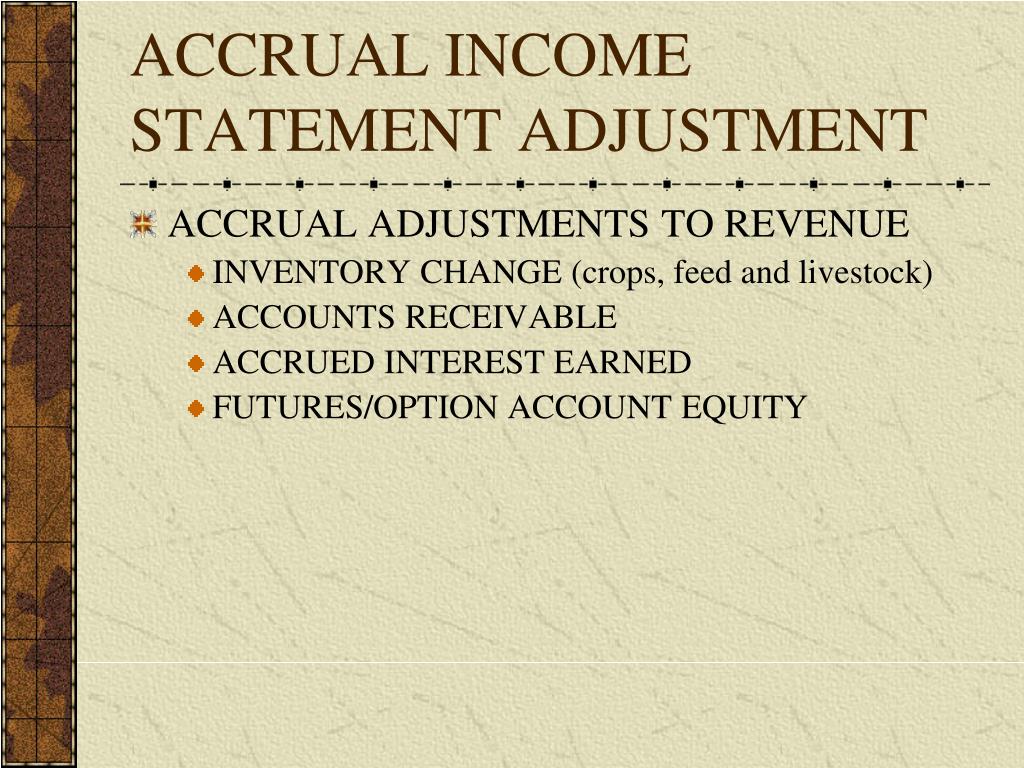

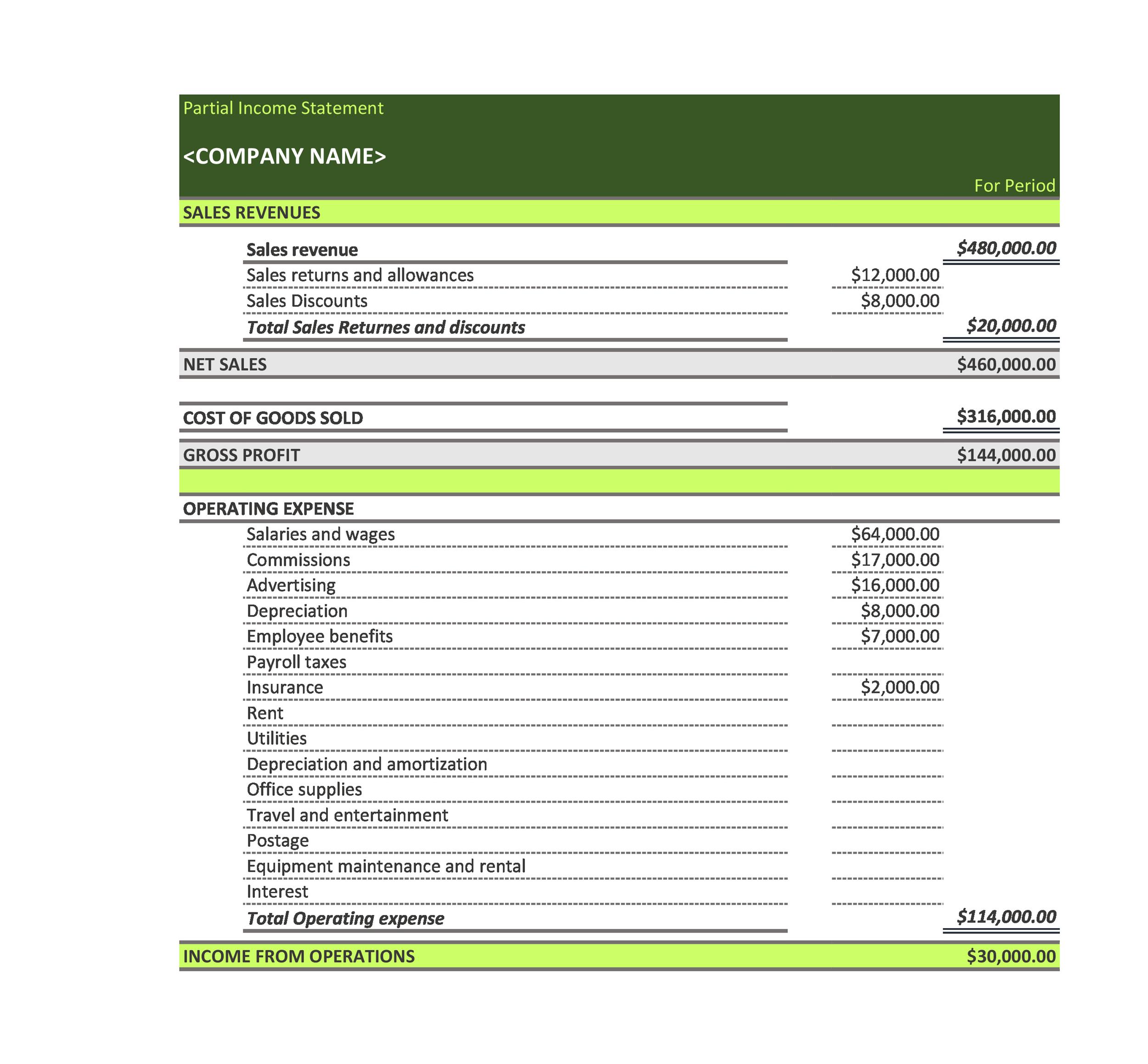

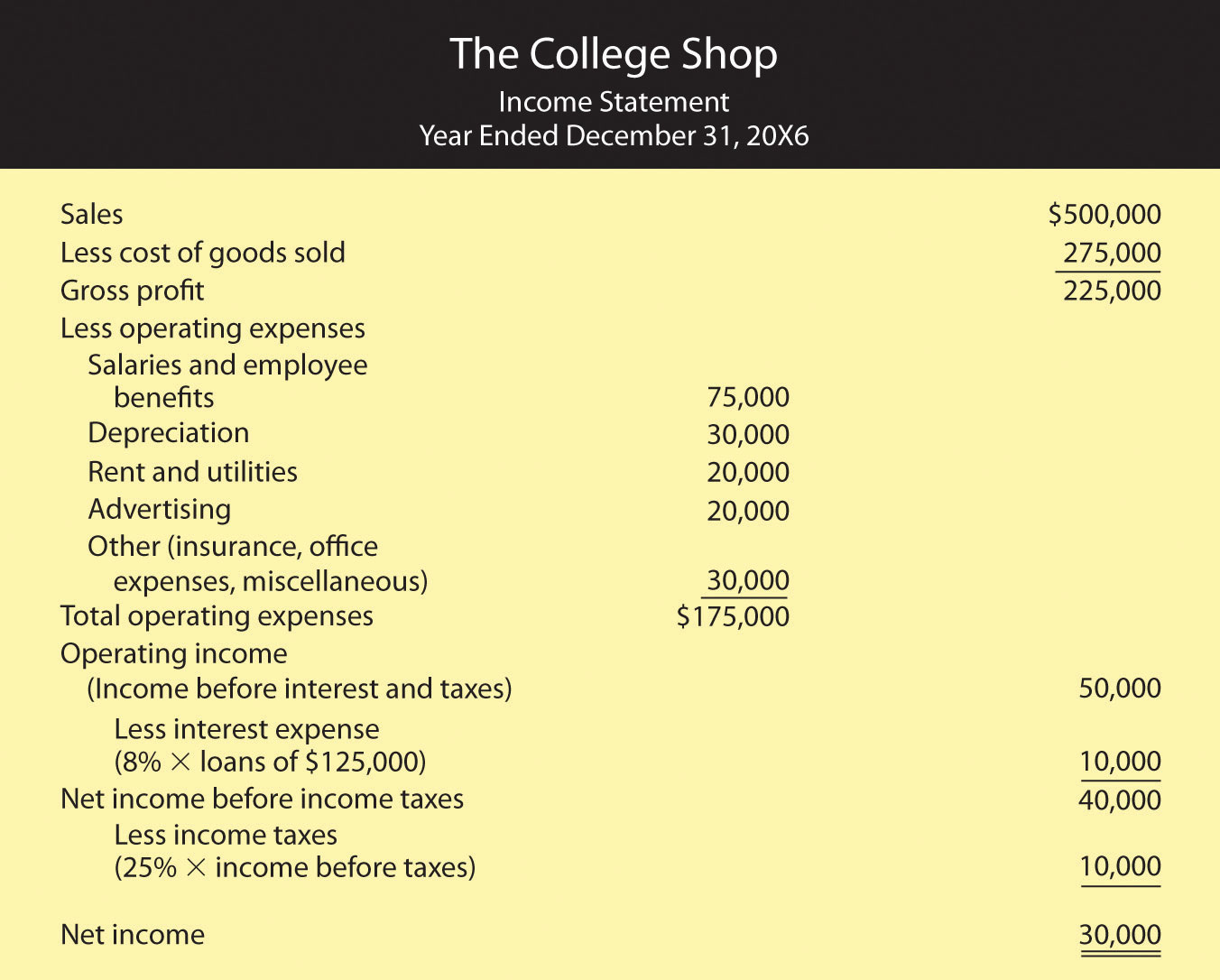

Accrual income statement example. The consumer uses the electricity, and the electricity meter counts the usage. General and administrative selling research & development restructuring = operating income other revenue and expense: Financial statements are prepared under the accruals concept of accounting which requires that income and expense must be recognized in the accounting periods to which they relate rather than on cash basis.

Accrued revenue is revenue that has been earned by providing a good or service, but. Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or. An exception to this general rule is the cash flow statement whose main purpose is to present the cash flow effects of.

Example #1 when a business purchases the raw materials on a credit basis from the supplier then the entry in the books of accounts will be made on the invoice issue date or at the date of the receipt of the raw materials as the case may be and not at the time when the owner pay the amount to the supplier. An example of accrued revenue is electricity consumption. 2 common formats of the income statement:

