Looking Good Info About Deferred Income Tax On Cash Flow Statement Supplies Expense Balance Sheet

However, under the indirect method, the deferred tax will be adjusted to profit in the operating activities as the following rule:

Deferred income tax on cash flow statement. Deferred revenue appears on the balance sheet, and the cash flow statement. As a result, the $120,000 ncfo is the difference between $200,000 of net operating inflow excluding.

The amount you haven't paid doesn't affect your cash flow. Company buys a $30 piece of equipment (pp&e) useful life of 3 years;

+23.6% organic recurring operating income: But that cash might not necessarily show up as deferred revenue on the cash. Under the indirect method, deferred taxes are shown in the operating cash flow section as an adjustment to the profit (loss) before tax.

For tax purposes, depreciate using macrs (yr 1=50%, yr 2=33%, yr 3=17%) how to interpret deferred. How is deferred revenue reflected on the cash flow statement? The concept is explained further in.

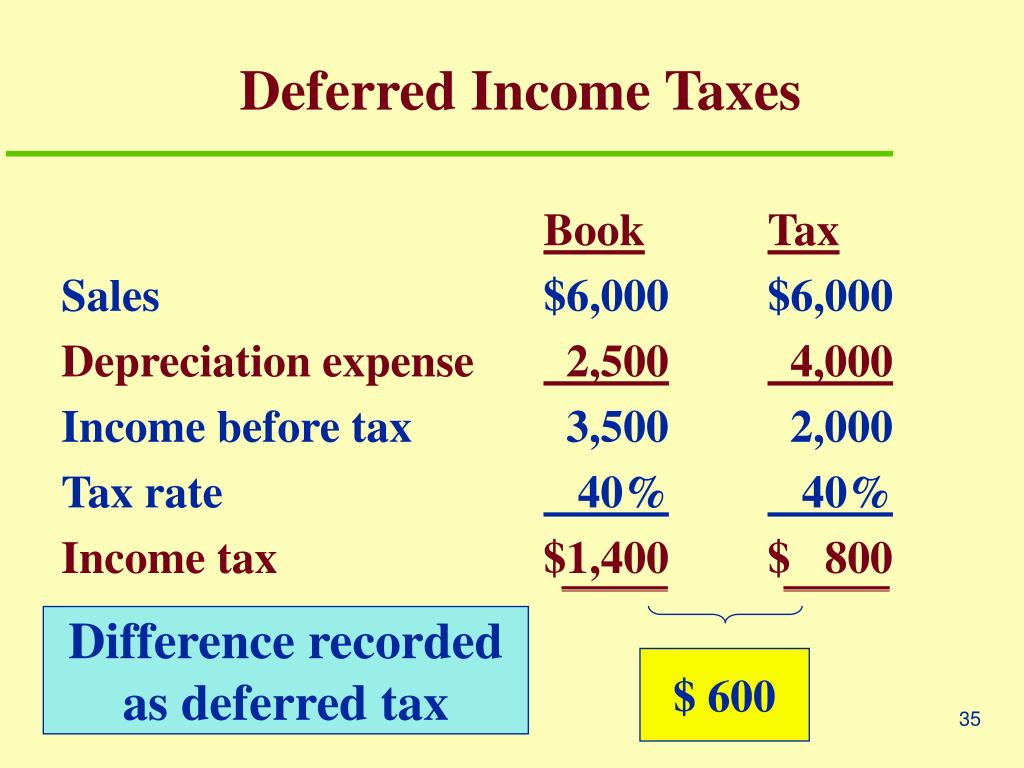

Adjustments for cash flows from investing and financing activities recognized in net income adjusted to arrive at cash flows from operating activities may include items such as: Using the direct method, the $92,000 total tax payment is allocated $80,000 to operating activities and $12,000 to investing activities. Below is an example scenario in which a deferred tax liability is created.

Any increase in the deferred tax asset or decrease in deferred tax liability shall be subtracted from the profit or loss before tax for the year. Therefore, it is not presented in the cash flow under the direct method. Deferred tax is a liability (or an asset) presented in the cash flow statement.

Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a complete measure of the net earnings. If we prepare a statement of cash flow using the direct method, the deferred tax will not show in operating activities as it is not a cash transaction. However, under the indirect method, deferred taxes are represented in the operating cash flow section as an adjustment to the profit (or loss) before tax.

Deferred income tax on a cash flow statement refers to the amount of tax that has not yet been paid but is expected to be owed. Deferred income tax is a result of the difference in income recognition between tax laws (i.e., the irs) and accounting methods (i.e., gaap). Deferred tax on statement of cash flow.

This requires the tax effects of a transaction to be reported in the same accounting period as the transaction itself. The cash flow and income statements are. Unrealized foreign currency transaction gains or losses;

The reason for deferred income tax liabilities and assets in the first place is because of the. Whereas, any decrease in deferred tax asset and increase in deferred tax liability shall be. Prepare the cash flow statement for norwich manufacturing, inc.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)