Accrued income can be the earning generated from an investment but yet to receive. For example, the income statement of a large corporation with sales of $8,349,792,354.78 will report $8,349.8 and a notation such as ( in millions, except earnings per share ). Rather, my clients paid the $10,000 in january.

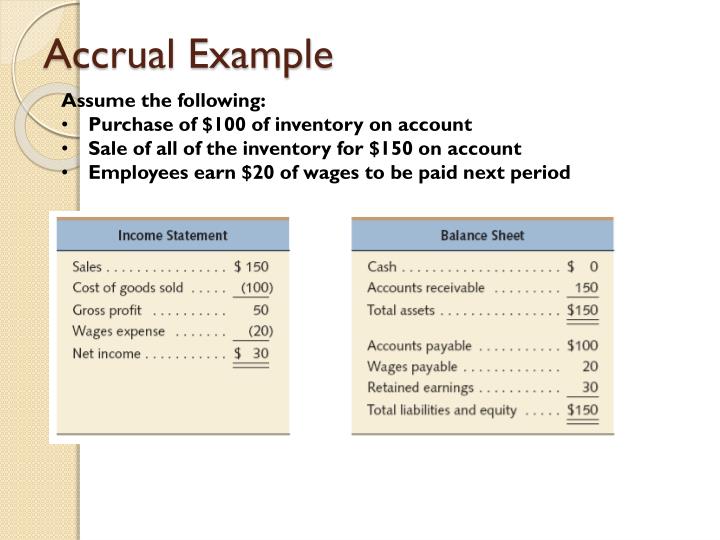

Similarly, accounts payable is a liability account that reflects amounts the business owes but. Accrual accounting gives companies an accurate financial picture at any point in time. Income is recognized when earned regardless of when collected.

The income statement complies with the accrual basis of accounting. Accrual basis of accounting always tries to match revenue with expenses. The consumer is billed at the end of the billing period.

For example, xyz company invested $500,000 in bonds on one march in a 4% $500,000 bond that pays interest of $10,000 on 30 th september and 31 st march. Cash basis accounting records revenue and expenses when cash related to those. Under the accrual basis of accounting my business will report the $10,000 of revenues i earned on the december income statement and will report accounts receivable of $10,000 on the december 31 balance sheet.

Purchasing $200 in inventory that you will sell next month will result in a $200 increase in inventory and a $200 decrease in cash on the balance sheet. Accrual accounting records revenue and expenses when transactions occur but before money is received or dispensed. Another example of accrued income might arise from interest a company earns on an investment.

An airline sells its tickets days or even weeks before the flight is made, but it does not record the receipts as revenue because the flight, the event on which the revenue is based has not occurred yet. Fill out the second line giving the date of the end of the coverage period for the statement — for example, “period ending december 31, 2019.”. The investment pays interest in the amount of $1,000 every march 1st and september 1st.

Fact checked by katrina munichiello what is accrual accounting? When you sell the inventory, revenue and cost of goods sold (the expense) will be recognized on the income statement. For example, assume company abc makes an investment on march 1st.